THIS COULD EXPLODE GOLD & SILVER: Will Basel III Be Implemented This Month…by LYNETTE ZANG

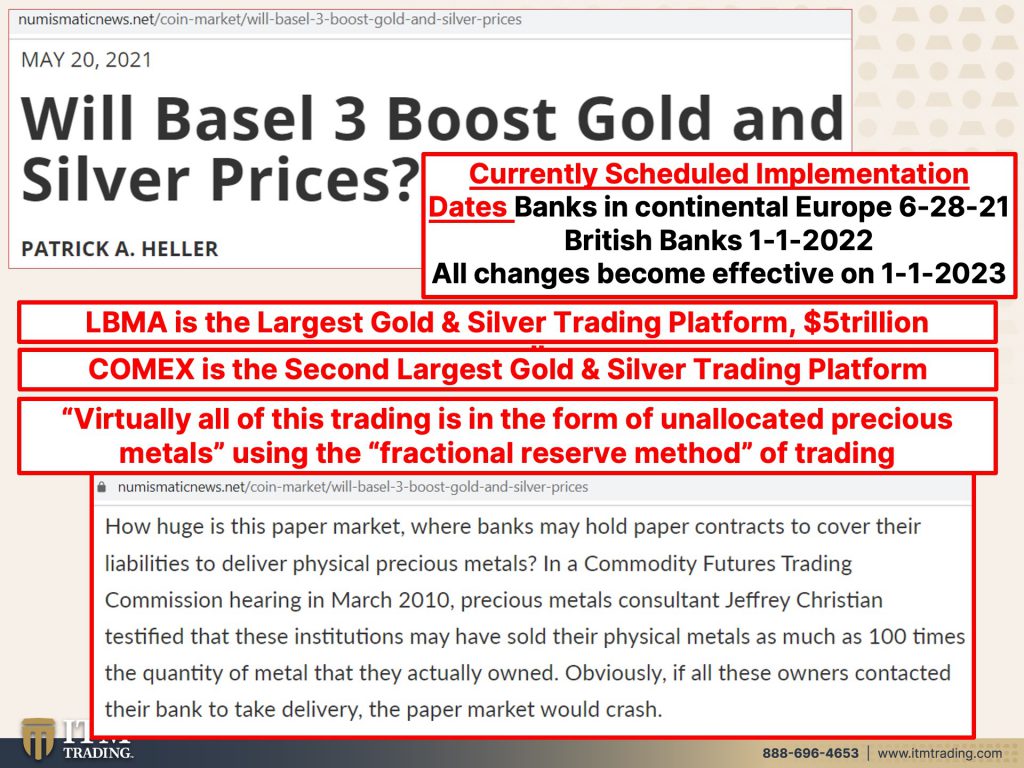

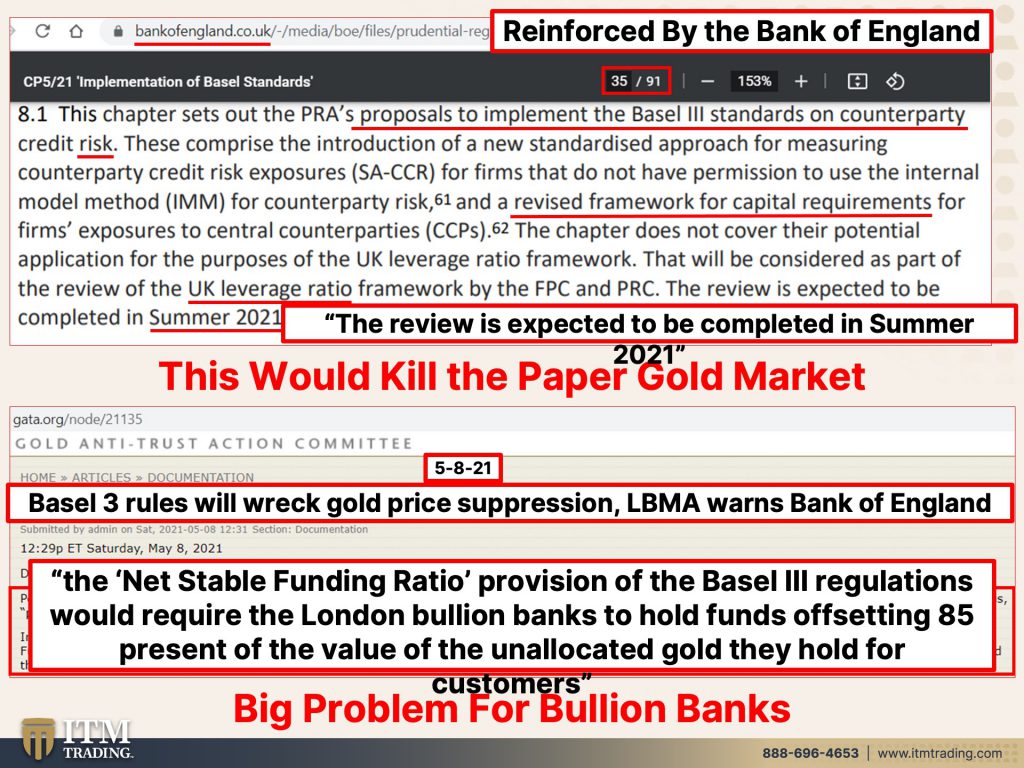

For those unfamiliar, the BIS (the central bankers central bank) developed new banking rules after the financial crisis in 2007-2008 to stem the extreme leverage levels in the global banking system. Implementation of these new rules has been postponed many times and now a new deadline on several of the new rules, is scheduled to begin on June 28, 2021, for banks in Continental Europe.

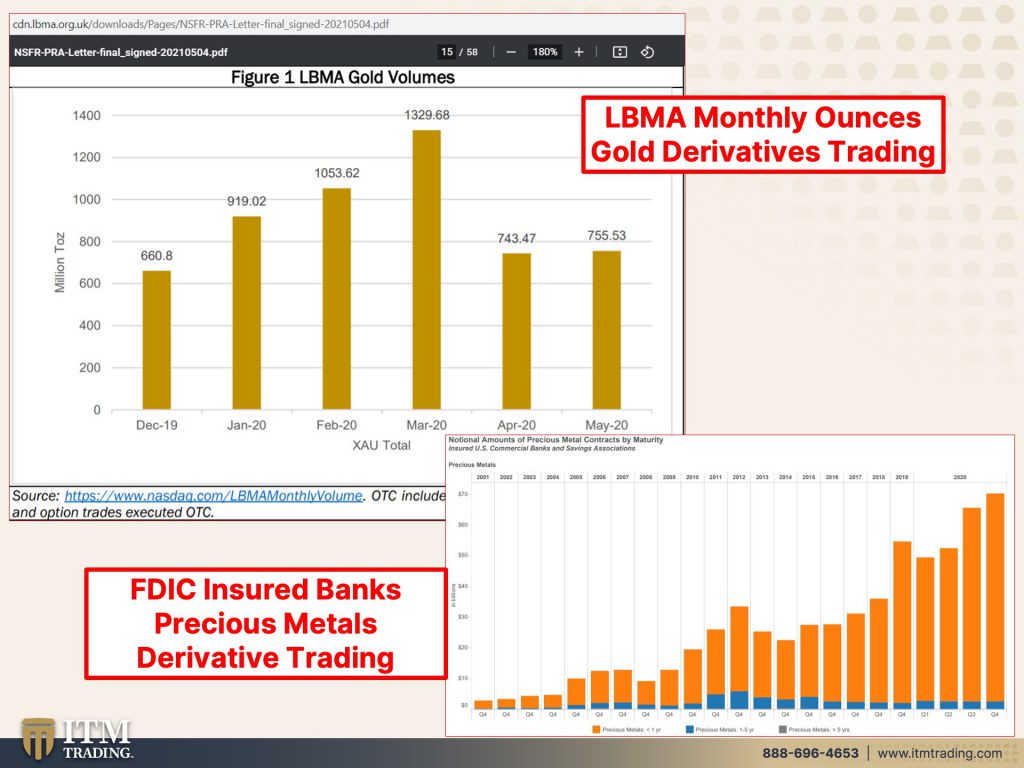

For this paper, we will only be focusing on the precious metals markets, gold and silver. We all know that in the physical realm there is a finite amount, but Wall Street operates on a fractional reserve basis that enables them to create in intangible form, many times the amount of available gold and silver. These gold and silver derivative contracts have enabled central bankers control over the nominal price that the public sees and provides nice trading profits for bullion banks. But if the proposed changes in Basel III were actually implemented, all that would change.

