Part Two: The Problems that Caused the Last Crisis are Bigger Today, 2008 Was Just a Warning!

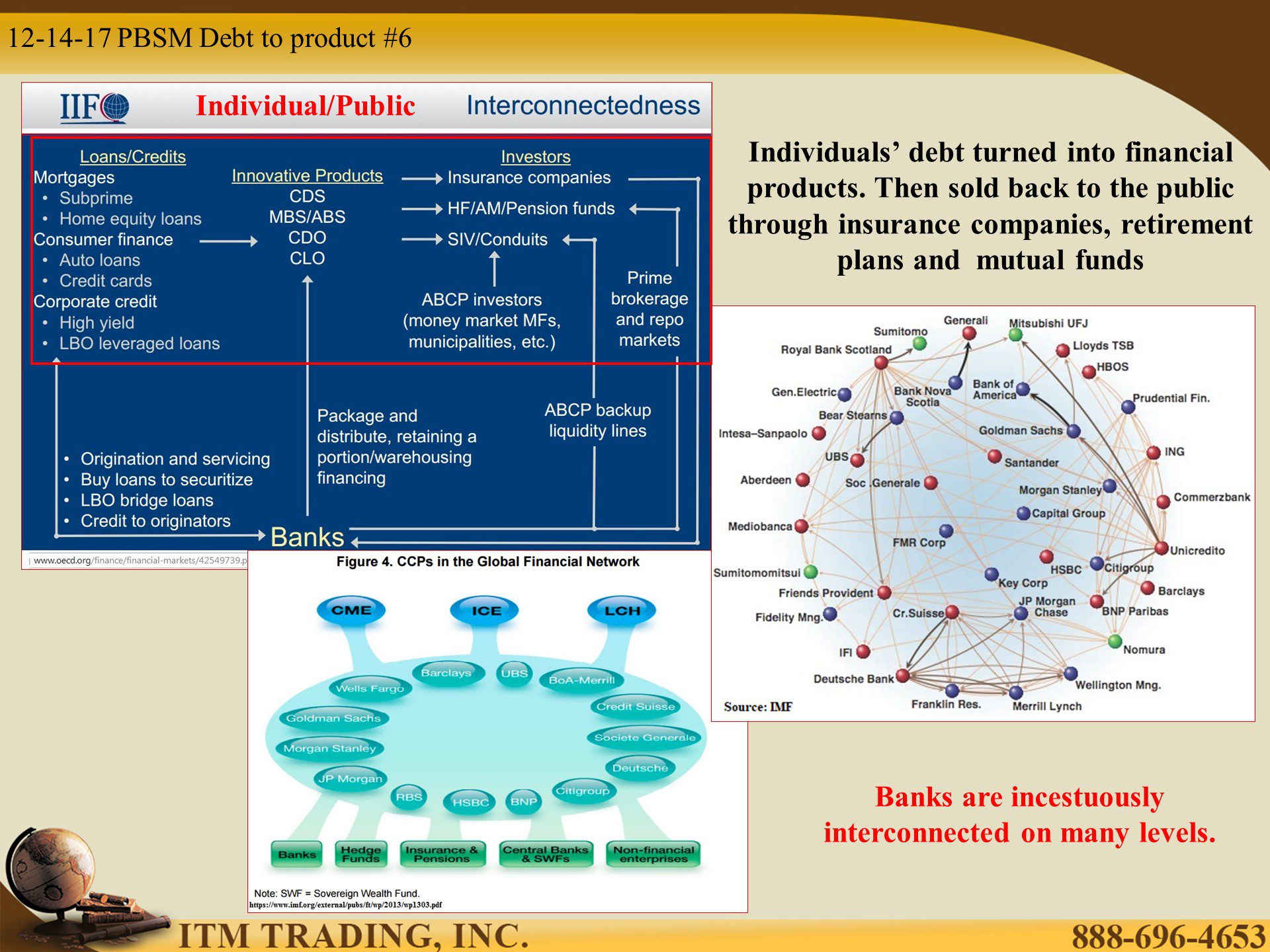

In 1997 adding new debt to the financial system no longer expanded overall economic stimulation, as witnessed by the monetary velocity (the speed at which people spend). Since banking is primarily based on growing debt and leverage, the financial system turned to “Financial Engineering†and deregulation to generate stimulation and income for the banks. One could say that Wall Street was now in control.

