CRYPTOS, GOLD & GOVERNMENTS…HEADLINE NEWS WITH LYNETTE ZANG

Transcript:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And I’m telling you, history tells us all off. I know that we’ve been trained to go shorter and shorter and shorter and shorter. Every 15 seconds. We have a new thought, forget the old one. Here’s the new, but I’m telling you can learn a lot from history. We’re going to do headline news today, and I’m going to start with, uh, now I haven’t really looked at this technically yet, whether or not this is the top of the market, but home buying slows down as prices climb to records. So the buying is slowing, but the prices keep going up. April mark, the third straight monthly decline, the longest downward stretch. Since last spring, I remember we still have the mortgage moratoriums that will be lifted. I don’t know. At some point maybe they can keep postponing it for a while, but there will be inventory that’s coming back on. So look, everybody’s got to have a place to live. You guys know, I, you know, recently bought my bug out house, so it has a function, but I’m hoping that nobody is thinking that real estate is a good place to put their, their hard earned Fiat money at this point, Or even into stocks. We’re going to talk a bit more about this, but share buy backs, dividends on the rise already this year, us companies have authorized 504 billion of Cheri purchases. According to Goldman Sachs group through May 7th, the most during that period and at least 22 years interesting, the pace of announcement trounces even the 2018 Bonanza that followed the sweeping tax overhaul of late 2017. Us companies also ramped up dividend spending in the first quarter data from S&P Dow Jones indices show increasing their payments by an aggregate 20.3 billion on an annualized basis. That marks the largest quarterly increase since 2012. Now look aside from the fact that the insiders are draining, whatever money is in their corporations out through buybacks or through dividends. Really what I want to point out is, I don’t know, do you kind of remember what happened with Boeing and a number of other companies, but particularly Boeing who did a lot of that kind of thing.

And then when the COVID pandemic hit, they had to be bailed out over and over again. So the point that I’m trying to make here is that with basically money for free and all the printing presses that we are getting reassured, they’re not even going to think about thinking about tightening in any way. This is the opportunity to get that last bit of wealth out of the system while the naive public is piling in. And that’s all of hers kind of exploring care, but I think he feels uncomfortable with it as well. It’s just one of the indications of how close we are to the end of this mess.

