THE SECRETS OF MONEY: How to Make Sure You Are Always Wealthy. ODOS with Lynette Zang

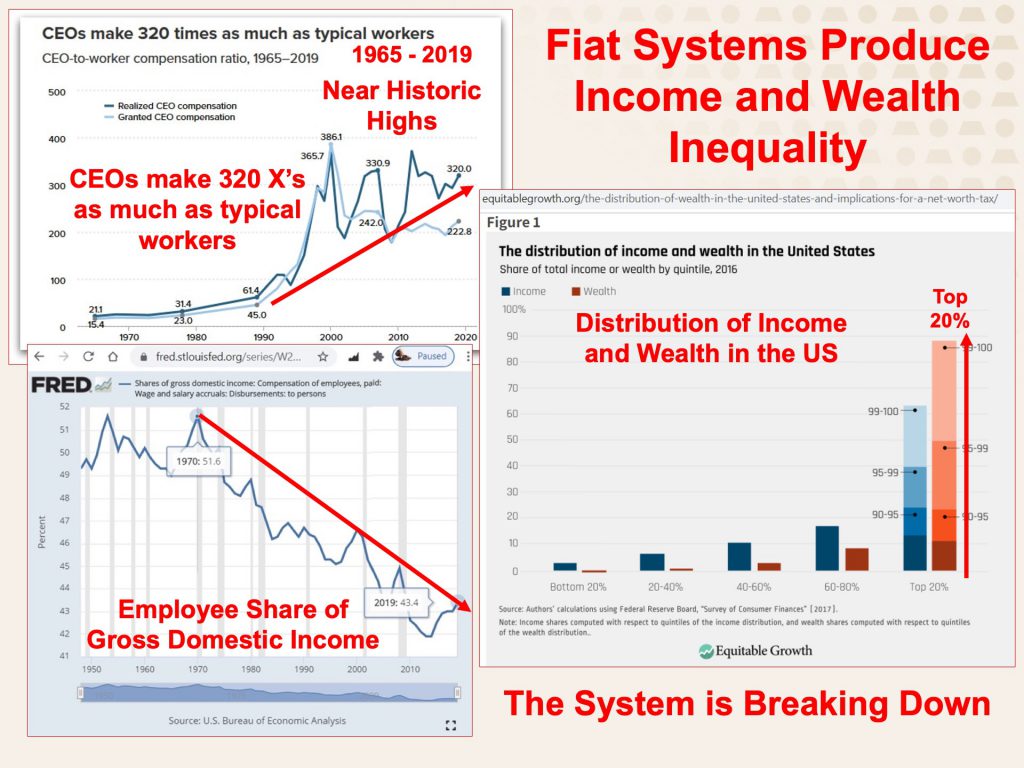

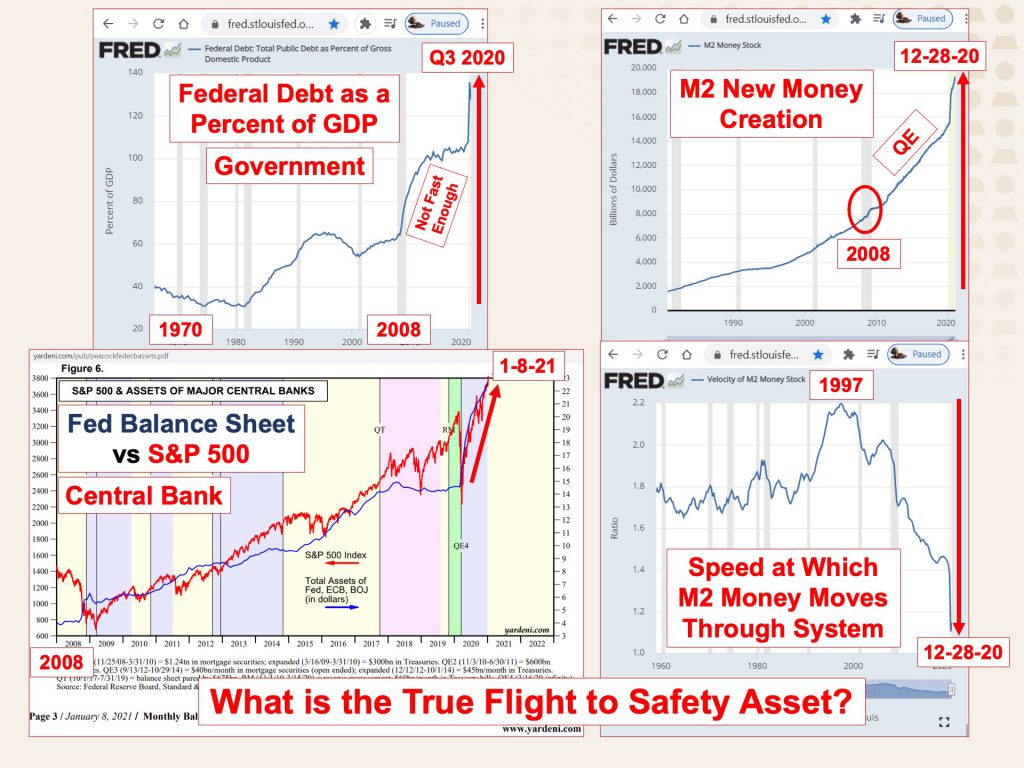

As I write this, the world is resetting; socially, economically and financially. If you doubt what I say, just look at how different the world looks just over this past year. Coronavirus justified global shut ins, shutdowns and the massive transfer of wealth to the 1% via hyper central bank money printing hyperinflating the stock and real estate markets. Additionally, the chaos we see around civil rights and political insurrections are all typical of a shifting system.

But underneath it all is the money we trade our labor for, use to barter with and attempt to save for future use. This seminar on financial literacy is important for everyone because money impacts our daily lives and that takes us to my favorite question, “How many times can you be lied to, when you do not know the truth?†So, let me remind you of the truth about money and show you what this next currency iteration looks like.

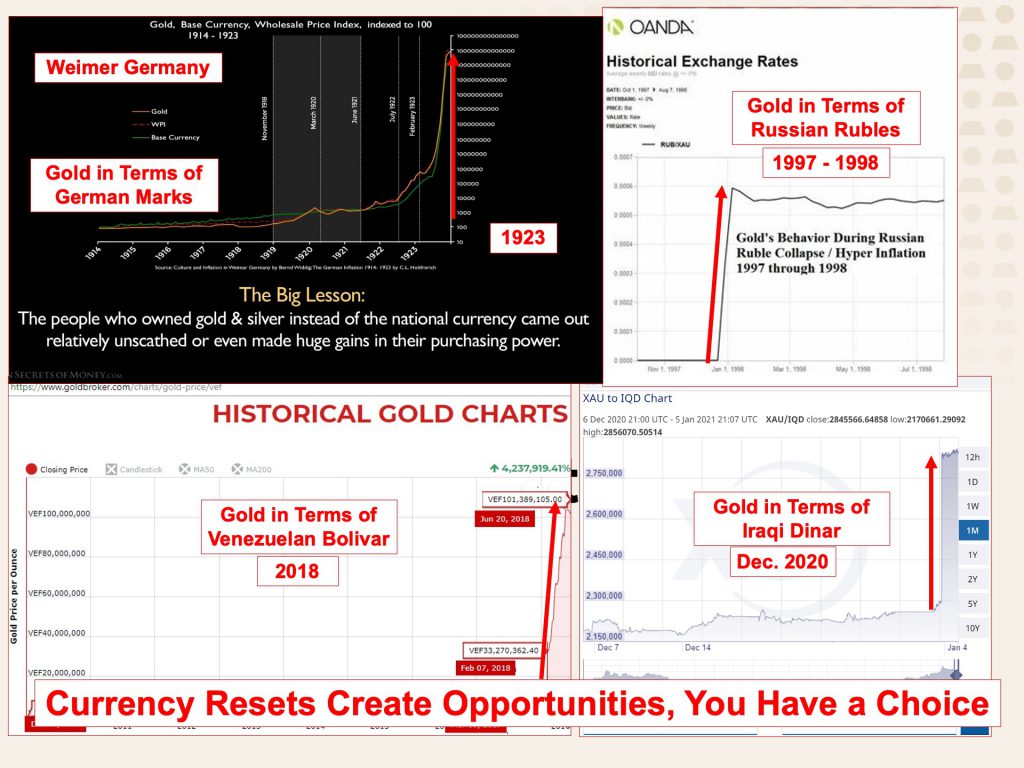

Although many currency experiments were tried over the past 6,000 years, gold emerged as the primary currency metal and silver as the secondary currency metal, because these commodities, particularly gold, were the only tangible assets that could meet all criteria to be a good currency. Currency needs to be a tool of accounting for measure, a tool of barter for trading, a tool of savings for future use and a store of value for fair payment of labor. In other words, money is a barterable tool to value and store your labor.

Gold meets all these requirements because it is finite, indestructible, divisible without loss of market value and labor based with the broadest base of buyer (having use across the entire spectrum of the global economy). Which is why gold is universally accepted as money. Importantly, it supports the individual because it is private, you hold it and own it outright, and it is an easy way to carry a lot of wealth in a small moveable package.

Importantly, gold money enabled the public to hold governments toes to the fire since, if an individual did not like government policy, they could simply convert their paper money into gold money. Effectively, this created restrictions around how much debt governments could grow and required fiscal responsibility, thereby giving the individual a level of control over the government.

