Real Estate Market Imploding | by Lynette Zang

CHAPTERS:

0:00 Real Estate Bubble

1:21 State of Commercial Real Estate

4:55 Housing Cracking

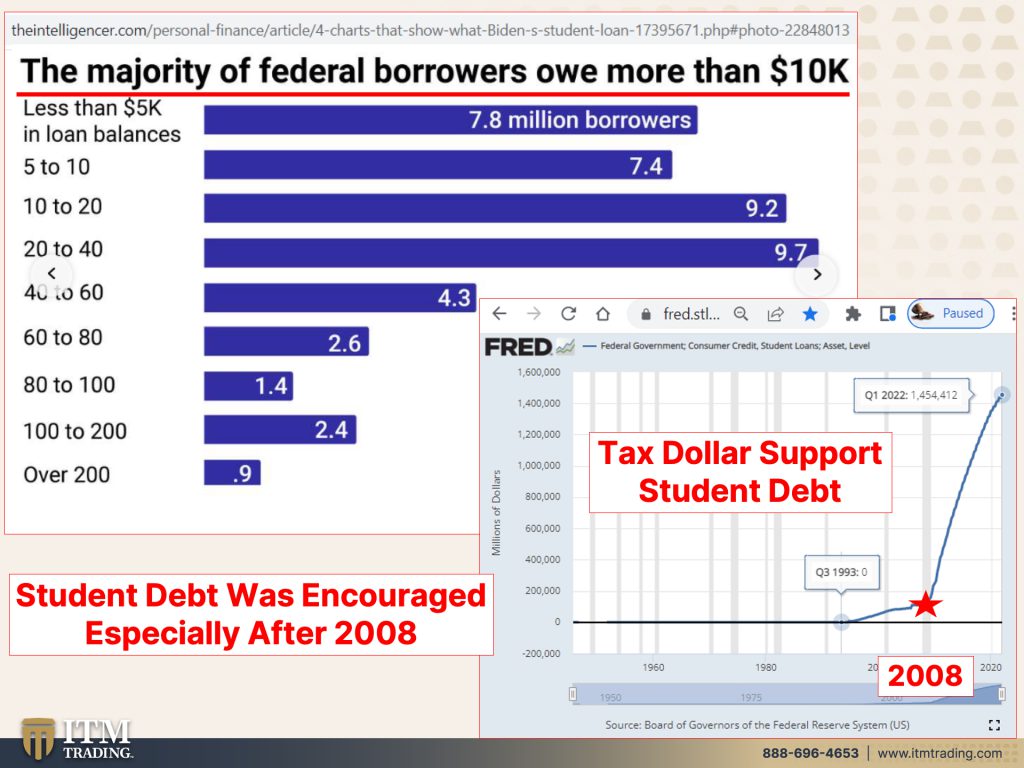

6:29 Student Debt & Home Loans

11:20 Gold to Housing Ratio

13:18 Have Your Strategy in Place

by Lynette Zang

People always think that how it is, is how it will continue to be. Both for the good and for the bad. The speculative gains funded by the free money policies by both the Fed and the government are most likely over as the Fed fights for its credibility with rising interest rates.

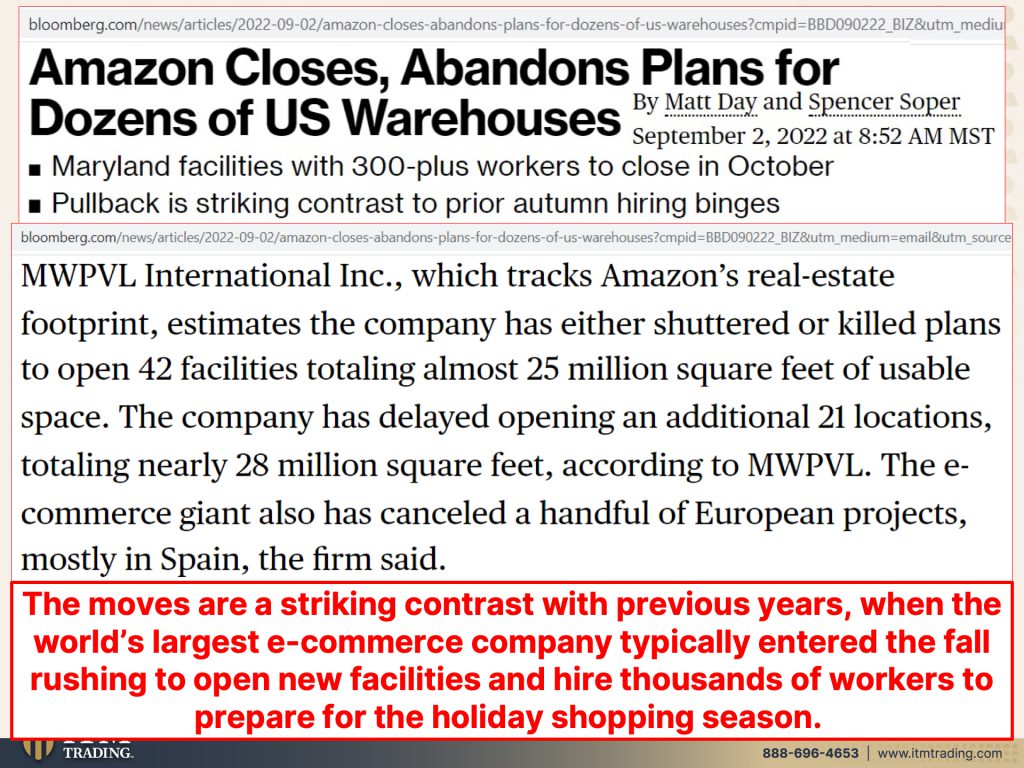

Just as interest rates anchored near zero, inspired massive speculation in real estate prices, rising interest rates have popped that bubble. First in single family homes and now it looks like commercial and warehouse properties will be under pressure.

