Insider Trading: What is Really Going on with Gold and Silver

Insider Trading: What is Really Going on with Gold and Silver by Lynette Zang

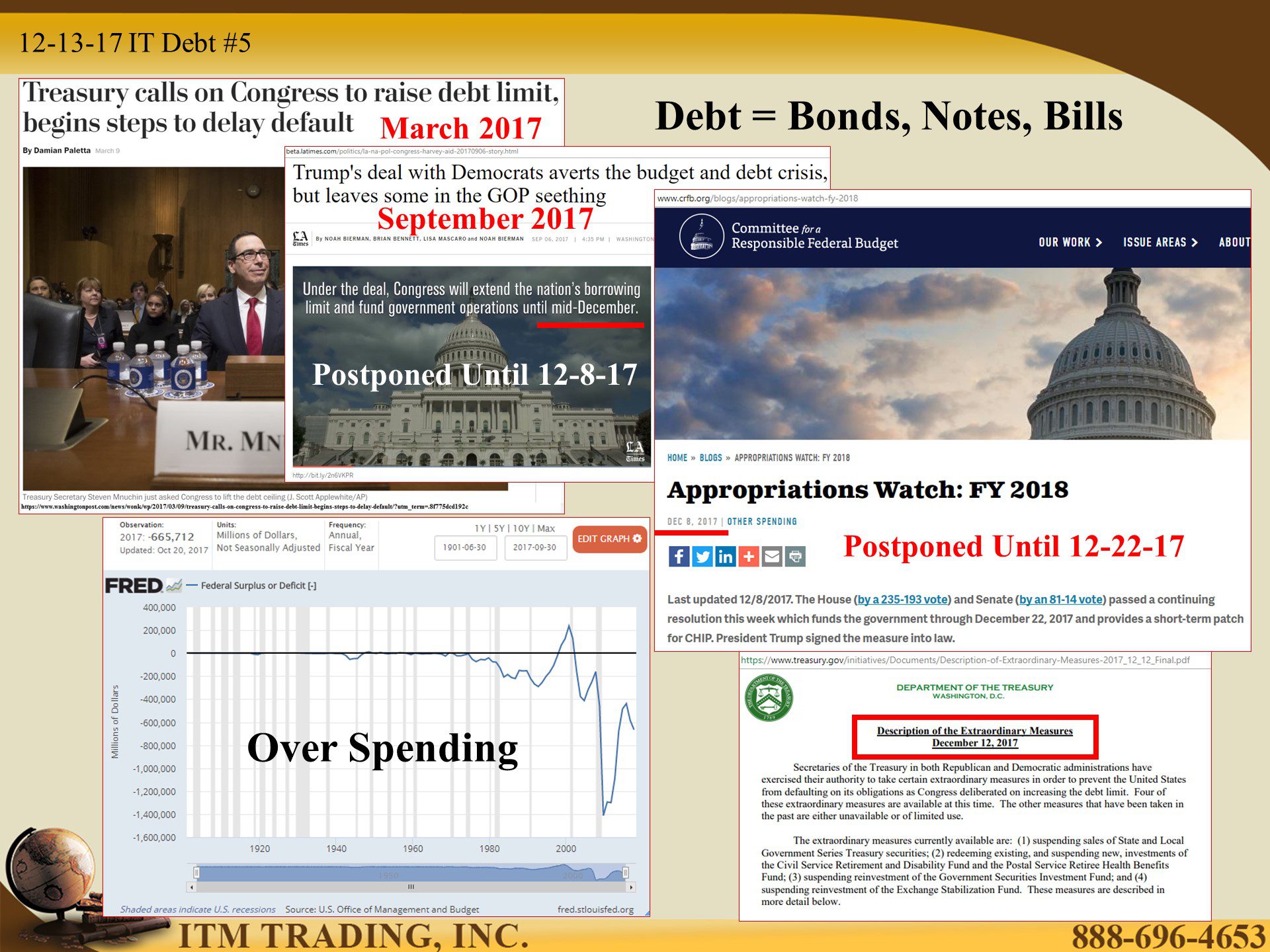

Yet another pattern shift in the bond market. Up until September the yield movement of the US Treasury 10 Year Note and the German 10 year Bund were almost perfectly correlated, but in September, there was a pattern shift. Today, the difference in yield between the two is at the widest level yet as both bond yields rise. Why does this matter?

Because our current fiat money system is based upon debt and the US debt limit has been suspended since last March 15th. This means that the government can spend as they wish and the new ceiling will be raised above that level. But the interesting thing is that while the debt ceiling has been raised fourteen times since 2000, it has been suspended only three times starting in 2013. This is a pattern shift that in my opinion, indicates that the extraordinary central bank policies put in place during the 2008 crisis, are breaking down.