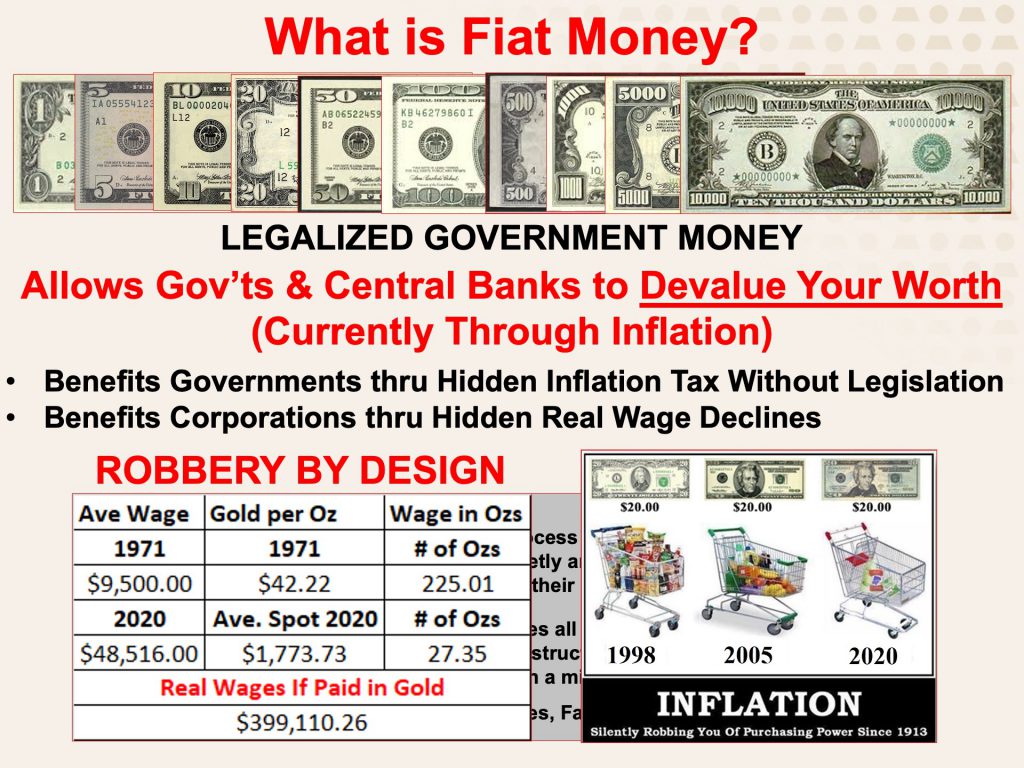

The solution was the great fiat money experiment that began in 1913, the legalized “Federal Reserve Noteâ€. By definition, a note is a debt instrument. Over time, gold’s backing of this fiat currency declined and in 1971, was fully removed as the world then transitioned into a fully debt-based system, “Full Faith and Creditâ€. As long you trust the government, you will loan them money. Importantly, when Nixon removed gold backing the US currency, in reality, full control of inflation was given to a private corporation, the Federal Reserve. But if you hold cash outside of the banking system, the currency protects individual privacy.

Today, we are at the end of this great debt-based money experiment and what those at the top have in mind is a digital currency. Why should you care about this? Because, according to their definition, the new currency is “Programable†fiat money with “Controllable Anonymityâ€. Programable fiat money gives central bankers the ability to transmit their policy directly and immediately, to the public in real time. As shown in the IMF working paper “Enabling Deep Negative Rates to Fight Recession: A Guide†found here https://www.imf.org/en/Publications/WP/Issues/2019/04/29/Enabling-Deep-Negative-Rates-A-Guide-46598 Further, with “controllable anonymity†means you will have no control over your privacy as well. That is, as long as all your wealth is held inside the new financial system.

As a review, Gold money is tangible, you hold it and own it, therefore it runs no counterparty risk, and it is private in your control. The current fiat money is backed by debt and the ability to take on more debt. Central banks and governments control the value of money via inflation, but you can still have privacy by holding cash outside the banks. The future money, Central Bank digital Currency (CBDC) is programable fiat money whose value can be directly and immediately controlled by the central bankers. Additionally, central bankers and/or governments would control privacy as well.

It’s up to you to determine what kind of money you want to hold your wealth in. Ultimately, we will all need to barter with the legal money of the state, but personally, most of my liquid wealth will continue to be held in gold. When I need the currency of the realm, I will convert as needed. In this way, I will retain the purchasing power and privacy of my money, regardless of central bankers abuse of power.

with Lisa Riley, CEO of ODOS Synergy Services

https://www.odossynergyservices.org/

Slides:

Sources:

Slide 1: N/A

Slide 2: N/A

Slide 3:

https://www.payscale.com/data-packages/ceo-pay

The distribution of wealth in the United States and implications for a net worth tax

Slide 4:

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://fred.stlouisfed.org/series/GFDEGDQ188S

https://fred.stlouisfed.org/series/M2V

https://fred.stlouisfed.org/series/M2

Slide 5:

https://www.xe.com/currencycharts/?from=XAU&to=IQD&view=1M