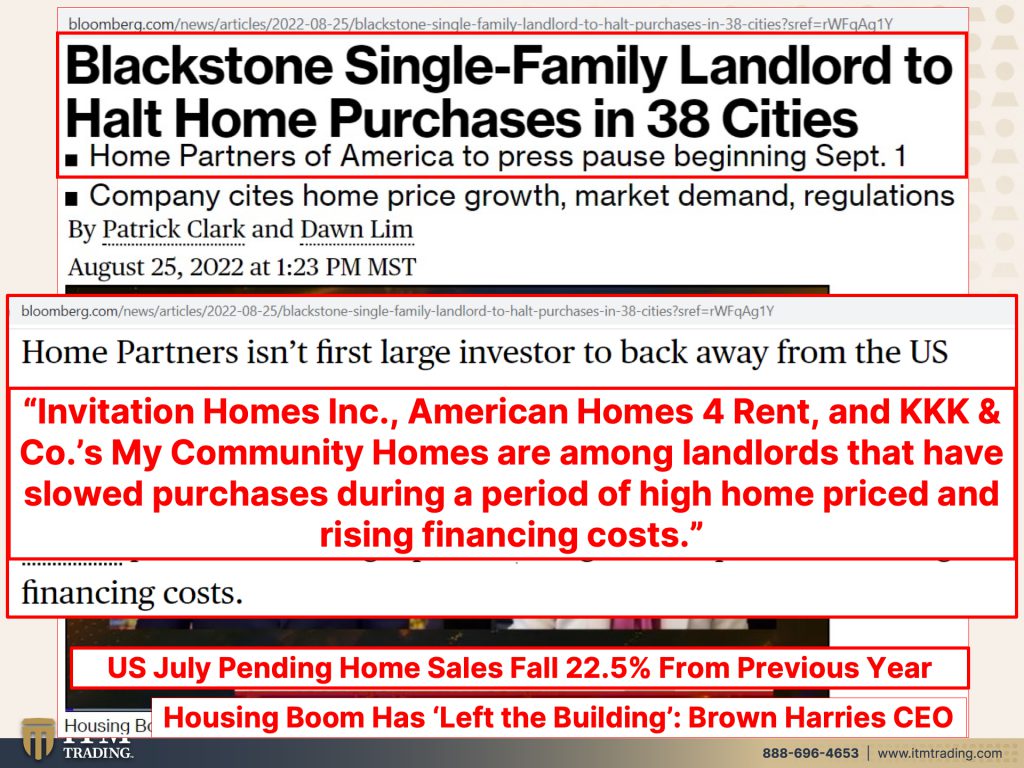

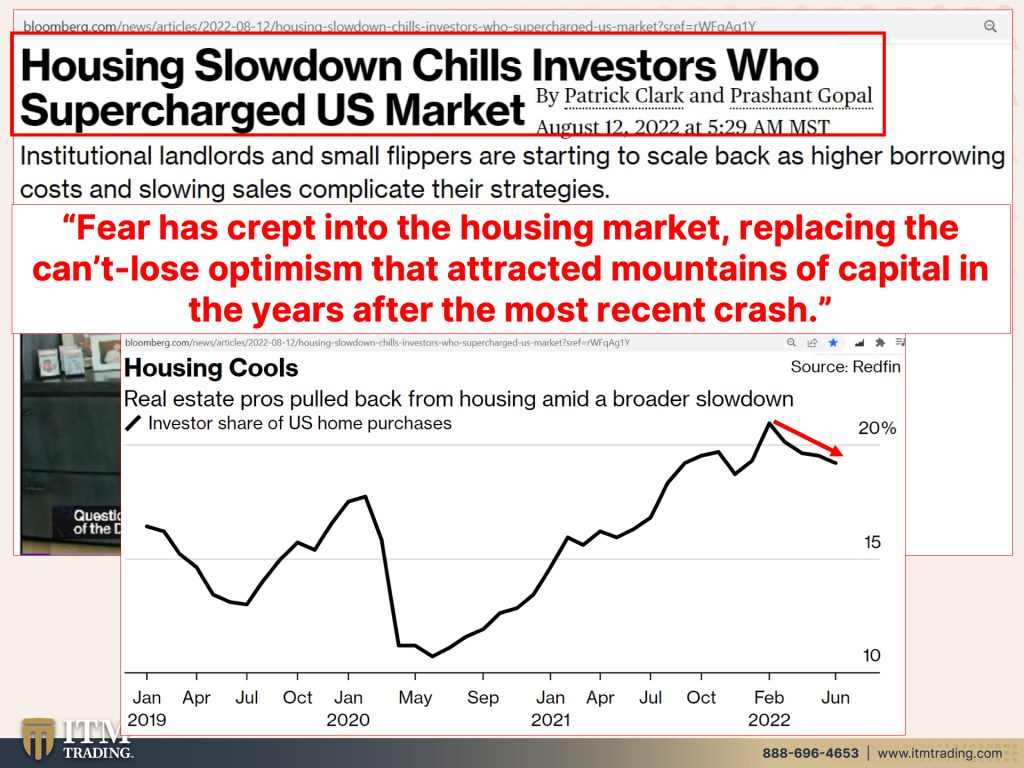

Quoting from Bloomberg’s article Housing Slowdown Chills Investors Who Supercharged US Market, “Fear has crept into the housing market, replacing the can’t-lose optimism that attracted mountains of capital in the years after the most recent crash.â€

If big investors, like Blackstone, halt purchases, what would the impact on the market be? After all, institutional investors work with other people’s money, and that money flooded in and was cheap. Now that is changing. And it’s being reflected in the data.

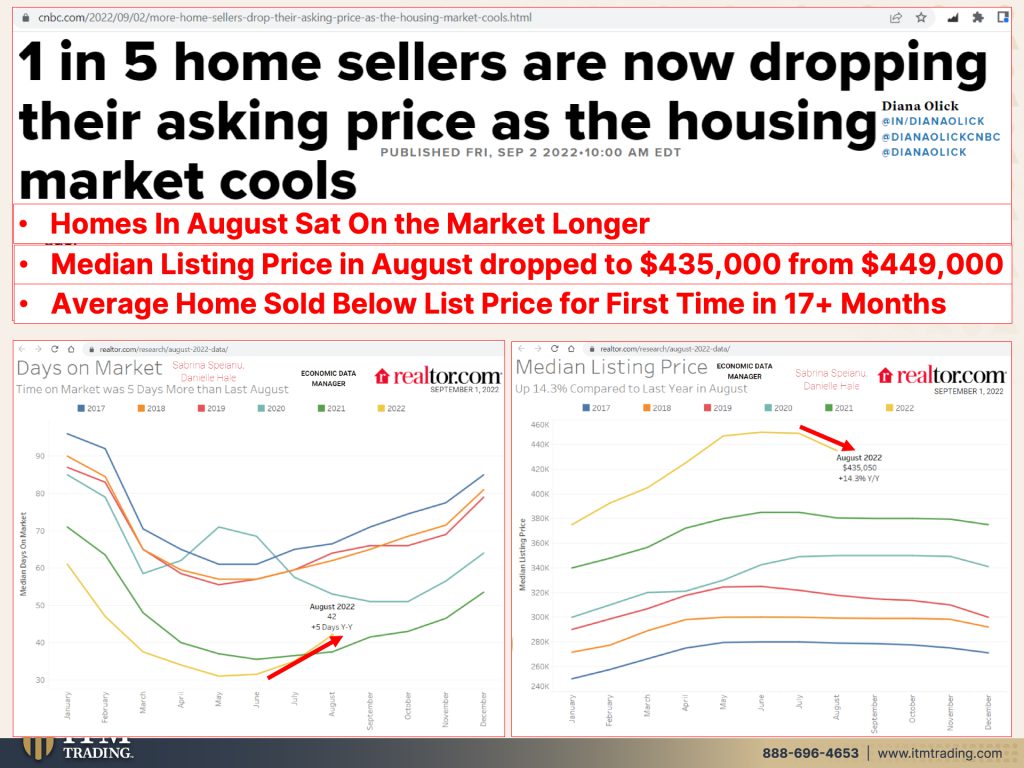

Homes are staying on the market longer, median prices have begun to fall, and “one in five home sellers are now dropping their asking price.â€

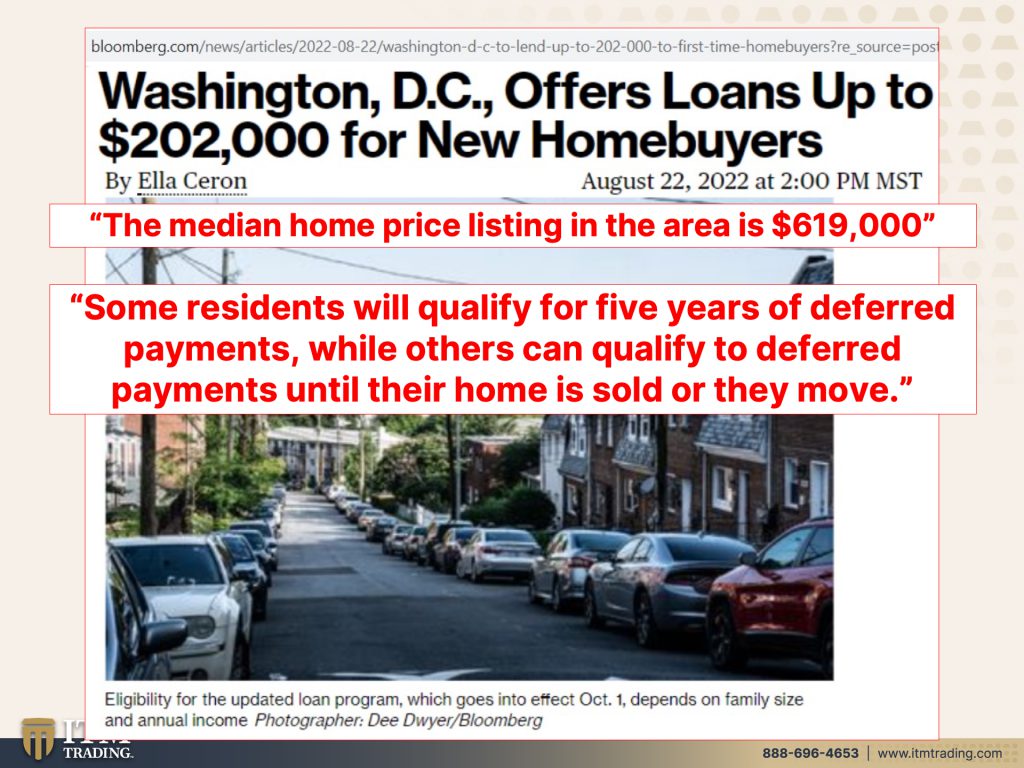

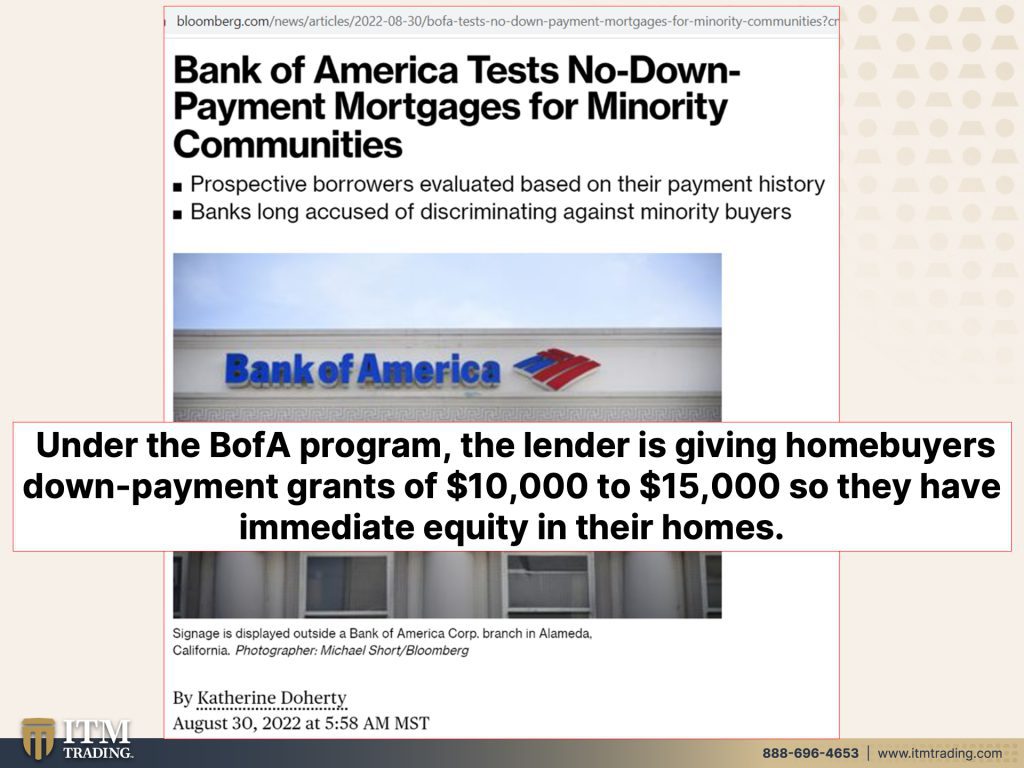

Will anyone step in to stem the tide? There seems to be an attempt to create a new pool of buyers to catch this falling knife. During the boom, credit was unavailable to those on the lower economic scale. But now credit and opportunities are becoming available to those same people; Washington, D.C. offers $202,000 in loans that do not have to be repaid until you sell the property or move. Bank of America is now “testing†no-down-payment mortgages for minority communities. Hmmm, I thought we tested those in 2008.

