How the Loss of World Reserve Currency Status Impacts Everything

Boy, I just love it how things are hiding in plain sight. For example, you might read the article but not fully understand how it impacts you. The US has held the title of the World Reserve Currency since the forties. Once we went on to a debt system and went completely off the gold standard, the only reason why we got to retain that title was because of the petro dollar. We’ve been watching that issue evolve, but now something significant is happening and you need to know about it.

CHAPTERS:

0:00 Hiding in Plain Sight

1:22 USD Currency Lifecycle

5:20 Saudi Arabia and Opec +

7:09 Federal Debt Held by Foreign and International Investors

9:16 Debt Ceiling Limit

11:52 Banks Buying Gold

14:12 FDIC Plans for Collapse

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Boy, I just love it how things are hiding in plain sight. And so you might look at them, you might read the article but not fully understand how it impacts you. Well, you know, the US has held the title of the World Reserve Currency really since the forties. And the only reason why we got to retain it once we went on to a debt system and went completely off the gold standard was the petro dollar. And we’ve been watching that issue evolve. But now something significant is happening and you need to know about it, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer. And I need to talk to you about the evolution of the loss of world reserve currency status. Because quite honestly, it’s us here that live in the US and use dollars that is going to feel the largest impact of this shift.

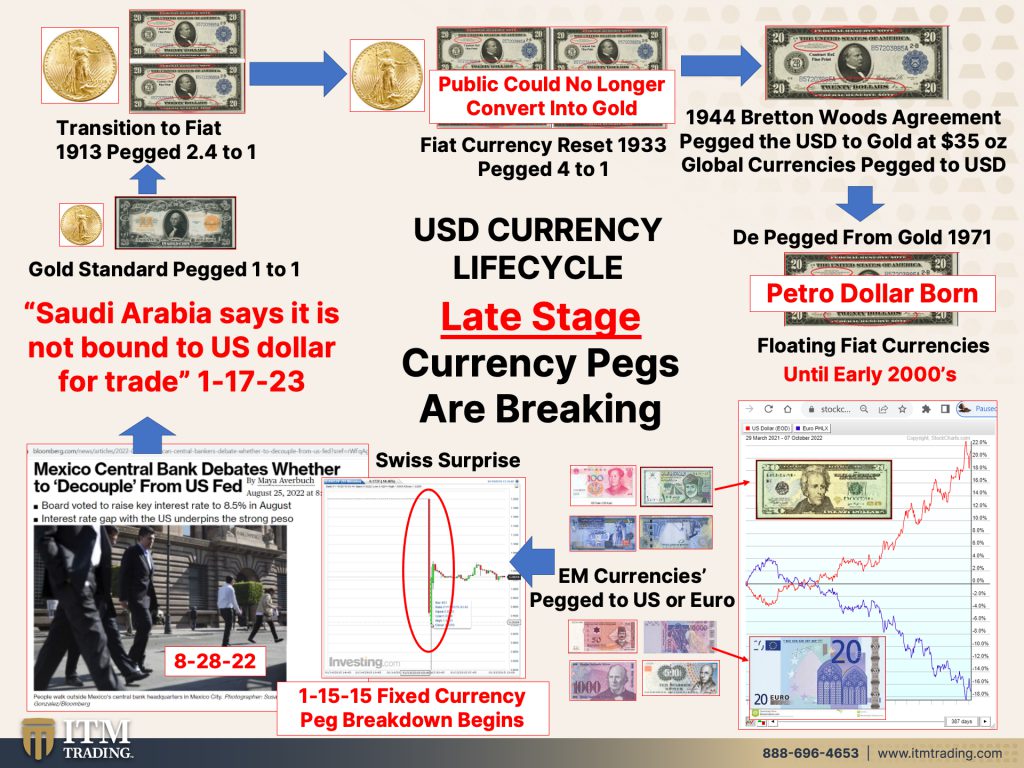

So as a little reminder, you know, inside this is a currency lifecycle issue and I don’t know why most people don’t really, that are really bright. They don’t quite get it, but it’s the way it always works. This is your repeatable pattern. You’ve seen this before as we transition from a fully gold-back currency to a fully debt-based currency and the shifts that have happened. But it was in 1971 when the petro dollar was born that helped the US retain its position as the world reserve currency. Which means, if you are a government, a corporation, or an individual going outside of your borders to buy things like oil, lumber steel medicine, anything, you basically had no alternative but to use US dollars. Okay, well we know that that’s been shifting really since 2002. And an additional shift has been put in place with Saudi Arabia saying it is not bound to use the US dollar for trade. So what that basically means to us is that all of those governments and corporations that are out there holding dollars to make the purchases of oil specifically will no longer have to use them. So they don’t need them. So they can send them to the SDR substitution fund and turn them into SDRs. They can send them home to the US in some way. That also means they don’t have to buy our debt anymore. So this is a very, very, very big deal. As much as we’re hearing about this soft landing garbage, this is not gonna be a soft landing, not when you see everything that happens. And for us here in the US, this could certainly usher in the hyperinflation if a lot of those dollars are sent back home.

