SHIFT IN CENTRAL BANK SUPPORT: Will CB’s Stop the Madness?…BY LYNETTE ZANG

If you don’t already own your own house or land free and clear, which I’m sure that’s part of your plan at some point. Well, how else are you supposed to retire and create a stable future if you never own your own property and can therefore at least fix some of your costs or eliminate them, but unfortunately with the new global agenda for the public to own nothing and be happy? Well, there’s a major issue on folding with real estate and it’s actually been unfolding since 2008. This will be an even bigger hat trick than the last crisis where everyone rushed out and bought property only to get it pulled out from underneath them. A few years later, you know, the difference is we’re not talking about standard crashes or recessions anymore. We’re talking about an entire social and economic reset. The good news is I’ve been studying economics and currency life cycles for well over 50 years. So I can help people plan for this exact moment. Now, of course, this isn’t the first currency reset in history. And if you understand how this process works well, you’re the one who can pull the hat trick when the time comes first, I’ll show you their plan. Then I’ll show you my plan and you can choose what’s best for you coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM trading, a full service, physical gold and silver dealer specializing in that planning. And today we’re going to talk about real estate because data out is showing that it’s appreciating or going up in price. I mean more substantially than since they started tracking the records, but I’m also wondering if the trend of big corporations going in and buying up real estate that started in 2008. Isn’t coming to conclusion now. So if you look at the median price of a home up 23% year over year, right, that makes a whole lot of sense, especially since this is supposed to be the stable part of your portfolio, but they’ve been working very hard on turning real estate into more of a wall street product, and you are going to pay the price. Now, of course, as prices have been moving up, they are enticing.

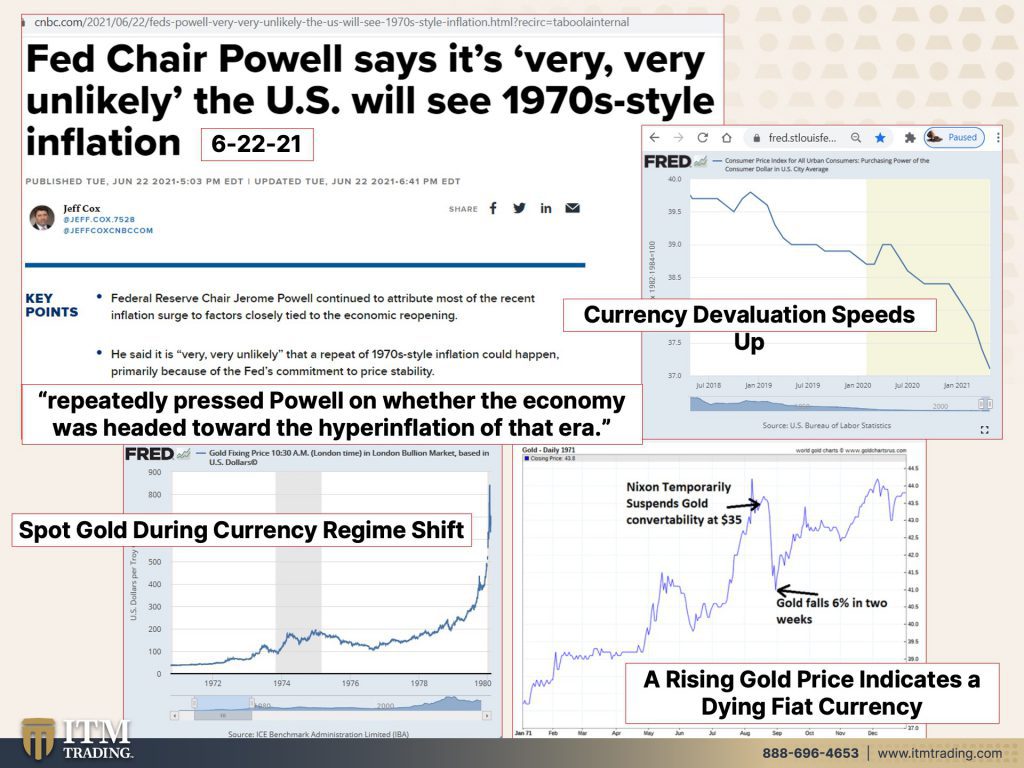

Those that have been holding out to put their properties on the markets. Of course, they’re still lamenting the fact that there’s not quite enough property for all of the corporations to buy up, but could this be an indication of a market top and actually does it really matter to the corporations if it is with all their free money and other people’s money? So the result of the global central bank money creation on real estate, you know, this is not just happening here in the U S this is a global phenomenon, and you could see Sweden, Denmark, Russia, and then the us is force in prices going up. But is it really that value going up or is it really the value of the currency going down as global central banks debase the currencies that are already out there because frankly, this kind of global move is not normal price action move.

So now that would definitely inspire more people to sell. Now, of course, if you’re selling it to this market, you’re going to have to be buying also into this market, or you become a renter, which she’s really what part of their agenda is housing market Gompers, or do you think because if corporations are getting money for free or they’re using other people’s money, their savings, well, they’re getting paid and you’re taking all the risk. And I don’t know whose benefit that really is in because it should be clear. They want America should become a nation of renters. Woo. The very features that made houses and affordable and stable investment are coming to an end. And really, again, that isn’t something that’s new. That’s something that started in 2008 eight.