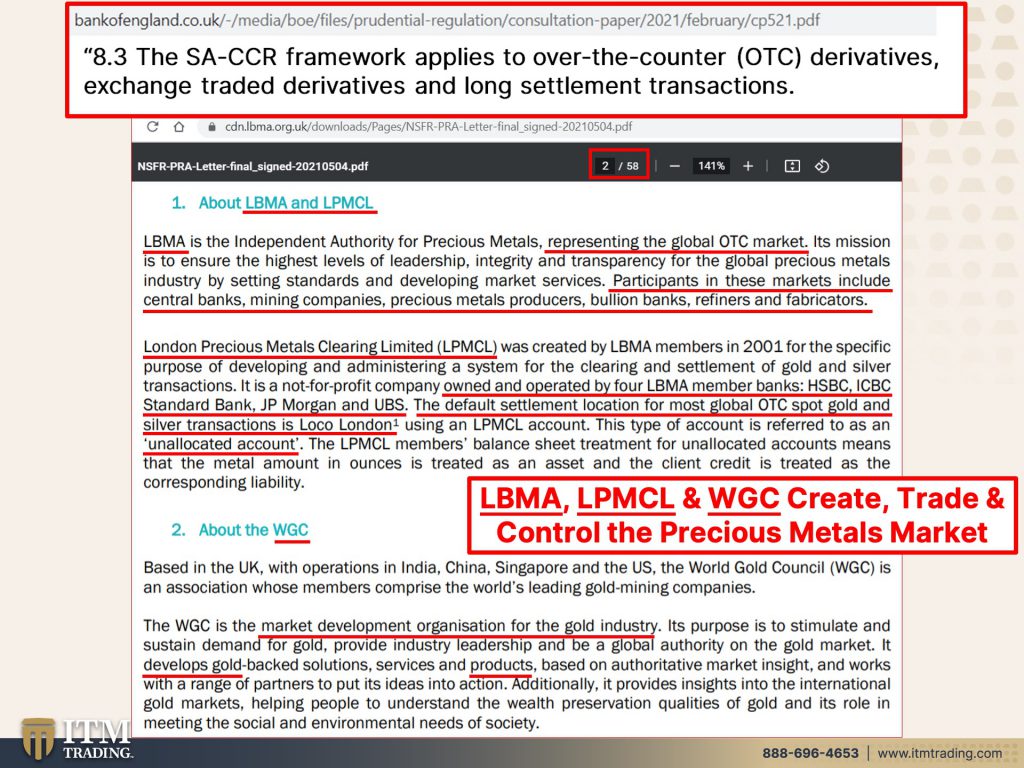

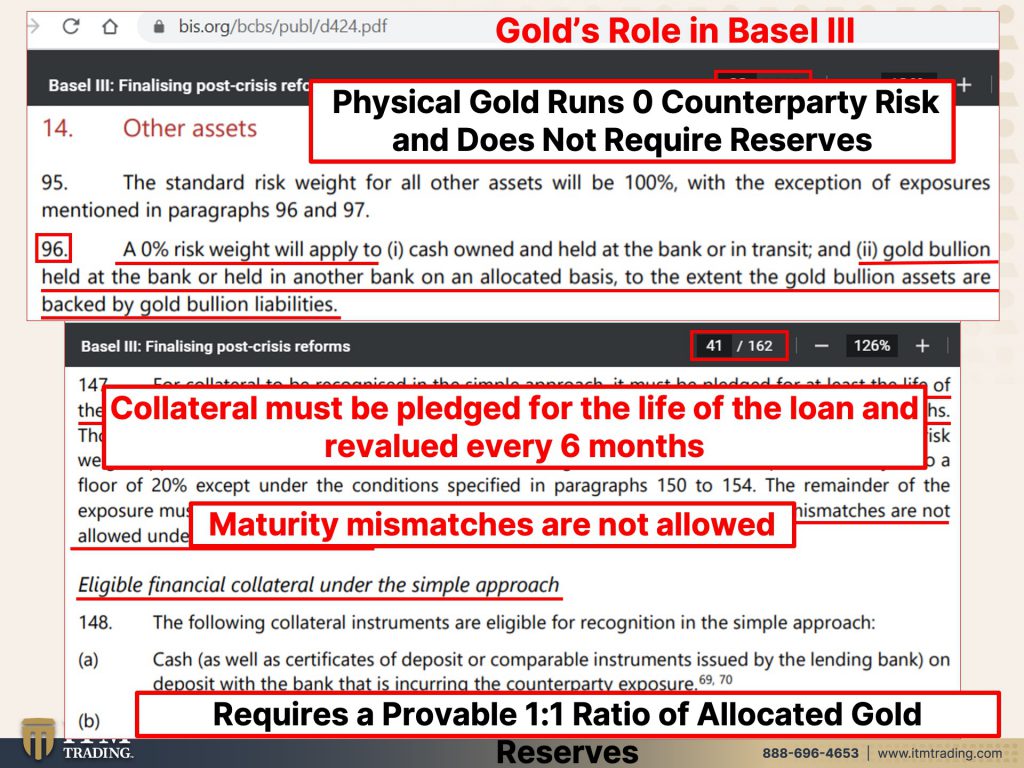

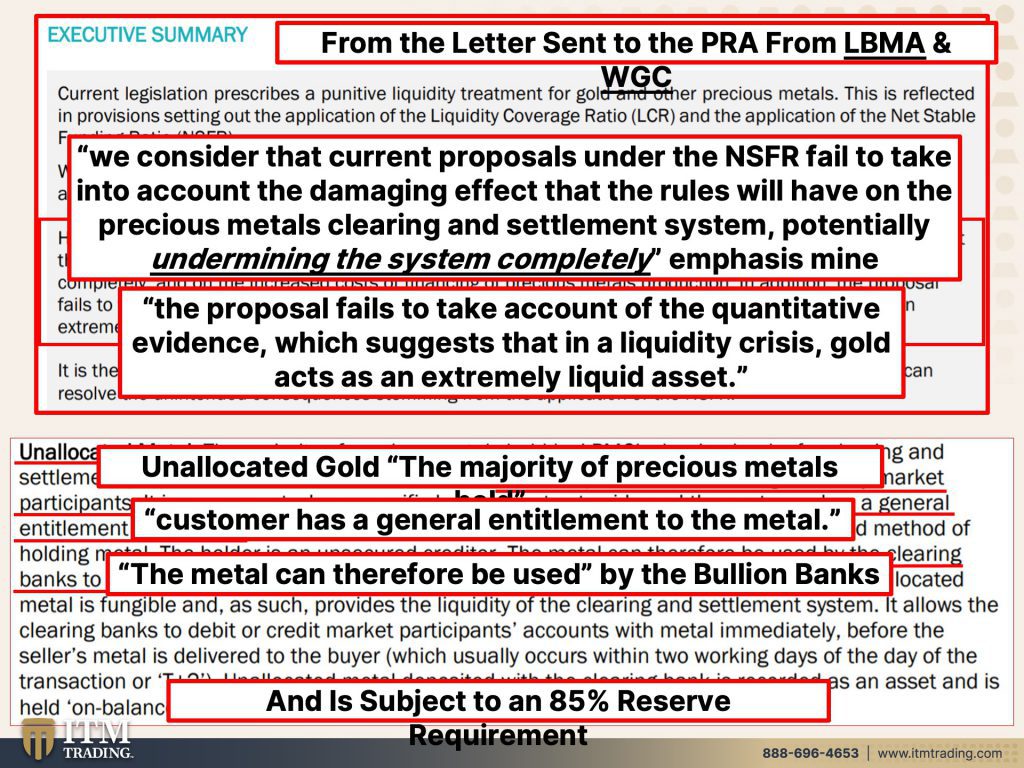

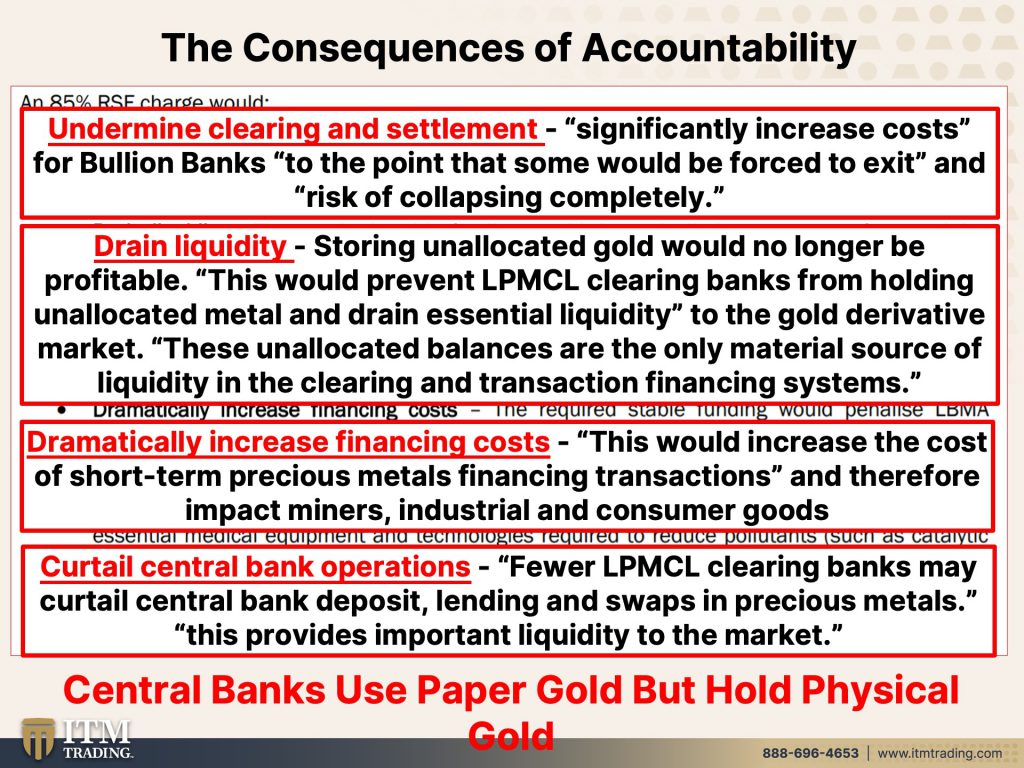

That’s because the new rules would require the bullion banks (HSBC, ICBC Standard Bank, JP Morgan and UBS) to put up 85% reserve on their gold and silver leveraged derivative bets, which carries massive amounts of counterparty risk. At the same time, physical gold has been moved up to a tier one asset that requires no reserves because it runs no counterparty risk.

According to a plea from the LBMA, (the world’s largest metals trading platform) and the WGC ((the market development organization for the gold industry that develops gold and silver products), if implemented this would potentially kill the current derivative metal market. But it would also, most likely push the nominal prices of gold and silver up exponentially, as bullion banks rushed to cover their infinite short (selling something you do not own) gold and silver positions by being forced to buy in the very limited availability, physical markets.

Personally, I think the implementation will be postponed since I don’t believe the central bankers are yet ready for this shift. Of course, I could be wrong. We’ll know one way or the other, very soon. Additionally, the balance of Basel III is scheduled for full implementation in 2023, the same year LIBOR implementation has been postponed until and also the same year the Fed anticipates having the digital dollar ready. Coincidence?

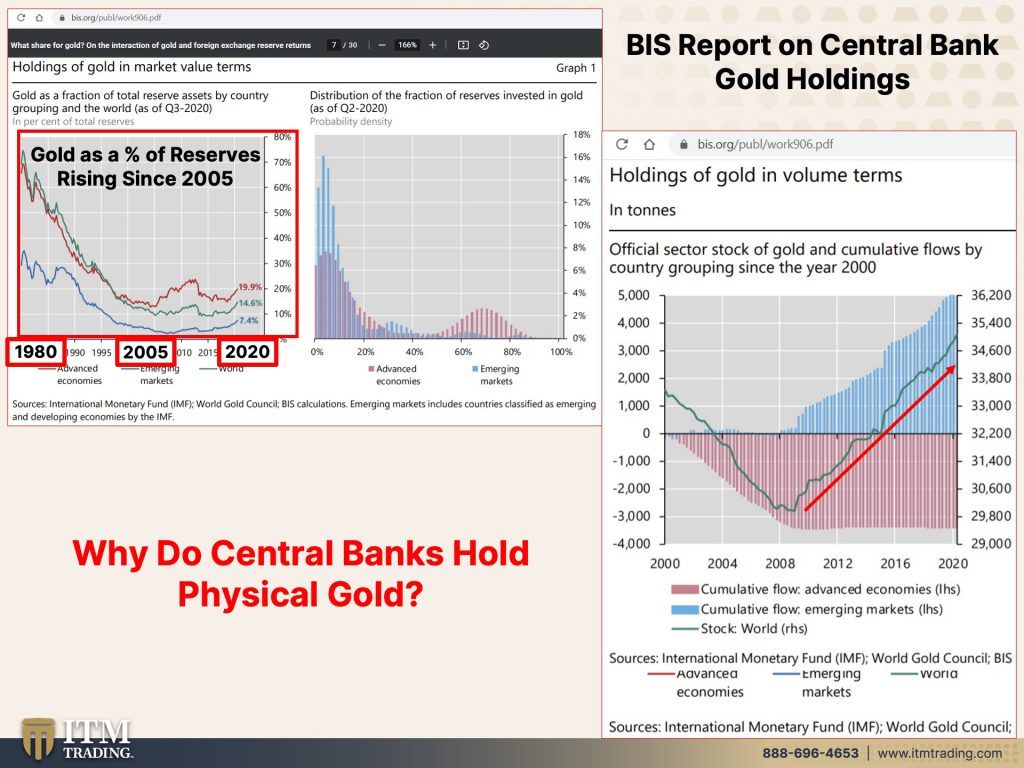

Because this could be seen as a justification to RESET the fiat currency system, which, historically, has always been done against physical gold. Plus, in a recent BIS report on central bank gold holdings, they showed that central banks actually began accumulating gold in their reserves in 2005, so before the 2007 financial crisis. Interesting.

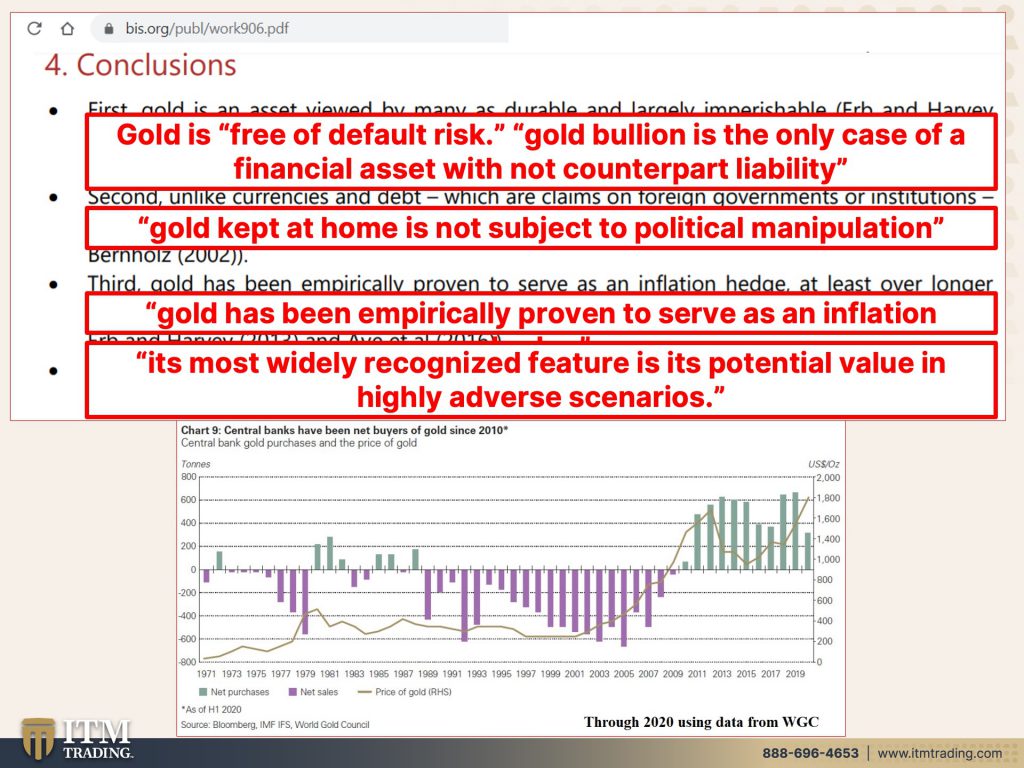

Further, in this report they conclude that gold is “free of default risk†and “is the only case of a financial asset with no counterpart liability†(emphasis mine). They also state that “gold kept at home is not subject to political manipulation†and “has been empirically proven to serve as an inflation hedge†which is critical with the massive amounts of new money being created these days. And finally, “its most widely recognized feature is its potential value in highly adverse scenarios.â€

This is why central bankers accumulate gold and why you should too.

SLIDES:

SOURCES:

https://www.numismaticnews.net/coin-market/will-basel-3-boost-gold-and-silver-prices

https://cdn.lbma.org.uk/downloads/Pages/NSFR-PRA-Letter-final_signed-20210504.pdf

https://www.bis.org/bcbs/publ/d424.pdf

https://www.gata.org/node/21135

https://www.bis.org/publ/work906.pdf

https://www.gold.org/goldhub/data/monthly-central-bank-statistics

We believe that everyone deserves a properly developed strategy for financial safety.

Lynette Zang

Chief Market Analyst, ITM Trading