GLOBALIZATION IS BACK: Is This Opening the Door to Global Taxation?…HEADLINE NEWS WITH LYNETTE ZANG

DIRECT TRANSCRIPT FROM VIDEO:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And never has that been more important than right now, because much as the revolution that began back in 2000, actually before 2008 on a global basis. Well,

And then when we were bringing things in more locally, well, all that has changed and they’re pushing us back toward globalization and really it gives corporations a huge advantage. So we’re going to talk about that today. Since the G7 tax deal is a starting point on a road to global reform. Now, you may think that this is only about corporations, but you know, once the tax man comes, as he comes for everybody, however, we’ll just stay here for the moment. Now on the bottom, I’m going to show you how this has been to the benefit of corporations and continues to be at this point down here is the tax rate. So you can see that the us, which is right here is at about a 21% tax rate at the moment.

And let’s see, There are all of those higher tax rate countries is still lower than what you and I pay, but, okay, these are the lower tax rate countries. This size of the bubbles dictates the movement of the profits from the higher tax rate jurisdiction to the lower tax rate jurisdiction that increases the profit poor per employee. Particularly when those rates fall below 10% and here’s 10% here. So you can see that. Now, do the employees see much of that? No. Right now, because there’s such a challenge in hiring people, all of the employees are getting a little bit more, but this is what’s enabled all of that income inequality. And you know, I’ve got to say that this is not going to be stopping any time soon. But with Janet Yellen, our treasury secretary, who was the head of the reserve, I’m going to just read this whole piece, asked how she would sell the deal to us. Legislators Yellen said it would provide a level of certainty to corporations in the US and globally about what the environment is there’ll be operating in. And that environment has been very unstable because wow, taxes going up ties is going down. What happened before corporations? You might remember this wasn’t that long ago, corporations just accumulated their profits in a lower tax jurisdiction. And then once president Trump gave them that super low tax, then they brought it all back.

That has actually happened in the past two, 2005. This was what 2017, 18, but she hailed the revival of multilateralism. Let’s go for that globalization. Let’s just make sure it’s one big world that the central banks, the IMF can control. And the bank for international settlements that the bankers can control. Sounds like a deal to me. What I’ve seen during my time at this G7 meeting is a deep collaboration and desire to coordinate and address a much broader range of global problems. Yellen said that they’ve been creating much. So you have to be aware of that because I’m thinking that this is opening the door to not just global taxation for the corporations, which of course the consumers are going to be paying anyway, but it could also be opening the door to global taxation on everybody period. And by the way, since we’re talking about this here, the us is the only country that even if you are a us citizen, no matter where you live in the world, you’re still paying us Taxes.

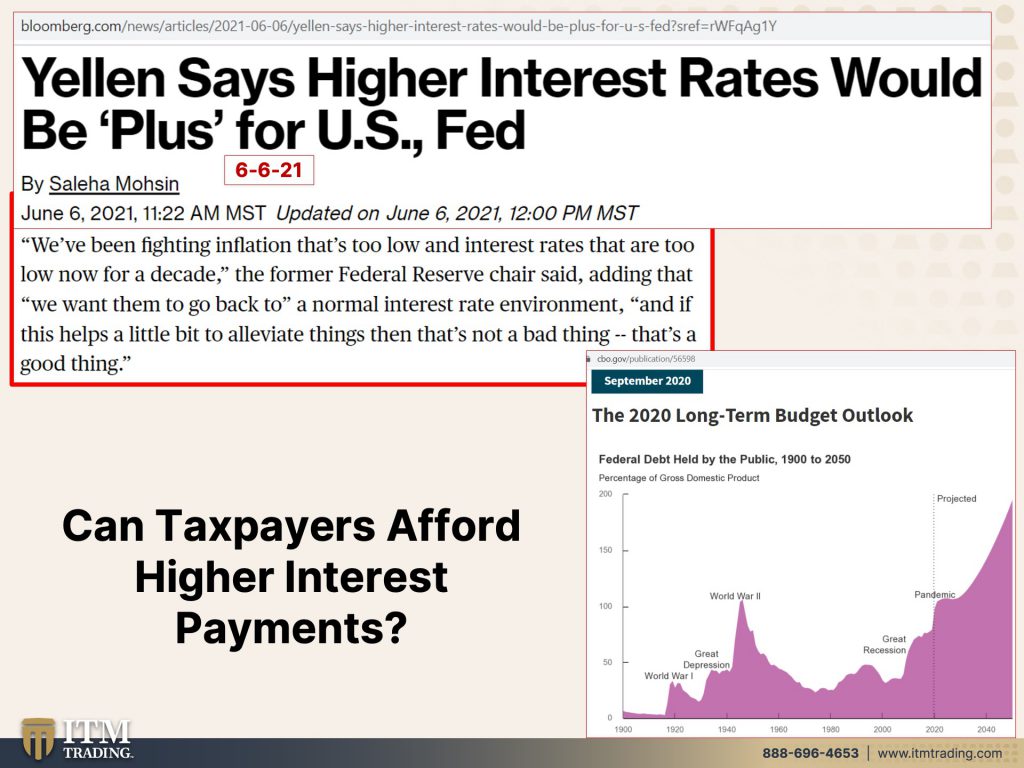

Just saying, now at the same time, Janet has been very busy this week because she says higher interest rates would be a plus for the U S. And for those said, Oh, really? Yes, because after all we’ve been fighting inflation, that’s too low. We need more inflation. And what that really means is the value, the purchasing power value of the us dollar is do high. They’re taking it down. That’s why you need gold. They’re taking it down inflation. That’s too low and interest rates that are too low now for a decade, more than a decade. And who did all of that, by the way, never own responsibility. The former fed chair said, adding that we want them to go back to a normal interest rate environment. Well, why would they want them to go back to a normal interest rate environment? And so they could lower them again in the next crisis. They want the rates up because the next thing they do when they lower them is into negative rates. And that’s been, you know, pushing on a string. We talked about that last week that, you know, in those repo markets that’s already been happening. And if this helps a little bit to alleviate things, then that’s not a bad thing. And exactly what things she doesn’t go into. Cause I don’t think this alleviates things, but that’s a good thing really, really well. This is the mountain of debt through this is through 2020, the pandemic debt. And we know that it’s going up higher. I mean, President Biden has a 4 trillion annual budget deficit set, etcetera. So I’m not sure that they can afford to have interest rates go up to service all of this debt. And by the way, that’s us, that’s taxpayers that are responsible for that.

That’s the piece that people never really think about that when government spends money, the money they’re really spending is yours and mine taxes have to go up. They have to go up to pay for all of this. Can we afford those higher tax, pay those higher interest rates? Because this is the other piece. They didn’t put a graph in here, but I’ve shown it before. And I’ll talk to you about it. When we run deficits. What they’re saying is we’re not paying this much in principle, let alone all of the interest on top of it so that the interest goes into those deficits. And we’re compounding interest a while ago. I think it was maybe 2007 or eight, something like that. I did a study because I said, well, wow, the deficits at a trillion dollars. So it hadn’t been 2008 or nine. The deficits that it’s a trillion dollars, but the debt that we’re servicing is that $13 trillion.

Why?

Well, when you go in and you look at, they’ve got it all broken out. If you’re not paying principal, all your principal, guess what? You’re not really paying all your interest either. So what we have is compounding interest. It’s like if you have a credit card and you pay the minimum, so you’re not paying of the principal and you’re not even paying all of the interest that interest now gets tacked onto the principal and you’re paying interest. You’re compounding that interest. You’re paying interest on interest. Do you ever get out of debt when you do that? No, you’ll have to inflate it away or governments do you. And I don’t get to do that, but it, governments have to inflate it away. They have to, they have to. That’s why she’s saying fighting inflation. That’s too low.

That’s insanity.

You need to really understand that inflation is not an absolute in money in a field money system. Yes. It’s baked into the cake so that they can transfer your wealth. It’s an invisible inflation wealth tax, but gold doesn’t get a flight away. So in real money, no inflation is not a necessary phenomenon in the Fiat money system. It is absolutely a necessary phenomenon. And every single time, every single time a central banker says we have TULO inflation. We need more inflation. They’re telling you that the purchasing power of your currency is too high and they’re going to destroy it. And that is what we work for. And some people attempt to accumulate it for future use.

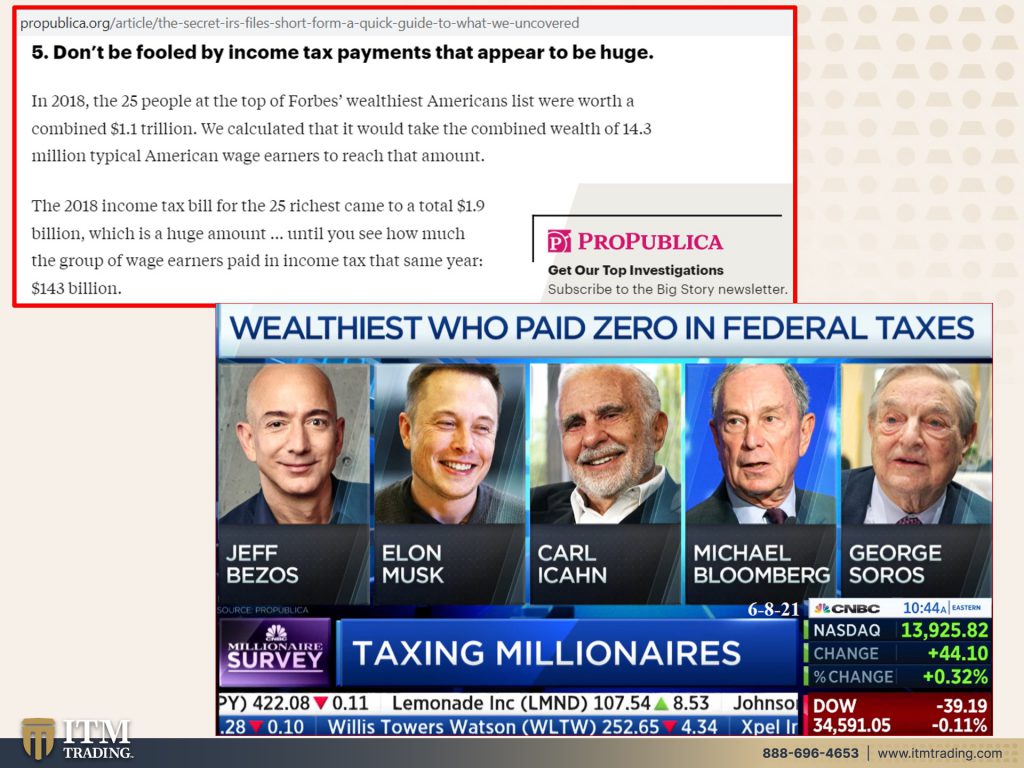

All right, I’m going to get back to it. I’m sorry. I’m digressing here. Thinking about taxes. This just came out today and I just thought it was kind of interesting, uh, by the way, all the links to everything are over in the blog. So make sure you go, but this is from ProPublica and talking about how the, uh, let’s see the secret IRS files short form, a quick guide to what we uncovered and where they showed that billionaires were basically paying well, here you go. This is from CNBC wealthiest who paid zero in federal taxes. Now they’re not saying that happens every year, but they’re saying it happens consistently. And listen to this in 2018, the 25 people at the top of Forbes, wealthiest Americans list were worth a combined 1.1 trillion. We calculated that it would take the combined wealth of 14.3 million typical American wage earners to reach that amount.

And we certainly know that their wealth has grown exponentially during the pandemic. The 2018 income tax bill for the 25 richest came to a total of 1.9 billion, which is a huge amount until you see how much the group of wage earners paid in income. That same year, 143 billion. So you have 14.3 million typical average American wage earners that it takes just to earn as much as the 25 wealthiest Americans. But yet they’re paying almost 10 times more taxes. Then those billionaires, I don’t know, sounds fair to me. And when corporations pay so low taxes, w what do you mean? I think enables the extra dividends, the extra, the extra stock share buybacks, all of this financial, original engineering and manipulation that leaves most out in the cold. Now, look, I know that there’s been a huge movement to democratize investment. Will that happen back in the end of the twenties as well?

So I, while on one hand, I definitely applaud it, but people need to be more educated, not just here, go buy stuff on margin and watch AMC issue. Shares of stock go from basically zero to 60 bucks a share in about a heartbeat because people are trading on options. Oh, what is money that the government gave them? Yeah, I’m sorry. We are in a melt up phase. This will not end well. I’m going to put my neck on the line. This will not end well. And we’re not that far from the end. I can’t tell you exactly when, but the more insane it is, the closer you. And I know we are near definitely near the end. So I want to look a little bit at, you know, you’ve seen this before. This is the most current piece on the S and P 500, which is in red versus the central bank balance sheets, because the fed is talking about, Oh, I don’t know, raising interest rates, tapering their bond purchases, which doesn’t mean they’re going to stop.

It just means that they’re going to buy fewer. I’m going to show you that schedule in a second, but going back to the interest rate piece and how Janet Yellen says that would be such a good thing. Well, a, this is just the investment grade debt. We’re not talking about leverage loans. We’re not talking about high yield debt or any of that, which is much higher than this, but can these corporations, this is debt 11.3 trillion that is due by 2025. And when you have debt, you either have to service it. You have got to pay it, make your payments on it, or you have to roll it over, or you have to default on it. So you’ve got 11.3 trillion of investment debt, which may or may not really be investment grade. Since we know that the grading services has been a little lenient, particularly in that triple B category, which should be junk rated.

So all that debt has to roll over. Can the fed can corporations afford to pay a higher interest rate? I don’t think so, but they think that if they go at the super slow pace, and they’re not even talking about raising rates in here, they can’t, whether it’s on our government debt, it’s on corporate debt. It doesn’t matter if it were just individual that cause you know, you’re paying a whole lot more on any of your debt than governments and corporations are. So they’re, they’re giving you a possible taper timeline where they will buy just a little bit less of government bonds than they’re currently buying. And they’re not even saying for sure, they’re going to do this, but they don’t want another taper tantrum. In other words, they don’t want the stock market that they have worked so hard to push up, to go down

Because every time that has happened here, here, when they started slowing down here, when they try, they made an attempt to taper. There you go. And we’re not even talking about margin debt and here. So June to July, they will start to discuss the taper, just discuss it. We’re not doing it, just discuss it. Then September to November, they’re going to announce that they’re going to taper, but they’re probably not going to do it until January, February. Maybe they will be good. Cause this is just possible. So if the markets don’t like it, then maybe they won’t taper. No, they won’t taper. When they attempted to taper and roll off their balance sheet, they didn’t stop buying. They just stopped reinvesting the dividends for a minute and re-investing the principal. They just stopped reinvesting as much and the markets did not like it. Look at how volatile the markets were. That’s when they did the pivot, that’s when everything changes. But the reality is is that the money markets, the, the global plumbing of the financial markets is breaking down in a big way and has been since September, 2019. So when she says, well, that would be a good thing for the public and for the fed that interest rates go up. Oh, heck no. Oh, heck no. So they’re creating all of this inflation, which I do not believe is transitory trading inflation. Yeah. Like lumber is coming back down from the stratosphere, but that is, but no, you know, I could be wrong about this because clearly it is not within my control. But just like when they went from a target of 2% inflation to an average of 2% inflation, that was to justify what they’re doing now, because they knew this was coming.

And, you know, I just did an interview interview with Daniela Cambone over at Stansberry Research. And she asked me, she asked me some great questions. You totally want to see that. Um, but you know, she asked me why aren’t they saying this? And you have to understand whether it’s Powell or it’s Yellen or it’s Biden or it’s anybody else that’s in government or in the financial sector. They cannot tell you the truth. Because if they told you the truth, you would make different choices. And that choice would be to pull your wealth out of the system that they have currently I did and are controlling it. You pull your wealth out of the system. They can’t steal it from you. Yeah.