So let’s look at that a little bit more closely because they aren’t inbound by it. But what they say is there are no issues with discussing how we settle our trade arrangements, whether it’s the US dollar, whether it’s the Euro, whether it’s the Saudi riyal, whether it’s the Chinese you want, whether it’s any other currency. And so all of those foreign governments that right now are forced to hold dollars and buy dollars in dollar denominated assets, they’re not going to be bound to do that anymore. The world’s largest oil exporter, which has maintained a currency peg, remember we’ve been talking about the peg to the dollar for decades, is seeking to strengthen its relation with crucial trade partners including China. The kingdom is a pillar to a petro dollar system established in the seventies that relies on price crude exports in the US currency. So we are at risk because really what happens when the world no longer is required to hold US dollars? We’ve exported our policy all over the world, we’ve angered a lot of countries. So what if they now have are in a position to retaliate? Are you prepared for that? Because the Fed won’t even have to use their money gun to create new money to impact the inflation. Just that loss of status as the world reserve currency and the petro dollar no longer matter, that’s gonna do it right there and then.

Because what we’ve watched is the evolution. Saudi foreign Minister says oil price stability reflects correct OPEC plus policy. Now price stability is such an interesting term because you and I would automatically think, okay, well the price stays the same. But to central bankers, to governments, probably to foreign ministers, price stability means that the price goes to a level that you as the individual do not change your choices. So you still drive the car as much, use as much oil, etcetera. You don’t change your behavior. That’s what price stability really means. Even if you think it means something else, they know what it means. Saudi Arabia’s foreign minister said on Tuesday, which was January 17th, that oil price stability showed the kingdom was correct in its position during last year’s row with the United States over the OPEC plus decision to reduce oil output targets. So that’s what they do. They simply reduce how much oil they’re putting out. Which we were saying, you know the US was saying you need to pump more oil to lower the price. And they’re like, no, but you know who’s the plus? It’s Russia. Do you get that? It’s Russia. Is Russia the US’ friend? Does Russia want the US to continue to be the world reserve currency? I don’t think so. We know that’s not so.

And look at the level of debt held by foreign and international investors. You can see going all the way back to the seventies that it’s been a, a steady incline, a little dip in the 2002, but it’s been a very steady incline. Little bit of bumpiness here going into 2008 and look at how straight line and then there’s a shift. Can you see that? That is a pattern change and whether or not you realize it and whether or not you even know what it means, what you need to know that it means is that something is changing. So when you get this straight line and a little bit of bumpy here going into that, but up here is when the bumps really start and look at this decline. Look at it. It is the largest decline in treasury debt held by foreign investors since they started tracking it. Uhoh uhoh. So you see what I’m saying? The world is getting ready for the US dollar to no longer be world reserve currency. Are you getting ready for that? Let me show you how big that move is even more closely cause this was just the fourth quarter in 2021, right? So a year, that’s how much foreign holders of our treasury debt. Well boy, they were the biggest buyers of the treasury debt other than the Federal Reserve. That’s not true anymore. This is a danger signal. Soft landing garbage, no such thing as a soft landing. It is the most selling on record and you need to stand up and take notice of it. This is a very, very, very big deal if you are living in the United States.