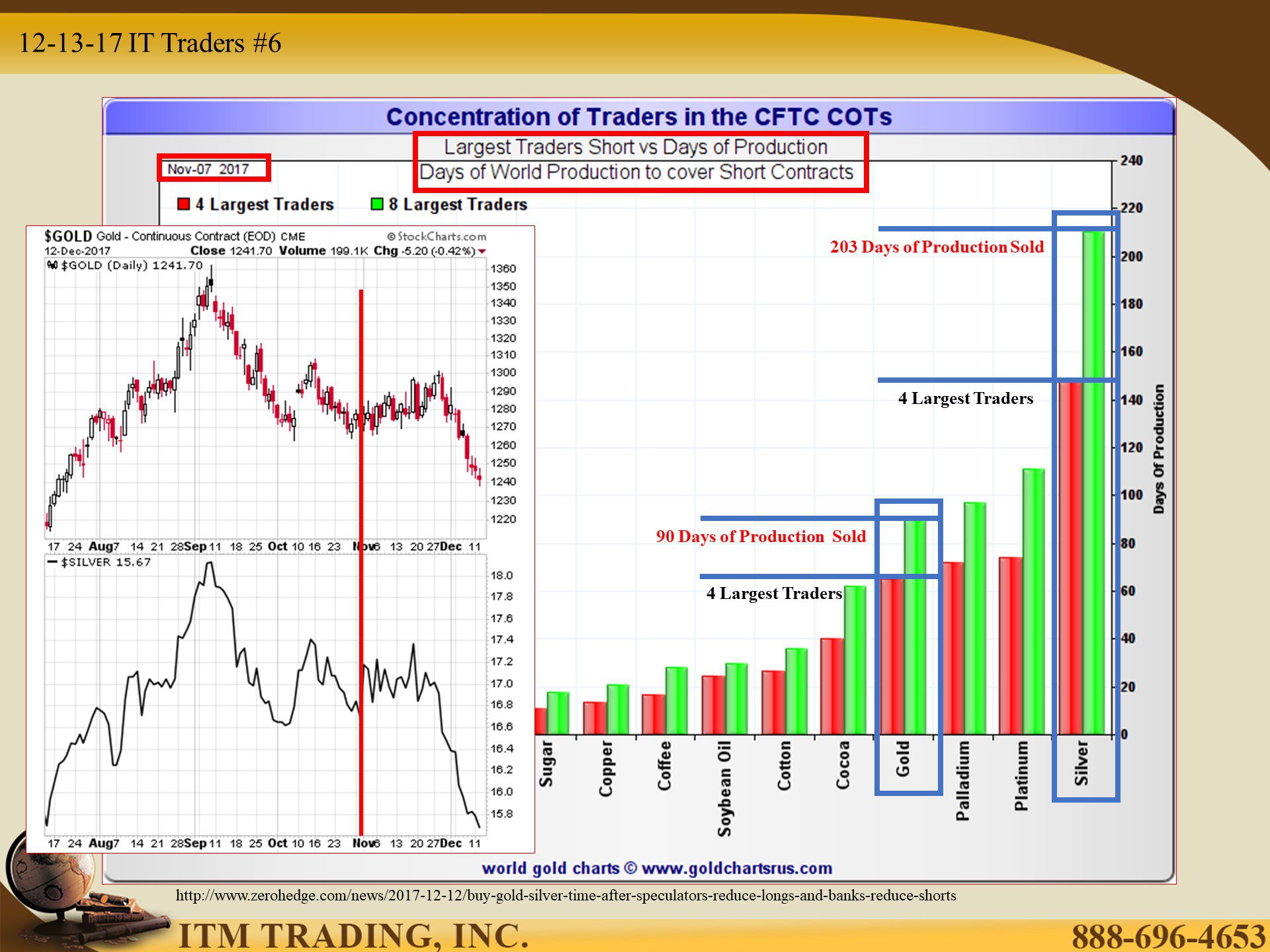

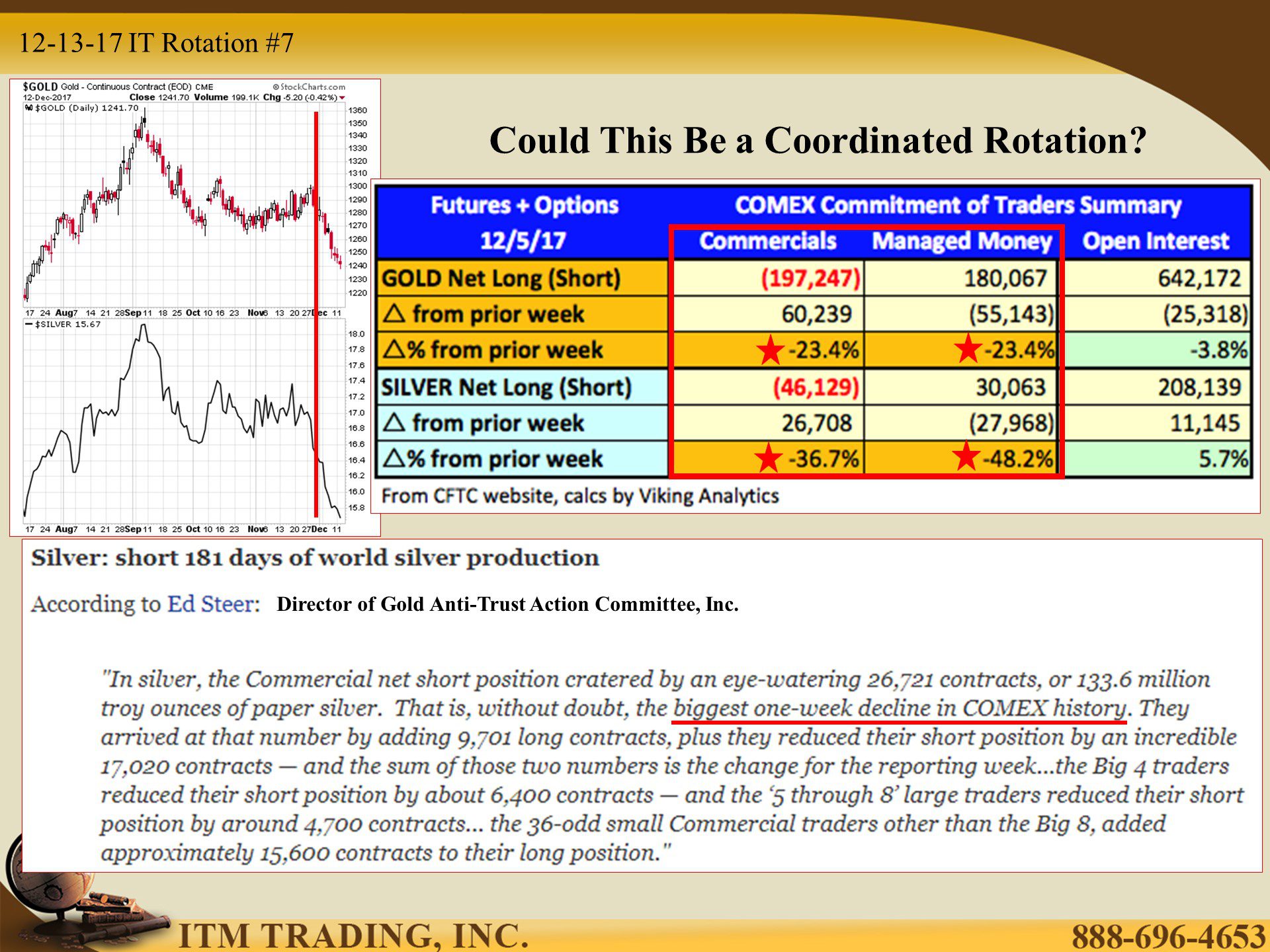

Do you think that governments and central bankers want you to know this? Gold and silver, as monetary metals, were near all-time highs when this breakdown began. Keeping in mind that a rising gold price is an indication of a failing currency, it was inevitable that the visible fiat price had to be “managedâ€.

