How Soon Will The USD Collapse?

Analysts have been warning of the dollar’s impending doom. What if other countries start a mass exodus of the U.S. dollar and stop relying on our currency altogether? Some experts worry that the dollar’s dominance may be under threat. What are you supposed to do when a large part of your wealth and investments are tied up in a failing currency? It’s not about the number in your account. It’s about what you can buy with that number. Mexico, one of our largest trade partners to the south, just started the deep pegging and decoupling process from the U.S. dollar. While Saudi Arabia recently has also been talking about accepting other currencies for oil. These are major indications of our monetary system unraveling. What if you are being set up to keep your money inside the banks and the markets while the financial institutions are transferring their own money into gold? As always, I’ll explain what’s happening and give you the knowledge, age and power to protect yourself.

CHAPTERS:

0:00 Introduction

1:54 Mexico to Decouple

4:11 Stunning Rate Hike

6:15 Peso Strongest Levels

8:36 Peso Losing Value

10:55 Inflation Rate in Mexico

15:55 Gold Reserves in Mexico

TRANSCRIPT FROM VIDEO:

Analysts have been warning of the dollars impending doom. What if other countries start a mass exodus of the US dollar and stop relying on our currency altogether? Some experts worry that the dollars dominance may be under threat. What are you supposed to do when a large part of your wealth and investments are tied up in a failing currency? It’s not about the number in your accounts, it’s about what you can buy with that number. Mexico, one of our largest trade partners to the South just started the de-pegging and decoupling process from the US dollar. While Saudi Arabia recently has also been talking about accepting other currencies for oil, these are major indications of our monetary system unraveling. What if you are being set up to keep your money inside the banks and the markets while the financial institutions are transferring their own money into gold? As always, I’ll explain what’s happening and give you the knowledge and power to protect yourself. Coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service, physical gold and silver dealer, really specializing in those custom strategies. And I’m telling ya, I hope you have yours in place. If you don’t, click that Calendly link below. Make time to talk to our consultants because we are running out of time. Now, I brought this up last August, so I’m just going to remind you of what’s happening right now. That is critical. It is a critical indicator.

And you might recall, cause we talked about this then, that the central Bank of Mexico was debating on whether to decouple from the US Fed. Now let me give you a little bit of context because in 1971 when the US dollar, when Nixon took us off the gold standard, closed that gold window, all currencies up to that point, all currencies were pegged to the US dollar. That was true from the 1940s until 71. Then they all went free floating. And so each country would then have its own monetary and fiscal policies. But in the two thousands, early two thousands, right when the feds started buying back treasuries, the whole and the euro was created, the whole world re-pegged either to the Euro or to the US dollar. So Mexico’s currency was pegged directly to the US dollar. So the US dollar went up, so did the Mexican peso and if it went down, so did the Mexican peso. But in order to maintain that peg, they have to have the same monetary policy.

So if we go back, Mexican policy makers keep a close eye on the US rate since when the differential narrows, it can trigger destabilizing outflows of capital. Now they don’t specify in this whether that’s automatically destabilizing to Mexico because when banks, Central banks raise interest rates, then that can attract more investment in that country. But my question to you, this is a key, right, is this the start of the next financial crisis? That’s why I’m saying if you don’t have a strategy in place, if you don’t have your monetary foundation secured with gold and silver, get it done, please get it done. Because this could be definitely, I mean everything that happens is really the beginning of the end.

