Part II EXPERTS SOUND THE WARNING BELL: Is Your Retirement at Risk? By Lynette Zang

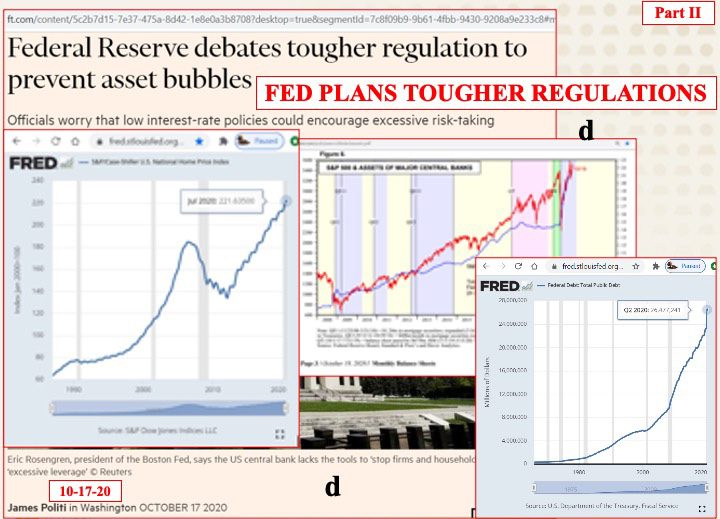

The Fed wants you to believe they are concerned about future fiat asset bubbles. Frankly, that’s a joke since “financial repression†is a key tool used by them. Financial repression in the form of ZIRP (zero interest rate policy) that forced savers to take on more risk, since they are not being paid to hold “safe†government bonds. (government bonds are considered safe because governments can tax and create the money to repay the principal)

Have more questions that need to get answered? Call: 844-495-6042

Who are the biggest savers? Those either in retirement or those planning for retirement and we should all know about the retirement crisis that has been unfolding since the last financial crisis in 2008. Additionally, those institutional investors that manage defined benefit plans that “guarantee†monthly benefits, both individual corporations and multi-employer plans, as well as fixed annuity contracts are mostly underfunded. Which means that promised benefits are bigger than the funds available to pay those benefits, even with stock and bond markets at record highs.

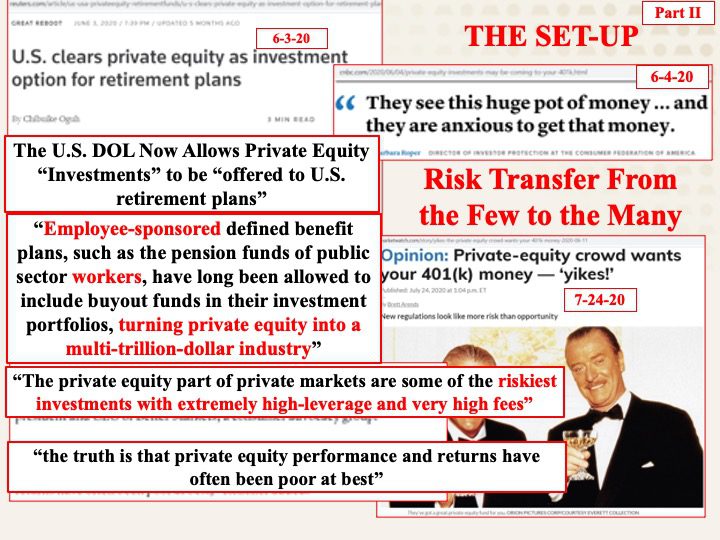

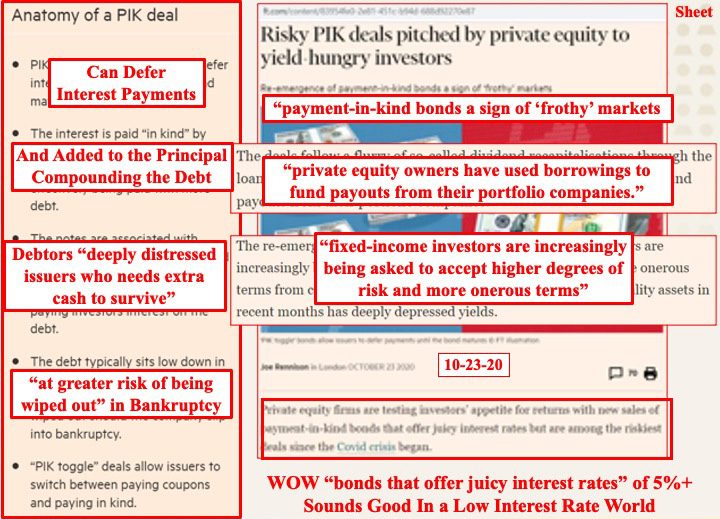

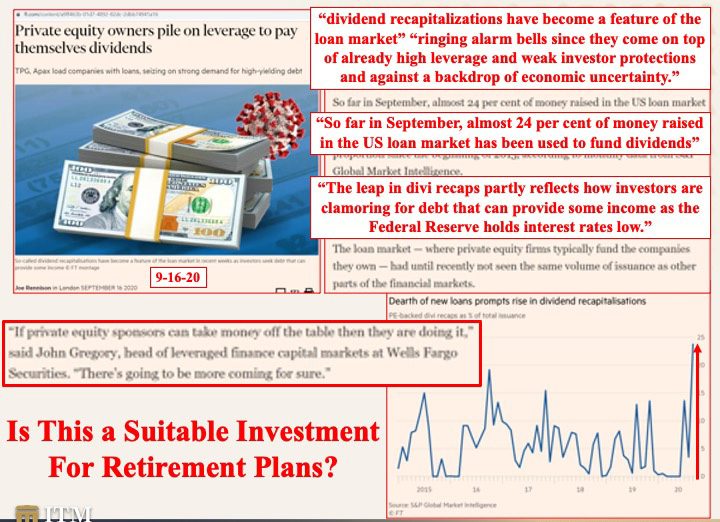

What is the answer to this dilemma? Deregulation and higher risk. But this policy has been unfolding since 2016 as Dodd-Frank investor protections have been dismantled (though bail-in has not been touched). Some think the low hanging deregulatory fruit has been plucked, so now comes the bottom of the barrel, private equity.

Private equity coffers have grown exponentially in the Feds free money environment. Some of that has been used to lobby for access to the multi-trillion retirement plan market. Finally, success. In June 2020, in the depth of the pandemic crisis, the DOL (Department of Labor) cleared private equity as an investment option for retirement plans claiming superior performance, though many question this claim.

There is, however, precedence, since in similar market circumstances in the late 1970’s, pension plans were allowed to use private equity. I suppose they considered those managing pension plans sophisticated investors, but with this long track record, and considering how underwater these plans are, it appears not to have worked as well as hoped.

Do you think that average 401K plan investor understands the opaque private equity market?

How about ETFs, a new wall street product that gained popularity since the financial crisis in 2008. With the Fed’s money printing wind for support, non-managed ETFs with lower fees took over from managed mutual funds. But not all ETFs are created equal, though legally, they do not have to hold cash reserves (most don’t). They can, however, hold lots of leverage.

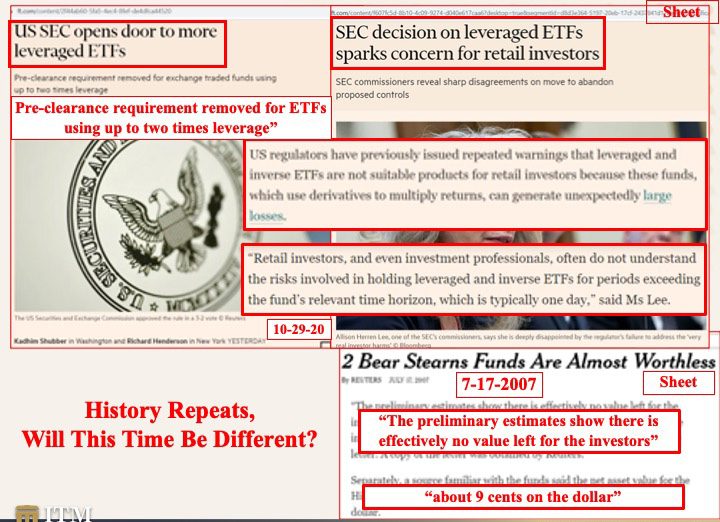

Experts have been sounding the warning bell about the potential amplified losses by these leveraged and inverse ETFs stating that “It is best to avoid these funds altogether. They are only designed for a one-day holding period, and making a bet over that horizon is no different than going to a casino.†But you can hold them in retirement plans.

In fact on October 29th, the SEC (Securities Exchange Commission) eliminated the pre-clearance requirement for any ETFs using two times leverage, even as some SEC commissioners stated “Retail investors, and even investment professionals, often do not understand the risks involved in holding leveraged and inverse ETFs for periods exceeding the fund’s relevant time horizon, which is typically one day.†Does this financial product seem appropriate to you?

For me, it takes me back to 2007 and Bear Sterns who had similar products, the Enhanced Leverage fund and the High-Grade Fund, that ended up virtually worthless near 9 cents on the dollar. Up until they collapsed, retail investors were assured they were OK. Bear Sterns even threw money at them to keep them afloat, but overnight, they collapsed anyway.

And that’s the thing, when this house of cards becomes too expensive to support, they game will be over. What will you have when that happens?

I will be holding real assets; food, water, security, shelter, gold and silver. I’m also working on being part of a community that comes together and to get through this social, economic and financial crises that is already unfolding. What do you want to be holding when this jenga economy implodes?

Slides and Links:

Slide 1:

https://fred.stlouisfed.org/series/CSUSHPINSA

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://fred.stlouisfed.org/series/GFDEBTN

Slide 2:

https://www.marketwatch.com/story/yikes-the-private-equity-crowd-wants-your-401k-money-2020-06-11

https://www.cnbc.com/2020/06/04/private-equity-investments-may-be-coming-to-your-401k.html

https://www.brookings.edu/interactives/tracking-deregulation-in-the-trump-era/

Slide 3:

https://www.ft.com/content/83954fe0-2e81-451c-b94d-688d92270e87

Slide 4:

https://www.ft.com/content/8e746db1-6acf-408d-8f0a-769ffe68fe4a

Slide 5:

https://www.ft.com/content/a9ff463b-01d7-4892-82dc-2dbb74941a16

Slide 6:

https://www.ft.com/content/2f44ab60-5fa5-4ec4-8fef-de4dfca44520 10-28-20

https://www.nytimes.com/2007/07/17/business/17cnd-bond.html

Slide 7:

Slide 8:

https://www.gold.org/goldhub/data/monthly-central-bank-statistics