Don’t Let Wall Street Use Your Deposits for Risky Investments

Are the Federal Reserve and Wall Street putting your deposits at risk? In this video, we explore the controversial proposal to ease capital requirements in the $22tn Treasury market. Some believe this move could expose the largest banks in the US to riskier investments, leading to potential losses that they may not be able to absorb, all while using your money without your knowledge. Don’t be caught in the middle of a glorified Ponzi scheme on a national level. Watch our latest video to learn how to protect yourself and your wealth from this con game.

CHAPTERS:

0:00 Exempting Treasuries

1:59 Banks Want More Liquidity

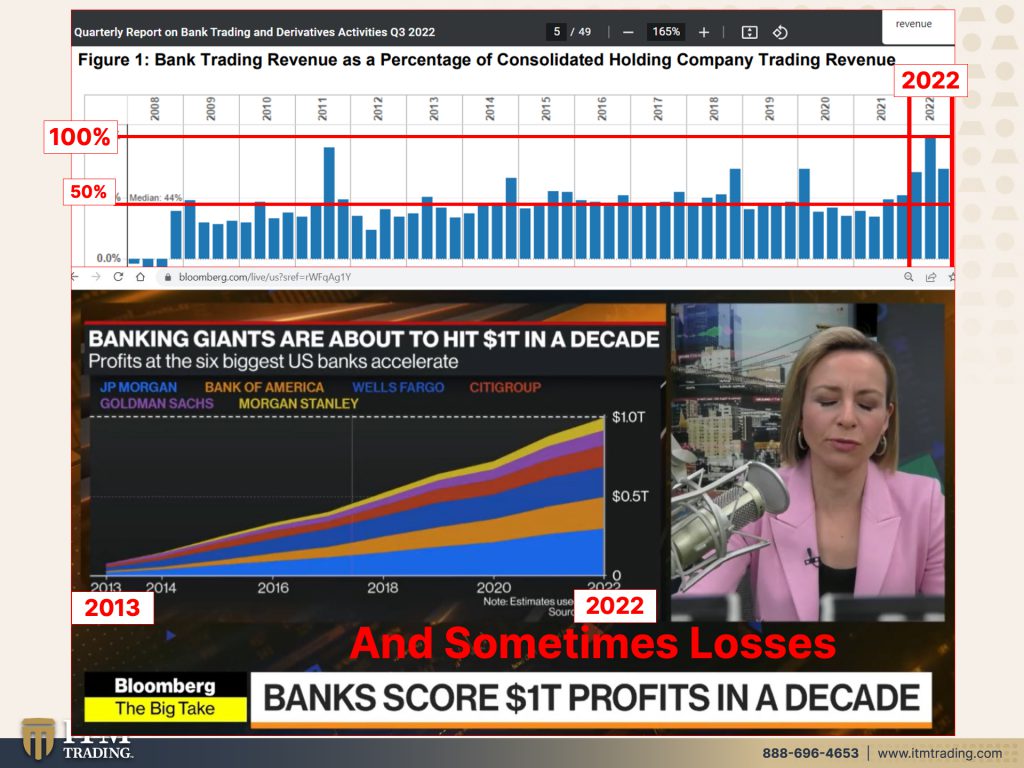

6:51 Bank Trading Revenue

12:04 Derivative Contracts

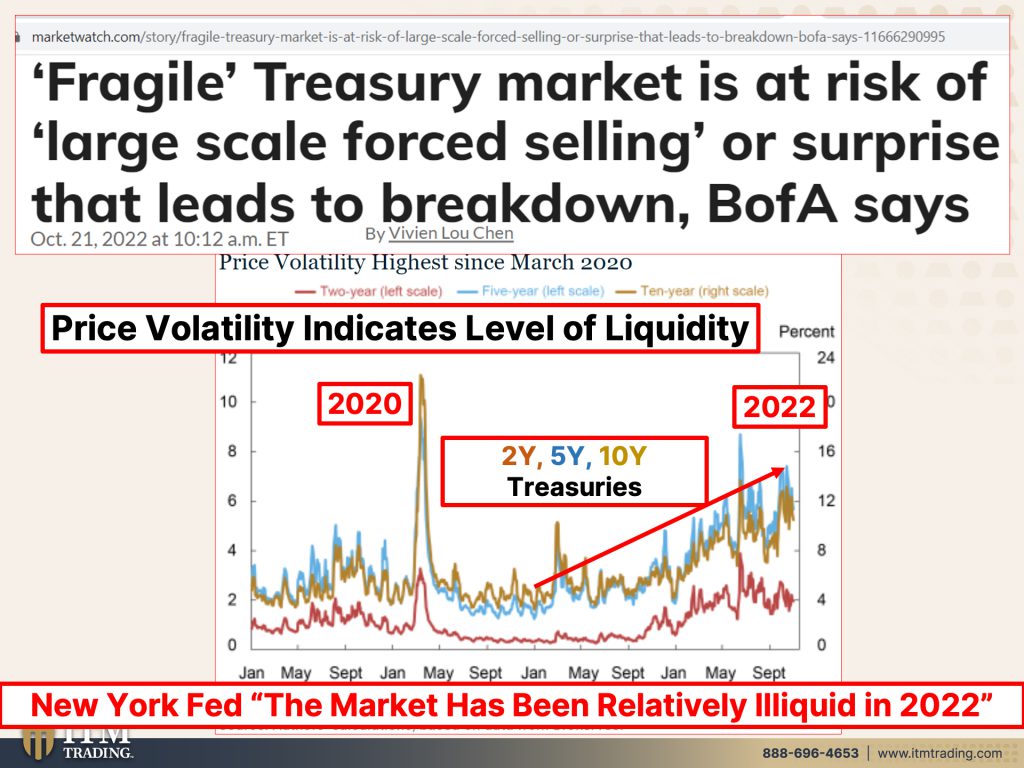

20:32 Price Volatility

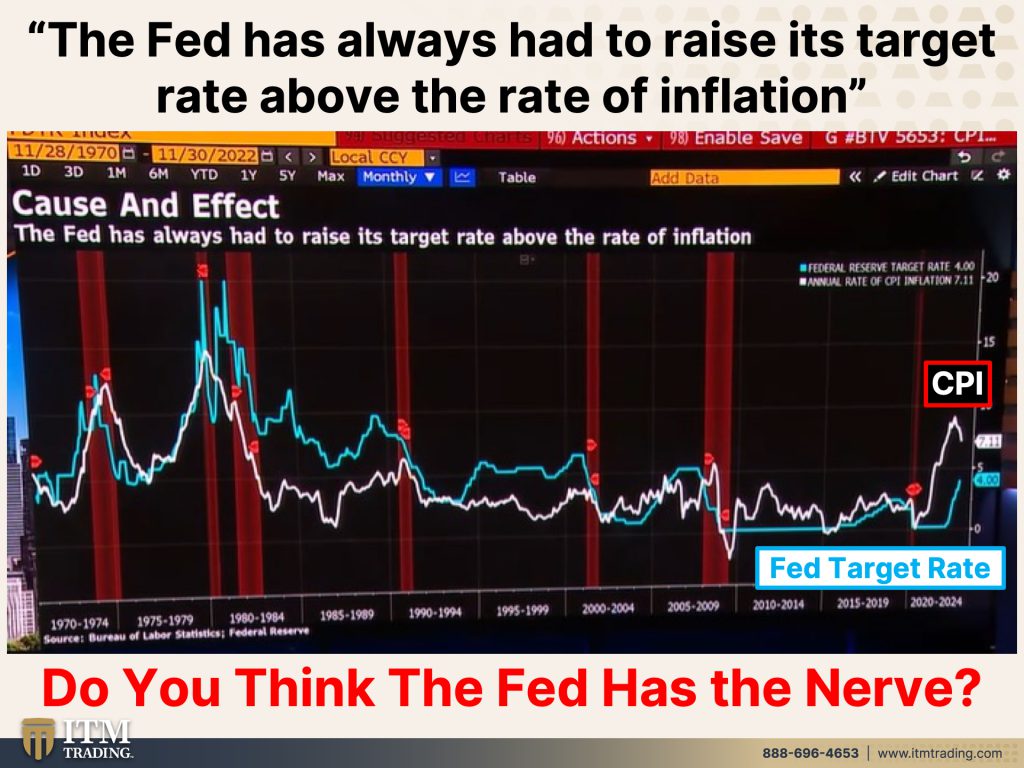

24:12 Rate of Inflation

27:09 Spot vs. Collectible

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Wall Street is now calling for the Federal Reserve to ease capital requirements in the 22 trillion treasury market. Why would they do that you ask? Because reducing capital requirements by exempting treasuries would allow the largest banks in the US to use and risk the majority of your deposits in the derivative market, in the stock market, in the bond market for trading for their own gain. This is dangerous. They know the entire system is going under, and this is how they could take your money and legally lose it. Remember who went to jail in 2008? No one. It’s a glorified Ponzi scheme on a national level. There are key indicators breaking out right now that can put you on the winning side of this, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service physical gold, silver dealer specializing in custom strategies. And I have to tell you that at this point in time, it has never been more important for you to have a strategy than it is today because Happy New Year, we’re now in 2023. So click that Calendly link below and do yourself a favor and create your own strategy. Because I’m gonna tell you, you know how if you are thinking you’re gonna declare bankruptcy and you get credit cards in the mail, you just, some people would anyway run out and max those credit cards out because you know you’re not gonna have to pay for ’em anyway. Well, I hate to say that, but that’s kind of what I’m seeing with Wall Street and the banks and the central bank today.

Wall Street wants capital rules eased to unblock $22 trillion in treasury markets. Well, what does that mean, right? Because you read that and it doesn’t seem so, okay, fine. They want that. Well, right now they have to put a certain level of reserves in case there’s a problem. They have to set those aside for treasuries, but they don’t wanna do that because they’re making so much money trading. They want to use whatever money that’s in the system that they can, and we’ve seen them change these rules before, like 1995 when they set up the sweep accounts that enabled them to take your deposits, sweep them into sub-accounts in their name, that they can then use as collateral for whatever other loans and trading that they want. So this would be another level of that. Do I think they’re gonna get it? I don’t know. We’ll see Probably, but I don’t know for sure. The Fed will now though, embark on a review of the requirements blamed by banks for reducing liquidity. And you know, we’ve been hearing quite a bit about liquidity or the lack of the ability to buy and sell easily. I mean, it was great when the Fed was creating all of this liquidity by just printing and printing and printing and printing and printing. I think you got the point. Many, many, many, many trillions of new dollars and giving it to Wall Street to play with. Well, you know, they’ve kind of stopped doing it at that level. So now Wall Street, the banks, are complaining and they want more liquidity. Banks have long argued that reducing their capital requirements, in other words, the reserve