Desperate Governments Do Desperate Things

It should be pretty obvious to everybody that it is definitely profits over people. And you can come out and you can say anything you want. But the reality is, is that desperate governments do desperate things. And when it comes to controlling the population, is there any length that they ultimately will not go to to make that happen? But there are more of us than there are of them.

CHAPTERS:

0:00 People Over Profits

1:59 President Signs Bill to Avoid US Rail Strike

5:38 Gross & Net Margin

7:52 Congress Imposes Rail Agreement

12:51 Gold Going Up

15:57 A Fair and Good Currency

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

It should be pretty obvious to everybody that it is definitely profits over people. And you can come out and you can say anything you want. But the reality is, is that desperate governments do desperate things. And when it comes to controlling the population, is there any length that they ultimately will not go to to make that happen? But there are more of us than there are of them, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer, but specializing in custom strategies. And I think we all need a strategy because what we’ve been witnessing is that if you are inside of the system, the plan is to take total control. That’s why having physical gold and silver in your possession is so critical. And I know, I mean, honestly, I know that the stuff that I talk about is not fun stuff and nobody really wants to hear it, especially around the holidays when it’s supposed to be about joy and family and all of that. But unfortunately, I don’t think we can ever give up our vigilance and I don’t feel like we can ever stop paying attention to this evolution because we’re now at the end of 2022. So I wanna go over briefly what just recently happened with the rail strike.

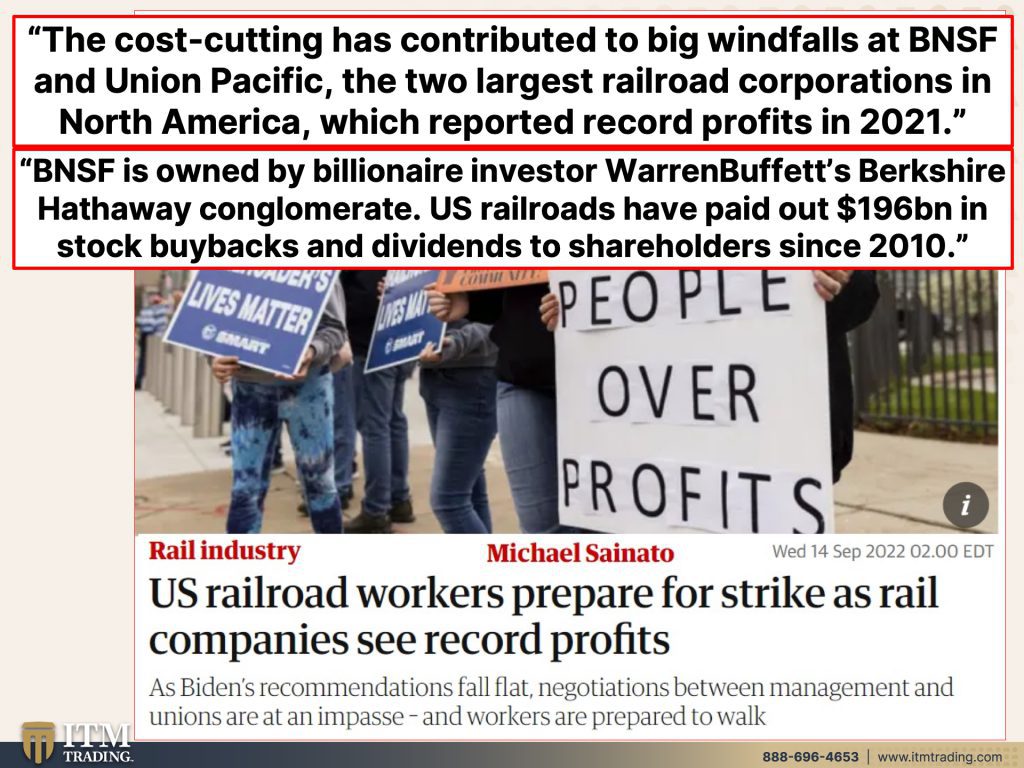

We all know that essential workers were required to work through the worst of the pandemic. And now the rail workers, which is part of our, the US supply chain, it’s a global, but this is happening in the US. Well, they went on strike and what did they go on strike for? Hmm. How about some sick days? So US railroad workers prepare for strike as rail companies seek record profits, people over profits. That’s what the sign says. I agree with that. The cost cutting that they got to do during the pandemic has contributed to big windfalls at the two key largest railroad corporations in North America, BNSF and Union Pacific, which reported record profits in 2021. BNSF is owned by billionaire investor, Warren Buffet’s, Berkshire Hathaway conglomerate. US railroads have been paid out 196 billion in stock buybacks and dividends to shareholders since 2010. So huge for, oops. So huge for dividends and share buybacks and stockholders. But let’s have some of that. What happened to the trickle down effect, right? That’s what central banks have been using forever. They’ll give it to the wealthy and then it’ll trickle down to the bottom. It doesn’t trickle down. That theory has been disproven over and over and over again. And frankly, I would say that it’s being disproven by this current rail strike as well.

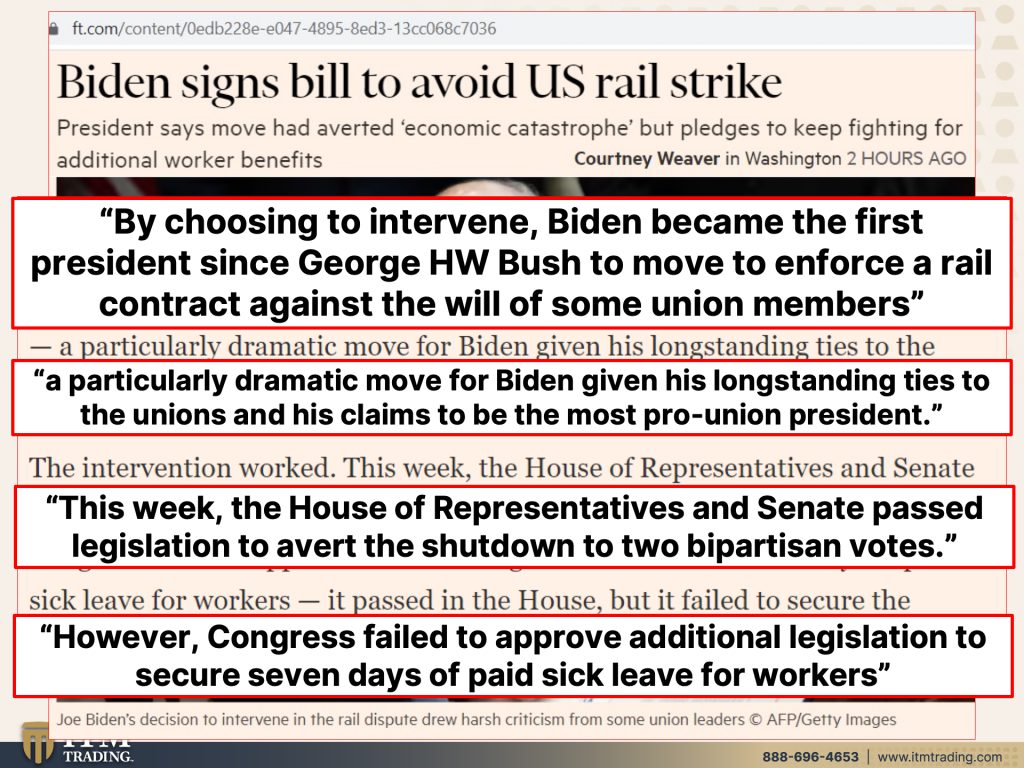

So President Biden, who is a big defender of the unions, signs a bill to making the rail strike illegal. Isn’t that interesting? By choosing to intervene, Biden became the first president since George H.W. Bush to move to enforce a rail contract against the will of some union members. And maybe they were only a couple, I don’t know, we’ll talk about that. A particularly dramatic move for Biden, given his longstanding ties to the unions and his claims to be the most pro-union president. So I’d say that he was either pretty desperate or he’s showing his true hand. I’ll let you decide that. I don’t need to decide that for you. This week, the House of Representatives and Senate passed legislation to avert the shutdown to two bipartisan votes. So everybody’s in agreement. However, Congress failed to approve additional legislation to secure seven days of paid sick leave for workers. Now, frankly, if somebody, hopefully nobody does, but if somebody gets COVID I think, well, isn’t that like a two? It used to be a two week process. What is it now? Is it still two weeks, Edgar? I think it still is, but they can’t even get seven days. So the rail workers have to make a choice of going to work sick, which then spreads anything that they have that may be contagious or staying home and losing pay. Hard choice. I mean, obviously very hard choice.

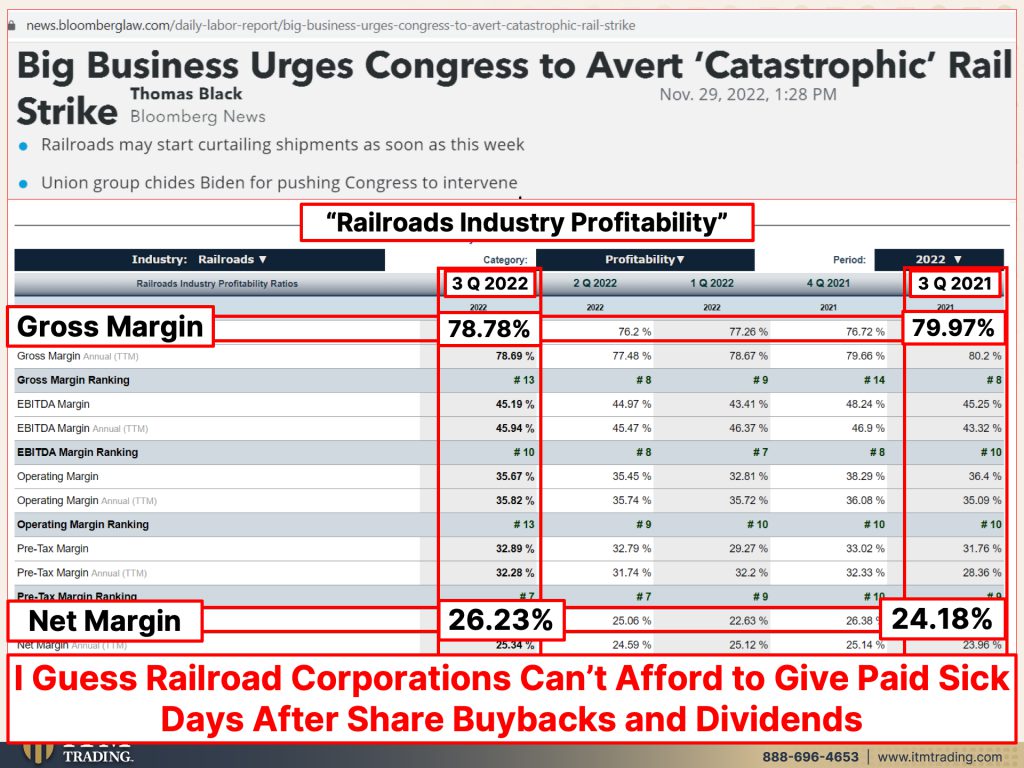

And of course big business urges Congress to avoid that catastrophic rail strike. Now, this isn’t just the railroads, it’s all big business because this is the backbone of what moved the goods around the country. But let’s just take a little look at the profits of the railroads because clearly profitability for big corporations is far, far more important than how that impacts you or me or inflation or anything else. You know, remember they never really complained as long as all of that big money that those wage increases went to the top. Now that it’s going to the workers as well. Now it’s a problem because it could create a wage price spiral. I dunno, again, I’ll let you determine that. I know how I feel about it. But let’s compare year over year, third quarter, 2021, right there, and third quarter 2022 that we’ve just completed. And what do we see? Well, first let’s look at the gross margins. Okay, well, back in 2021, there are gross margin for that quarter was 79.97%. That’s a pretty large gross margin. A little bit less in 2022, little bit less. But what about their net margins? Hmm, let’s take a look. Well, in 2021, the third quarter, their net margins, so that’s really their profit was 24.18% and they didn’t give them paid sick leave. Well, here’s their net margin, even though their gross margin was a little bit smaller, 26.23%. And again, you know, I guess that the railroad corporations can’t afford to give paid sick days after share buybacks and dividends. Let’s get our priority straight people, and I’m being facetious, I hope you get that.

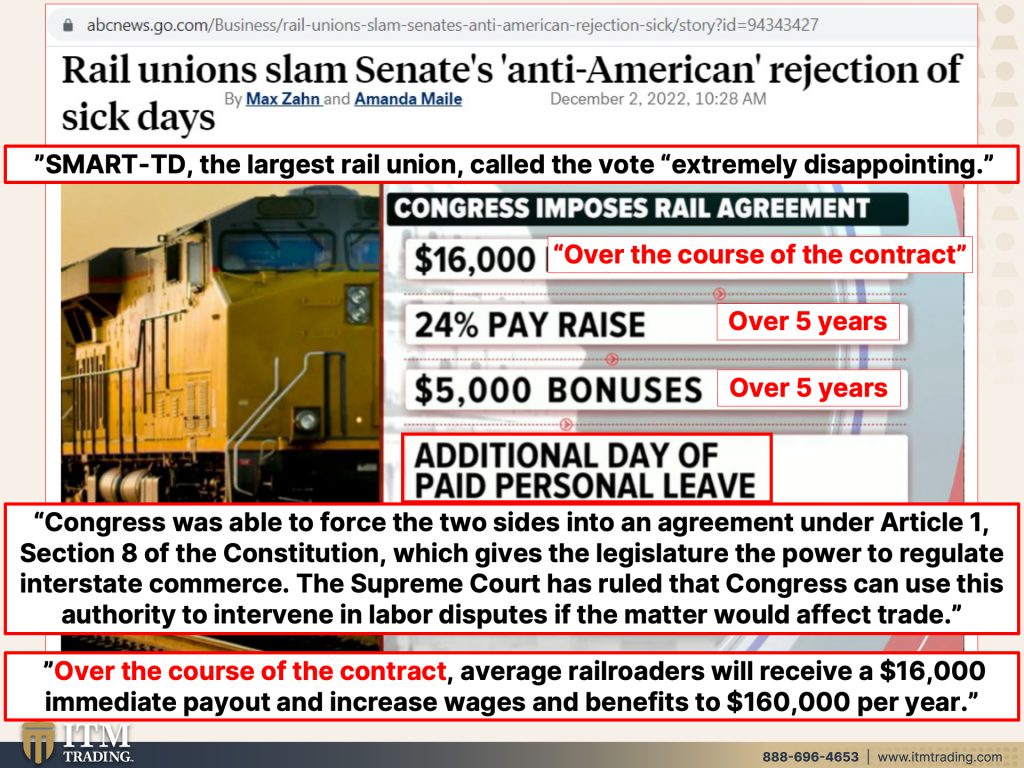

So what they’re really doing here, rail union slam senates, anti-American rejection of sick days. I mean, what is that? They’re fighting for paid leave for new parents and they can’t get sick days? So what I love about the way they say things, and you always have to, you always have to see underneath the surface to see what they’re really saying. The largest rail union called the vote extremely disappointing. I mean, we’re talking about hundreds of thousands of workers that are really unhappy with this. It doesn’t look horrendous, right? It says 16,000 immediate payout, but when you read the details, that’s over the course of the contract. So these railroad workers are not getting a check in the mail for $16,000. No, no, that’s over five years. This is a five year contract, 24% pay raise over five years. This is not even keeping pace with inflation, which is well over 5%. And that’s really, I mean, they make it look good, 24% pay raise, but this is over five years. So you’re not even talking about 5% a year. And inflation is much hotter than that. $5,000 in bonuses, yeah, over five years. So they get a measly thousand dollars bonus a year for the next five years. But oh wait, they did give them an additional day of paid personal leave. Isn’t that nice? No sick days, no additional sick days. They have a real problem with that one. But here, here’s one more day of personal leave. Whoop, dee-doo you can tell I have a bit of a challenge with this. Congress was able to force the two sides into an agreement under Article one, just in case you’re wondering how they could do this. Article one, section eight of the Constitution, which gives the legislature the power to regulate interstate commerce. The Supreme Court, we love them, has ruled that Congress can use this authority to intervene in labor disputes if the matter would affect trade. So there you have it. I think it should be pretty clear. Big business is more important because what they really did well, I’ll come to that was just, yeah, I mean, again, made sure that big business gets taken care of over the course of the contract. That’s what everything says. So over the course of the contract, it’s a five year contract. Average rail workers will receive a $16,000 immediate payout and increase wages and benefits to $160,000 a year. Which if you’re making less than that, that may sound pretty good, but it doesn’t even keep pace with inflation and the loss of value of the US dollar, which is going away. So they make it sound like really good. But is it really that good? Because from what I’ve read, most of the, those that are involved in the rail unions are not real happy about this. And I’m pretty sure Warren Buffet makes more than $160,000 a year, right? And they’ve got record profits.

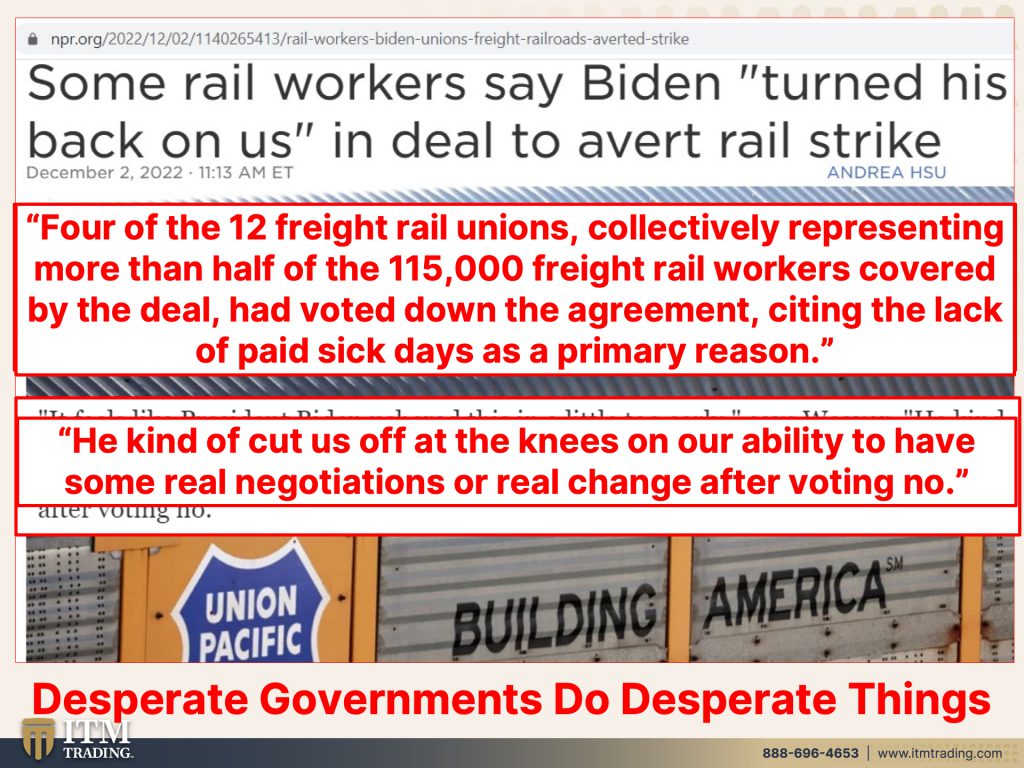

Some rail workers say, Biden turned his back on us because he is supposed to be so pro-union. But four of the 12 rail unions collectively representing more than half of the 115,000 freight rail workers covered by the deal had voted down the agreement more than half citing the lack of paid sick days as a primary reason. I mean, you’ve gotta wonder, I wonder, why would they have a problem giving workers sick days? I mean, you know, hopefully nobody does get sick, but goodness gracious, if they do, they really need to. He kind of cut us off at the knees on our ability to have some real negotiations or real change after voting no. Desperate governments do desperate things. Is this a little taste of if things aren’t going the way the government wants to in other areas as well, will they again take those desperate measures? I think they will personally, but we’ll find out. But don’t worry, because big business has your back.

Here, I love this. HSBC will have to share custody with JP Morgan of $52 billion in gold bars. Oh, isn’t that interesting? JP Morgan will join HSBC in storing bullion for the world’s biggest gold back exchange traded fund, GLD. We have been taught that the only options are inside of the markets, the fiat money markets. So people buy GLD thinking that they’re buying gold, but honestly, all they’re buying is a contract that of a trust. You do not have access to the underlying gold HSBC and JP Morgan has access to that underlying gold because they’re holding it in their vaults. How convenient. The addition of JP Morgan will change the current single custodian and vault operating model to accommodate the activity of the fund in anticipation of future growth. So what they’re really saying here is they know that gold is going up and gold is become going to become even more and more important to the markets than it is today. And the reality is, it is the single most important thing that you can do to guarantee that your wealth remains intact, but not in this way. Let me show you, I’ve shown you this before. I will always show you this again because this is a relative performance chart between spot gold, which is just a contract, push a button, create as much of it as you want, no big deal. And GLD, which again, all that is, is a trust. All you own are shares and a trust. You do not own any of the underlying physical gold. You don’t own any of this. You own shares of a trust, you own pieces of paper that can easily be taken away from you. Perception management really creates that illusion, right? So if they can manage how you perceive things, oh, GLD is gold, then you move forward in a manner that they want you to move forward in. So instead of really being diversified with the tangible, you just keep all your wealth in those intangible markets. And then of course, it’s so much easier to take away from you because when the market’s implode or when a scandal erupts, and I mean who you gonna call? There’s nobody frankly to call. So I’m just asking you, don’t be fooled. Please don’t be fooled. The real trend that we’re dealing with is the end of the currency’s life cycle.

That’s what we’re really dealing with. And so that’s what you really need to deal with. It doesn’t matter when you look at the stock market or the bond market or the ETF market or the, none of that matters if it goes up or down or sideways because all it is is an illusion of wealth. And illusions can evaporate quite rapidly. Please, don’t be fooled. Make sure that you have physical gold and physical silver because this is real money. This is real wealth. This takes time, effort, energy to pull out of the ground. So when you convert your fiat into this, what you’re really doing is you’re trading because you work for that fiat, right? So you’re trading your labor for someone else’s labor. That’s the way it was at the beginning. And I’m seeing an awful lot of circles. That’s the way that you have a fair good currency right here.

This is it. So make sure you watch last week’s video on capitalizing on the bubble, because let me tell you, there’s always opportunities in every crisis. And I think 2023, we’re gonna see some major crisis. If you haven’t done this already, please start your Calendly link by clicking that link below and going ahead and making a time to talk to one of our consultants. If you haven’t done so already, please make sure that you subscribe. It’s more important now than it’s ever been so that I can keep you up to date on what’s really, really happening. Leave us a comment, give us a thumbs up and share, share, share. And until next we meet. Please be safe out there. Bye-bye.

SOURCES:

https://amp.theguardian.com/business/2022/sep/14/us-railroad-strike-union-pacific-bnsf

https://www.npr.org/2022/12/02/1140265413/rail-workers-biden-unions-freight-railroads-averted-strike

https://www.ft.com/content/0edb228e-e047-4895-8ed3-13cc068c7036

https://csimarket.com/Industry/industry_Profitability_Ratios.php?ind=1104

https://www.aar.org/news/senate-votes-to-avert-rail-strike/#!

https://www.npr.org/2022/12/02/1140265413/rail-workers-biden-unions-freight-railroads-averted-strike

https://www.ft.com/content/0edb228e-e047-4895-8ed3-13cc068c7036