THE DISAPPEARING ACT: No Buyers. No Market by Lynette Zang

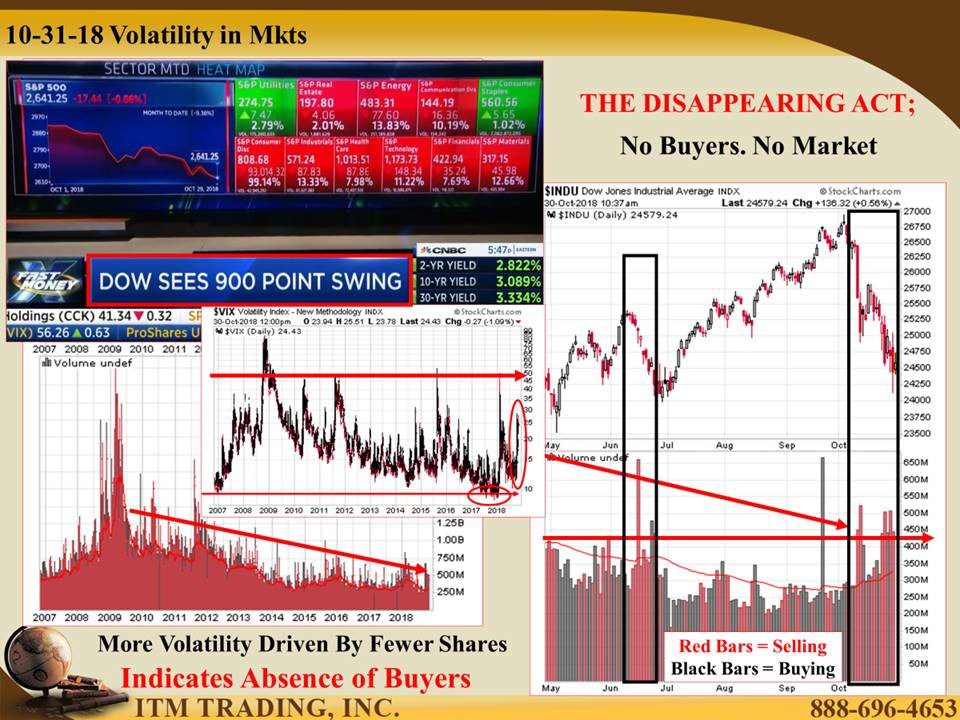

Wall Street media seems confused by wild price swings in the stock market. I don’t know why they should not be so surprised since the base of buyer in the stock market has been shrinking since changes to decimalization of stock prices made in 2000, dramatically reduced profits for market makers (Broker Dealers) whose job was to put a floor under fallings market. Why take the risk if the profit is not there? So where did it go?

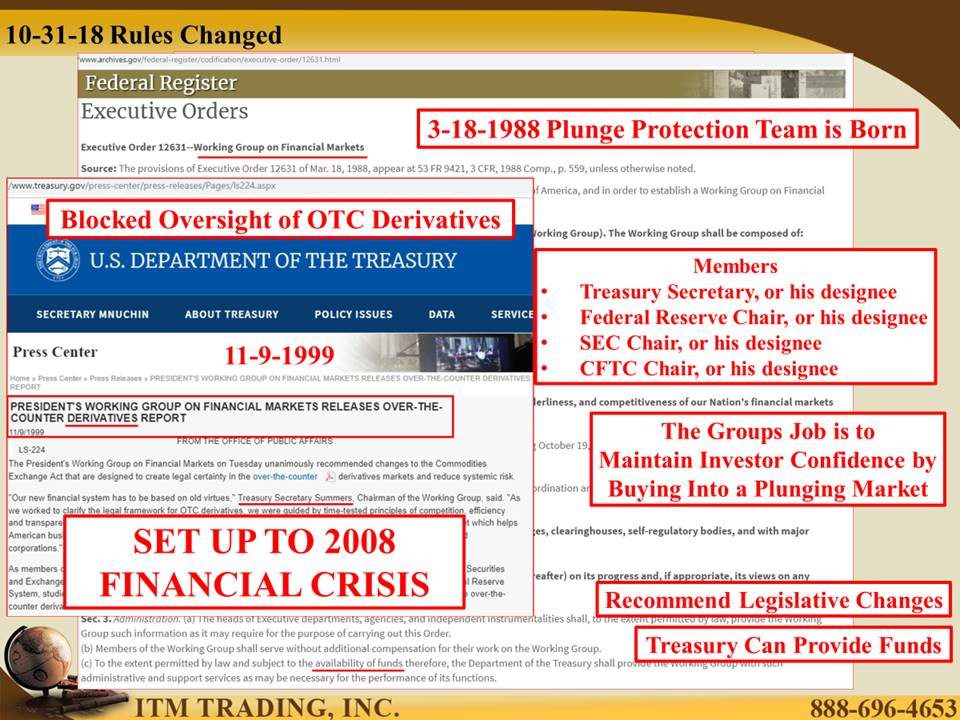

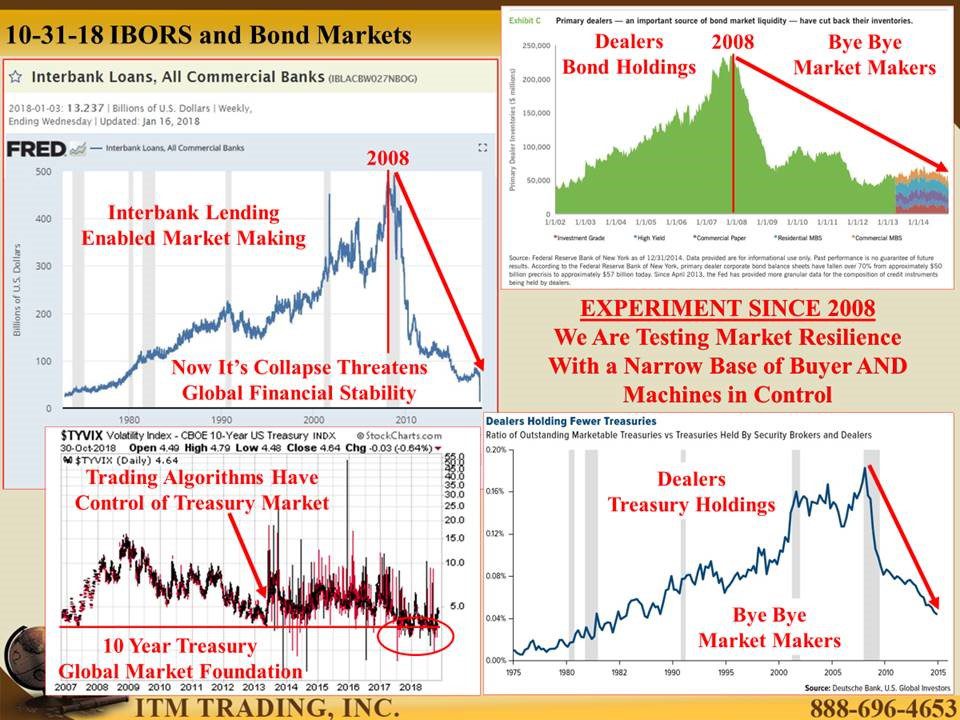

Enter the rise of the machine whose algorithms could execute trades at lightning speed and take advantage of slower traders, like those executing trades for individuals, mutual funds and retirement/pension plans. Also enter the rise of derivatives created by complex algorithms that few understand. Remember what happened in 2008?

But in this central bank “managed†market, volatility (the life blood of profits) fell to historic lows forcing mergers and consolidation in that business as well, which further reduces the base of buyers and concentrates risk in a few key players.

Because of this concentration and the inter-linkage throughout the global financial system systemic risk is easily amplified and was tested in 2010’s flash crash and again in 2012’s and 2015’s flash crashes. Of course, those tests occurred as global central banks were providing hyper inflated money for free into the system, but that’s now changing as global central bankers are attempting to “normalizeâ€. So, who is left to buy?

According to wall street media and thanks to tax law changes, corporate buy backs appear to be the key stock buyer. Since we’ve been in earning season, which temporarily prevents corporate buybacks until two days after earnings are announced. Thank goodness we are almost through this season and corporations are getting ready to step back in, but this month’s whipsaw markets should have been a warning to the individual investor. Ask yourself what happens when corporate buybacks stop?

Can you count on the Plunge Protection Team created after 1987s stock market debacle? Depends on government and central bank balance sheets, which have exploded since 2008 as have computer trading, which has taken over the system and not really been fully tested in a market run.

The bottom line is simple and logical. YOU cannot sell your holdings unless there are buyers for what you want to sell and wall street buyers of stocks and bonds has declined by, roughly 70% since 2008.

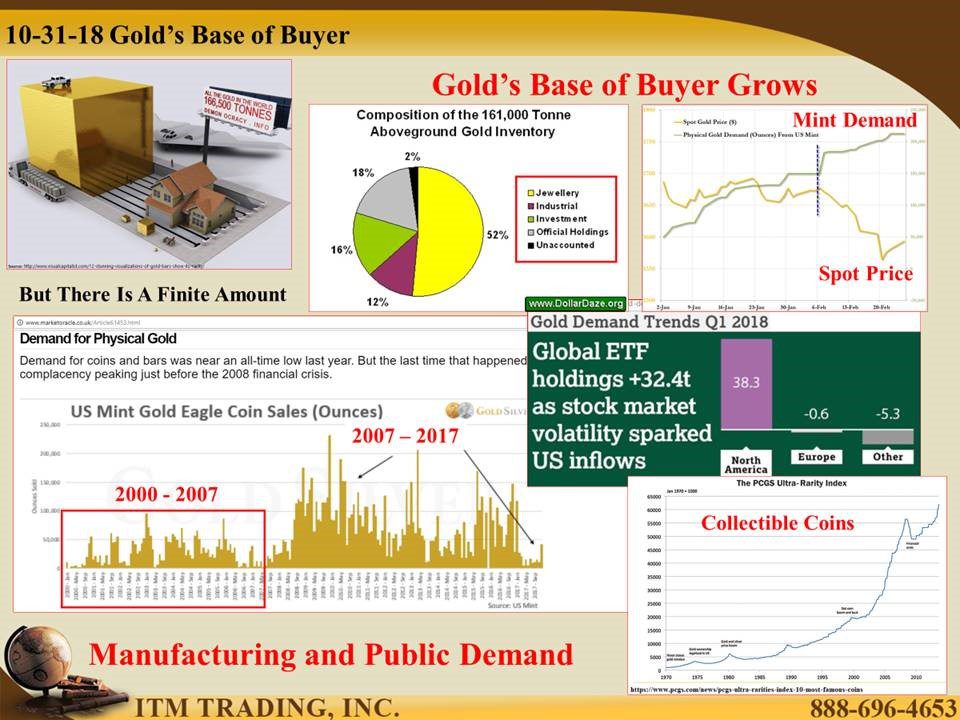

But as fiat product buyers have declined, physical gold and silver buyers have expanded. Of course, there is always a constant base between jewelry, industrial, investment and official holdings. But those same central bankers that were major sellers of gold, have become major buyers. Gold ETFs are a new wall street product begun in 2004 and Mint demand has exploded as well.

Where would you rather hold wealth? In intangible fiat products with a diminishing buyer base that is only interested in profits or real physical gold and silver with a solid basic demand base that is growing as rapidly as market fragility?

Slides and Links:

https://stockcharts.com/h-sc/ui

https://stockcharts.com/h-sc/ui

- https://www.archives.gov/federal-register/codification/executive-order/12631.html

- https://www.treasury.gov/press-center/press-releases/Pages/ls224.aspx

- https://www.treasury.gov/resource-center/fin-mkts/Documents/otcact.pdf

- https://stockcharts.com/h-sc/ui?s=$SPX

https://www.ft.com/content/d81f96ea-d43c-11e7-a303-9060cb1e5f44

https://www.theguardian.com/business/2014/jun/07/inside-murky-world-high-frequency-trading

https://stockcharts.com/h-sc/ui

https://stockcharts.com/h-sc/ui

http://www.marketoracle.co.uk/Article61453.html

https://www.gold.org/sites/default/files/file-uploads/6738/gdt-q1-2018-central_banks-v2.pdf

https://srsroccoreport.com/central-bank-gold-purchases-now-control-10-of-the-total-market/

https://www.gold.org/sites/default/files/file-uploads/6738/gdt-q1-2018-central_banks-v2.pdf

YouTube Short Description:

YOU cannot sell your holdings unless there are buyers for what you want to sell and wall street buyers of stocks and bonds has declined by, roughly 70% since 2008.

But as fiat product buyers have declined, physical gold and silver buyers have expanded. Of course, there is always a constant base between jewelry, industrial, investment and official holdings. But those same central bankers that were major sellers of gold, have become major buyers. Gold ETFs are a new wall street product begun in 2004 and Mint demand has exploded as well.

Where would you rather hold wealth? In intangible fiat products with a diminishing buyer base that is only interested in profits or real physical gold and silver with a solid basic demand base that is growing as rapidly as market fragility?