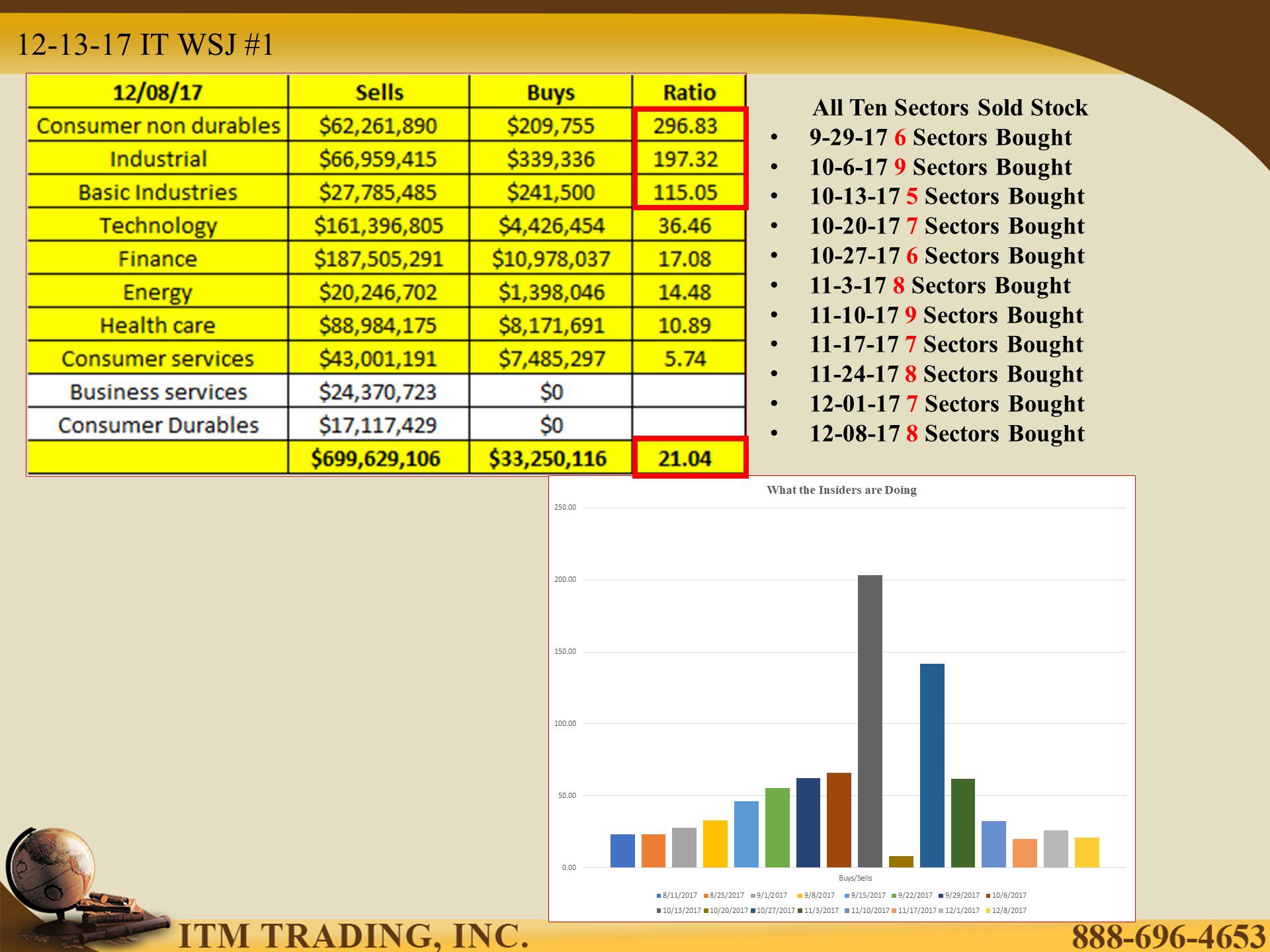

We’ve examined many of the fiat money tools used to “manage†market prices. Today we’re going to look at one way the traders help hide the truth from the public and make money for themselves in the process.

Slides and Links:

http://www.wsj.com/mdc/public/page/2_3023-insider.html

http://stockcharts.com/h-sc/ui?s=llnw

http://www.nasdaq.com/symbol/llnw/insider-trades

http://stockcharts.com/h-sc/ui

https://fred.stlouisfed.org/series/GFDEBTN

https://fred.stlouisfed.org/series/GFDEBTN?cid=5

https://fred.stlouisfed.org/series/GFDEBTN?cid=5

https://www.thebalance.com/u-s-debt-ceiling-why-it-matters-past-crises-3305868

http://beta.latimes.com/politics/la-na-pol-congress-harvey-aid-20170906-story.html

http://www.crfb.org/papers/year-end-debt-dilemma

https://fred.stlouisfed.org/series/FYFSD

https://edsteergoldsilver.com/visitors/

https://www.reuters.com/article/us-bank-nova-divestiture-goldman-sachs/goldman-sachs-among-bidders-for-scotiabanks-metals-unit-sources-idUSKBN1DS2C5

https://www.reuters.com/article/us-bank-nova-divestiture-goldman-sachs/goldman-sachs-among-bidders-for-scotiabanks-metals-unit-sources-idUSKBN1DS2C5

https://blogs.wsj.com/moneybeat/2017/12/05/gold-trading-hasnt-been-this-quiet-since-2005/