The process is painful, but it’s not all bad slowly, but surely most Americans single biggest asset, their home. This was a way for people to create some equity is becoming more liquid, call it the liquefaction of the housing market. We’ve been talking about this really for quite some time now. Um, part of what the goal is, is for you to hold your title to the house in digital form that can then be broken down. So if you have say a couple hundred thousand in equity, but the equity is broken down into little bite sized pieces, dollar pieces. Now you’re out shopping. You see something that you want, and you’re what you end up doing is spending your equity whose best interest is that in and in this global economy, um, somebody from any walk of life in any country can own the equity in your house.

But here’s the piece that we really have been moving towards since 2008 mega landlords are snapping up homes before the public can even see them. So because of the price action that’s been going on, because what are these mega landlords care about once they have you renting from their property? Can you kind of remember Potter’s field and it’s a wonderful life and were those people better off because they were renting in Potter’s field or no, because they ended up owning their property and therefore you can control your house. You can the prices, your monthly expenses, and you can even dare I say it, pay it off. I mean, it used to be that they would have mortgage parties when mortgages were paid off. Now they’ve gotten that timeframe of which you hold a property shorter and shorter and shorter. And now it’s getting out of reach for especially first time home buyers.

But for many people that may, may take advantage of this price appreciation and think, well, okay, I’ll just rent for a while. And then that may just not really be an option that you’re thinking that it is. And during the pandemic, look at how much the rent is costing, how much that has gone up. That’s gone up like over 4%. It’s pretty substantial, but don’t worry because you’re going to own nothing and you’re going to be happy and you will pay what wall street demands that you pay. And what I also find really interesting in all of these prices going up, and we’ve been, we’ve been questioning this since the rent moratoriums and the mortgage moratoriums have been put in place. What happens when that whole piece begins to unwind? Well, they’re trying to one wind it’s so that it doesn’t have an impact, but you know, certainly there could be a whole lot more properties that come onto the markets for the mega corporations to buy. And how easy is it for people with an eviction on their record may get really easy to actually go out and rent something else. And how much will that be because of the people that have needed to take advantage of the moratoriums? Well, they’re usually in the lower income category.

The other piece that I want you to be really aware of is the gold to home price decks, because historically this can tell us where we are in this trend. And we know that particularly both gold spot gold and also real estate, well, real estate has been targeted for reflation. So they’re both tangible assets and presumably they both cover inflation except when you can own out, right? And it’s portable, which is gold and really state, you cannot put on your back and tack take away. So it’s not just the price appreciation or the price inflation, let let’s call it what it is not appreciation it’s inflation because of course it’s been targeted for the reflation trade, but it’s also the ability for states and municipalities to charge you higher taxes on the real estate. And gold has been doing exactly what it’s supposed to be doing right along.

And that is the amount of gold to buy the current residential real estate. Your home has been dropping. And what we know is that historically on average, a can’t say what it’s going to look like this time, because there will be a lot of real estate that is going to be coming on the market, whether it’s from the mega landlords that are doing it with all sorts of debt, where others that are forced to sell their primary homes, because again, the debt you have debt, then you become a debt slave. And as long as your income can keep pace with that debt, not a problem, but this is part of the function of gold inside of the strategy, because what we know is historically on average, 25 ounces of gold will buy an entire city block buildings and all, and we can see in the charts and the graphs, wow. Gold to real estate peaked in 2001, but it’s going to get a whole lot better because gold has not been targeted for reflation yet. However, keep in mind, that is how they reset. They do that overnight revaluation of the currency.

So gold has been doing exactly what it’s supposed to be doing. It will continue to do it. It’s going to continue to put you in a position to have the wealth transfer your way because you’re actually holding its purchasing power, the value. So we’ve had kind of a little bit of insanity because I was with George and at his event. And now I’m so excited because I, um, this week going to be with Gerald Celente who is hosting freedom, peace and justice festival in Kingston, New York, my hometown. So I’m really excited to be able to go back there and speak at this rally. And I hope to see you guys there next week. Well, I’ll be back and I’ve got a lot more things planned, but for behind the scenes and updates you, and definitely for this week, you want to be following the Instagram and Twitter because I’m going to show you the house I was born into and the schools that I went to.

And, you know, haven’t been back to look at this stuff in a long time and I’ll even show you my daddy’s development, where I have a street named after me, Lynette at Boulevard. So I’m very excited to have the opportunity to go back to some of my old haunts and take a, take a drive down memory lane. And you’re going to be able to see all of that on Instagram and Twitter. And don’t forget that we’ve got the ITM trading podcast. And by the way on Friday, I’m not sure that we’re going to release it on Friday, but Gerald and I are going to have just a sit down conversation. So many things are going on that. I want to talk to him about basil three being one of them. But if you have not already subscribed, please turn on that bell notification, hit subscribe, turn on that bell notification.

So you get alerted and make sure you leave us a comment and make sure that you share, share, share. And until next we meet, keep in mind, it is a hundred percent time to cover your assets here at ITM trading, we use the wealth shield and you’ve got to have a place to make your last stand. That’s your real estate. That’s your property. Along with food, water, energy security, barter ability, wealth preservation community, which is what these events are all about. My work is all about really and shelter. So until next we meet, please be safe out there. Bye bye.

SLIDES: