Fed Chair’s Desperate Speech…HEADLINE NEWS with Lynette Zang

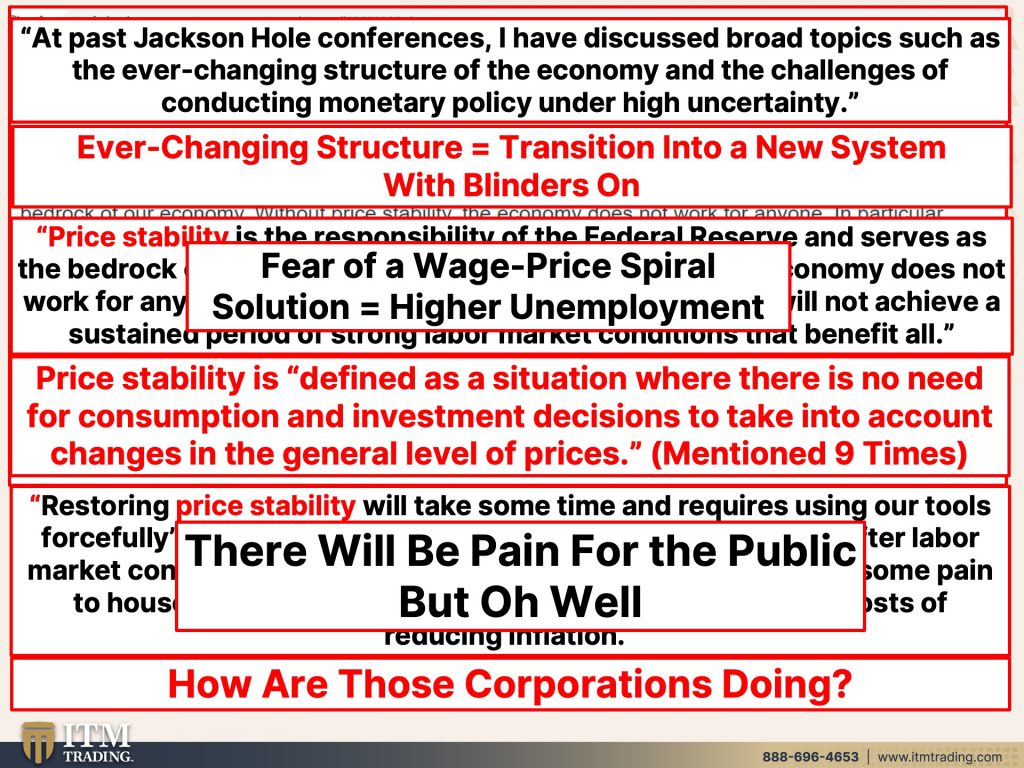

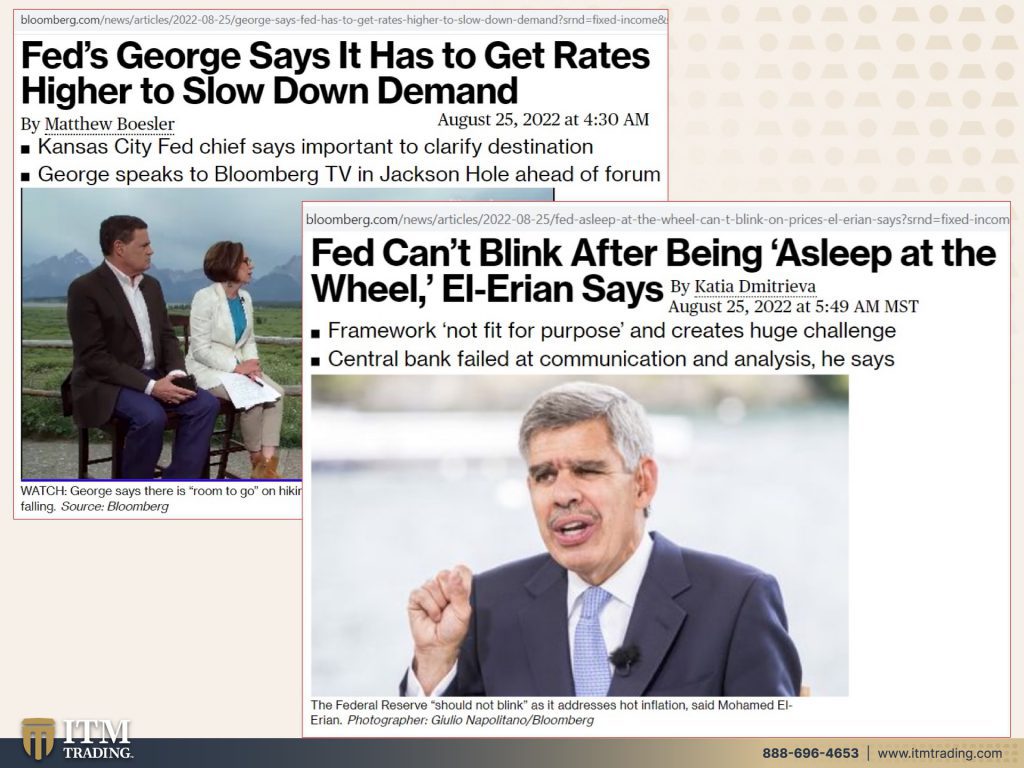

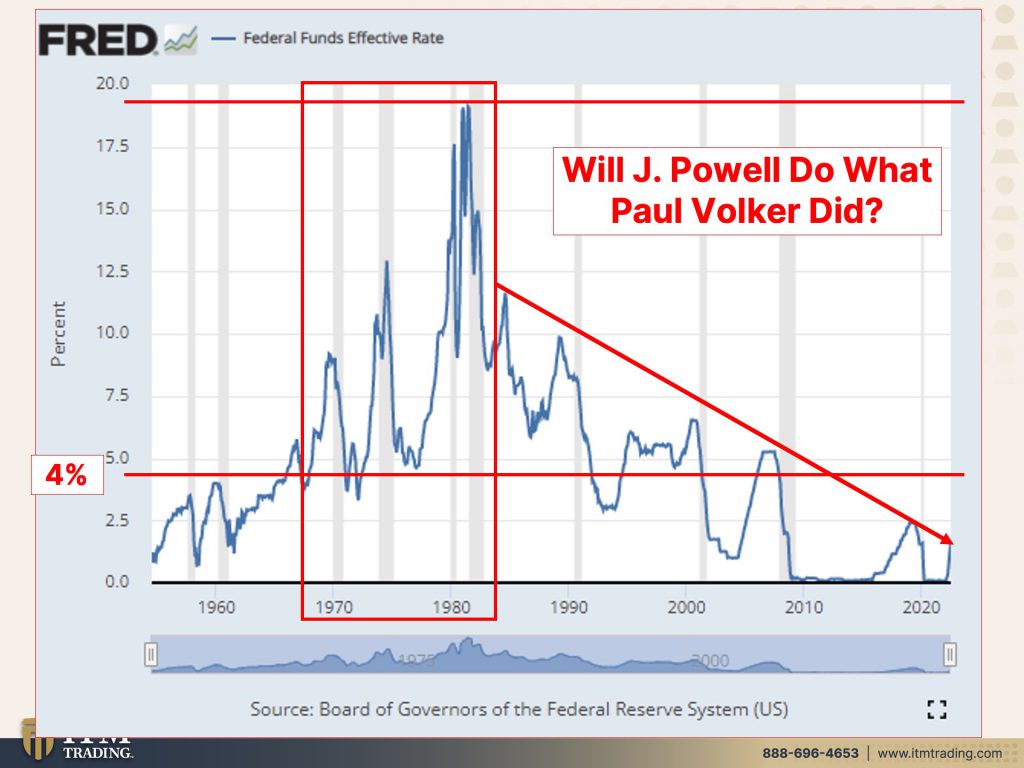

The Federal Reserve chair Jerome Powell is pushing back against the belief of a pivot in the near term. What he is really battling for is Fed credibility. We talked about this.

Giving up “forward guidance,†was indeed, a very big deal, since every con game requires confidence. The risk is, in their effort to regain what they recently gave away, that they push us into depression. But, in my opinion, that is inevitable anyway.