requirements by exempting treasuries and cash reserves from calculation of their so-called supplementary leverage ratios, would allow them to participate more in the market. In other words, they want to be able to trade even more. And I mean, it, it should be pretty obvious, particularly since 2008, that bank trading is, and bank profitability is very, very, very important to the central banks. They’re just too big to fail. You and me we’re just about the right size to fail, but the banks are not. So if they didn’t have to hold reserves for treasuries, there you go. They could just trade more and more and more. Oh lucky them. But what that really means is that the FDIC insured banks and the FDIC was created in response to the bank runs of the twenties and the early thirties to get you to have confidence and, and hey, don’t you think, my deposits are insured. Well, they’re insured up to $250,000, however, the FDIC has to have the funds to pay the bank. So if one bank goes down and another bank goes down and, and they kind of stagger that, not a problem. But in 2008, the FDIC actually admitted that if even one more small bank went out, then it would be obvious to everybody that they had no funds for this and they were in a deficit. So they’re not, they’re no longer in a deficit, but they have roughly a penny, a little bit more than a penny to ensure every dollar. So as long as those the banks go out in an orderly fashion, you’re never gonna know how much at risk you are. But in this current environment, can you tell me, I mean, put hopium away and tell me do you really think it’s gonna be that nice and orderly? Because what they’re talking about doing, no, I don’t think this is gonna be orderly at all. Liquidity in the market for US government debt has deteriorated as banks have pulled back from their traditional market making roles. So the banks themselves have been instrumental in, in, in that loss of liquidity in the most important market on the planet, the US Treasury that underpins everything.

But let’s go back to the banks and their trading revenues. Cause we talk about the treasury markets and we talk about liquidity a lot. This is from the most current of the third quarter of 2002, office of the comptroller of the currency, OCC reports on derivatives in FDIC insured banks. And you know, I use this report a lot and if you take a look at it, they have been generating roughly 50% of bank trading revenue. And this is as a percentage of the consolidated holding company, they’re trading revenues. So banks have roughly been doing a median of 44% of bank holding companies. They generate their revenue through bank trading. And you can see this is 2008, not that year <laugh>, but thanks to the fed many of the years. But look at 2022. Isn’t that interesting that that bank revenue went from an average, a medium rather of 44% all the way up to, hmm, my goodness, a hundred percent? at least in one of the 2022 quarters. So substantially there has been a huge jump in trading revenues for the banks, particularly with all that volatility. Traders love volatility up and down because they’ve got these derivatives. And look, you know, a penny or two here or there doesn’t seem like that much. But when you’re doing trillions of dollars worth of contracts, that adds up fast. So you can see banks are really dependent upon that trading revenues. And it’s a very good thing because wow, they all went from roughly not even a quarter of a trillion in 2013, which by the way, let me remind you, was when they changed their accounting procedures with netting and compression to make it look like the notional value of the derivatives that they’re trading were going down. But they weren’t, they were just hiding the truth. So I don’t even think it’s much of a coincidence, <laugh>, that we could see this because derivatives, which I believe is what’s going to ultimately take this whole system down. You know, derivative trading has exploded since the crisis, the financial crisis in 2007, 2008. And by the way, that financial crisis was created by a derivative implosion. They did not fix any of those problems. They just allowed those problems to spread and integrate throughout the entire system, through mutual funds, through ETFs, through all these fancy products that they’ve created. Because that’s what Wall Street does best, creating new products out of nothing. But what that does is it puts you in jeopardy. And while they’ve been making some really nice gains, you can see that, there are also potential losses that are involved. But you know, there’s a saying, if I owe you a hundred bucks, I have a problem. If I owe you a million bucks, you have a problem. So I’m telling us we, all of us have a problem because history has shown us again and again that it is the depositors and the taxpayers that actually end up footing the bill. The gains go to the banks and then the banks redistribute those gains outside of the banks between share buybacks, special dividends, etcetera. When that money’s out of the banking system and there’s a problem, hmm, they’re not clawing it back, are they? They’re turning around to the government, they’re turning around to Congress and saying, hey, we need a taxpayer bailout. And we’ve certainly experienced that before. But keep in mind it was after what happened in 2008 that the Dodd-Frank law was enacted. I mean it was never fully written even though it was canceled, much of it. But that’s where they put in the bail-in laws and they have not reversed those. So I believe that this next crisis that we’re going to see is going to involve your savings, your bank deposits, bailing in these banks, and then taxpayers on top of that. Because if I owe you a million bucks, you got a problem. We’ve got a problem guys, no doubt about it.

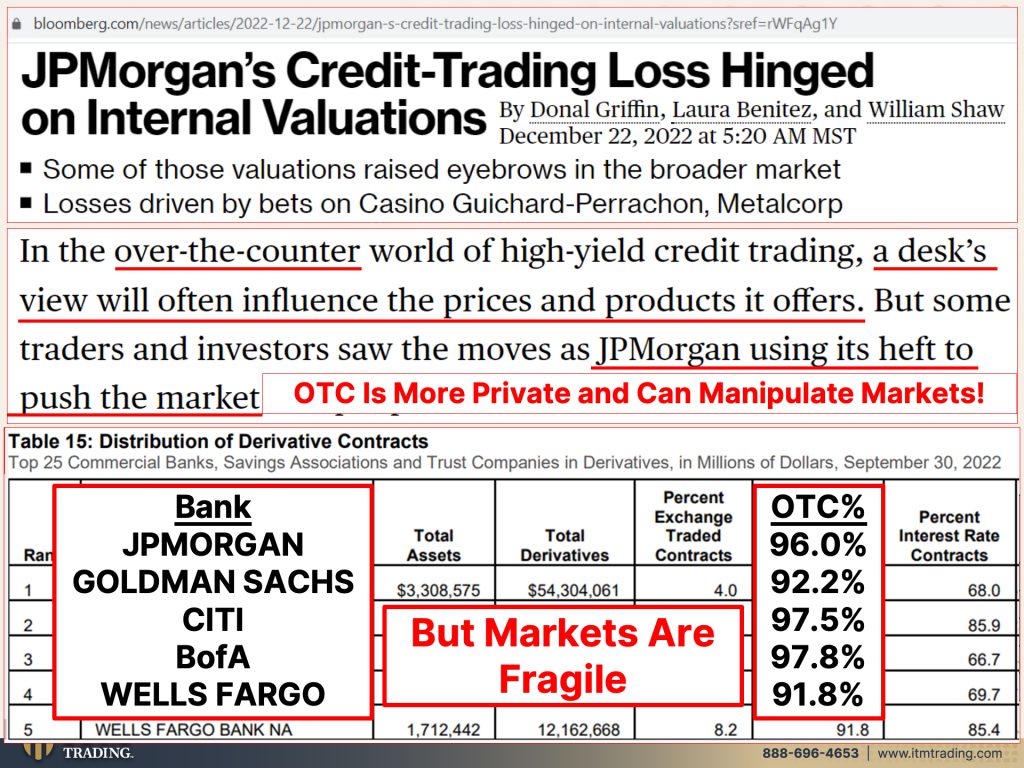

This headline to me was so flipping interesting and the reason why it was so interesting is because they’re actually admitting in bold print, what does it say here? Credit trading losses hinged on internal valuations. Now that means that JP Morgan said, oh, this is worth X. In our opinion, this is worth X. But other market participants in the same area had valuation down here. JP Morgan’s was up here, so they were selling it to their clients up here with up here valuations. And the market was not demanding it. So it would be like, like you having your house and say, you know what? I wanna sell my house for $5 million when the rest of the market is at $500,000. Well that may be what you want and maybe you’ll find a sucker that will buy that. Maybe you will. JP Morgan did. <Laugh> Lord knows Goldman Sachs has their “muppets,” but is it really worth that? And who eats that loss? So the fact that they admitted that this hinged on internal valuations when anybody else in the marketplace completely disagreed and had these same kinds of derivatives much cheaper, but they could do this because they’re over the counter. And so that means over the counter is a lot more private and it’s based on a desk’s view. So in other words, JP Morgan’s trading desk’s view and it will influence the prices and products that it offers. And because you and I as consumers and customers don’t really know how they value these things, if you are working with a stockbroker or somebody else similar to that and they say, okay, well I think you should invest in this and it’s, and here’s the price. All right? If you trust that guy, you’re gonna go, okay, but you’re gonna be buying it way above market. And what really happens in those cases is that the risk is transferred from the bank from JP Morgan teu. And you’re paying for that risk on top of it. I mean it’s genius, it’s evil genius, but it’s genius. JP Morgan is also using its heft to push the market cause it ain’t real. And we all know if you don’t hold it, you don’t own it. Who reads the fine print? Right? Nobody reads the fine print and the OTC market much more private and can easily manipulate markets. We’ve seen that happen with precious metals, gold and silver quite a bit. So let’s just kind of take a look at it cause I’ve shown you the leverage even recently from this particular report. But first, let’s look at the top five banks that are writing derivatives, Morgan Sachs, city, bank of America, and our lovely Wells Fargo who can’t get out of fines and fees, but business as usual and what have you. All right? What percentage of their derivative trades are over the counter? There’s been this huge push to put them on a common platform. How have they succeeded since 2008? Let’s look. Ooh, 96% of JP Morgan’s derivative transactions are still over the counter. 92.2% for Goldman, 97.5% for Citi, 97.8% for Bank of America, 91.8% for Wells Fargo. I don’t think they’ve done a very good job of shifting those derivative trades to a essentially cleared entity. That is a lot, a lot is more visible. No, they’d rather keep it over the counter. And they’ve had how many years to make this transition and this was so important. Yeah, no, why? Cause they have a lot more control. If they keep it over the counter, it’s a lot more private and they can easily, more easily manipulate the markets with it. I mean honestly, it’s that simple. And so you have $610 trillion in notional value. So that’s what the banks say, okay? You know, some of it could be market and some of it could be internally valued. This is how much our derivative position is. Okay, well, I mean, come on. Has Wall Street not shown you time and time and time again that they can certainly be trusted? I don’t really get it to tell you the truth. Maybe it’s because I’ve lived my life in this arena for so long and pay so much attention that I can see the truth. I don’t trust them. I don’t trust the banks. I don’t trust Wall Street. I don’t trust the Federal Reserve. I don’t trust the BIS, I don’t trust the IMF. I don’t trust any of those guys because their job is to keep you in the system so they can transfer your wealth their way. But now, because of all of the shenanigans that they’ve been doing, again, we are in extraordinarily fragile markets, extraordinarily fragile and illiquid. It requires the Central bank. See, they never run outta money. I can run outta money in the gun, but it requires the Central bank to just keep printing. And you know, when I was listening to Bloomberg, I heard somebody say, well, okay, the Federal Reserve has gotten us into this fix with threatening a recession because of raising the interest rates. They can just get us out simply by pivoting and lowering interest rates again. Will that really get us out of the mess? Yes, they can do that. And yes, they will do that. I don’t know exactly when, but yes, they will, when they have broken something really badly, you’ll see a pivot. And my bet is, is they will do so much of this that it makes what they did in 2020 look like nothing. Just like that’s what happened from what they did in 2008 to what they did now. Well, no, the Federal Reserve is gonna do a pivot at some point, but that won’t fix anything because they haven’t fixed anything yet. All they do is create new accounting tools to make it look different. So if they owe you $32 trillion, whose problem is that? I mean, honestly, whose problem is that? Because everybody is admitting, I mean they’ve been talking about the fragility in the lack of liquidity in the treasury markets since 2015, right? So this isn’t like it’s a new problem and something that they have not known about, but you know, you don’t do anything until the public knows about it. And by the time the public really sees it, it’s in their face, right? So the public now knows about the high inflation, that’s about the money printing, right? But the fragility of the treasury markets, I think the general public, they’re not looking in this direction. They have no clue. They’re so busy trying to figure out how they’re gonna feed their families and take care of everybody.

So let’s look at the price volatility and how lucky JP Morgan and those other banks made so much money and why trading and derivatives have become so important to them. And we’re just looking at the treasury Market in this particular case, but that volatility, the price going up and down, they’re betting on it one way or the other. And that’s how they’re, that’s how they’re making their money, especially when they can get away with it. And what we’re looking at, I’ve color coded these based upon the lines, right? So the two year, the five year and the 10 year treasury, and we know that the two year and five year pay more than the 10 year. So we’ve still got an extremely inverted yield curve. That’s what happened in 2020, right? at the be start of the pandemic. And they got that volatility down until January of 2021. And then the volatility started in earnest. So way before we even saw the market correction, which really started when they started raising the rates, I mean first it was transitory. I mean, come on. And, and so the volatility in 2022, which is in this area has been growing and growing and growing, that is an indication that something is really broken. And we know that traders are having a very hard time, if not an impossible time selling large blocks of treasuries. They have to break them down into itty bitty pieces. Or you would then notice the price and you would see interest rates spike even more than you’re seeing them at this point. And even, I mean they admitted openly, even the New York Fed did this whole report and they stated the market has been relatively, relatively, I love that word, relatively nominally, notionally, <laugh>, you know Yeah. Relatively speaking, you know, has been relatively illiquid in 2022. Yes it has been. So what’s gonna stop that lack of liquidity that, oh my God, I wish this could happen to the Federal Reserve where all their money guns went away and didn’t work anymore. I mean, we are, that is actually where we’re headed because that’s the hyperinflation, the the only thing they have is to drop interest rates to zero below zero is where they’re headed. So negative rates, which then takes away your principle, erodes your principle and print more money. That’s it. So the system is done. This is why you hear me say all the time that the system is dead. Because in reality, when you look back historically in order to fight inflation, and this only goes back so far because inflation, and I guess you really need to know inflation is not a monetary phenomenon. They want you to believe that it just happens. It is a fiat money phenomenon. Normal if, if we were in a real market that was based truly upon supply and demand, yes, prices would rise and fall based upon real supply and demand. But absolutely everything has been turned into a Wall Street trading profit or trading product. And it’s all for Wall Street’s profit.

But let’s take a little look at history here and now these brown bars represent official recessions. And so you can see if that blue area is the Federal reserve rate and the white bar is the rate of inflation you can, or white line. You can see that here back in Paul Volker’s time. Yes indeed. They had to raise the rates above inflation. Have they done that yet? No. But what you can also see is that the steepness, so the speed at which they are raising rates is basically pretty much unmatched anywhere other than over at the beginning of this Fiat money experiment, as they were kicking everything off. I remember I got married in 77 and we bought our first house, I think it was 79, yeah, I think it was 79. And, and the interest rate on that house was 12%, but I think I only paid $59,000 for that 1800 square foot, three bedroom, two bath house. What would I have to pay for that now, right? So something’s gotta give, either you’ve got higher interest rates and that makes your mortgage payment go up. Or right now where are we? We’re at very high pricing, even though it’s coming down a little bit in some areas we’re still at extremely expensive prices and now interest rates are going up. So I’m wondering honestly, if you can see the CPI here and you can see the Fed target rate here, do you think the Federal Reserve actually has the nerve to push the interest rates above 7%? Above 8%? And what do you think would happen to the economy if they did with all of the debt levels that they have? You know, it’s done. I mean, I don’t know what else to tell you and I wish I could say something different, but history shows us that the end of this Fiat Money’s life cycle is here. It’s not something that we’re waiting for, it’s here. And what happens June 30th with the LIBOR and SOFR transition? I mean, maybe I’m wrong, I hope I’m wrong, but that’s an experiment. And they haven’t done anything to show me that they know what they’re doing. I wish they did. I have children, I have grandchildren. I wish they did, but they aren’t.

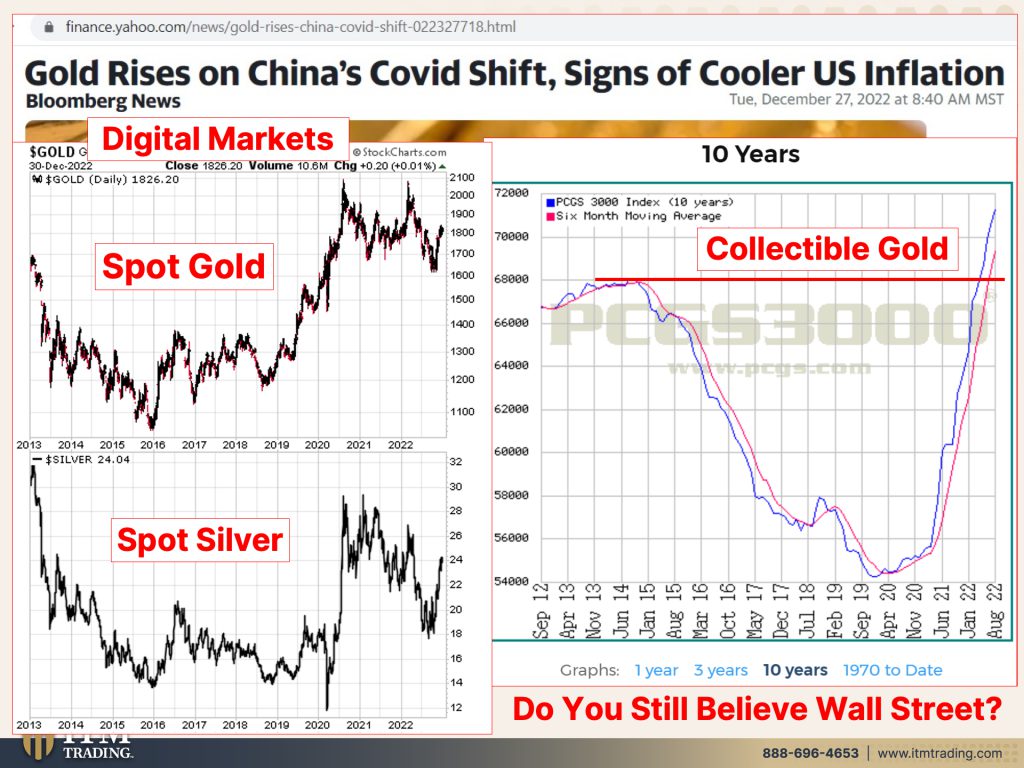

So, you know, do what I say, not what I do. We know that the central banks have bought more, we don’t have a fourth quarter number yet, but we certainly know through the third quarter of 2022, they had bought more gold than they ever have in history. And, and you know, that’s what you should do because who knows more about what they’re doing than they do. But it’s interesting because spot gold, spot silver, you know, that’s just a paper market and it’s easy to manipulate as we’ve seen over and over again. Here however is the collectible market. And it was, I talked about this before too, that resistance level breakout, right? And you can see that first breakout that I noticed in the collectible gold market was back in October when I was getting ready for a, an event that I was doing. And I went, holy cow. Well, you can see now that it’s broken out in a very pervasive way. That’s this stuff, this kind of stuff. Not your super high ticket coins, you know, that go for millions of dollars that broke out a while ago and that’s just flying to the moon on a Lorna Dune. But this market is also so while they can manipulate the spot market, this is your true supply and demand market, I suggest you call that Calendly link below, get your strategies set up and get yourself protected. We are definitely running out of time.

There’s one big question that I have to ask you. Do you really still believe what Wall Street tells you? Do you think that what they’re doing and what the banks are doing is in your personal best interest? No, but this is and holding this is because if you don’t hold it, you don’t own it. And it truly is just that simple.

So make sure that you watch last week’s video on what’s to come in 2023 and make sure too that if you haven’t subscribed already, please subscribe, hit that bell. We’ll let you know when we’re going on air. And it, it is critically important for you to be in the know because you guys know ignorance doesn’t make you immune, it just leaves you vulnerable. You can listen to us anywhere on all major podcast platforms, Apple, Spotify. Please leave us a review and, and make sure that you are sharing, sharing, sharing because it’s critically important that people know where we are and what’s to come. If 2022 was a pivotal year, which definitely was 2023, could well be a crisis year. Make sure that you can at least sustain your standard of living, if not, benefit from this crisis that’s already unfolding. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://finance.yahoo.com/news/gold-rises-china-covid-shift-022327718.html