A GLOBAL THREAT US & China Clash of the Titans

The Asia-Pacific Economic Cooperation summit ended on November 17th. Vice President Pence was there, as was President Xi, it was not a pretty meeting. In fact, for the first time in the 21-member Pacific Rim groups history, they were unable to end with a joint statement, exposing deep divisions between the US and China and sending global markets deeper into bear market territory.

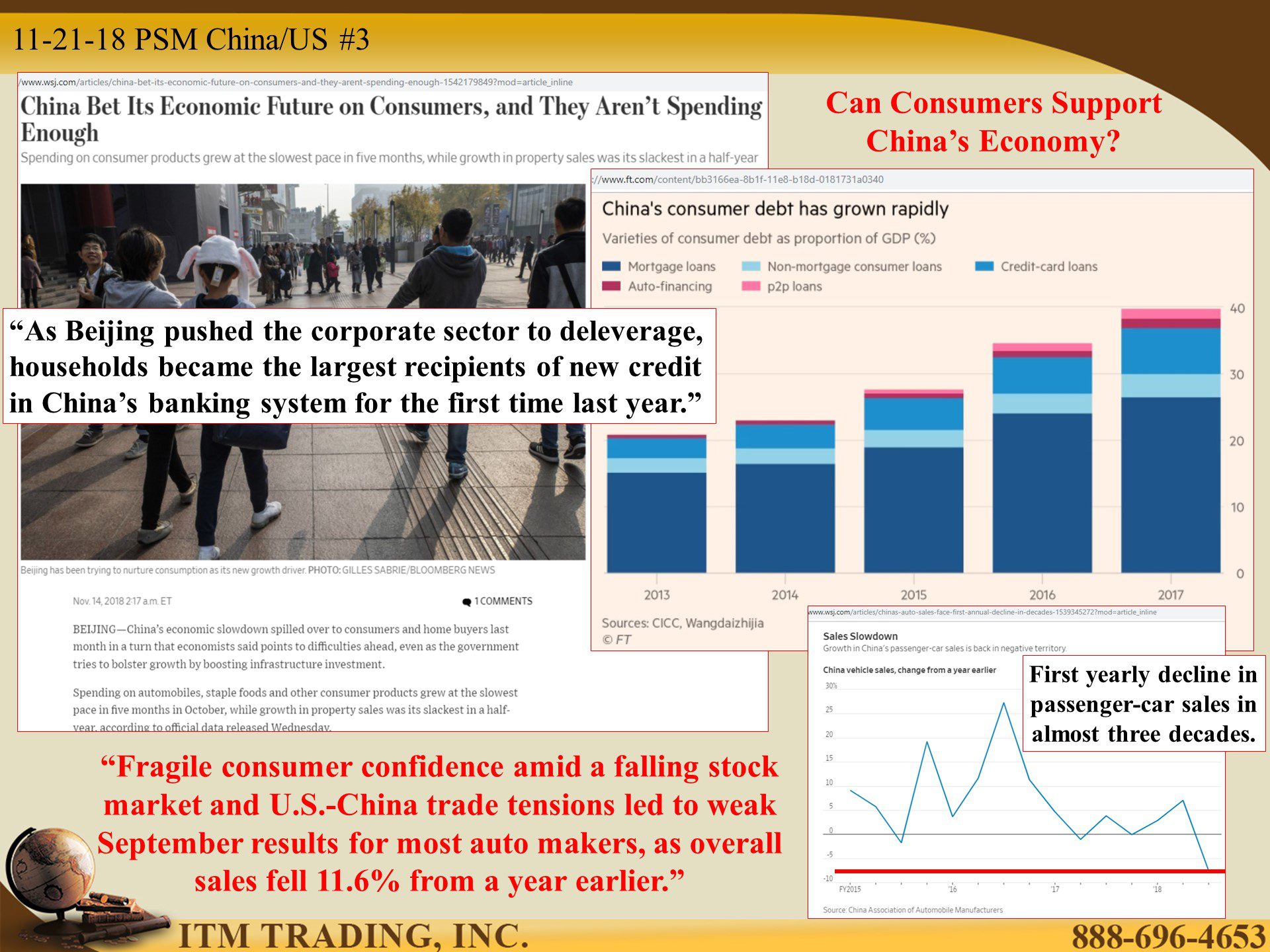

A key concern is China’s economy, the second largest next to the US and once hailed as the engine of global growth. But that growth was fueled by massive corporate debt build up. Which was something Beijing was attempting to get under control. So, to keep growth going, China is attempting a shift to a consumer driven economy and consumer debt skyrocketed.

Unfortunately, consumers have pulled back spending because of the bear market in stocks and uncertainty over the impact of the trade war with the US.

In fact, China’s growth gauges, indeed, global growth gauges all indicate slower growth in the future as demand for credit dries up. Which means that the ability to use debt to “stimulate†economic growth may be coming to an end, not just in China, but globally as well.

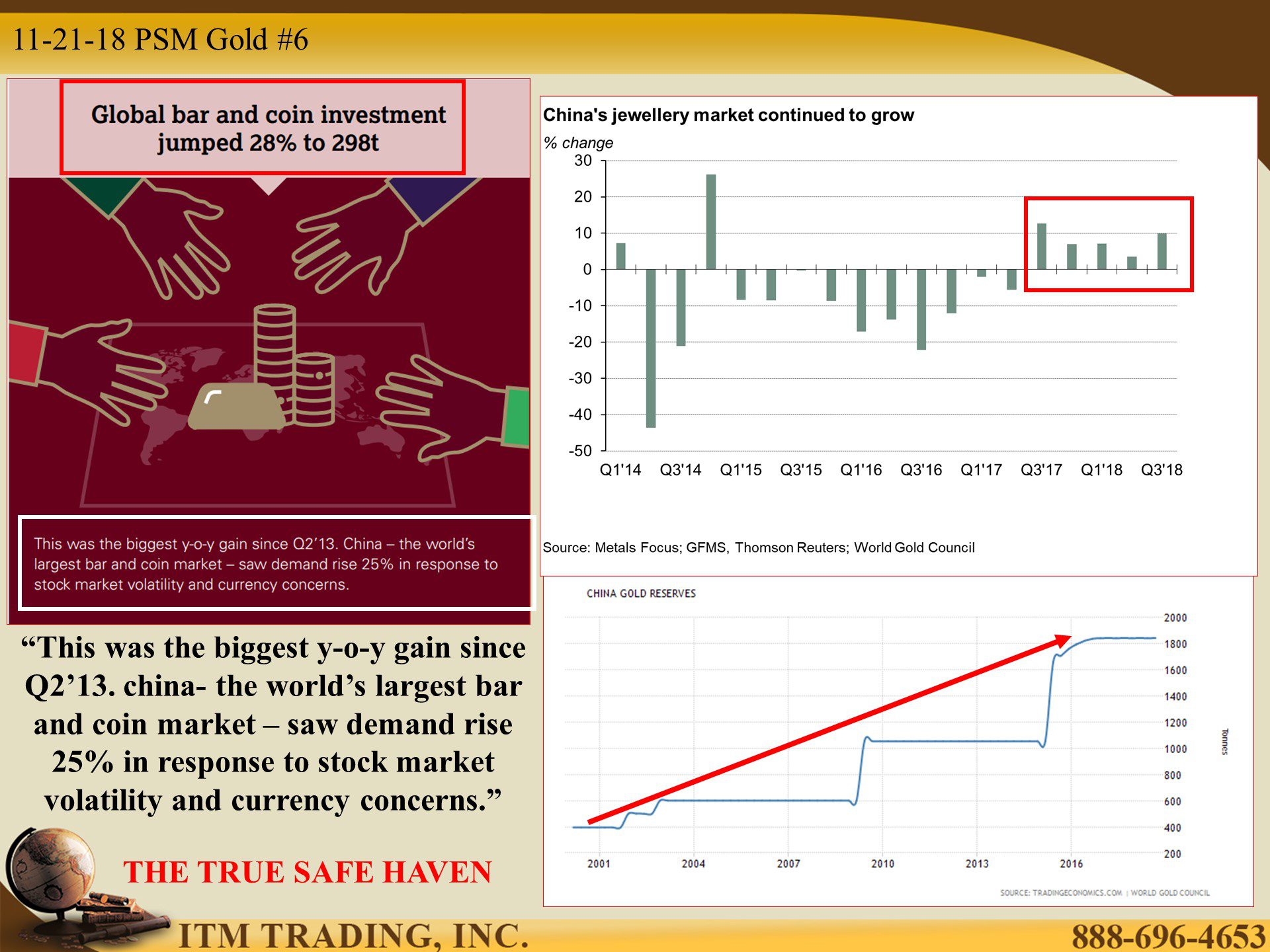

Perhaps that explains the 28% surge in global gold coin and bar demand and the expansion of central banks buying gold at levels last seen in 2015, when the current currency peg system began to break down.

It’s really quite simple, those that understand money, buy gold. In my opinion, those that understand gold, buy collectibles.

- https://stockcharts.com/h-sc/ui

- https://www.wsj.com/articles/china-bet-its-economic-future-on-consumers-and-they-arent-spending-enough-1542179849?mod=article_inline

https://www.ft.com/content/bb3166ea-8b1f-11e8-b18d-0181731a0340

https://stockcharts.com/h-sc/ui

https://tradingeconomics.com/china/gold-reserves

11-21-18 PSM A GLOBAL THREAT US & China Clash of the Titans By Lynette Zang

The Asia-Pacific Economic Cooperation summit ended on November 17th. Vice President Pence was there, as was President Xi, it was not a pretty meeting. In fact, for the first time in the 21-member Pacific Rim groups history, they were unable to end with a joint statement, exposing deep divisions between the US and China and sending global markets deeper into bear market territory.

Perhaps that explains the 28% surge in global gold coin and bar demand and the expansion of central banks buying gold at levels last seen in 2015, when the current currency peg system began to break down.

It’s really quite simple, those that understand money, buy gold. In my opinion, those that understand gold, buy collectibles.