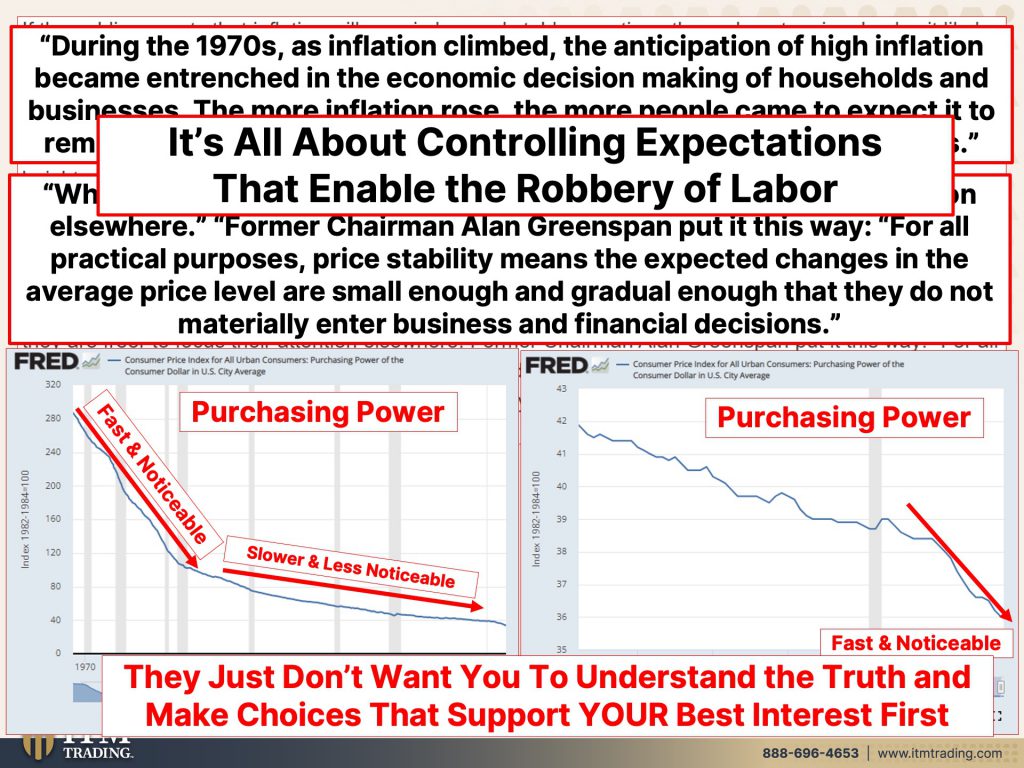

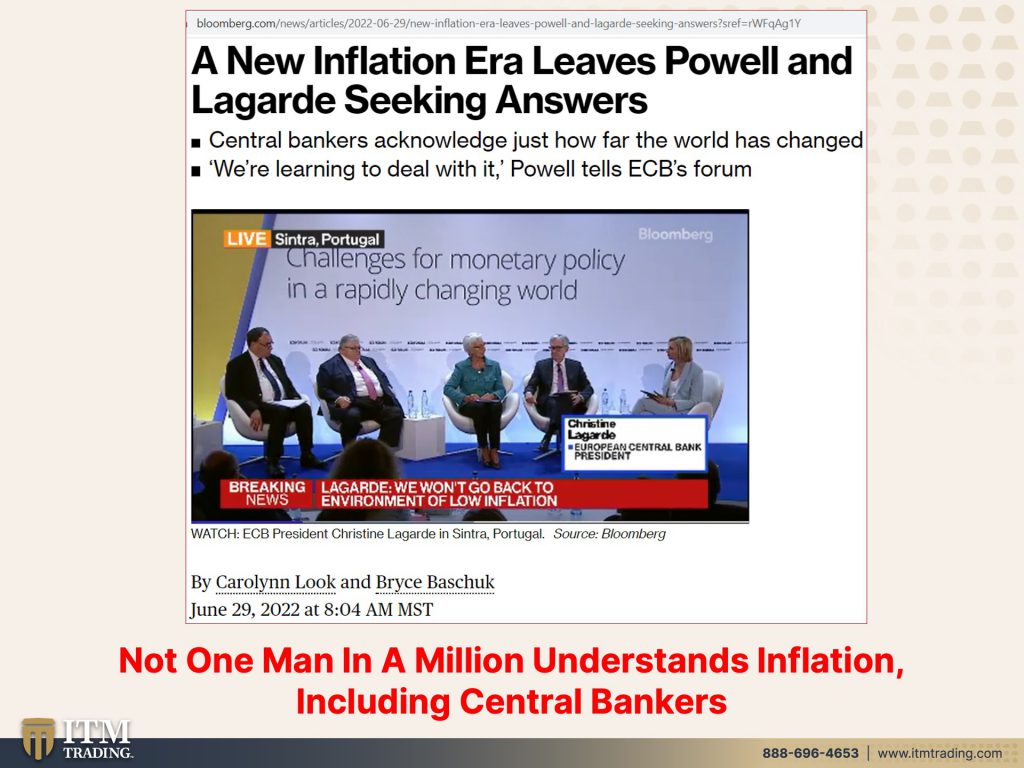

Let’s really look at what is happening because they have admitted they don’t understand inflation as well as they (arrogantly) believed.

It was their free money policy, used since 2008 and held in assets targeted by the Fed for reflation, which is spilling into the real economy as supply chains remain strained, that is now making inflation obvious to the public.

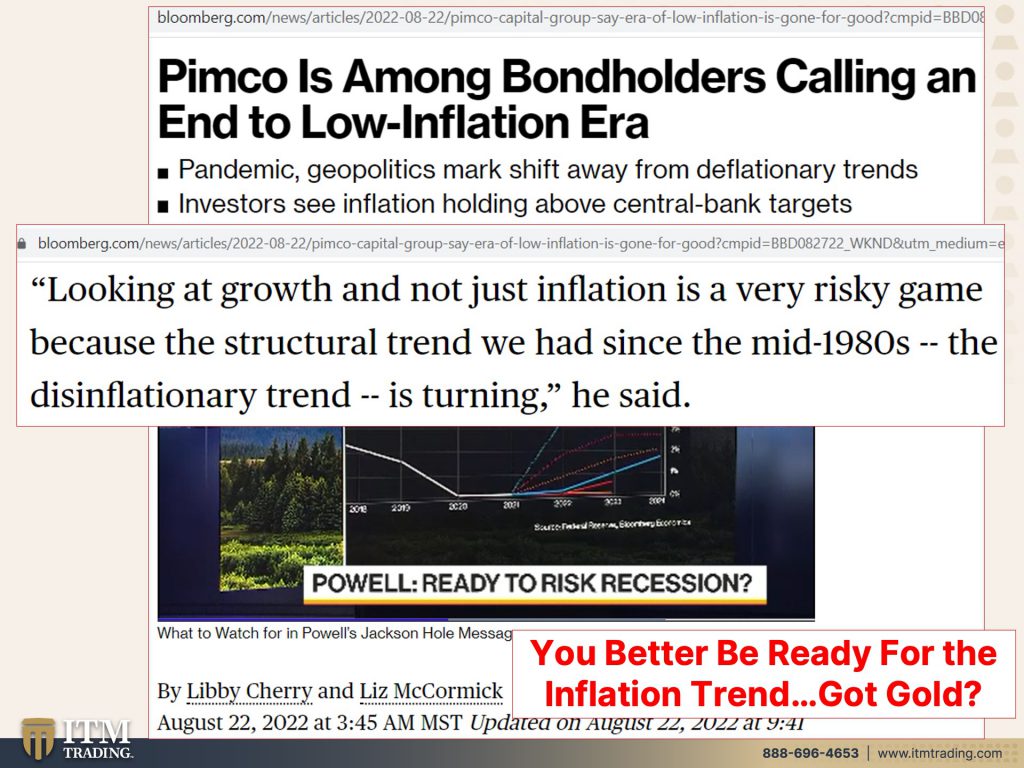

But if the government and Fed are really serious about curbing inflation, why aren’t they working together like they did with “stimulus†pumped into the system during 2020?

So, the Fed is trying to regain control and raising rates to slow borrowing and raise unemployment at the same time the US government is passing massive spending packages and using loan forgiveness to “stimulate†the economy.

Does this make sense? Or is this part of the plan, since the more the government stimulates, the more the Fed must raise rates to prove its power, since that is really their only tool.

How long can this game go on before the next crisis takes the global system down?

I cannot tell you the exact answer, no one can. But what I can tell you is that you had better be ready.

Food, water, energy, security, barterability, wealth preservation, community, and shelter. We all need to be secure in all these areas to maintain a reasonable standard of living. This is something many people around the world are discovering today, but it’s too late for them to do anything about.

Good money gold is the foundation of this security simply because you will be entering the next crisis with real money that has the broadest base of buyer. You will be doing the same thing that global central banks are doing.

Have you ever asked yourself why central banks buy gold? You have a notable example in Russia. Love them or hate them, they loaded up on gold in preparation of being cut out of the SWIFT global payment system. They have been accumulating gold way in advance of their actual need. They had a plan, and so should you.

SOURCES:

https://tradingeconomics.com/commodity/gold

https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm