INFLATION & GLOBAL CORPORATE TAX…HEADLINE NEWS WITH LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

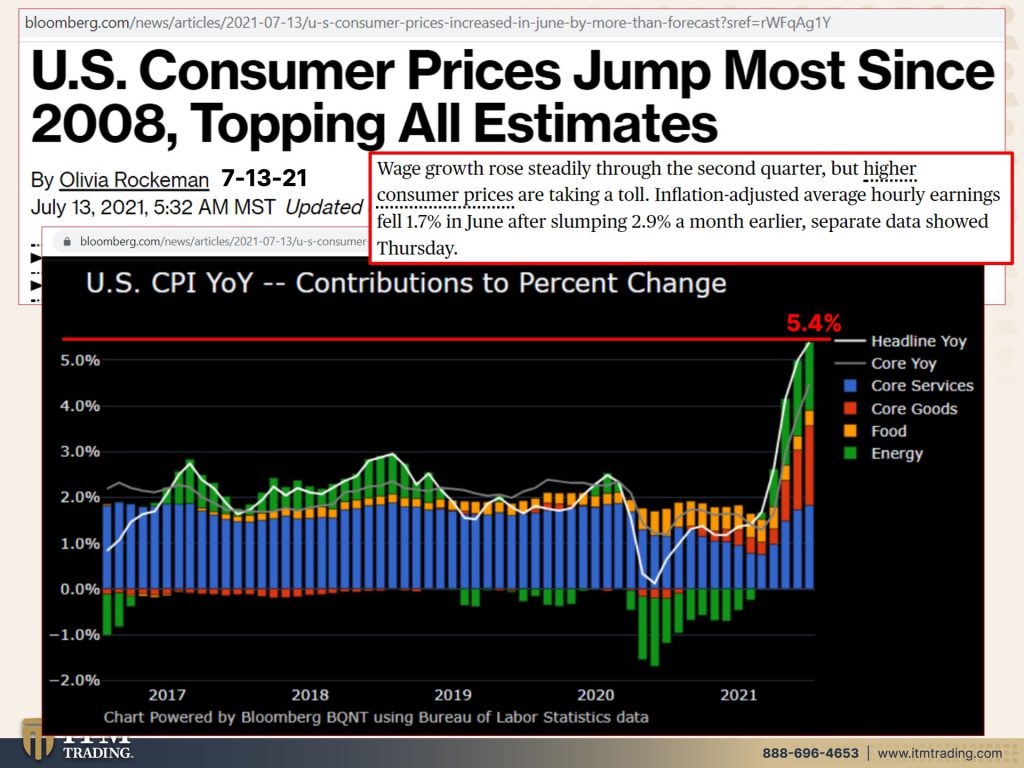

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver company, specializing in custom strategies. And one strategy, frankly, that should be apparent to everybody is you need to hold physical gold and silver outside of the system. But today we got some inflation numbers. They beat everybody’s expectations? So look at this us consumer prices jumped most since 2008 it’s with, I’m glad that they think it’s transitory. And some of it is, I mean, used car prices were up 45%, but the inflation is coming in at a whopping 5.4%. And not all of that is about used cars or even hotel rooms. And frankly, I do not think that it’s transitory and many others don’t think that either, but here wage growth rose steadily through the second quarter, but higher consumer prices are taking a toll inflation adjusted average, hourly earnings fell 1.7%.

It’s that nominal confusion, by design wages never keep pace with inflation. This is what has enabled that income and wealth inequality. And quite frankly, I cannot say for sure that, that, that this is where the hyperinflation is starting, but it sure feels like it to me, it sure feels like it. So if you’ve been dragging your feet because of this reason or that reason, or whatever, other excuse that you’ve been using, stop using it, it does not serve you well. All of the estimates were for 4.8, 5.4. That’s nothing. That’s nothing compared to what we have coming because they haven’t stopped the quantitative easing that they started back in 2008 to try and buy them time. And they’re not going to stop it. They cannot stop it. for a while. They just held it in the stock market. And guess what? Well, that’s not true. That’s not true.

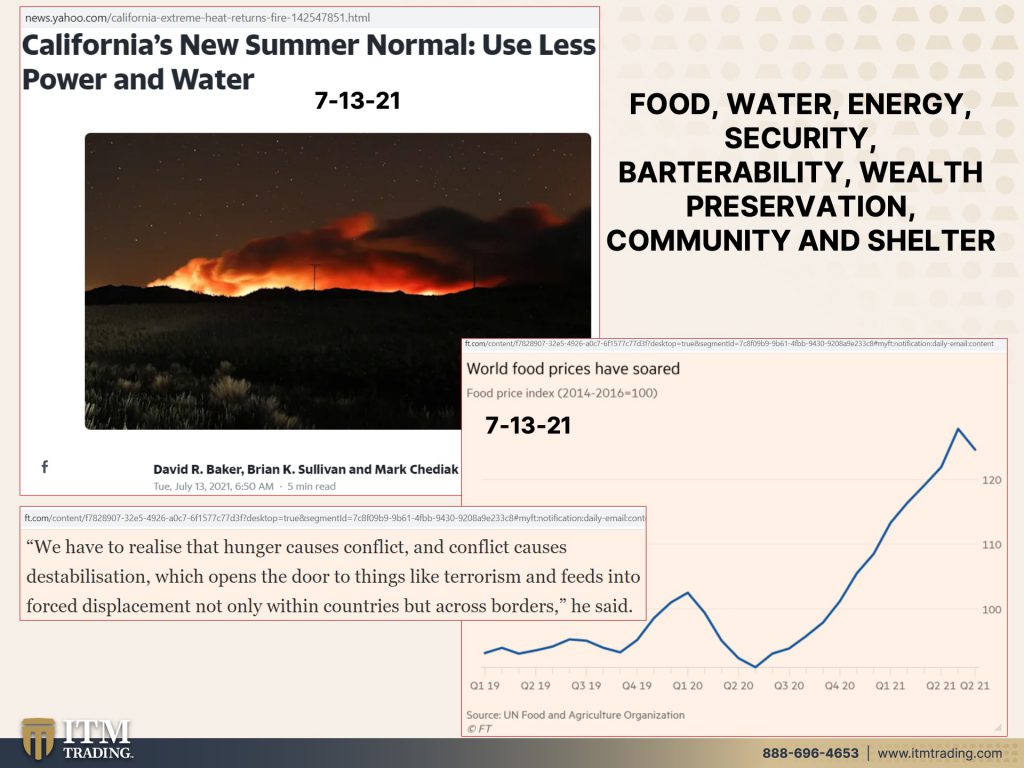

Food prices have been going up dramatically all over the world. The cost of medicine, the cost of education. They want us to believe that there’s been no inflation or that the inflation has been subdued, but that’s not true. It’s just going to get worse. And it’s going to be more and more noticeable. But, you know, the mantra, food, water, energy security, barterability, wealth preservation, community and shelter. Hmm California’s new summer normal use, less power and water. What if you had your own sources, would you have the same kind of impact that you’re going to have to deal with blackouts and brownouts? And that’s coming to a community near you. We can see it coming, do something about it while we still have the opportunity. Now we’ve talked a lot about the fact that food becomes the single biggest issue for people during these transitions and look at these global food prices.

That’s why it’s so important to have some kind of stock of food so that it doesn’t have an impact. Maybe you can do a garden, maybe you can’t, but there is always a way that you can make sure that you and your family can eat. Now, they’re going to try and keep everything calm. Okay? From this article, we have to realize that hunger causes conflict and conflict causes destabilization, which opens the door to things like terrorism and feeds into force displacement, not only within countries, but across borders. And how about it topples government regimes and the central banks. How about that? So we’ve got the first form of open UBI coming, the Childcare Tax Credit. That’s going out to about, I think, 6.5 million people, but you need to make sure that you are not going to have to pay it back because there are certain parameters that enable you to keep it.

And so don’t put yourself in a bad position, look into this a little bit more. If you’re going to receive it and make sure that you’re not going to have to pay back, but make no mistake. This is the beginning of the UBI. And once the stuff goes in place, do they ever change those rules? Everything that was temporary Nixon took us off the gold standard temporarily. And here we are all these years later. Now I will grant you that at the end of this mess, when everybody has lost confidence in the currency and in the systems, we are going to have to go back on to some kind of gold standard to get that confidence back up again, and to have people actually using the new currency. But I’m thinking 1971 to, I mean, I don’t know exactly when that’s going to happen. That’s an awful long time for it to be temporary.

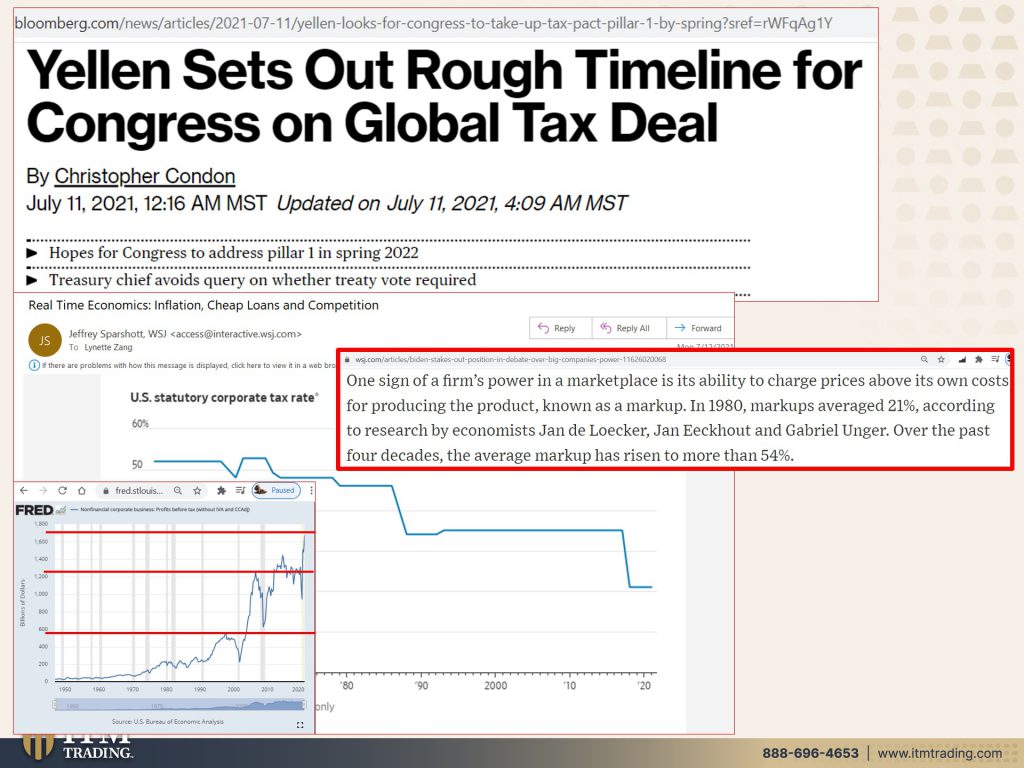

For me, it hasn’t been as temporary because I’ve been accumulating gold and silver, and I hope that it hasn’t been temporary for you because we need to become our own central bankers. And I, you know, and you’re hearing the agency because things are speeding up. Can you feel it now? They’re going in for a global corporate tax, which I think is frankly, just a way to open the door to a global citizens tax as well, because now the world is again, shrinking. So when they’re talking about the food and people being hungry and causing riots and whatever, that’s what could frankly stop this, but this, and I’m sorry, I didn’t animate this time. I just didn’t have time, but this is the statutory corporate tax rate in the U S and you can see that it’s gone down and down and down.

And now we’re at 21%. And the new global corporate tax rate that they’re calling for is 15%. And in the meantime, look at corporate profits….You can see the corporate tax rate is just gone down, down, down over time because they’re are clearly a lot more important than the individuals. And even so, you know, they’ve got accountants, they’ve got attorneys to figure out how they can pay zero. We’ve talked about this in the past. And in the meantime, these are corporate profits. This is going into 2000 crisis, right? The NASDAQ bubble. This is 2008. And here we are in 2021. These are the non-financial corporate profits. They need a tax break.

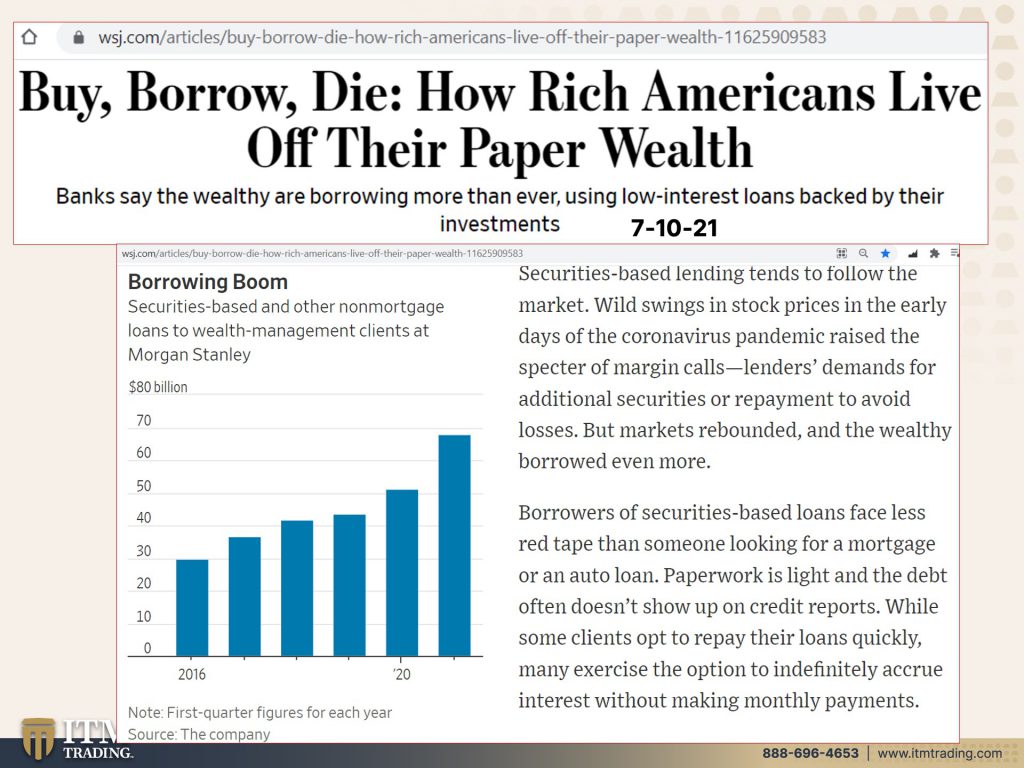

They need it globally, globally. That’s why I’m saying to that. I really think that this is just a way to open the door, to make us all more global citizens and to tax you as the individual, we’ll start here because what do you care on this global corporate tax? And that gets them in the door. It’s going to be interesting. I mean, we, frankly, we could not be living during more interesting time and they expect to get this done by Spring of 2022. Of course they need approval from Congress. Will they get it? We’ll see. We’ll see. But in the meantime, the wealthy that are getting wealthier because of all of where all of this hyperinflated money printing is going is into the targeted markets. What’s the attitude buy, borrow, die. How rich Americans live off their paper, wealth. This is something frankly that we’ve talked about in the past.

And what corporate, what individuals that have stock in these different corporations do is they use that as collateral to borrow. Well, as long as they keep going up, not a problem, which is one of the reasons why we have seen the wealthy targeted and doing the stock market targeted and real estate, doing so much better. But when they go the other way, that’s not so good because debt is only good if you have the ability to actually pay it off. Boom at any moments notice. I don’t agree. There are those out there that think, well, you know, buy, borrow, buy, borrow, and never pay the taxes on it because, let me read this whole thing. Securities based lending tends to follow the market. Wild swings in stock prices. In the early days of the Corona virus pandemic raise the specter of margin calls, lenders demands for additional securities or repayment to avoid losses, but markets rebounded and the wealthy borrowed even more.