We did, so the bank will “grant†those buyers $10,000 – $15,000 so they have immediate equity. That is supposed to motivate them to continue paying the debt, but that was still easy equity. It might just matter more if that was earned and saved equity.

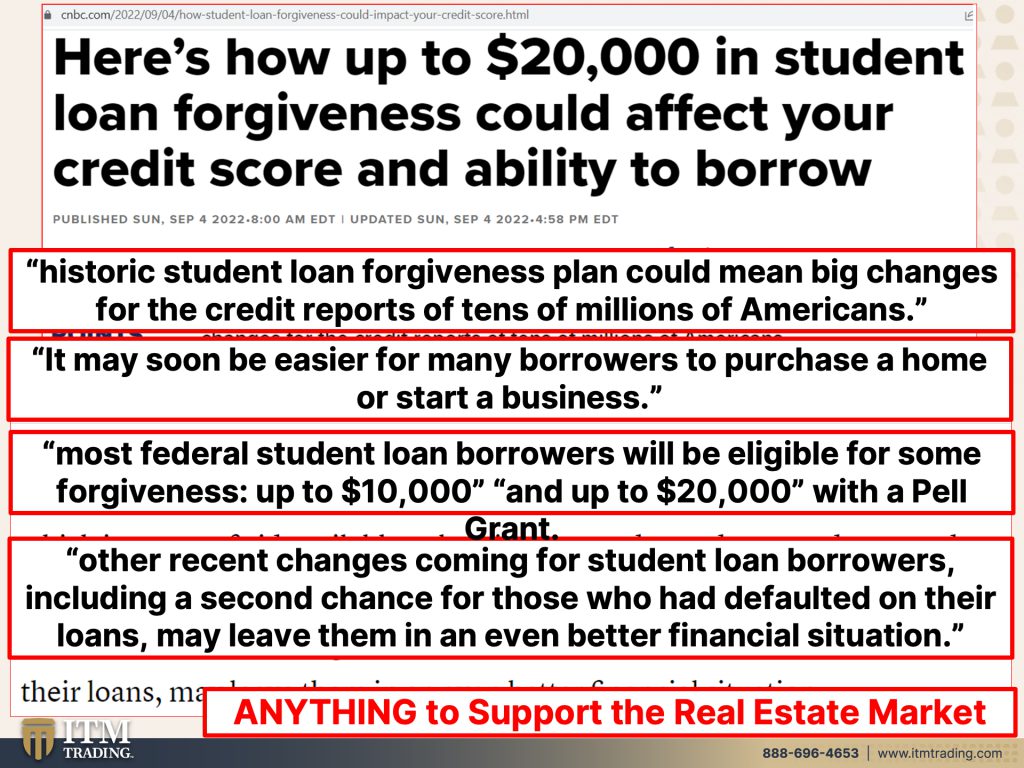

And of course, we cannot forget the student debt forgiveness of upward of $20,000. This could change income to debt ratios as well as credit scores, enabling still saddled with debt buyers the ability to take on more debt and buy a house.

Looks like an accident waiting to happen to me. Particularly because instead of the Fed and Government working together, their policies battle each other. The Fed is raising interest rates to attempt to curb inflation, while the government passes spending bills (with titles like the “Inflation Fighting Bill†that takes a lot of current spending before seeing the benefit in 10 years. Sigh.

That means that this is the time to take the most conservative stance as the Fed battles for credibility putting the entire system on the line. Are you ready for this? Don’t you want to hold what has worked for thousands of years, simply because it is a commodity money asset that has the most buyers of any financial asset. Additionally, it is the only financial asset that runs no counterparty risk.

Gold performs all these functions and more. It is the single most conservative stance you can take. Isn’t that what we all need now?

SOURCES:

https://www.realtor.com/research/august-2022-data/

https://fred.stlouisfed.org/series/FGCCSAQ027S

https://www.cnbc.com/2022/09/04/how-student-loan-forgiveness-could-impact-your-credit-score.html