Debt Ceiling 2017

YouTube Translation

hi guys Lynette Zang chief market analyst here at ITM Trading a full-service physical precious metals brokerage house. Well I’m sure that you guys are aware that we hit the debt ceiling tomorrow okay and they’ve already started talking about raising the debt ceiling making extraordinary steps to postpone etc.

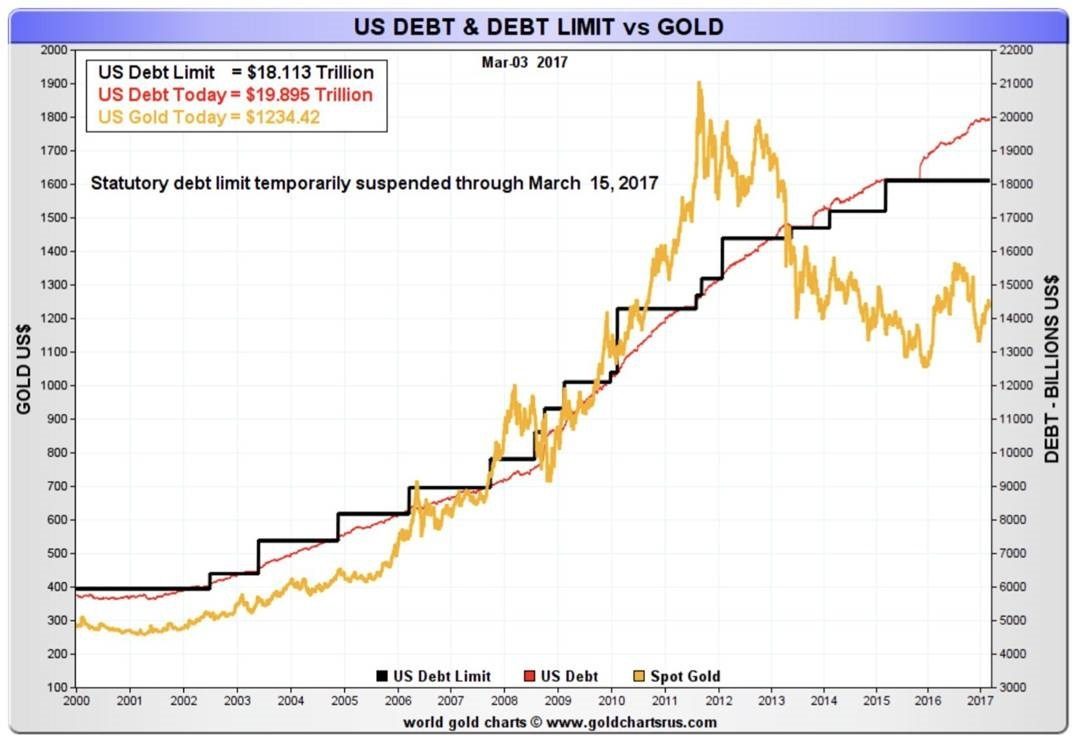

I want to show you what the real problem is because frankly they raise the debt ceiling what times since nineteen sixty-two so big deal why does not do it again what makes this time different let me show you number one and remember will have jpg on these so just click the link below go look at these graphs.

The number one this is the graph on the deficit spending so you can think of this like a government credit card you can see that when the debt limit was set by gold you basically have to stay within a budget but once we went off of that which you can see right here and Congress sets the debt ceiling well you can see what’s happened ever since perpetual deficit the big problem with that which I’m going to talk more about next week is compounding interest so this is income the bottom ones that’s spending we’re already spending more than we’re taking in but even if we were to stop spending we are still going to have that debt grow because of that compounding interest so that’s the problem going into this debt ceiling all right well here you go the debt ceiling has been hit at trillion or will tomorrow now what I want you to notice on this is the pattern right smooth let’s take off since we became debt based in a lot of things had changed rules of regulation had changed long-term capital management but notice that after that every time we hit a recession the speed of the growth of the debt increased and look at this pattern that we’re seeing since the crisis hit do you see if that choppy anywhere along here to remember when you when you step back when you’re in the middle of it you can’t see the pattern but when you step back and look it becomes really clear and here’s why is really a very big issue this is the monetary velocity chart so it indicates whether an economy is being stimulated the growth of debt stimulated the economy and we hit Pete growth in after that the weight of the debt and the compounding interest has dragged the economy down so even though President Trump is talking about spending all of this money and I mean I will see if they raise the debt ceiling or not that’s still not going to likely be stimulative because nothing has since you see that well-meaning that wouldn’t be such a big problem except for this I love how they name it ok but this represents the funds all of your mind taxpayer funds that we put into Social Security and Medicare trust fund and remember those benefits are paid out of current contributions so any of the excess was borrowed via Treasuries so they took the money spent it and left you with Treasury debt now look the baby boomers first of us started taking social security in we’re going to be talking more about this in another webinar but you’ve got a tsunami of baby boomers coming up behind those and they’re all going to want Medicare and Social Security plus the older we get the more health care costs can you start to see the problem it’s not just one debt ceiling is everything else that they’re doing and I only showed you those two little areas but let me make this personal for you because you and I also that’s them and we’re a plural know the debt is what the government commits you to on on their behalf so here this is per citizen debt now this is also net can you show them that bottom one that’s net debt that’s not that compounding debt and then you have the debt per citizen that we’re responsible for and then you have those unfunded liabilities medicare and social security because all that money has been spent so you know the average income is grand because you really afford that level of debt on that income can you see the problem now here’s another truth because all of this new desis they want to issue this is the Federal Reserve buying Treasury bond all right look and they started doing it a so already at that point they weren’t generating enough enough interest in our treasury bonds to fund their deficit spending this is hyperinflation okay or it’s a hyperinflationary pattern okay that’s qe qe qe so are they the only buyers of our debt well pretty much yeah because look remember foreigners are selling off our debt so who’s going to buy when we raise the debt ceiling which we’ll see what happens but you know they don’t do it we’re going to have a government shutdown and there’s a speed that they are burning through that cash that could come this summer it could actually even come earlier than that you know can the markets really afford that now keep in mind to next week I’m going to talk about the impact is Janet Yellen raises the race tomorrow which I think she will I’m going to talk about the impact of that and wait until you see what I found but I definitely want to leave you with this chart and you should recognize because I just I’ve been showing you the interest on the two year Treasury and look it had just broken above that line the last time I showed you look at where it is now now you have the -year treasuries that has broken above the line and just barely on the year bond so the markets of the moving interest rates up and this is really been in a concerted way because remember all the derivatives against them we’re going to talk a whole lot more about this next week but I hope you understand from this that we are responsible for this debt the debt it’s not just that it’s not sustainable the system is breaking down everything I showed you that’s what it’s telling me you see those pattern ship so tomorrow should be a very interesting day i will see you on Thursday like us on Facebook subscribe to us on YouTube follow us on Twitter and give us a call

Images