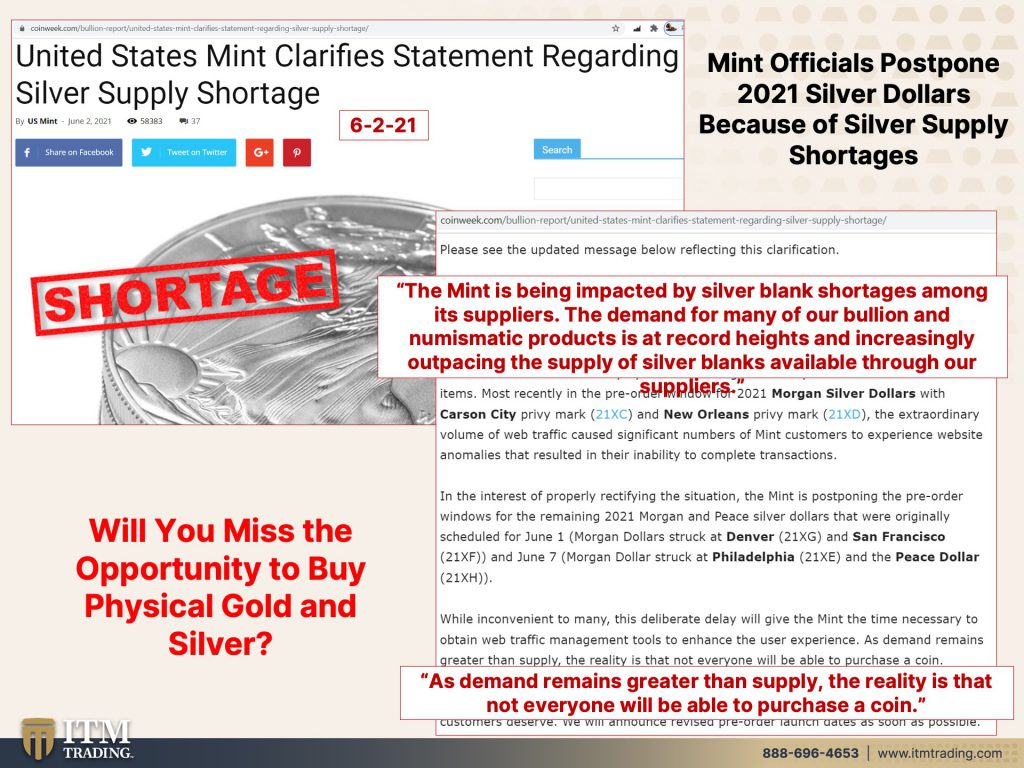

Personally, I don’t want my wealth stolen from me. I worked too hard for it and I have a family that I really care about. And I’m pretty sure you guys do too. So let’s talk about silver for a minute because, uh, you may or may not know that the United States mint said that they were postponing issuing Morgan and peace silver dollars for 2021. And they came in to clarify it because there is a shortage, Oh, really a shortage on silver shocker. And they say, and you know, read this whole thing. Cause this is all from the mint. The mint is being impacted by silver Blanc shortages among its suppliers. The demand for many of our bullion and numismatic products is at record Heights. So demand is at record Heights. Supply is a shortage, okay. And increasingly outpacing the supply of silver blanks available through our suppliers. Kind of like when the silver ETF modified their prospectus because they couldn’t get the silver to create their baskets because demand was outpacing supply. And you still have, well, last time I looked today, it wasn’t even 28 bucks an ounce that makes so much sense. And I think that people are really starting to wake up to the fact that this makes absolutely no sense. And therefore, as hidden as the manipulations used to be, maybe they’re not as hidden anymore. And I view that as a good thing. We need to wake up while there’s still time because we, as far as I know, and I didn’t check with Eric, so I’m sorry about that. But I haven’t heard in our meetings that we can’t get silver so we can still get silver. Maybe not the 2020 ones who cares. Silver is silver. Gold is gold. In any form. You want to make sure that you have the physical and it is in your possession so that you own it and you control it because I will just remind you of what they said from that bank for international settlements, which is the central banker central bank gold hell. That home is not subject to political unrest. And it is a great inflation hedge. And it is best known in crisis to protect its holders from being negatively impacted by that crisis. It’s true. So gold at nine 1900 bucks an ounce when it’s easily, it’s fundamental value is easily somewhere near 20,000 bargain bargain bargain. Get it while you can get it while it’s still available and get what is available. Because I would always rather be two weeks too early, two years, too, early 10 years, I don’t really care. I would always rather be early than even one second, too late. Because when you are too late, you lose all choice. And If you lose all choice in this one, whatever you have busted your butt to accumulate in all these years, it transfers to somebody that didn’t work as hard as you did to accumulate that. And you have to decide if that’s okay with you, because I can tell you right now, it is not okay with me. So, like I said earlier, I did a great interview with Daniela Cambone over at Stansberry Research. Uh, we had a lot of fun doing it as well, and I think you will really enjoy it. And I’m so excited. Um, you’re going to see me in the same ensemble as sorry, but cause I forgot, but uh, I’m going to be a guest speaker at the rebel capitalist live in Miami, uh, this coming weekend. And I’ll be sharing behind the scenes on all of my social. So if you got tickets come and say hello, I will see you there.

I’m planning on being there really. And, and I don’t want to quite say this because it might not actually happen, but I’m going to be around all weekend. So I’m really excited about this and I hope to see you there, but you can see those behind scenes footage on the Instagram at Lynette Zang or at the tweet on my Twitter account at item trading underscores Zang. And of course this will, we’ll also be filming from there on Thursday, right. We’re going to do on Thursday. So I’ll have a different ensemble on because, uh, have access to clothing then I’m sorry. I forgot to bring it today. So you’ll see another one me wearing this, but all right. So if you haven’t already, like and share. If you haven’t subscribed, please do so hit that bell. We’ll let you know when we’re getting low, when we’re going alive. And uh, until next we speak, remember hundred bazillion percent. It is time to cover your assets. And here at ITM trading, we use the wealth shield, which by the way, for those that are going to be at George Gammon’s event, well, I’m going to be talking a lot more about the strategy there too. So here we use the wealth shield based on gold and silver. And until next time please be safe out there. Bye-bye.

SLIDES:

SOURCES:

https://www.cbo.gov/publication/56598

https://www.yardeni.com/pub/peacockfedecbassets.pdf

United States Mint Clarifies Statement Regarding Silver Supply Shortage