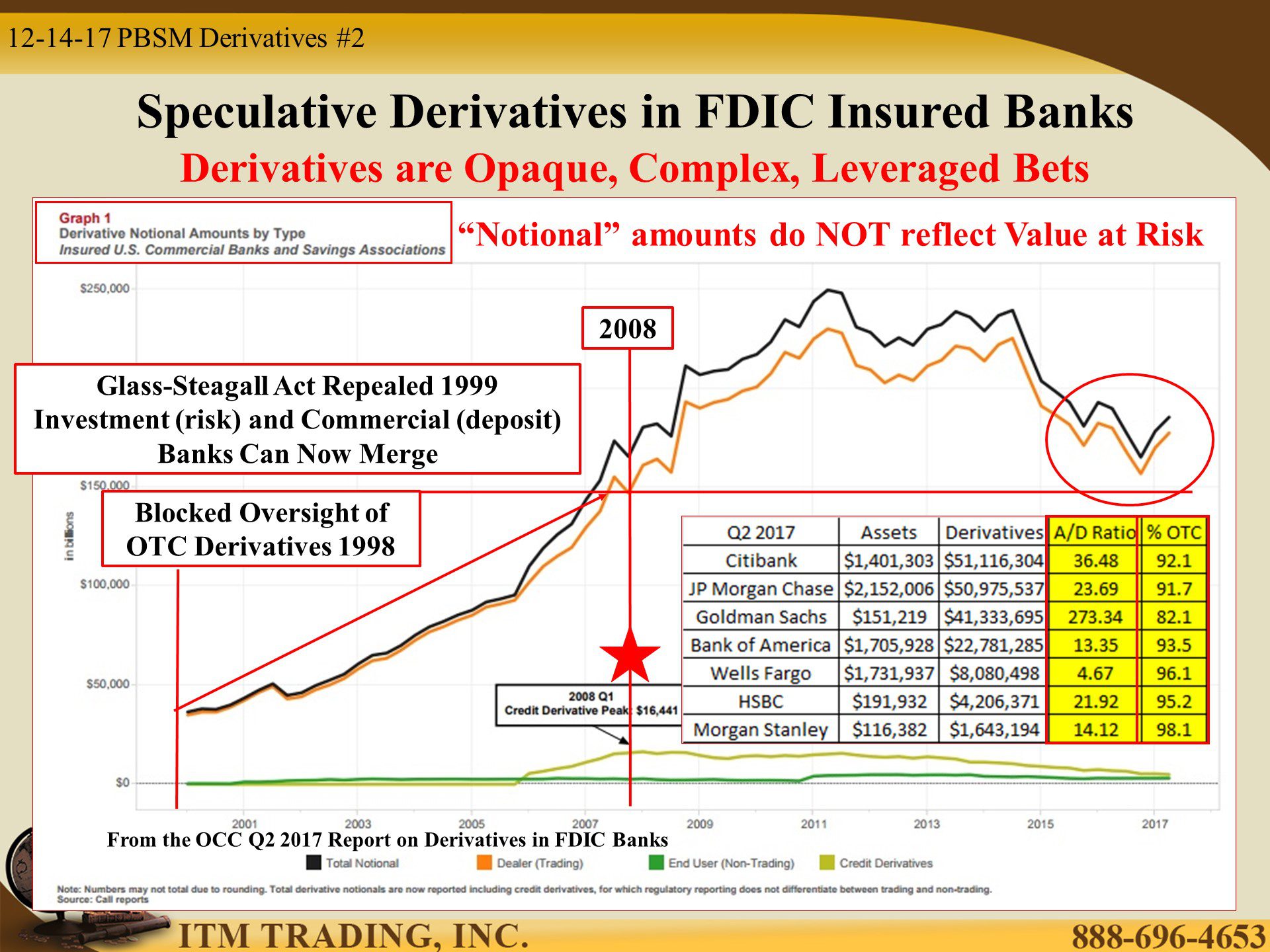

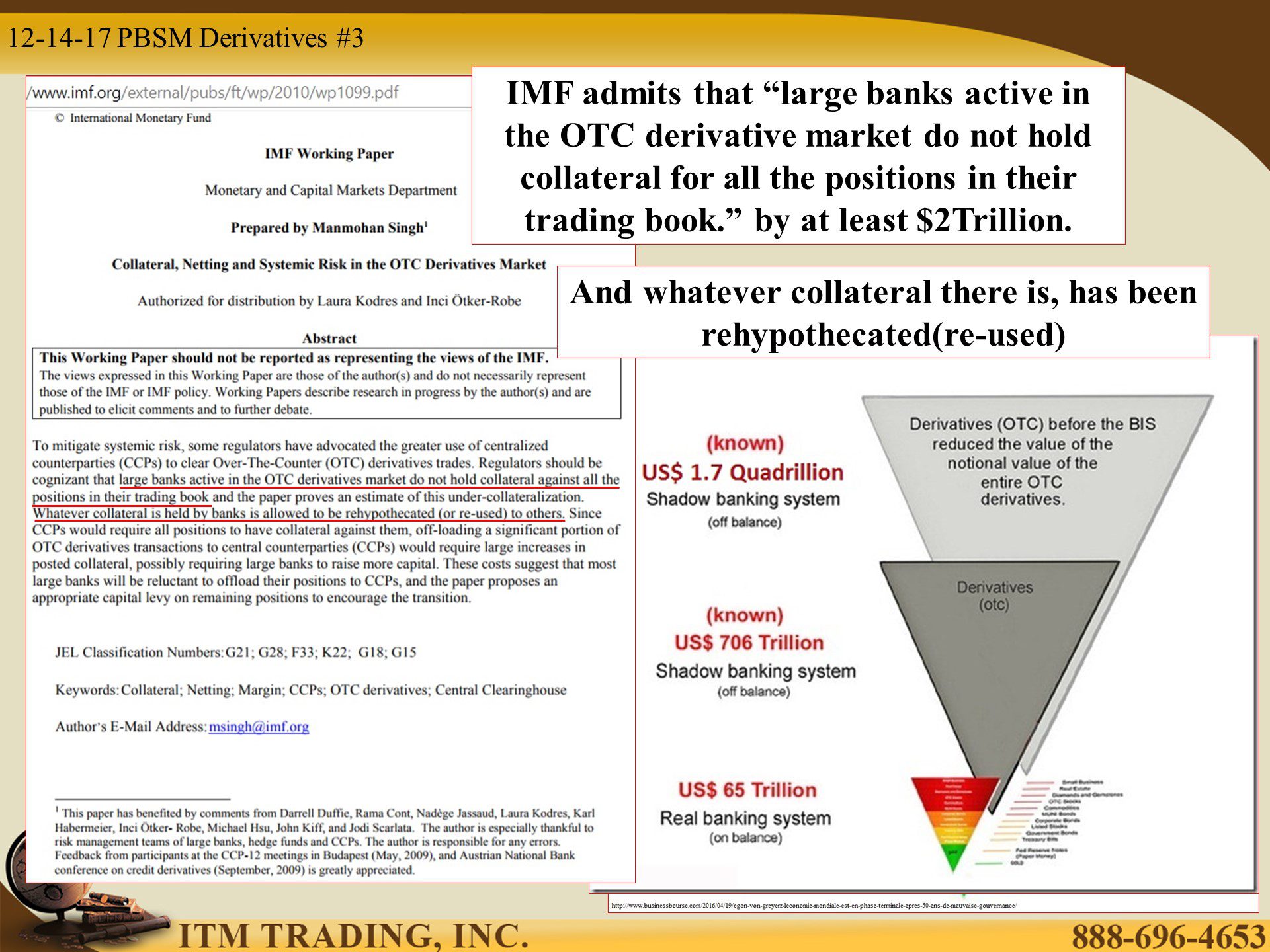

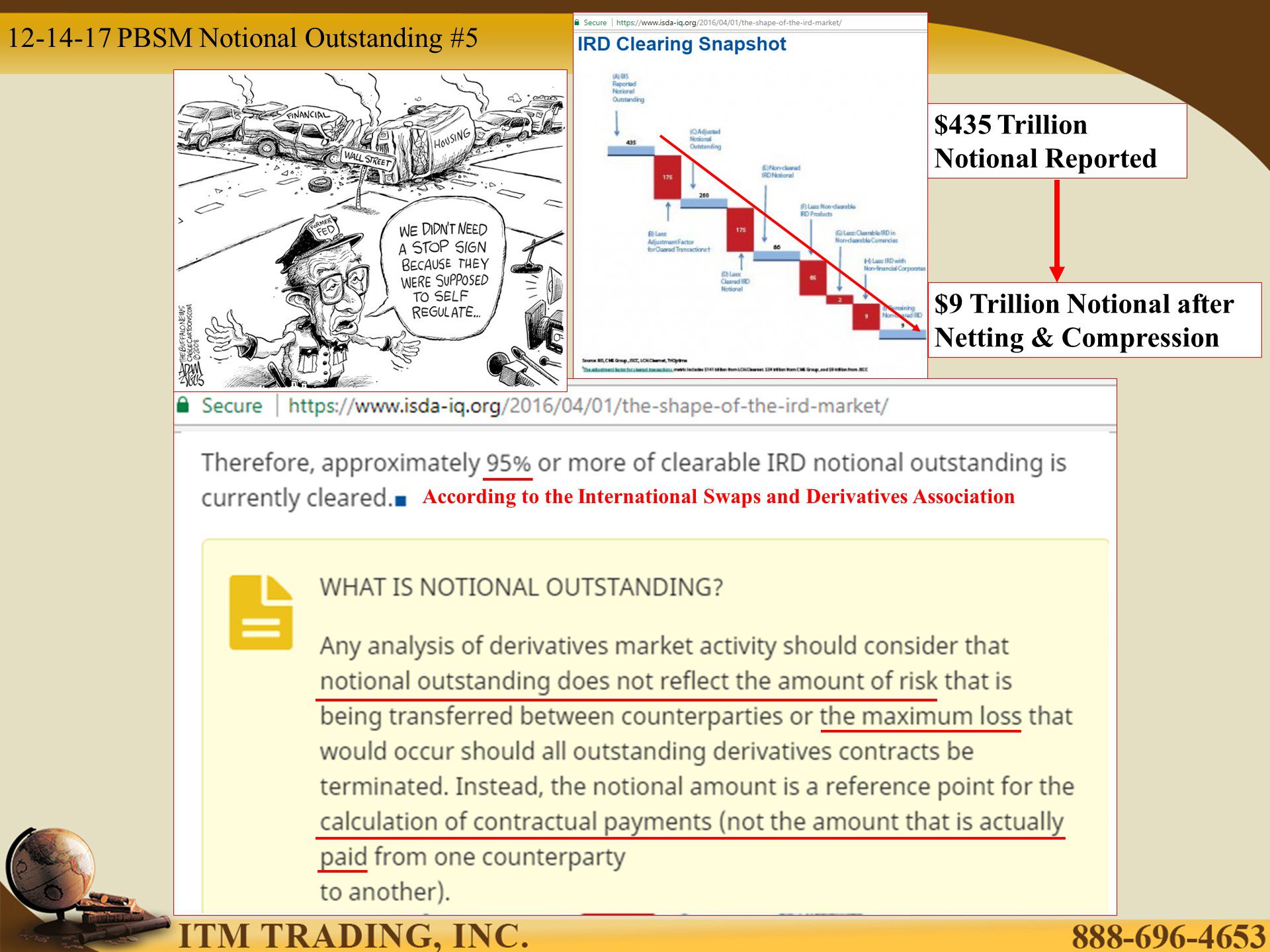

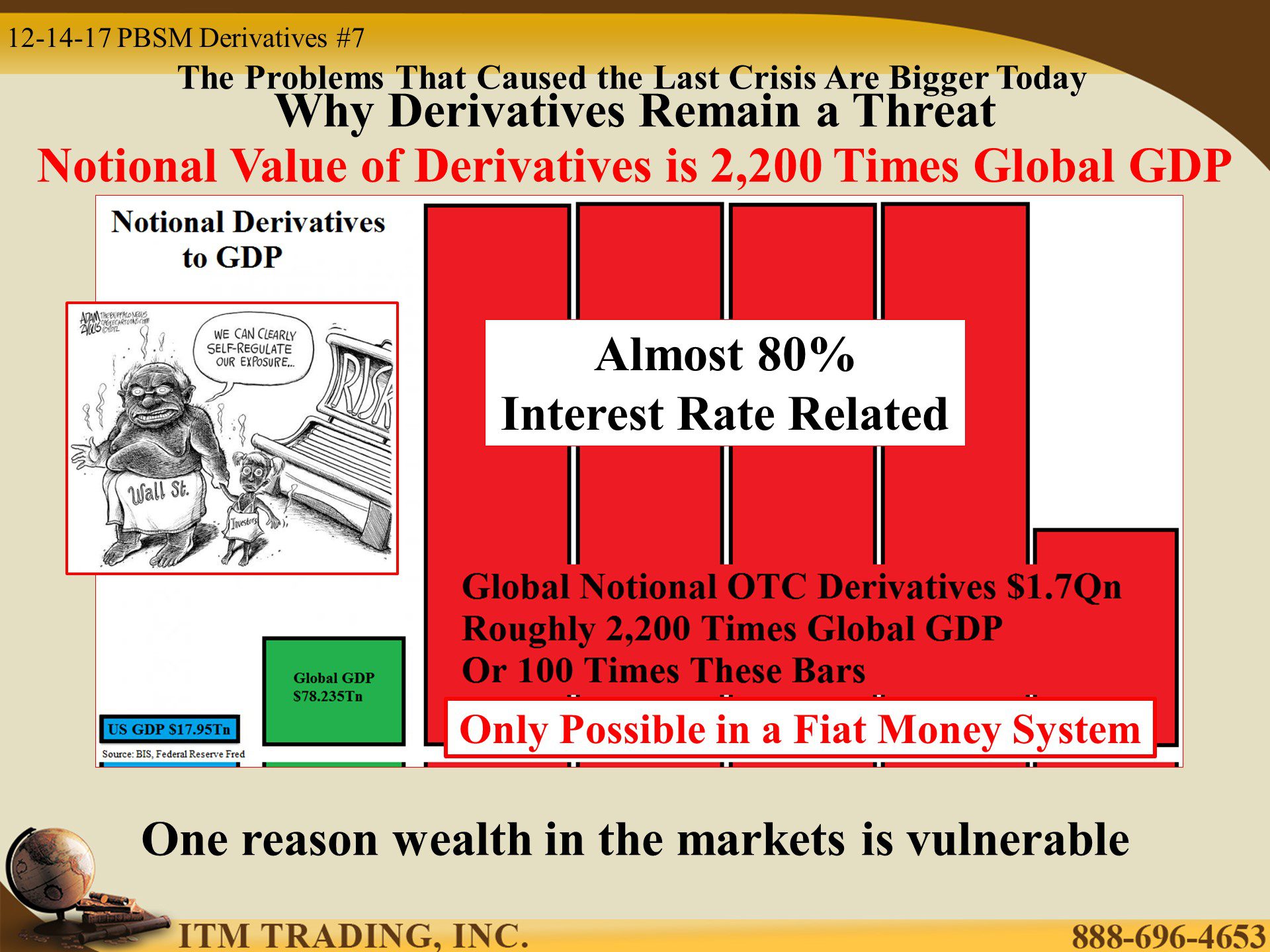

Speculative derivatives exploded, though most were hidden from scrutiny via the OTC (Over the counter) market. Simply put, derivates are bets based upon an asset or instrument (stocks, bonds, real estate, fiat currencies, bitcoin and other derivatives). Their market value is based upon the price action of the underlying, though you cannot convert the derivative contract into the underlying. OTC derivatives are either bi or tri lateral trades, meaning between two or three entities, so there is, at best, a very limited market for OTC derivatives.

In addition, banks were allowed to self-regulate and grow extreme levels of leverage. This growth was fueled and maintained by credit. In 2008 the credit markets froze and mortgage derivatives (CDO) imploded killing the debt based financial system.

It is not a surprise, having transferred control to Wall Street, that traditional central bank tools (interest rates and debt expansion) no longer covered up the truth. Global central bankers used experimental tools to put the system on life support until the new money standard and financial system could be put in place.

They want the pubic to believe the issues that cause the crisis have been solved. But is this the truth? Is the derivative threat solved? That’s what we’ll examine this today’s Peek Beneath the Skin of the Markets, then you can draw your own conclusions.

To View Part 3 of 4: https://www.itmtrading.com/blog/part-three-current-laws-make-wealth-markets-vulnerable-2008-just-warning/

Slides and Links:

-

- Â

Â https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/derivatives-quarterly-report.html

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/derivatives-quarterly-report.html

Â https://www.isda-iq.org/2016/04/01/the-shape-of-the-ird-market/

https://www.isda-iq.org/2016/04/01/the-shape-of-the-ird-market/  https://www.imf.org/external/pubs/ft/wp/2015/wp1521.pdf

https://www.imf.org/external/pubs/ft/wp/2015/wp1521.pdf  https://www.bis.org/publ/qtrpdf/r_qt1712.htm

https://www.bis.org/publ/qtrpdf/r_qt1712.htm  http://fortune.com/2017/04/21/donald-trump-obama-financial-regulations/ http://www.businessinsider.com/donald-trump-owns-gold-2015-7

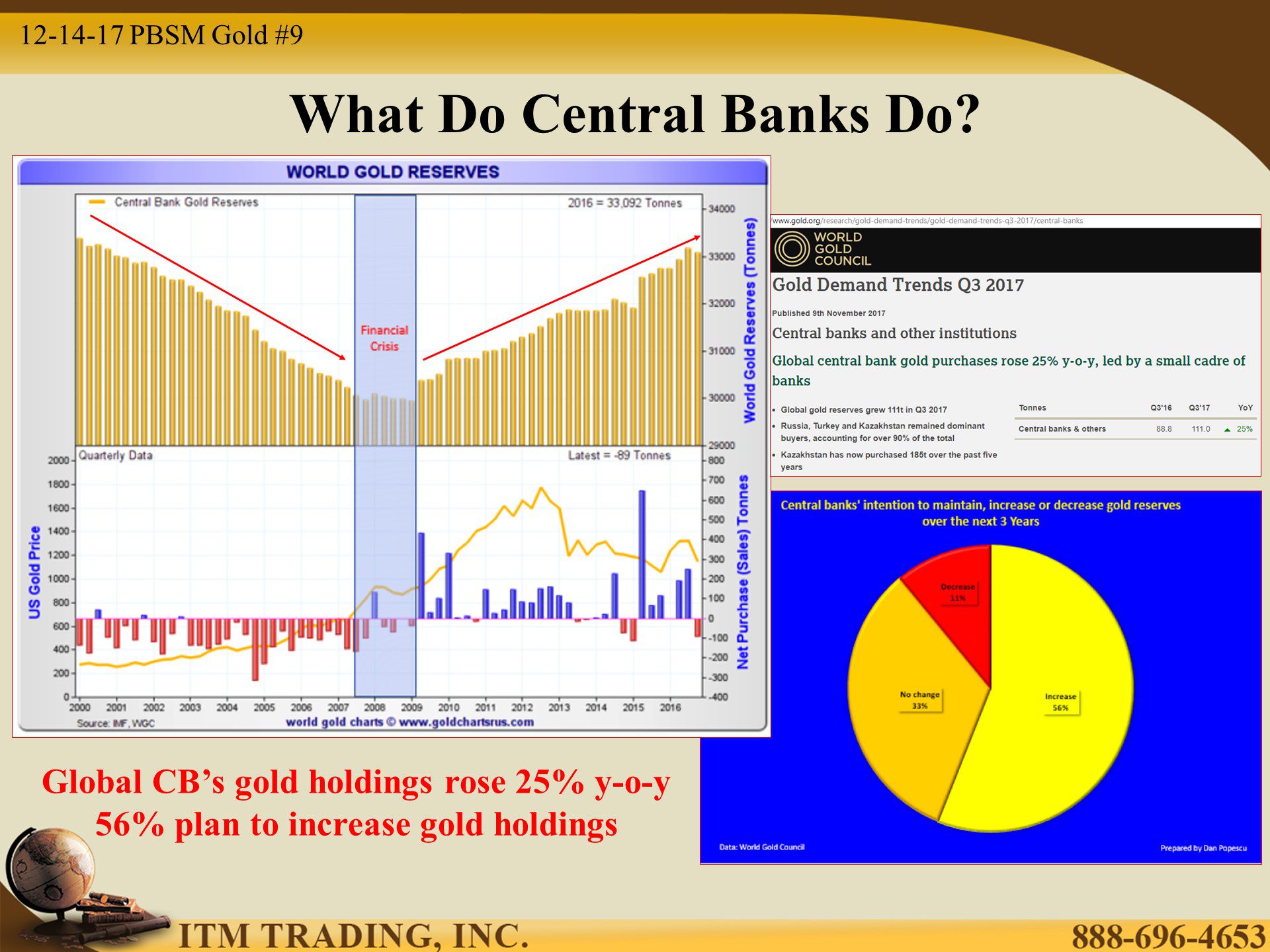

http://fortune.com/2017/04/21/donald-trump-obama-financial-regulations/ http://www.businessinsider.com/donald-trump-owns-gold-2015-7  https://popescugolddotcom.wordpress.com/2017/01/26/gold-and-silver-outlook-2017/ https://www.gold.org/research/gold-demand-trends/gold-demand-trends-q3-2017/central-banks

https://popescugolddotcom.wordpress.com/2017/01/26/gold-and-silver-outlook-2017/ https://www.gold.org/research/gold-demand-trends/gold-demand-trends-q3-2017/central-banks

- Â