GET PAID TO BUY A HOUSE: The Dirty Story Behind Negative Mortgage Rates…By Lynette Zang

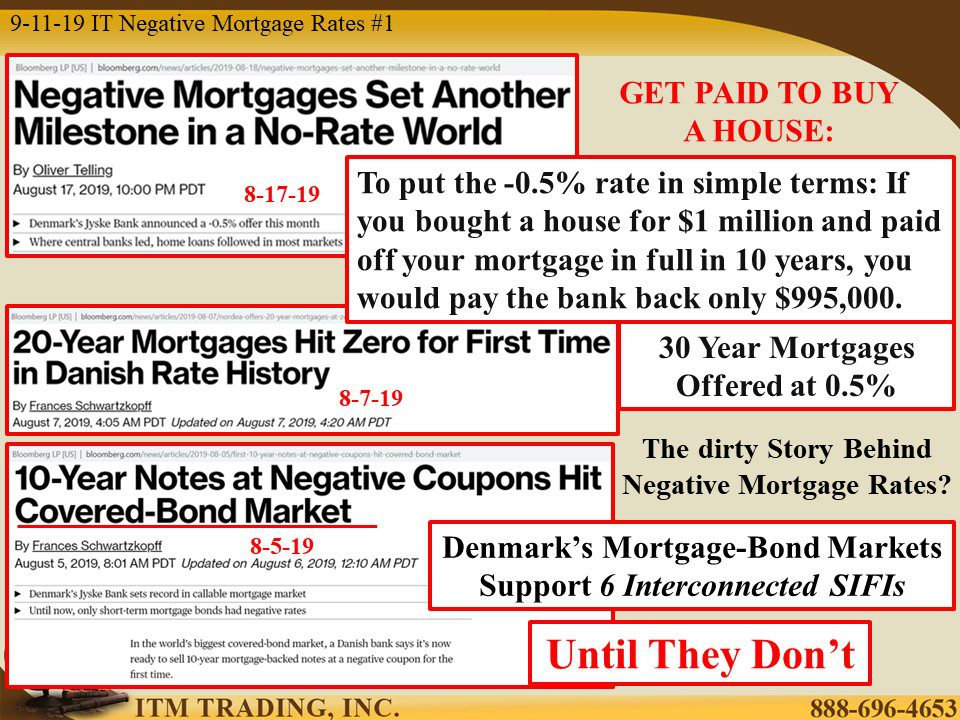

Getting paid to buy a house seems too good to be true. Yet negative interest rates have driven mortgage rates in Denmark into that Alice in Wonderland world. At first it was just for the banks, but now the public can get paid to take out a 10-year mortgage too. Isn’t that awesome? But why would banks pay you to take out a loan?

Because Denmark is home to six SIFIs (Systemically Important Financial Institutions) that depend on the covered bond market for funding by repacking mortgage debt into covered bonds that are then sold, mostly to other banks and the public through “institutional investors†investing for insurance and pension funds as well as other Funds.

Denmark’s covered bond market was first established 200 years ago and consists of fixed, callable bonds, which would allow a bank to reset the interest they pay on the bond if interest rates fall (though the interest rate on the mortgage remains until refinanced). Only roughly 4% of all variable rate Danish mortgages have a rate cap and interest only loans can be extended for up to 10 years. Denmark’s covered bond market, one of the largest in the world, has almost quadrupled since 2000. The expansion must continue, even as property nominal values are at highs.

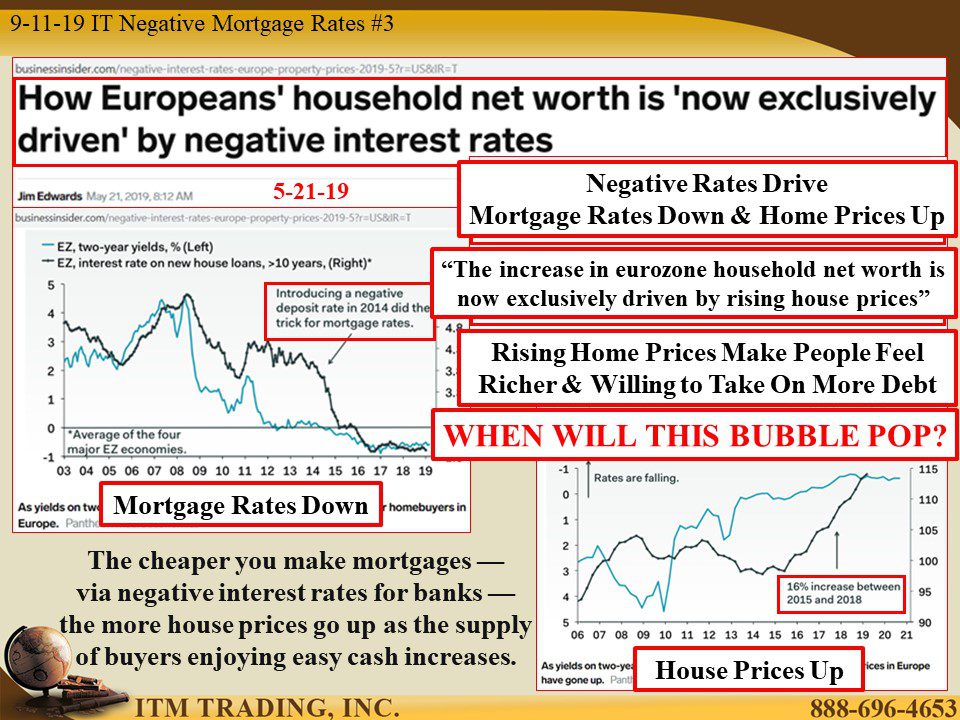

Easy credit and paying people to buy homes (negative mortgage rates) should push real estate prices even higher, even as covered bonds transfer some risk from the bond originator to other banks and the public. But negative yields have a negative impact on bank earnings.

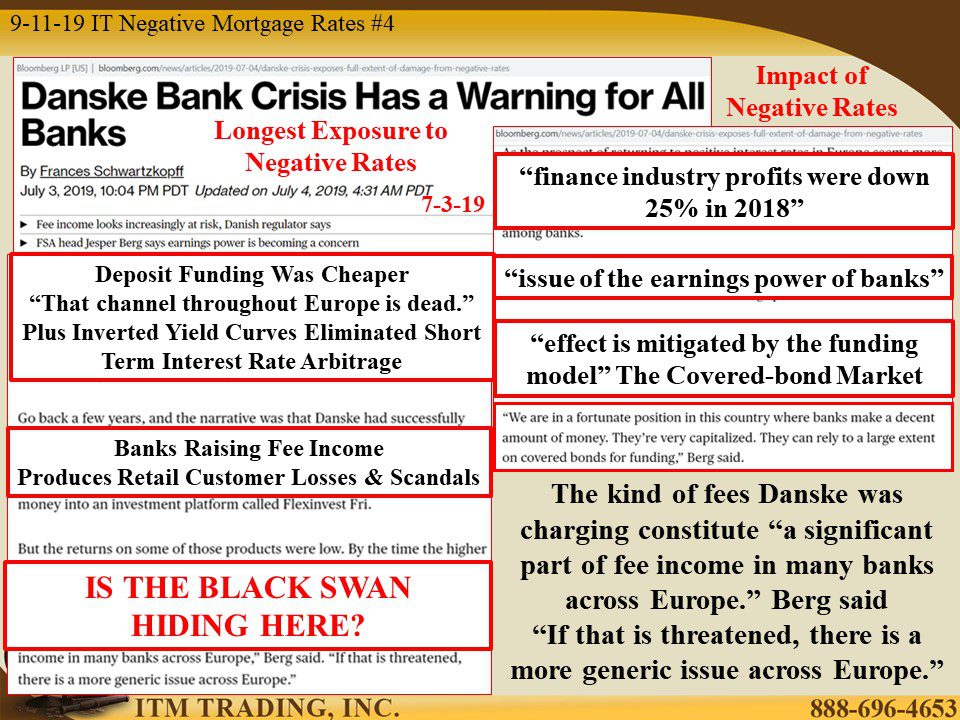

Central banks need banks to transmit policy to the public, therefore, bank profitability is another ball being juggled in this insane rate environment. Traditionally, deposit funding was cheaper for banks than market funding, but negative rates make that more expensive, since most banks have not yet transferred negative rates through to the smaller retail public. In addition, banks could generate income by interest rate derivatives that utilized the difference between higher, longer rate debt and lower, shorter rate debt. Inverted and flat yield curves killed those income opportunities. What’s a bank to do, that needs profits, to offset all of those profit losses? Raise fees.

Danske Bank has been exposed to negative interest rates longer than any other bank and have been rocked by yet another scandal as they drove retail customers to high fee “investment†products. “By the time the higher fees were included, clients were losing money. The bank nevertheless recommended the product and collected the fees.â€

This scandal now jeopardizes “a significant part of fee income in many banks across Europe†FSA (Financial Supervisory Authority) head Jesper Berg says. Further he stated that “If that is threatened, there is a more generic issue across Europe.†Yes indeed, if banks cannot generate profits and only bleed losses through negative rates, how long can that last?

No one knows the answer to that, because there is no historic precedence. We are in unchartered waters without a lifeboat and sharks circling. No one knows when this bubble will pop, but do you really think this can go on forever?

Additionally, and critically allowing the public to feel like they are participating in wealth growth has been a key tool in monetary regime transitions. Happy days are here again!

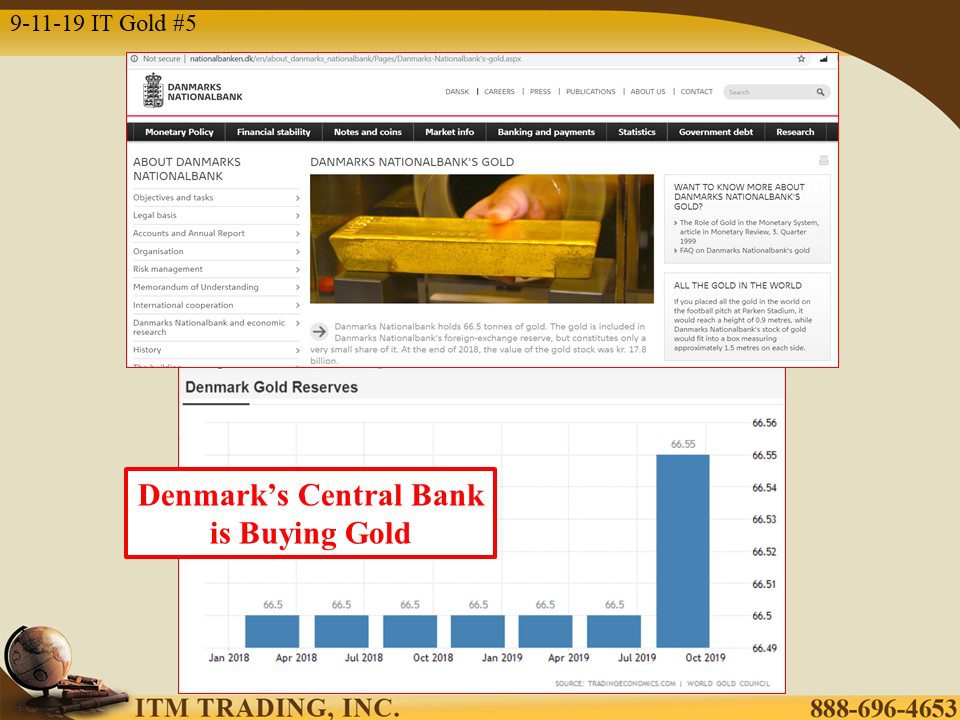

Last year saw central bankers buy the most gold in 50 years and accumulation has escalated even more this year. Denmark’s central bank has begun to accumulate gold too. How about you?

Slides and Links:

https://www.bloomberg.com/news/articles/2019-08-07/nordea-offers-20-year-mortgages-at-zero-interest-as-rates-plunge

https://www.bloomberg.com/news/articles/2019-08-05/first-10-year-notes-at-negative-coupons-hit-covered-bond-market

https://danskebank.com/da-dk/ir/Documents/Other/Danish-Covered-Bond-Handbook-2016.pdf

http://www.nationalbanken.dk/en/about_danmarks_nationalbank/Pages/Danmarks-Nationalbank’s-gold.aspx