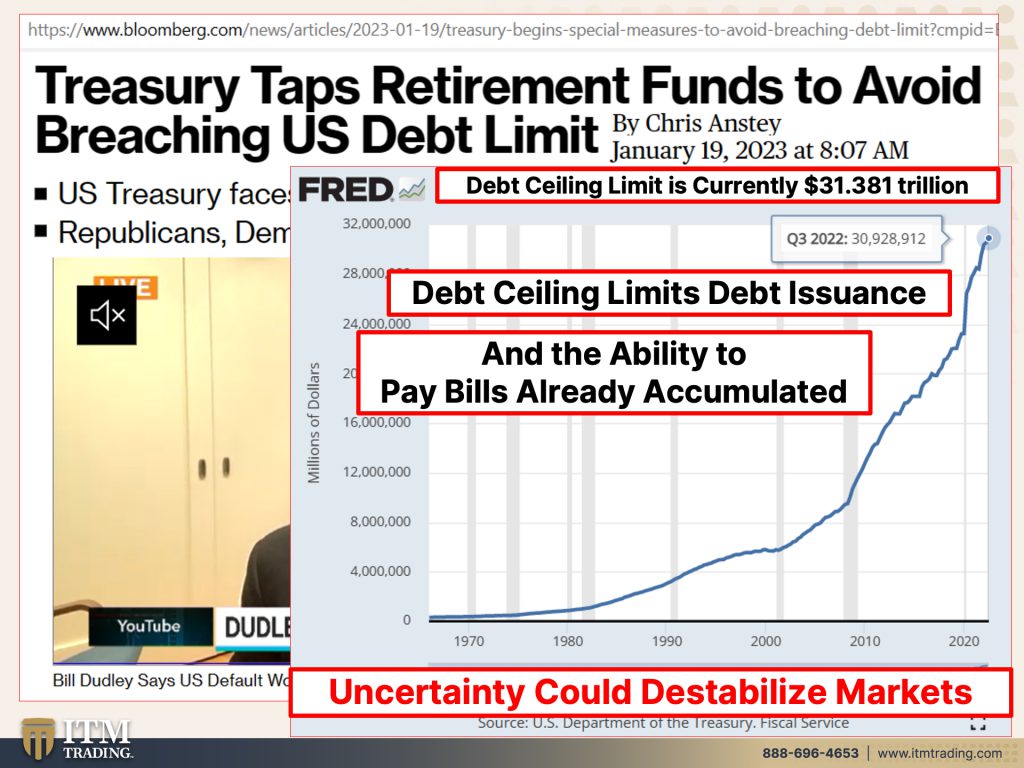

And in the meantime we’ve hit our debt limit of 31 plus trillion dollars and now there’s gonna be another fight. There is another fight on the floor between Democrats and Republicans. Are we gonna raise the debt ceiling? Ultimately, probably, we’re not gonna default on our loans. We can print the money that we need to repay that debt, unlike you or I who have to go out and work hard for it. But just remember, yes, they will raise the debt ceiling and oh that one’s not working. Let’s use this one. See, don’t worry, the treasury’s got plenty of these money guns and they’ll just keep shooting them and shooting them and shooting them. But every time they do that, the value of what’s already out there declines. And even if they don’t do it as much, but I know they will, even if they don’t do it as much, if foreigners are no longer buying treasuries using as many dollars and they’re sitting on a lot of dollar and dollar denominated assets like treasury debts and they sell that, that’s gonna have a major impact on you and me. Here’s what that treasury debt looks like. We’ve hit the ceiling of 31.381 trillion. We did that last Thursday. We’re in extraordinary measures. Of course they’re gonna raise it. But you ask yourself for you personally, if your debt looked like that and your income did not keep pace with the growth of your debt, what do we know We are in trouble. But here’s the thing that people also need to understand. When we hit a debt limit and the government can’t issue any more debt, it impacts the ability to pay the bills already accumulated. It does not impact their ability to take on even more debt, which I think is interesting. It just impacts the ability to pay. So will they raise that? Sure, of course they will. But we saw what happened in 2011 and it destabilize the markets. Can we afford to destabilize the markets today? Well if you want a big crisis mm-hmm, yes you can.

Because do not forget Goldman warned us and I’ve been warning you forever. The dollars grip on the global markets is over. So let’s look at, this is the US dollar index. So you know how we hear, oh, it’s a strong dollar, it’s a weak dollar. That’s against a basket of currencies. And I want you to see that just like gold, silver and the collectible coins have done, you know, a righteous cross in the positive, the dollar has just had a death cross in the negative. But regardless of even that chart, what I really want you to understand is that the dollars purchasing power is really what matters the most to you and me and it’s under major pressure. So what did Goldman do? They recommend that investors keep buying gold? Well let’s look at that. All right, here’s the spot Gold market, which we know doesn’t reflect the true fundamental value. There’s the spot silver contract that again, doesn’t really reflect its true fundamental value and they’ve had a cross in a positive way. The Golden Cross. Now, you know, they’ve been trying to to get gold out of our memory and certainly anybody that’s been born since 1933 has not held gold as money, even though before that, yeah it certainly was okay? But we still call it the golden cross. The Golden Goose, the Golden Book. It’s in our vernacular because it’s in our being and when the dollar completely implodes and we head into hyperinflation this and this is what you need because truthfully, if you don’t hold it, you don’t own it regardless of your perception.

So if you have it looked already, because this is so critical, you definitely wanna watch the video that I recently did on the FDIC plans for collapse. Banks buy gold and plan for bail-in, and you need to listen to the, to the guys at the FDIC telling you how yeah, a bail-in is inevitable. You also wanna make sure that you watch the video on risk transfer, because what they’re trying to do is get you suckered in and you are taking all the risk and paying for it. And what do you end up with at the end of the day. Because truthfully doesn’t matter how many of these things you have, it matters what you can convert them into. And if you haven’t started your strategy yet, you need to by clicking that Calendly link below and having a conversation with one of our consultants and getting your own personal strategy set up. I mean we are running out of time so the sooner you get it, the better you’re gonna sleep at night. Cause I know I sleep well at night cause I don’t own any of that fiat money garbage more than I have to because it’s still our tool of barter. But I own a lot of this and I own a lot of this and it doesn’t run counterparty risk. Everything else is. So if you haven’t yet, make sure you subscribe. Hit that bell, we’ll let you know when we’re going on. Leave us a comment, give us a thumbs up and share, share, share. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.businesstimes.com.sg/international/saudi-arabia-says-it-not-bound-us-dollar-trade

https://fred.stlouisfed.org/series/FDHBFIN?cid=5

Debt Ceiling Update: US Treasury Taps Retirement Funds to Avoid Breaching Limit – Bloomberg