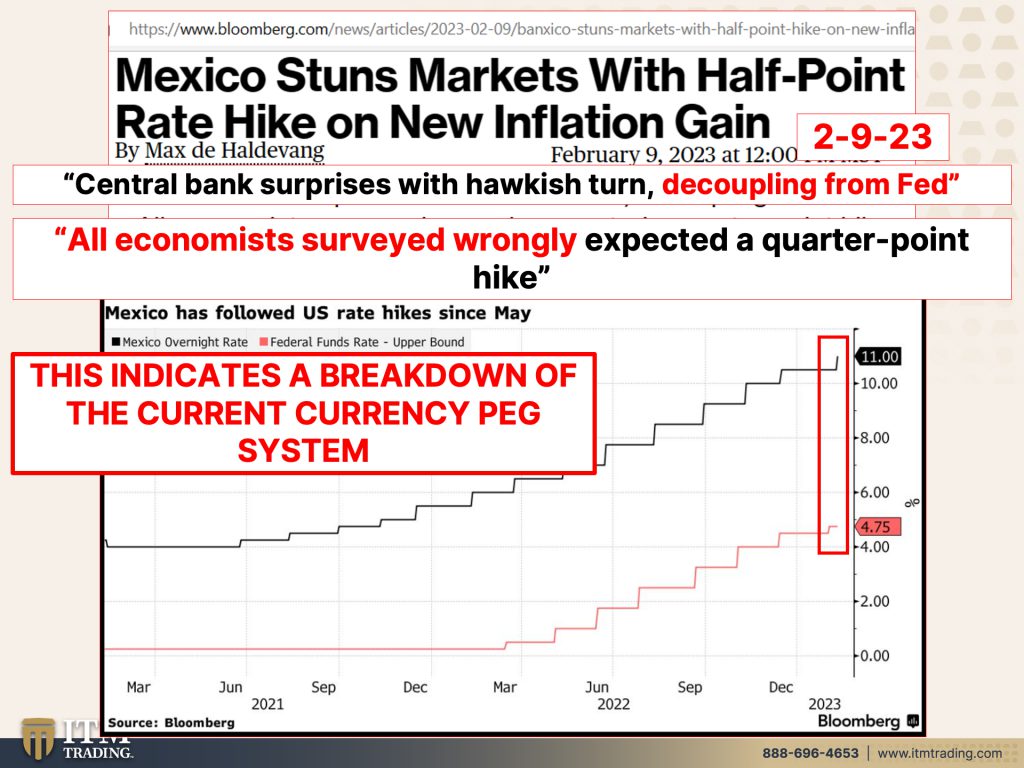

But just recently Mexico stuns the market with a half point rate hike on the inflation gain and they started fighting inflation long before the Fed did. But this is the piece. So this is the Mexican central bank increasing rates. This is the Fed increasing rates. All economists surveyed wrongly expected a quarter point hike because that would be the norm to maintain that pegs. But there wasn’t one economist out there that saw the de-pegging or that shift coming. That alone should alarm you because we certainly see how great they’ve been at forecasting everything. I mean, hey, we just had another surprise with inflation and shockingly it was mostly made up of of housing and energy. So this is not a surprise, but central bank surprises with hawkish turn decoupling from the Fed. And you can see the difference. Here, the Fed just went up a quarter of a point and here the Central Bank of Mexico went up a half a point. Now that may not seem like all that big of a deal, but what that actually does is indicates a breakdown of the currency peg system and that is because we are going into a brand new system. But that’s also gonna create a lot more volatility and a lot more problems.

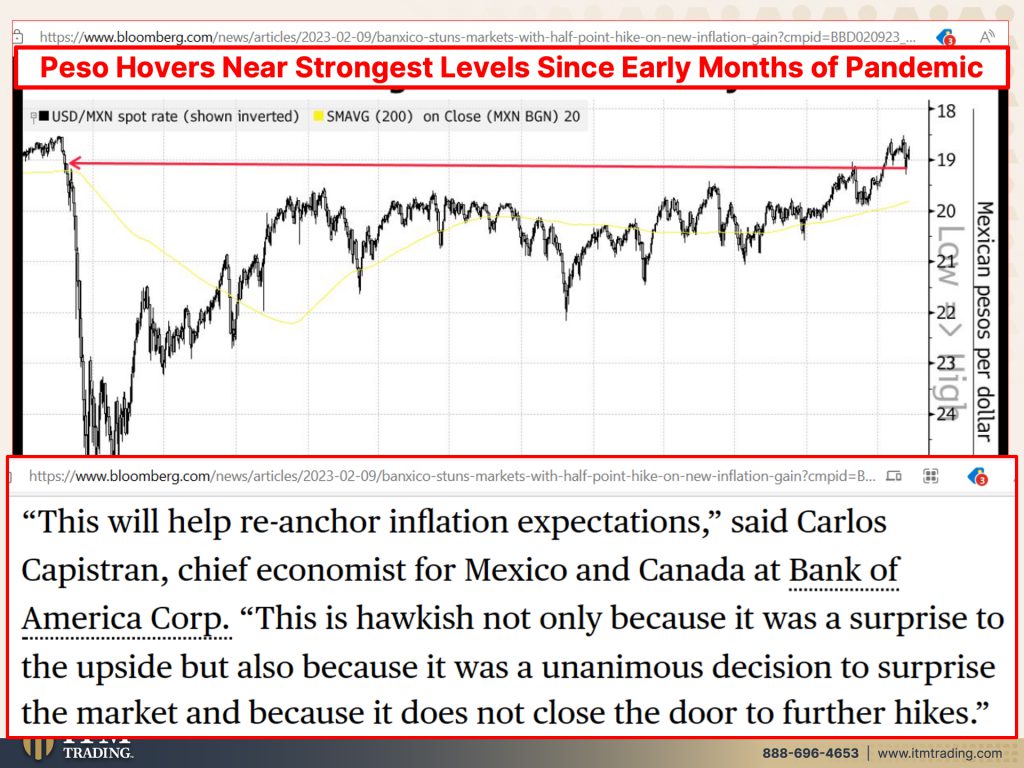

At the meantime, since Mexico raised their interest rates by half a point. Hey, the Paso hovers near its strongest levels since the early months of the pandemic because in theory or kind of in reality, but also in theory, you’ll see what I mean by that in a second. If you can put money in Mexican bonds, let’s say and generate more fiat then in your mind, you’re doing better. But I wonder if that’s really true. However, what they say is this will help re-anchor inflation expectations because frankly nobody’s really getting inflation under control. They’re telling you that they are. Is this disinflation? Well, they just revised the numbers up for November and December and January came in hotter than anticipated, even as the Fed slowed its rate rise. I’m telling you all of that is look over here, look over here and trust us. We got this. They don’t got this. This will help re-anchor inflation expectations. It’s the expectations that matter. This is hawkish not only because it was a surprise to the upside 50 basis points versus 25, but also because it was a unanimous decision to surprise the market and because it does not close the door to further hikes. But it was a unanimous surprise a unanimous decision to surprise the markets. So well gone. Are those days of the central banks saying this is what we’re gonna do and the markets believe them. Now central bankers are doubling down to, I don’t know, I can’t tell you. This is my opinion. It is not something that I have discovered exactly, but to keep the whole world off kilter so that this next bigger surprise has a much bigger impact and volatility will flow.

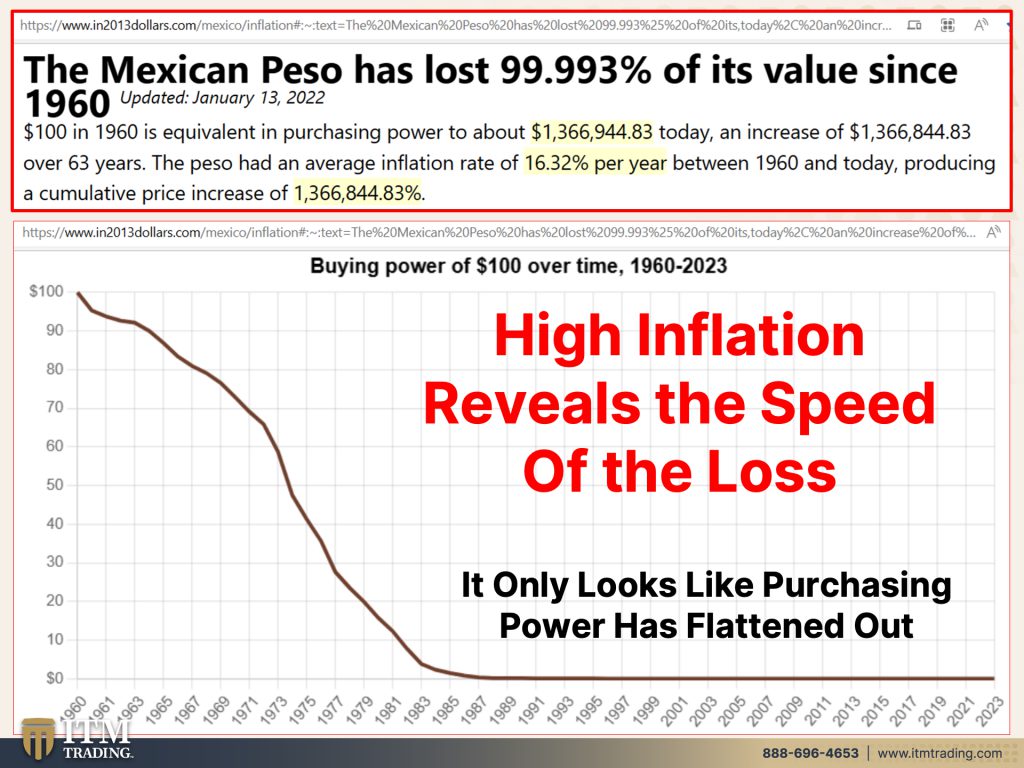

But let’s take a look at what’s really happening because surprisingly, the Mexican peso or maybe unsurprisingly the Mexican peso has lost 99.993% of its value just since 1960. Oh my goodness. So do we really have a strong peso or is this really what we’re looking for? And oh my goodness, doesn’t that really kind of look like the US dollars purchasing power chart as well? Yes it does. So down at this bottom, it only looks like the purchasing power is flattened out because they were able to grab so much of it in the beginning. The problem is, is that this high inflation reveals the real speed of the loss. So it doesn’t matter how many dollars you have or pesos or euros or yen or any of that government based money or government backed money, it matters what you can convert it into. 6,000 years ago, an armor, a suit of armor, one ounce of gold, 1900, a $20 bill or one ounce of gold, this is a $20 gold coin. Today, even at 18 1900, can you still buy a man’s suit with an ounce of gold? Yes you can. What do you get for that? 20 bucks a pair of socks. So don’t let nominal confusion take control of you. I don’t care if the markets go up, the real trend is underneath the surface that you don’t see because they don’t want you to see it. And that is in the purchasing power. That’s what matters most to you and me. And guess what? In Zimbabwe, billionaires can’t buy eggs. Give me a break. They can go out if they panned for gold and buy the eggs.

But look at the Mexican inflation rate. What you can see here is that they’ve, Mexico’s been raising the rates, they started raising sooner than the Fed did and it seemed to be getting a dip and now it’s going back up again. Well, the same thing can be said in the US where it seems to be taking a dip. But there are areas like food, housing, energy that are going back up again, okay? They didn’t really come all the way back down. This is pretty substantial. And how does it impact people?

The number of people living in poverty in Mexico, that’s what this graph is. And the percent of people living in poverty in Mexico is 55.7. They haven’t since the nineties gone through another currency regime shift, but like the entire world, they’re about to. And when you go into hyperinflation on average, so it can be different in different places, but on average 80% of the population ends up in abject poverty. You don’t wanna be one of ’em. I don’t wanna be one of ’em. I don’t want anybody, I don’t want anybody, whether they believe this or they don’t believe this, I don’t want anybody to be in those ranks because wealth never, ever, ever disappears. It merely shifts location. So the goal in the strategy that frankly I created for myself based upon historic norms is about having that wealth transfer your way. Because way too long have we allowed the elites to have that wealth transferred their way.

And you know how to stop them, be as self-sufficient and independent as possible. This is your wealth shield and shields are made of metal, not paper or promises, but they want you to stay in the system because it’s much easier to steal your wealth. They want you to think that the stock market is going up, therefore I’m gonna jump in it because I’m gonna make so much money, not when nobody will accept the dollar anymore. Oh no, that would never happen. It’s happened over 4,800 times. What do you think? I mean, do you really, we’ve had a huge advantage as being the world reserve currency, but what do you think? You think that we’re just going to remain that because we’re Americans, our standard of living is about to change dramatically. No, the world reserve currency lasts forever. And we are transitioning into a new social economic and financial system. You wanna transfer into that with fiat money that is easy to create because in the digital world, and there you go. Somebody asked me to do it that way. There you go. But I mean, in the digital world, they can create an unlimited amount of money. How easy is that to do? You push a button and we all know when things are easy, they don’t have much value. How about this stuff? You have to go and dig it out of the ground. You have to mine so you have to mine it, then you have to, then you have to go through the whole process of cleaning it. I mean this is a big process. This is not easy. It takes labor, it takes energy, it takes a lot and it’s used in every area of the global economy. Oops, I can’t see with that. Those fake dollars in my way.

Okay, so what does Mexico do? Well, you can see these are their gold reserves and they’ve been pretty stable, but they went up quite a bit in like 2011 as this whole thing has been unfolding. And do we really know? I mean, do we really know how much in gold reserves any country has? Do you really trust the central bankers? To be honest with you? Cause that’s not their job. Their job is not, to be honest with you, their job is to keep you inside of the system and transfer your wealth their way, their meaning the corporations, the governments, and the central banks. Because when you have nothing, you are more dependent on those powers that be and they have you by the cajones. Let’s face it.

Now, this is Mexico’s gold production, so they’re pretty good in producing gold, but boy, do you think you can see peak Gold? Have we hit that already? And how about the cost to mine? Because as inflation and the cost of energy and the cost of labor goes up, so does the cost to mine it. So we wanna keep all of that in mind because when you get physical with anything, I mean there’s a finite amount of this. And I don’t care what the shape, where the form is in, I don’t care if it’s bent or it’s broken or it’s tarnished or it’s dinged. Doesn’t matter. Every piece, everything that’s made from gold or silver, it’s monetary at its base. What do you wanna go into this new system with? Because I’m thinking that you probably want to go in with your most powerful tools and weapons. So Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Gold and silver are used in every single sector of the global economy. I don’t know why nobody talks about that very much, but that means that there’s always demand your broadest space of demand. And both gold and silver are the only assets that can say that they’ve never gone to zero.

Now, can GLD go to zero? Ah-Huh. Because you don’t own gold. You own shares in a trust you own your wealth is in the fiat money system and the purchasing power officially in the US is at is at 3 cents in Mexico. It’s at a penny. It’s not even at a penny. Why? Why are they, why are they still using that, right? I mean, I can’t believe you, Lynette. After all, I have money, I work for money. I can go to the store, I can buy things with that and you can do it until you can’t. And then you need, so first line of defense, garbage, cash, second line of defense, silver, main line of defense, gold. There are different kinds of gold and silver. They perform different functions. That’s why it’s so important to have a strategy that puts your goals first. This is what I need to accomplish. This is how much I need and we’ve got all the tools. So this is what I need to sustain my day-to-day living. This is what I need to make sure that, that if I lose all the wealth that I hold in that 4013B or that I choose to hold in anything else, and that goes to zero, okay? Have this a truly diversified portfolio to recoup those losses, to recoup taxes, to recoup fees, and to preserve your wealth. We’re getting closer and closer. Watching what Mexico just did. That scared the crap out of me. I’m not gonna lie to you because I understand having studied currencies life cycles, that there is a complete breakdown in the system and it is speeding up and it’s going to get faster and faster. But things always happen. Slow, slow, slow, slow, slow until they happen fast. So I would rather be, I don’t care 10 years too early. I don’t care how early I am, I just never wanna be one second too late.

And if you haven’t watched this yet, make sure you watch Crisis in Lebanon, video on Beyond Gold and Silver Channel. Don’t ignore that because I do a Mantra Monday, every Monday and it’s important for you to understand the whole point of the Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Also, make sure you watch last week’s video titled New Jobs Report Further Loss of Confidence in US Dollar. Because the reason why Mexican peso people are still working in using it is cause they still have confidence in it, but that rapid inflation rapidly erodes that. And we’re experiencing the same thing here. So if you haven’t already, make sure you subscribe. Hit that button. So we let you know when we’re going live. Leave us a comment, give us a thumbs up and share, share, share. And remember, financial shields are made of metal, gold, silver. And until next time, please be safe out there. Bye-Bye.

SLIDES FROM VIDEO:

SOURCES:

Banxico Stuns Markets With Big Hike to Tackle Inflation Woes – Bloomberg

Mexico Inflation Calculator: World Bank data, 1960-2023 (MXN) (in2013dollars.com)

https://www.statista.com/statistics/1039479/mexico-people-living-poverty/