FED’S FINANCIAL EARTHQUAKE WARNING: Are There Cracks in Your Assets? PART 1…BY LYNETTE ZANG

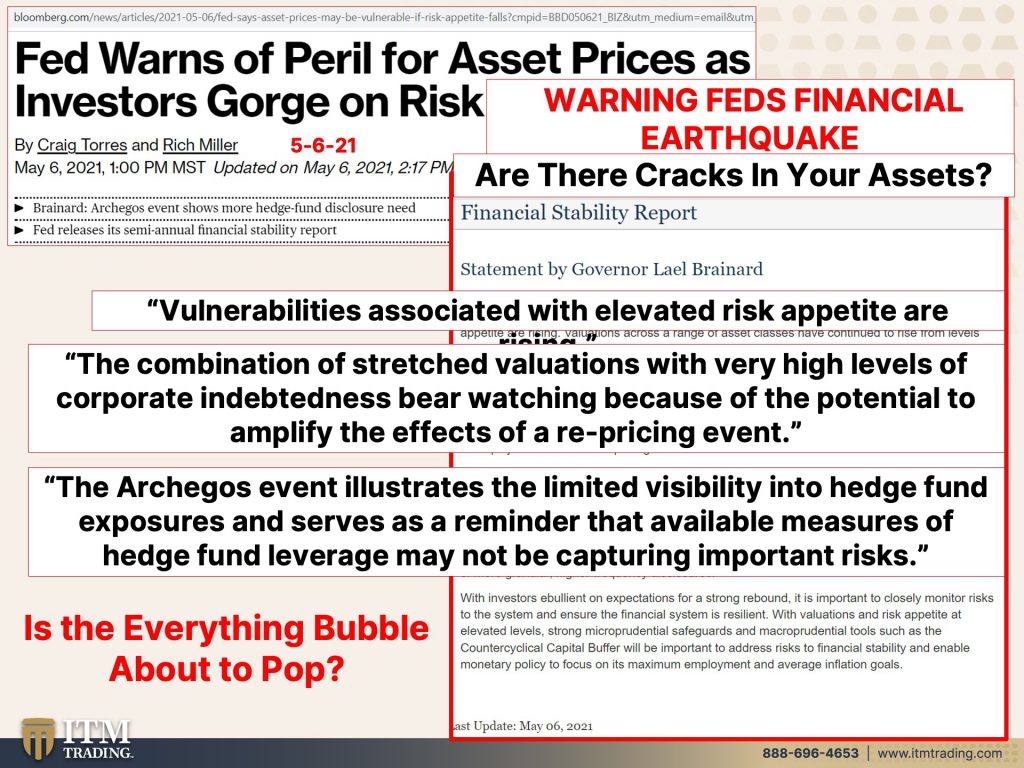

Well, the Fed published their “Financial Stability Report†and frankly, to many, it screamed WARNING! In fact, a Bloomberg headline reads “Fed Warns of Peril for Asset Prices as Investors Gorge on Riskâ€.

Who created the feast? The Fed did with its easy money policies.

Who will pay the price? Naïve investors and taxpayers of course.

In all fairness, they did admit that low interest rates might have had some influence, while avoiding accepting any real responsibility.

Importantly, they bring up the recent Archegos derivative bubble pop (this story is not over yet) stating that this “event illustrates the limited visibility into hedge fund exposures and serves as a reminder that available measures of hedge fund leverage may not be capturing important risks.†Since these same hedge funds access money markets and banks for much of their funding.

And because the entire global financial system is completely intertwined, the entire system, including all fiat money assets, as vulnerable to hedge fund moves. Does that make you feel comfortable?

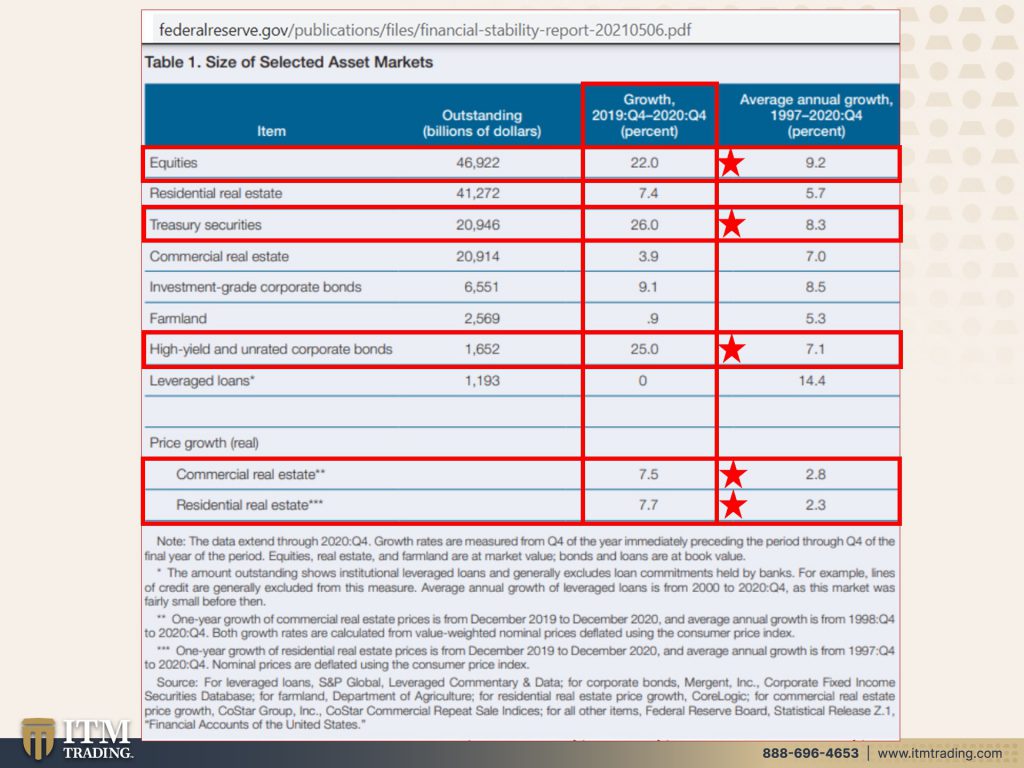

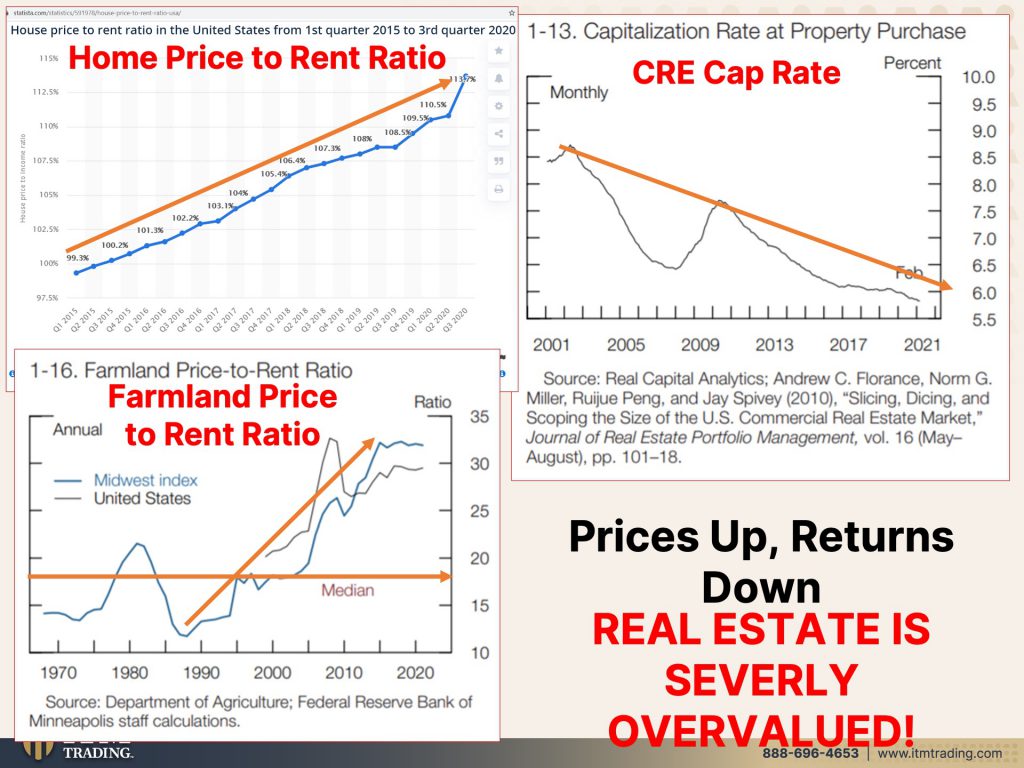

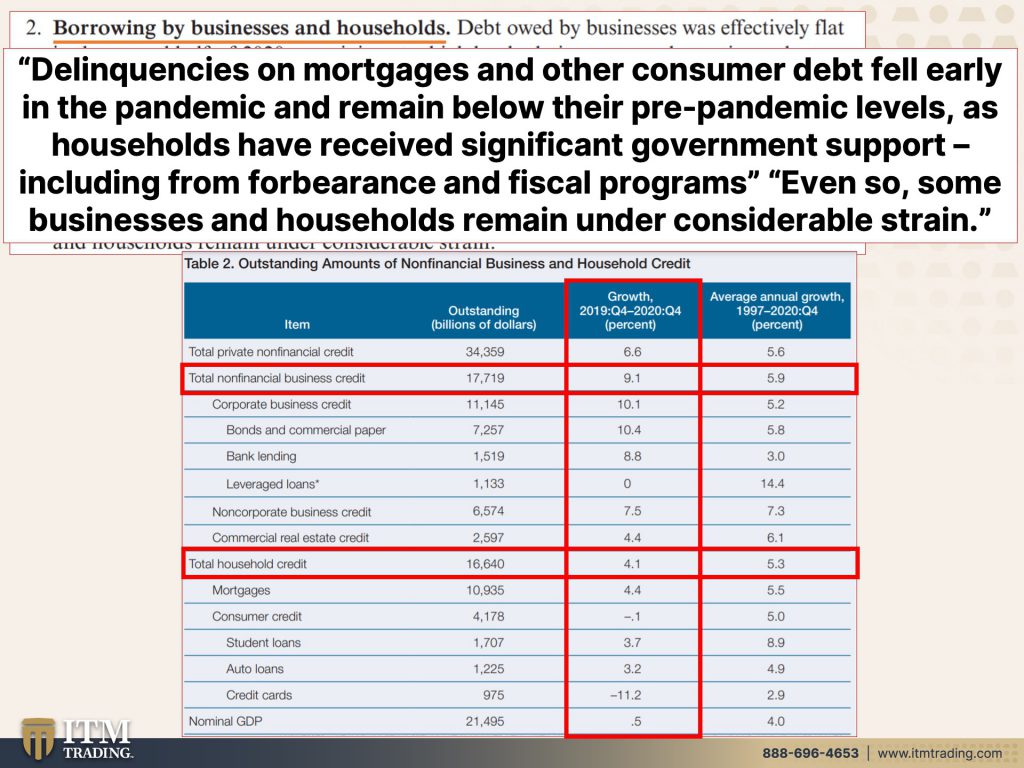

The areas examined in this report were “Elevated Valuations†because they imply that a market crash is in our near future. And since individuals and corporations have used these inflated valuations as collateral to grow massive amounts of debt, “when businesses and households cannot make payments on their loans, financial institutions and investors incur losses.†And would most likely be forced to sell these leveraged assets to meet margin calls, which would further push market valuations down.

Further, “Excessive Leverage†poses the “risk that financial institutions will not have the ability to absorb even modest losses when hit by adverse shocks.†If depositors are concerned about their bank or other financial institution (life insurance company) there could be a run (like March 2020) and “financial institutions may need to sell assets quickly at “fire sale†prices, thereby incurring substantial losses and potentially even becoming insolvent.â€

When this happened in 2008, the deposit insure was raised from $100,000 to $250,000 at banks and government guarantees were put on money market funds. This restored confidence and bought time to change the rules. Hidden from most, was that the FDIC was one failed bank away from the public discovering that their Deposit Insurance Fund (DIF Fund) was completely out of money. In fact, in the most recent DIF report there is on $117.897 billion in the fund to cover $9,119.579 trillion in insured deposits or just a little more than 1 penny for every 1 dollar they insure.

When this happened in March 2020, central bankers went to the media in full force touting their ability to create as much cash as they wanted to, which is what they did. Since then, global central bank balance sheets have added over $10 trillion and they are still climbing at hyper speed. Did this really create a dynamic growing economy or make all markets a lot more vulnerable?

You know I believe you should always do what the smartest guys on any given topic, do for themselves and central bankers continue to buy gold. Some were very thankful they had gold in their reserves to help them get through the pandemic and are now aggressively accumulating gold again, adding 95 tonnes in the first quarter of 2021.

They are buying gold because they know the days of the current fiat system are numbered. That’s why I buy it too.

Slides:

Sources:

https://www.federalreserve.gov/publications/brainard-statement-20210506.htm

https://www.bloomberg.com/news/articles/2021-05-06/fed-says-asset-prices-may-be-vulnerable-if-risk-appetite-falls?cmpid=BBD050621_BIZ&utm_medium=email&utm_source=newsletter&utm_term=210506&utm_campaign=bloombergdaily&sref=rWFqAg1Y

https://www.statista.com/statistics/591978/house-price-to-rent-ratio-usa/

https://fred.stlouisfed.org/series/FBDSILQ027S

https://fred.stlouisfed.org/series/BCNSDODNS

https://fred.stlouisfed.org/series/HCCSDODNS

https://www.yardeni.com/pub/stmkteqmardebt.pdf