Gold and Silver are Rising

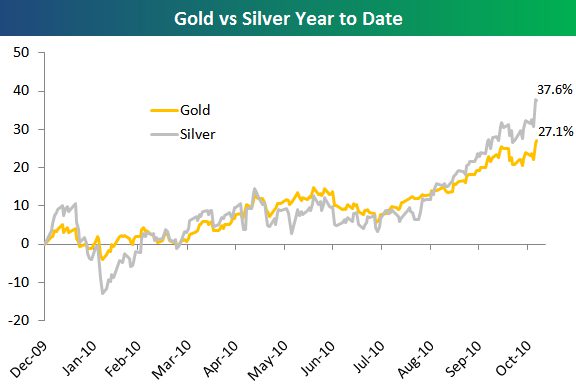

Gold and silver are steadily rising, which is a common trend for this time of year (gold rises an average of 13.1% in the last 4-5 months of the year, 8 out of the last 9 years). As of this writing gold is up $10.70 to $1,419 per ounce (a new record close) and silver is up $.84 to $30.24 per ounce (a 30-year high). We are on track to the tenth straight year of higher gold prices. As of right now gold is up over 463% since its low in 1999 ($252/1999 to $1,419/2010).

Everyday you can Google search gold in the news and you will always find “the reason†why gold prices are up or down for the day. Today for instance the Wall Street Journal is reporting the reason as inflation concerns and Euro weakness. This may have something to do with it but there is an underlying trend that tends to get ignored on a daily basis.

All assets move in bull and bear market cycles. Bull markets are strong and bear markets are weak. Currently we are in gold’s second bull market since Nixon closed the gold window in 1971. During the first gold bull market gold ran from $35 per ounce up to $850 per ounce, over a 2,300% gain. During the first nine years gold rose from $35 to $235 a 557% gain. During the last year it when gold saw its largest jump from $235 to $850 per ounce.

We are currently in the second phase the current gold bull market. Gold has risen slowly and consistently averaging 17.1% per year. We have not hit the third and final phase yet. The third and final phase will typically bring the largest gains, just like it did in 1980. The bull market is the underlying trend that is influencing gold’s price. Inflation and Euro weakness may be stoking the fire, but the fire has been burning for 10 years.

This is the reason why I always say that it is important to follow underlying trends and not the day-to-day action. If gold drops in price tomorrow news sites will report on why this happened. In fact they might say concerns for inflation subsided, or that fears of a weaker Euro subsided. This can be very confusing, therefore when buying gold coins the goal should be to buy and hold through the trend cycle.