It was the same thing where interest rates were pushed down so that corporations could refinance and get rid of their debt easier. And what did they do? They borrowed more. They borrowed more. The whole system is based on never ending debt. Can you see that this party is close to over? Borrowers of securities based loans, face less red tape than someone looking for a, say a mortgage or an auto loan, which would be more normal people. Paperwork is light. And the debt often doesn’t show up on credit reports, handy. While some clients opt to repay their loans quickly, many exercise, the option to indefinitely accrue interest without making monthly payments, which you can do as long as the price of your stocks and your bonds continue to go up. So quite handy that our central bank has targeted, these assets in a reflation trade and why they can’t stop.

And we’ve seen this in Venezuela. We’ve seen it all over the place where the stock market, this is nominal confusion, right? These wage increases, the increases in the stock market, the increases in the real estate market, right? You think that they’re going up, but what it really is, is the value of the currency going down and down and down every time the central bank creates more new money, the value of what is out there, declines. And we are the ones, that, cause we get it last. We are the ones, the normal human beings, that pay for this. This is why it is so critically important. Now you’re going to hear about, you know, because Hey, the central banks are still, bankers are trotting out and saying, no, this is transitory because used cars won’t keep going up a 45%. Well, it’s going to be interesting to see if the prices of used cars after actually come down, down the road.

I agree. They can’t keep going up 45% a year. Clearly they can’t. And they’ll blame it on the supply chain and their inability to get components in different things. But the reality is, is it’s all about when the fed took over and said, we are going to manage these markets. They are “managing,†they have managed these markets into a major hyperinflationary event. And this could very well be the start. So what’s the answer? Well physical gold and silver’s the answer. And interestingly enough, this was on CNBC this morning, really denigrating silver, delegate, grading. You know, those that believe in tangibles, look at this, she’s actually holding up a silver bar and they’re, you know, the pundits on these talking heads on wall street, they just, oh, there’s so much silver out there. And like gold. Nobody tends to throw it out. No, because it’s real flipping money. That’ll throw, throw it out. But there’s tons of stocks and bonds and contracts. We are a wash in these contracts, unless I repeat myself yet again. And I will probably repeat myself a million years on this. The bank for international settlements tells us that gold, silver are the only financial assets that run no counter party risk and if held at home run no political risk.

So while I’d like to see a Reddit, eye on gold as well, Wall Street, these talking heads are doing their jobs to keep people away from the only asset that even has a snowball’s chance in Hades of protecting them. Both physical gold, physical silver, outside of the system, truly decentralized, truly invisible once you own it, with no counter party risk, please tell me what else has no counterparty risk?

Well this morning, I’m not exactly sure when it’s going to be out, but I think she’ll get it out pretty quickly. I was on with Michelle Holiday, Portfolio Wealth Global channel, and we really dug in very, very deeply on the central bank, digital currencies, the CBDC’s. So I’m going to encourage all of you. We’ll post the link as soon as we get it. And I’m going to encourage everybody to go and watch that, she did a phenomenal job, but was really what was really nice with me for me was that a really had a chance to dig into that topic a lot.

And it’s such an important topic because that’s what they’re pushing us to. Now, also this week, I’m going to be on with my good friend, Patrick Vierra over at Silver Bullion TV. And he always does such a great job with the interview. So I’m really excited, cause it’s always good for me to see Patrick anyway. Next week, I’m going to be on with TradCatKnight and that will be Tuesday, but I’m not sure exactly when he’ll post it. So again, you just stay tuned to the socials. We’ll let you know when they’re coming out. Oh wow, two weeks in a row with two interviews in a row! I’ll be on with, on The Drew Pearlman Show. And that’s actually a new channel for us. So always fun because you never know what you’re gonna, what you’re going to get. If you like this, please give us a thumbs up.

And if you haven’t already subscribed, please do so hit that bell next to you. We will let you know when we’re going live. I really do always try to get the live shows out at one o’clock so you can kind of count on it. I know I’m a little late today. But that’s because you know, Meghan got married just this weekend. I was a little bit tired, but don’t forget. You can listen to all of our podcasts last on all major platforms and don’t forget to visit our Blog, itmtrading.com/blog. And don’t also forget to send in your questions, questions@itmtrading.com. I’m going to be answering a bunch of them tomorrow and keep in mind that financial shields are made of physical metal, not paper, not promises, not hope, and we need it now more than ever. So until next time we meet, please be safe out there. Bye-Bye.