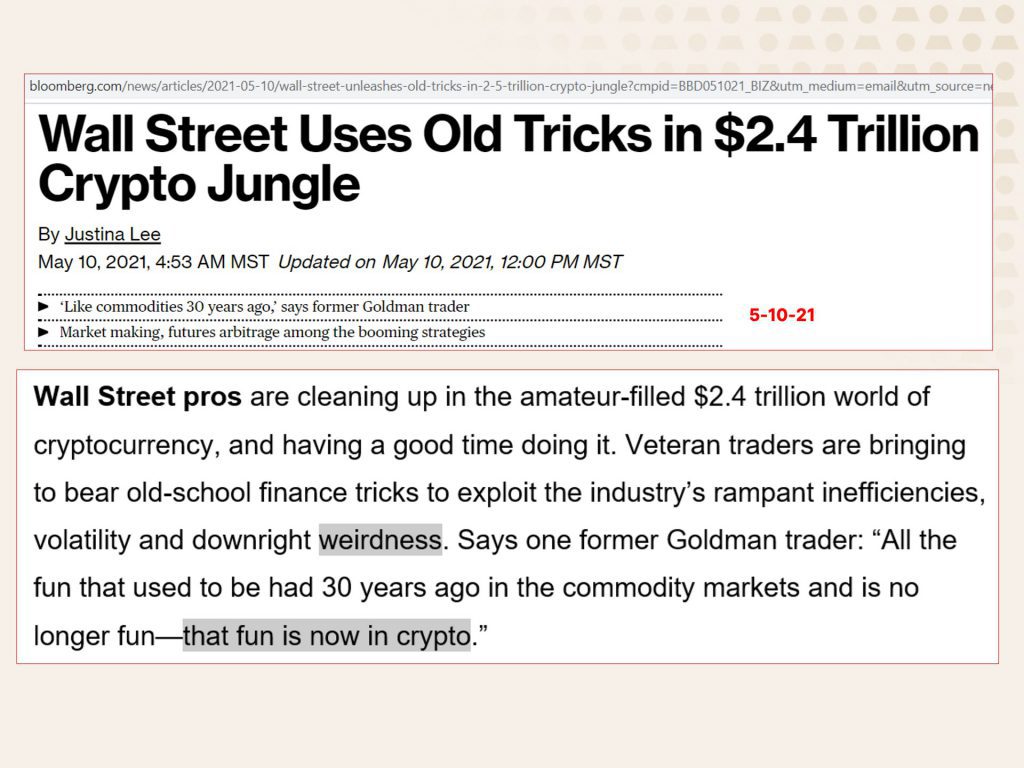

But, you know, look, I was part of wall street and I’m so grateful that I had that experience so that I could share it with you, but let’s go to the slides now. Okay. Because wall street is up to their old tricks in the crypto jungle. I love this like commodities 30 years ago. Yes, indeed. Wall street. It’s all about them making money. It’s not about you making money. Wall street pros are cleaning up in the amateur, filled 2.4 trillion world of cryptocurrency and having a good time doing it. Veteran traders are bringing to bear old school finance tricks to exploit the industry’s rampant, inefficiencies volatility, and downright weirdness says one former Goldman trader, all the fun that used to be had 30 years ago in the commodity markets and is no longer fun. That fun is now in crypto. And what is he really talking about?

It’s the wild west. The rules have not kept up with the technology and they probably won’t ever keep up with the technology. So it’s kind of like whack-a-mole, but in the meantime, the crypto world is more like the old west. And because of that Bitcoin revives, older power stations, cryptocurrencies, lofty prices have investors sinking money into electricity generation. And frankly, that is one of the Mo according to the MSEI, the most crowded trades is in the energy sector. So who’s going to be left holding the bag and remember too, this is all denominated in Fiat money. We’re going to talk about that more in about a second, but the battle between the governments that wants centralized money and the crypto markets. And I know that they’re saying that they’re decentralized, but if it’s all part of wall street, please tell me how that is any benefit to the normal Joe, because I don’t get it.

So there’s the treasury department is now requiring transfers of $10,000 or more to be reported to the IRS. And they describe crypto as significant detection problem and part of Biden’s proposal on tax evasion. And I can tell you a recent experience that I had. I don’t know that I’m going to tell you all of, all of this, but I will tell you that recently someone attempted to get me to send them money. And apparently they never looked at my work because they actually wanted me to transfer them Bitcoin. And I actually say to them, apparently you don’t look at my work. I can’t send you Bitcoin, nor would I, but this was somebody that really had ill intentions and were trying to scam me. And what did they want? They want to Bitcoin. I just thought that was really, really interesting and also laughable. And obviously it didn’t work, but China, uh, we know has been crap cracking down on the cryptocurrency area, their latest crackdown on Bitcoin and other crypto and Curt cryptocurrencies shakes the market.

So we have seen a pretty significant pullback in the crypto arena, but I’m going to read this, that the type is really small. China is trying to reign in cryptocurrency activities, even as the country has embraced the technology underlying Bitcoin and has plans to roll out its own digital one. But that of course will be centralized under the control of China central bank. That will be, oh, well they say that that will be controlled by its central bank. Beijing also wants to shut down cryptocurrency mining activities because they consume massive amounts of electricity. Often from coal fired power, power plants, while the country pledged to manage its carbon emissions. I mean, they had to wear, the citizens had to wear masks way before the pandemic hit because of how polluted their areas. But the Chinese government does not like the highly volatile speculative nature. Oh, is that why they don’t like the highly volatile speculative nature?

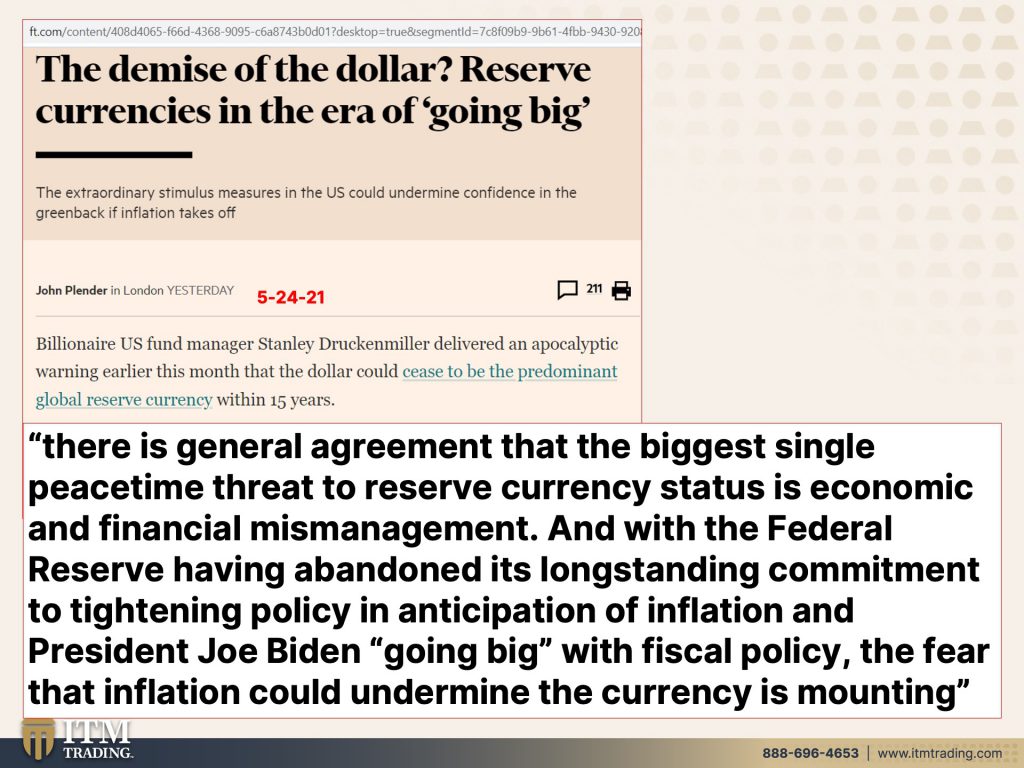

No, it is that they don’t like the loss of control they will control. And frankly, all governments, they’re not just going to go, oh yeah, we had a great ride. It’s your turn now. So I’m finding this battle. We talked about it. I’m finding this battle really, really interesting. And I look, we’re going in that direction. We know we’re going in the digital direction. What we don’t know is what that’s really going to look like yet. So for those that have said, well, why aren’t you doing cryptos? This is why. Okay. It’s not that I don’t know that that’s where we’re headed, but I don’t know what’s going to survive this. And this battle is heating up. So stay tuned. We’ll pay attention. We’ll see what’s going on with it. But something else that is definitely akin to that is the demise of the dollar reserve currencies in the era of going big.

So we know all of the massive, I mean, it’s, it’s even more than massive. The hyperinflated currency creation that the federal reserve is doing as the world reserve currency for viewers that are newer. What that means is if you’re the world reserve currency, you have no choice. But if you are going outside of your borders, you have to use dollars to buy, you know, oil or a lumber or steel or medicine or anything like that. Now that has been shifting really since 99, that’s when the Euro was created, was to take over and Hey, we were giving up our status back in 71. When we shifted into, into this new debt-based age and Petro based age, but no currency retains its status forever. And it’s a huge advantage because that means we’re that this isn’t really exactly true anymore, but we are basically the only currency that can create from thin air, the money to repay its debts.

How huge an advantage is that, and countries around the world are not happy about this at any more at all, frankly. And I don’t know why that went backwards because it’s supposed to go there today. What they’re talking about, and this is from that article and remember all of the links are below and also on the blog, but there is a general agreement that the biggest single piece time threat to reserve currency status is economic and financial mismanagement. And with the federal reserve, having a bandit and it’s longstanding commitment. Okay. I have a little challenge with that, but okay. I’ll just read it to tightening policy in anticipation of inflation and president Joe Biden, going with fiscal policy, the fear that inflation could undermine the currency is mounting. Yes. Think so. What are you going to do to protect yourself from this? Because we work for dollars and there are those that attempt to, to, to, um, collect and accumulate dollars for retirement.

Or even if you’re trying to avoid the dollar by going into the stock market, you can only convert that back into dollars or even the crypto market. So how do you defend against inflation? That’s a great, it’s a great question. It’s a question that everybody should be asking themselves. I’m sure they are asking themselves now. And I saw this and I thought it was really interesting. Um, you, you can read the whole article, but in 1977, Warren buffet set his out his thoughts. And he said, and I agree with him. The inflation tax has a fantastic ability. Think about when this was written 1977 as this great experiment was kicking into gear on purely debt. So you no longer had gold anchoring the currency and forcing some level of fiscal responsibility. Okay? The inflation tax has a fantastic ability to simply consume capital. If you feel you can dance in and out of securities in a way that defeats the inflation tax, I would like to be your broker, not your partner.

I agree, but let’s apply that logic today. The us ran a deficit where 15% of GDP in 2020, the congressional budget office also expects a multi-trillion dollar deficit in 2021. This would be the first instance of consecutive double digit deficit years since world war two, COVID fueled quantitative easing has also led the federal Reserve’s balance sheet to nearly double in size. And this time around the money stock has growing U S M two has grown at a 26% annualized rate since February last year, when the policy response started in earnest, even to the cool headed, this all screams risks.

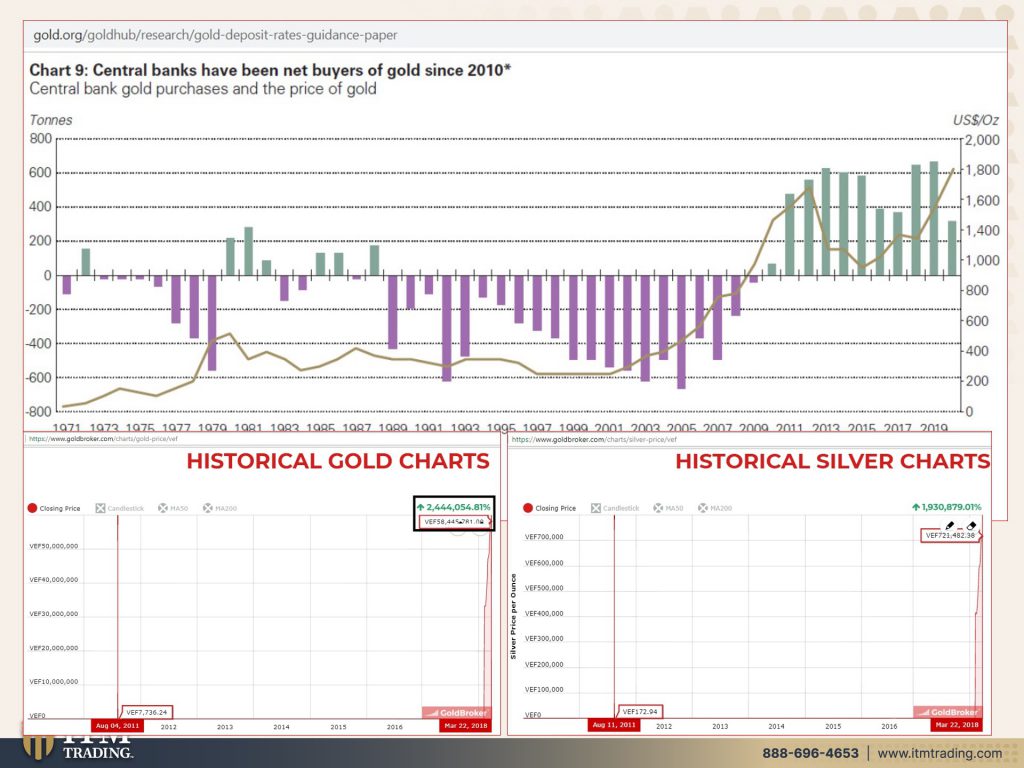

So one of the smartest guys in the room doing for themselves, this graph goes between 1971. And you can see that they were selling gold until 2008 hit. And you can see actually that started to shift in 2006, 2007, because they knew this was coming. You know, I had a question this morning and I’m going to talk about, um, what I did the interview that I did this morning. But the question that was asked was, but these guys don’t want to back a currency with gold. So how will they do that? Because they’re going to fight it. Well, yeah, they have been fighting it, but this is a con game and con games require confidence. It’s a Ponzi scheme. It requires confidence. And people now are starting to see, I mean, people that you would have never thought would have said anything about, oh, inflation.

I mean, I can tell you family members that this is the best the economy has ever been. You’re crazy when that you’re just a doom and gloom, or I am not a doom and gloom, or actually, if you’ve been watching me for a while, you can see I’m not an ER, no, everything is awful. It creates opportunities. And who’s getting into position, the wealthier, getting into position for those opportunities. So you can look at all of this buying. Now, this goes through 2020 through last year. And even though it’s lower in anticipation, right? 2018, 2019, the only reason why 2020 is lower than those other two years is because of the COVID pandemic and governments that needed the support needed their savings to help support their economies called on their gold. Some of their gold holdings to do that. Me too. I’ve done that in the past. When I’ve gotten into a bind, this is my savings. This is my savings. This should be all of our savings because it’s real money. I love this too. Silver, gold physical in your possession. It’s real money. Now you might be wondering, well, I’m not done yet. Wait, I’ll come back to this in a second. Think about this rock though, because it’s exciting. At least I’m excited about it.

Now, if you take into account a currency collapse. So whether it is when the us dollar officially loses its status as the world’s reserve currency, or it is that the public in general loses confidence in the currency, which is happening. This go takes you back to 2018. The first time that Venezuela reset its currency against gold and against silver. There you go. You want to fight inflation. Here you go. This has proven, proven track record going back thousands of years. That’s what I tried. Now, let’s go to the rock. Cause this is a very special rock. This is actually comes out of a gold mine. And it can you get in like closer? I don’t know if you can see this or not, but there are flex. You can actually see the flecks of gold and the flex of silver in this rock. So then it has to be refined. This takes a lot of time, energy labor to take it from this and put it into this, but it’s worth doing, because it has utility across the entire spectrum of the global economy. I love this rock. It’s I can see all the veins. I can look at it and it sparkles. And we can couldn’t really, can you see the sparkling in there? Because you can see the golden silver runs through it.

Let’s see. Maybe if I move it. So getting a little more sparkly so you can kind of see it. That’s very cool. And this is from an Arizona mine. So this morning I had really, it was so much fun. I have to tell you, I was a guest on wall street, silver with Jim Ivan and Lee and great, great, great questions. And a lot of laughs too. I had a really good time. And so I think you will enjoy this. They said it would be out probably over the weekend, right? But if you stay tuned to our socials, we’ll give you the link. And I think you’re really going to like this interview. I can tell you, I had a lot of fun. So usually a five, a lot of fun. I think it’s a pretty good interview. And tomorrow actually, I’m going to be on with my very good friend, George Gammon on the rebel capitalist channel. And you know, whether we’ll be talking about some things for the event, that’s coming up on June, June 9th in Miami. Oh yeah. I could look at the calendar the weekend of June 13th in Miami. So if you’re near there or you want to be there, we’ll have the link set up. You can go. And I would love to see you there. And I’m super excited. I can’t even tell you how excited I am to be doing this event. And, and by the way, I’m going to be talking a lot more about the strategy and more strategy specifics for those that are interested. And then on Thursday, this has been a very busy week on Thursday. I’m going to be on, have a coffee with Lynette, with my very good friend Wolf Richter from the Wolf street report. And, you know, I use his work all the time. The man is just brilliant. I think he’s really got his finger on the pulse of what’s happening. So I always looked forward to those conversations and I know it’s going to be a good one, but I am also going to be probably won’t come out until this week.

And I’m going to try and get it done, um, for this week on what’s happening with basil three. So stay tuned. I’m working on that diligently and that’ll be out this week as well, but for anything behind the scenes and any updates, just follow me on Instagram at Lynette Zang or Twitter at ITM trading underscores Zang. And of course we’ve got the, the podcasts on all major platforms. So if you don’t have time to watch, you can certainly listen. And right now, especially please share this information, share it with everybody. It’s so critically important. You guys know my favorite question? How many times can you be lied to when you do not know the truth, it’s time for everybody to know the truth.

So if you like this, please give us a thumbs up and keep in mind that it is a hundred bazillion percent time for you to cover your assets here at ITM trading, we use physical golden silver in your possession as a base, but frankly, you also need to make sure you have a good secure food, water, energy, security, community, and shelter. These are all the things along with barter ability and wealth preservation. These are all the things that we need to have a reasonable standard of living through this mess. That if, if somebody doesn’t think we’re walking through a regime shift, that I don’t even know what to say to them at this point, because to me it should be crystal clear, crystal, crystal, crystal clear. So until tomorrow, please be safe out there. Bye-bye.

Slides:

Sources: