Chief Economists Outlook: Global “Elite” Quaking In Their Boots and Fear A Loss of Power #WEF22

The World Economic Forum’s latest report discusses the global economy’s growing risk: Stagflation, which is a slowing economy with rising prices. They talk about it going back to the 70s, but what they don’t talk about, is what was really happening in the 70s? Protect your wealth from the growing economic risk and threats to our financial system. Call 877-410-1414 or Schedule a FREE Strategy Session https://calendly.com/itmtrading/youtube?utm_vid=DD6302022

TRANSCRIPT FROM VIDEO:

With all the calls for recession getting louder and louder and louder, it has the “elites” quaking in their boots. And I’m gonna show you what they think about it, coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And you need one. I’m telling you, you need one because the powers that be have them. So what good is it gonna do you, if you don’t.

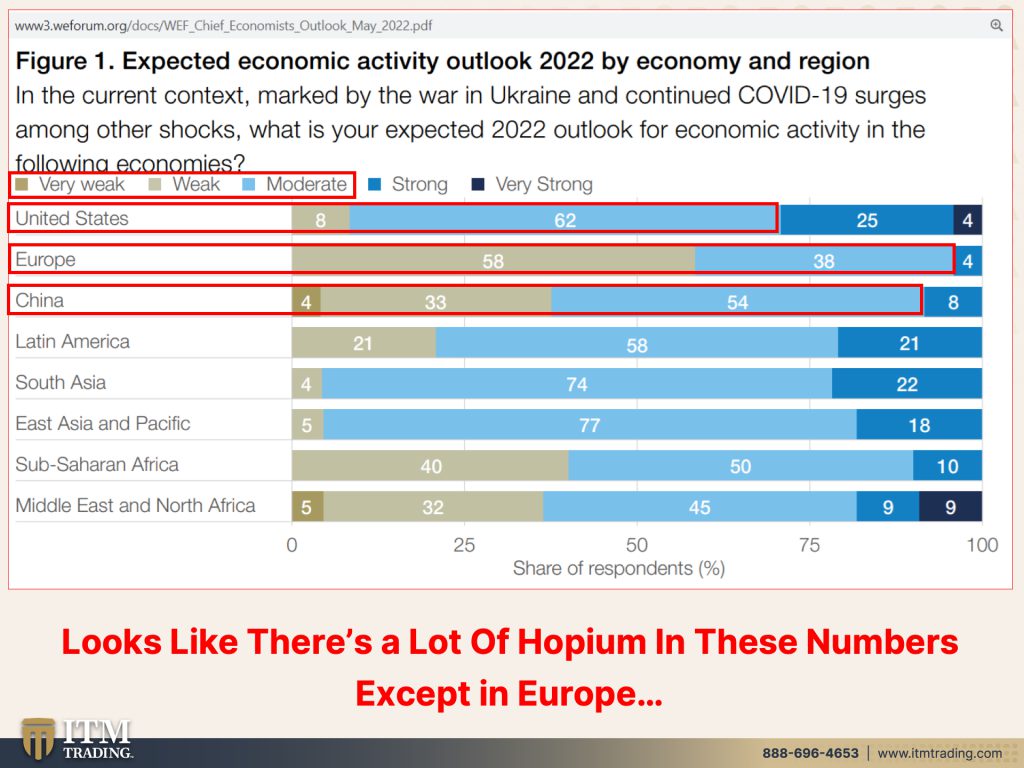

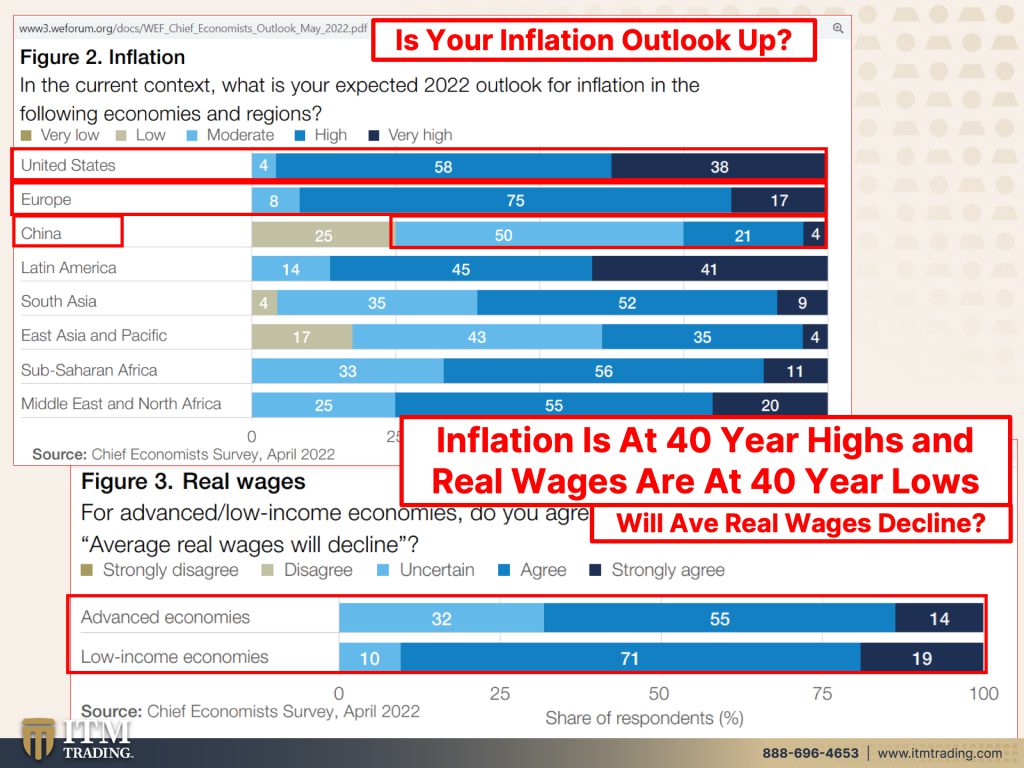

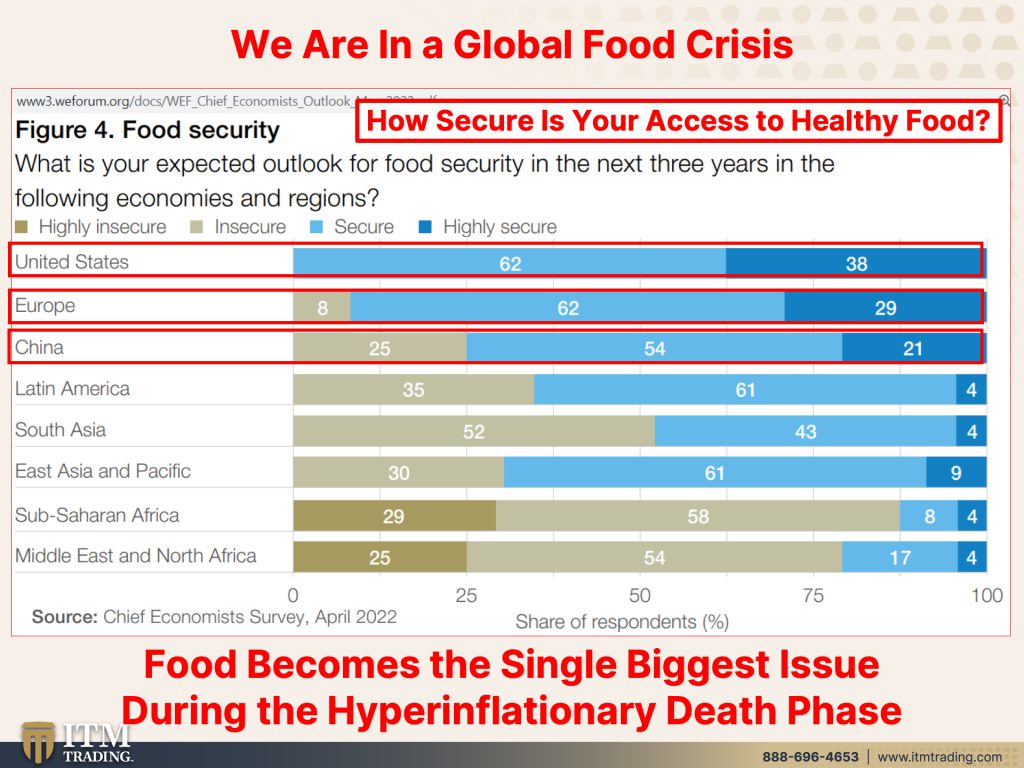

Let’s talk about the latest World Economic Forum, WEF Economists discussion because the global economy’s growing risk are stagflation, which is a slowing economy with rising prices. And they talk about it going back to the seventies. But what they don’t talk about is really what was happening in the seventies, which was a shift in the monetary system from at least a quasi gold standard to a pure debt based standard. Now we are resetting the global economy yet again, will they stay in power after this? I hope not, but time is going to tell, but let me show you what they’re thinking about, because really when you look at their Economist Outlook, increasing the potential for the ultimate loss of cons, I’m sorry, control and elite regime change. This is what they want to avoid at all costs. They got us into this mess. Are they gonna get us out of it? No, they’re not. They’re just gonna make it worse and worse and worse until we accept whatever garbage they wanna cram down our throat. Like, oh, I don’t know a full surveillance economy. We’ve talked about this so many times in the past, but now the future is upon us. So let’s take a look because first they’re looking at the expected economic activity for 2022 and the colors here, very weak, weak, and moderate. So in the U.S. What are they showing us? Well, they think that really, there’s just a moderate chance of the economy just kind of chugging along. Do you think that’s true? No. In Europe, in Europe, they’re more aware that they are in trouble as they are in China, but I honestly don’t think that this is accurate for the U.S. and the U.S. holds the world reserve currency. And we’ve seen so much about how that is changing. So I personally think that they’re still going on. Hopium that? I mean, if you look at it, inflation was supposed to come down the end of this year. Mm yeah. They have been wrong, wrong, wrong. or have they really been wrong or just telling us what they think we wanna hear, because they’ve got to keep in control of how we think that perception management machine is breaking down. We’re gonna be talking a lot more about that. Not just in this one, but coming up, the next thing they looked at is inflation. So what’s your inflation outlook, again, same colors, very low, low, moderate. And here <laugh> in the U.S. And also in Europe, they just kind of figured that it’s gonna be moderate to high. Okay. And then actually even very high. So yeah, they’re finally recognizing that inflation is not transitory and they keep talking about that peak inflation. But do you think we’ve hit the peak inflation yet? Because quite honestly, I definitely do not. You see the same kind of thing in Europe and also in China. So, you know, yes. Inflation is here. It’s here to stay. How about growth? Because will average real wages decline. Yep. Well, some are uncertain in the advanced economies, but they agree and they strongly agree. So the normal guy that’s going to work and trying to do the best that he or she can, you know, the cards are stacked against them in a very big way. And remember, hunger is the biggest issue for people going through these transitions, also medications and your ability to get them. This is why it’s so important to have a strategy and be prepared. I am a proud prepper because I believe my research and I’d be an absolute idiot and an absolute hypocrite if I didn’t move forward. And you can see more of that on the BGS channel, but make no mistake. Inflation is at 40 year highs and real wages are at 40 year lows, even though in nominal terms, in number terms, those wages have gone up. The reality is, is by design, by design. Corporations wanted to pay people less money, but if you’re used to getting 10 bucks an hour, you’re not gonna accept five. But if you can make that 10 bucks an hour spend like five, you accomplish it. This is what has enabled the wealth and income inequality. This is why we’re seeing in the system. This should be no surprise to anybody.

But like back in the seventies, like “high food prices eat up our wages while we eat less.” Is that not happening right now? So these are the patterns that you have to recognize in order to understand where we are in this trend cycle. So that while you still have a little bit of time and I mean a little bit of time, you can get yourself and your family in the best position possible. And one way you gotta do that is by having good money, gold and then silver as well. August 15th, 1971. And we were told that as long as we buy U.S. Made products, we would not feel the impact of inflation. And then of course, what the corporations pushed for globalization. I mean, back then it was a currency regime shift. Today, it is a currency regimes shift. That’s why you have stagflation. We had it back in the seventies and frankly, here we are again. Now had I known I was just a teenager then. And had, I really understood the impact of what my uncle Al who had all of those pre-1933 gold coins stacked in his house. He was prepared for this shift. He might not have fully understood what was going on with it. And I can tell you as a teenager, I really didn’t fully understand it, but I remember the chaos. And I also remember the energy that was in the air. And for those of you that were alive during that time, like I was can’t you feel that same energy in the air? It’s critical to get ready because the powers that be understand that this is where we are. That’s why they’ve been buying gold like crazy.

But, okay, let’s talk about food security because this is really critical and significant. And when you have all of these major powers telling us that there is a problem with food, global food security in the United States, we think we’re secure and very secure, but aren’t we seeing more bare shelves out there, maybe it’s in the lower end grocery stores at this point, but don’t you remember what happened in March and April of 2020? And it doesn’t matter what socioeconomic areas you were. I could tell you, I couldn’t get avocados. I didn’t really care because I had this fabulous garden from which to eat. And so my food circumstance was very secure. And by the way, we’ve now begun putting up the grow houses, the hot houses. So you’ll see more of that. So that up at my bug out location, I can also secure food and you’ll be seeing more about that. But food security is critical and do not be lulled into a false sense of security. Because at this moment, you can go to your grocery store and get what you want. They saw thought the same thing in Venezuela, Argentina, Turkey, many other places until they couldn’t in Europe. They just have a little area that is a little bit insecure, but I don’t really think that that’s true. Do you? Little more insecure in China, but still this is much, much, much, much, much, much bigger than what they’re showing us. And history is proven over and over and over again. And current history, current we’re living through this right now. Food becomes the biggest issue for people as we go through hyperinflation, you wanna make sure that you can have your food secure, and there are lots of different ways to do it. We talk about this on the BGS channel as well, but there are lots of ways to do it, just get it done. Now, whether you live in an apartment or you live in a hundred acre farm, you need to make sure that your food is secure for yourself, for your family. Maybe for others, I’m planning for 40 people. I’ll show you more about this. As, as things get built, it’s it’s happening right as we speak. So there’s not really much to show you just yet, but there will be.

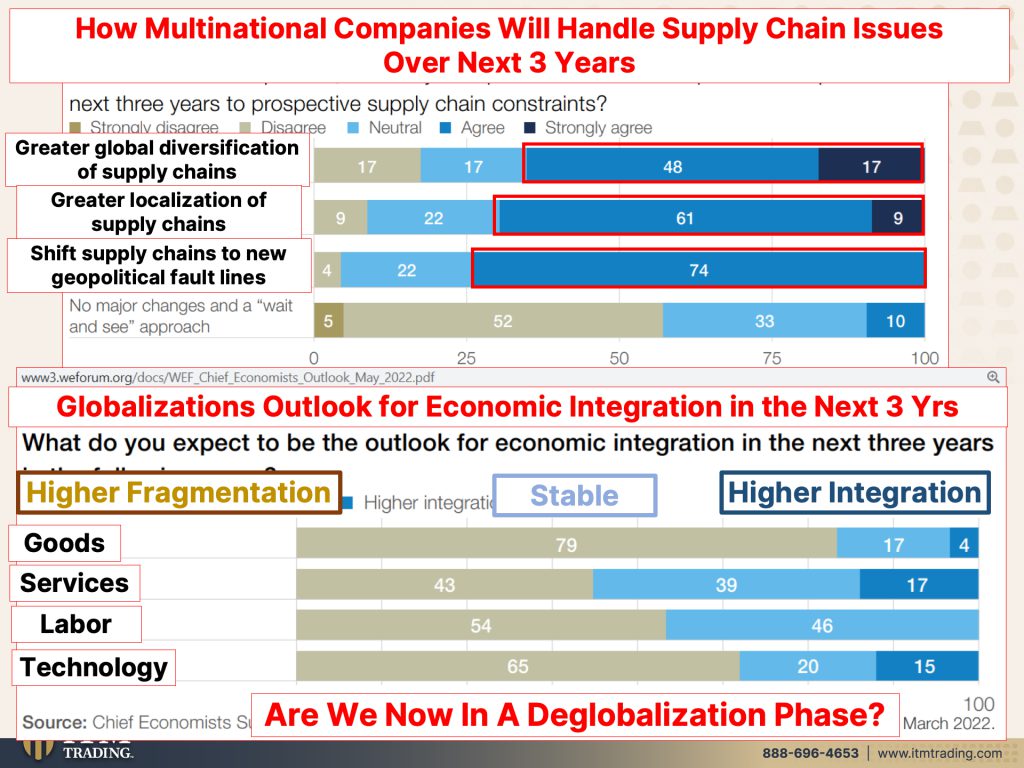

How multinational companies will handle supply chain issues over the next three years. So these are all of these corporations that have really benefited from going to the, to the place that has the least expensive workers, as well as the least expensive tax regimes, multinational companies. Thank you for globalization, which is becoming, you know, I don’t really wanna say that globalization is absolutely dead, but we are seeing a major rearrangement in this. And so this I think is a critical tool to be aware of. And we’ve all heard about the supply chains. So greater global diversification of supply chains. These are how they are handling it. And, and mostly in the U.S. We agree greater localization of supply chains. So when you’re hearing about the breakdown, more companies, more countries are pulling. I mean, we shipped all of our manufacturing away. Now we want it back. We shouldn’t have shipped it all away, but that’s another story for another day. It’s becoming undone right now. So it’ll be interesting to see what the world looks like in a little, in a little while and shift supply chains to new geopolitical fault lines. Because when you look at what’s happening out there between Russia, Ukraine, China, India, these, the geopolitical fault lines are shifting at the same time that everything else is shifting. Where is the power going to be on the other side of this? My bet, especially seeing what’s been happening with the world reserve currency or the reserve currency status shifting to those countries that have been accumulating gold. Gee, huh? Why would they do that? Because they have more safety when you have real money, globalization outlook for economic integration. So when you’re hearing about the discussion on globalization or de-globalization, this is what they’re looking at here, and they’re looking at much higher fragmentation. That’s this area, this color, which is right here is stable. And then that is very stable, which you don’t see too much of that, but high I’m sorry, high integration. So I think it’s pretty obvious in goods, services, everything, labor, technology, higher fragmentation, which means that these, these functions are coming home deglobalization. But I think we’re gonna end up with some kind of hybrid between a globalized economy or a globalized world and a de-globalized world. But first we have to go through de-globalization and that that’s what we’re seeing in goods, services, labor, and technology. So hence all the volatility that we’re seeing in the markets.

But make no mistake, cause we’ve talked about this. Ukraine War accelerates, but this was something that was already happening. The erosion of the dollar dominance and the world reserve currency where the entire world had no other option, but to use U.S. Dollars as their tool of barter, if they were going outside of their borders to buy oil or gas or lumber or anything else, but that has been declining from over 70% back in 99, when the Euro dollar was first created to take over as the world reserve currency down to 60% and what the world also witnessed with Russia and the U.S. Cutting off their ability to conduct in dollars on a global basis. Thank goodness they had built their stockpile of gold. And of course not every country turned their back on them. China and India are buying an enormous amount of Russian oil and gas, etcetera. As other countries are no longer able or have really been cut. The supply has been cut pretty dramatically. But what I really wanna show you is that we document the decline of the dollar and the share of international reserves since the turn of the century. And the shift out of dollars has been in two directions, a quarter into the Chinese reminbi. And we know China massively accumulates gold. We have no idea how much they actually have because they don’t really publish that. But no gold leaves that country. And since 2006, they’ve been massively encouraging their population to accumulate gold and hold it in the banking system, making it actually pretty easy to take away from the public if they want to. But that’s another story for another day and three quarters. So just a quarter has gone to the reminbi and three quarters into currencies of smaller countries that have played a more limited role as reserve currencies. But these are the countries that are accumulating gold as quickly as they possibly can. This is not an accident. Gold has been the financial anchor for thousands and thousands of years. It still is the financial anchor because it has the broadest base of use the most functionality and the broadest base of buyer, the broadest base of buyer. That’s why it’s retained that position for all these years.

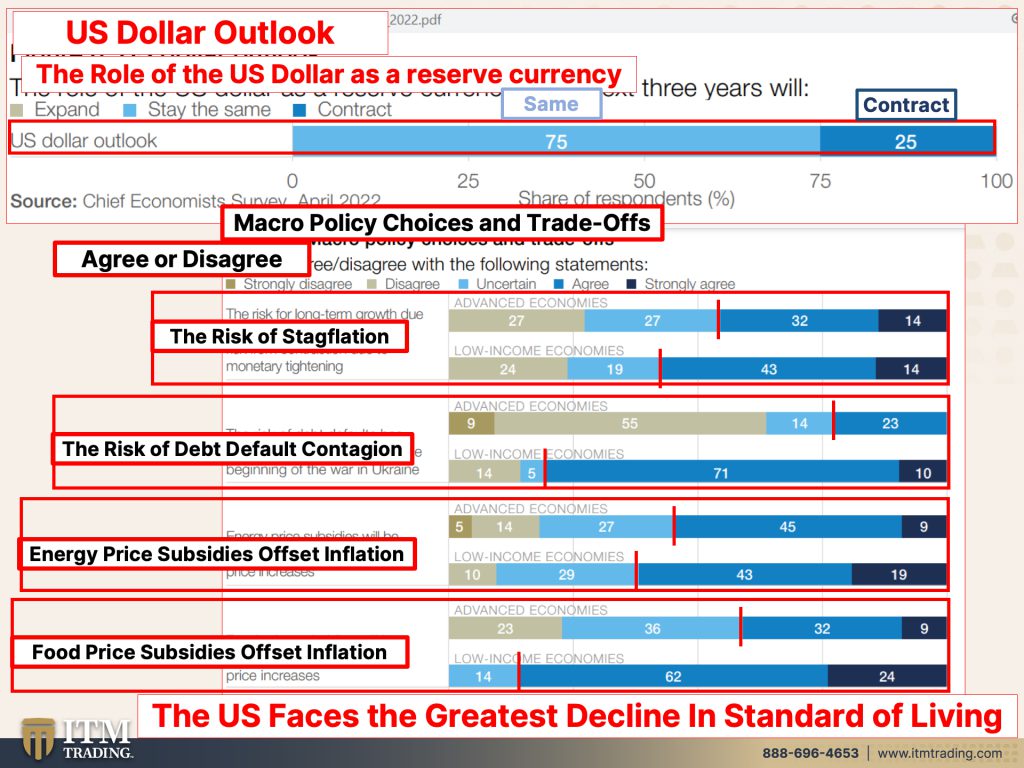

The role, so they ask about the outlook and the role of the U.S. Dollar in reserve currency and wow, look at this. They either 75% think that it’s gonna stay the same, even though the long term trend shows different and 25% think that it will contract or be a smaller and smaller position personally, I’m in that camp. And what that also means is that any U.S. Citizens are going to be feeling the impact of this a lot more because that’s our tool of barter, what we’re forced to use, but what are some of the choices and the trade offs.

And it’s either you agree or disagree with the following statements there is there a risk of stagflation? Okay, so this is agree and strongly agree. This is uncertain and disagree and even strongly disagree. So it looks like there are certainly more countries that see the rise of stagflation, where again, prices go up, but incomes don’t match it. Incomes growth goes down. The risk of a debt default and contagion. Wow. Look at this like 81% in low income countries, see that risk of contagion. This is something that they’re trying to deal with in Europe. We’re gonna be talking more about this in a video shortly, but this is something that really scares the BEE-JEEBES out of them in Europe as well. They should considering the sovereign debt crisis back in the early 2000 tens, 2000 thirteens. So really risky, but you know, in the U.S. and advanced economies, they don’t really see that as a problem. So what about the thoroughly integrated world in all of those bets upon it? I think that default contagion has a really strong probability of expressing itself on a global basis. Should it get big enough? And I think it will get big enough. I could be wrong. I hope I’m wrong, but I don’t think I am energy price subsidies to offset inflation. Well, yep. They gotta do something to offset this inflation because when people are hungry and hopeless, they make choices that would not otherwise make. And that threatens their position as does the food situation probably more even than the energy situation, but Food and Energy are like right up there. That’s why they’re two key components of the mantra. And I’m doing something on Energy on BGS this week as well, food price subsidies to offset inflation. There you go. You betcha. They’re gonna do that because they need to keep the public fed or they jeopardize their power and their position. The U.S. Faces the greatest decline in standard of living because of the advantage that we’ve had for all these years as the world reserve currency, because essentially what that did was force everybody else in the world to hold U.S. Dollar and dollar denominated assets, if they don’t need to hold them anymore. Guess what that means? That means that all those dollars are coming on home. And that means hyperinflation. I mean, there are so many signals that will show you the hyperinflation, but we do here in the U.S. absolutely. We will experience the greatest standard of living decline of anywhere else in the world because we had the highest standard of living of anywhere else in the world. So we’re gonna feel it the most as we lose that status.

Most cited potential risks over the next 12 to 18 months, Russia invasion inflation, monetary tightening. This is what we’re going through right now with the Fed’s surprise. We’re definitely gonna be if you have not seen this video, there was a critical pattern shift. You need to be aware of it because that was the last peg and this is critical, but that monetary tightening and inflation is really the biggest risk that we all run. Asset valuations, all these different things, foreign divestment from U.S. Assets. So that slowing demand, you know, if you’re in a real demand supply economy, slowing demand means increasing supply means lower prices. So as we go into this inflationary environment, people are, unfortunately, a lot of people are having to make choices between putting gas in their car or food on the table. That’s a very hard choice to make, but you wanna make sure that you are in a position. What if I’m right? What if I’m wrong?

That’s the point of prepping and being prepared? You know, it doesn’t matter whether or not I’m right or wrong, if I’m wrong. And I really hope I am, but I know I’m not. But if I am, then I have this wonderful vacation space for my family and myself, booty-hooty-rooty-manooty. That’s okay. And up here, since it’s off-grid, I have my, and I’m about to have the, well, the hot houses are being built right now. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. I’ve got everything that I need that supports that mantra. And for 40 people, I don’t know that I wanna have all 40 people up here, but this is what you really need to be prepared for. What if I’m right? What if I’m wrong? Get in a position where it doesn’t matter, whether you’re right or wrong, then you have all of your choices and all of your options open to you.

And you know, whether it’s the WEF or the IMF or the BIS, or the whole alphabet soup of all of these agencies, they’re all pointing in the same direction. So, you know, here’s the thing. Thank goodness. My father always said to me, do what I say and not what I do. He really was talking about driving, but I’d always say to him, daddy, that does not make sense to me. So I wanna see, do their actions support their words because when they do, I know they’re talking, they’re telling us the truth. And when they don’t, I know that it’s just about perception management.

So what is happening with gold? Let’s look at what’s happening with the gold market because it’s kind of been staying in a range, but ooh, solid jobs, data spurs, hike, rate, hike, bets. Yes. And we’ve seen that 75 basis points, which is still not enough to fight the inflation. I mean, honestly, it’s still a joke, but it’s beyond shock. And ah, we’re talking about this on another video coming up. So really solid jobs, data, gold slips, 1%. Why? Because gold pays no interest. Doesn’t have to pay you interest. It’s the single safest thing that you can do. But if the Fed raises interest rates that pays you interest, oh, that’s so much better as we watch them destroy the last vestiges of the purchasing power in the dollar or any of these Fiat money products. But you need to really understand that this debt is a contract and every contract runs counterparty risk. So if you look at that bill in your wallet, hopefully you have cash it says Federal Reserve Note, that’s a contract and it’s only as good as the counterparty on the other side of that contract. And the way that they set this contract up to begin with is that it loses purchasing power value over time. Hopefully slow enough that you don’t notice, but now it’s not slow enough that you don’t notice. So by holding dollars or any Fiat money products, you need to understand the real trend is in the declining purchasing power value. And you’re running all sorts of counterparty risk. Gold runs no counterparty risk, cause it’s not about getting your principle back, big deal. They just print the money. They just push a button. They don’t even have to print the money anymore. They push a button and boom, these digits can appear in your account. It’s what you can do with them when you get them. And by design, it’s less and less and less. And once we’re in hyper inflation, all confidence is lost. Then what does that mean? And you know, you’ve seen this before. You’re gonna see it from me over and over again, because this is how central bankers think about gold and why they’ve been accumulating it at the highest levels ever. Physical gold runs no counterparty risk kept at home. This is my favorite one. If you don’t hold it, you don’t own it. I don’t care what your perception is. That is simply a fact. So gold kept at home is not subject to political manipulation. They can manipulate the spot price, but they can’t manipulate the fact that gold has the broadest base of functionality and therefore the broadest base of buyer that they can’t. But you and I know it. So just believe it. Gold has been empirically proven to serve as an inflation hedge. What do you think? So they’ve got to suppress the visible price that you see. So we’re like somewhere around $1840-$1850, it’s a joke. It is so severely undervalued at that level. But a rise in gold prices, an indication of a failing currency. They don’t want you to understand the currencies failing, but you know, it is every time you go to the grocery store. And the funny thing is, is there are a lot of smart people out there that, that like, know these up here, but they don’t know it in here. And so they’re waiting, they’re waiting for bargains or they’re waiting for this, or they’re waiting for that. That’s a choice that puts you in a very vulnerable position. I don’t wait. I didn’t care what this bug out location cost me because I knew that if I didn’t do it, it could cost me my family, my life, my children, my grandchildren. No, I don’t care. I don’t care. So I’m not telling you to rush out and buy real estate because for speculation. No, no, no. And we’ll talk more about that, but you need to have a place to make your last stand, where you can have your Food, your Water, your Energy, your Security, your Community, and your Shelter. You need to have that, Gold’s most widely recognized feature is its potential value in highly adverse scenarios. Do you think we’re in a highly adverse scenario right now? Because honestly I certainly do. It’s all about inflation eroding your principle.

They’ve already gotten all of your purchasing power officially. Don’t let them take everything from you, have a plan executed and execute it. And if you don’t have a, just click that calendly link below and schedule a time to talk to one of our consultants and set up your own plan. And we do have the new channel BGS where we’re working hard to build that library. And we’re wherever you’re starting at the very beginning we’re seasoned. We wanna try and give you all the tools that you need to, to be fully prepared for what we have to deal with.

So to see behind scenes of my Urban Farm and also my bug out location, follow me on Instagram @LynetteZang and @beyondgoldandsilver. Also on Twitter @itmtrading_zang. If it isn’t @itmtrading_zang, it’s not me. And I promise you this too. I will never ask you for any money or to buy anything or any of that on any of those accounts. That’s not what we’re about. So if somebody’s soliciting you, they’re not really me, I promise. So please leave us a comment, give us a thumbs up and make sure that you share, share, share this video with anybody that you care about or others that will sit and listen, because this is not the time to be ignorant. Ignorance does not make you immune. It just leaves you vulnerable. And here at ITM trading, you absolutely know that it is time to cover your assets. And the foundation is with physical gold and silver real money. You hold it, you own it. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.ft.com/content/0f7945f5-b269-4d13-9151-c1ac9ec6fddc

https://www3.weforum.org/docs/WEF_Chief_Economists_Outlook_May_2022.pdf

https://www.ft.com/content/5f13270f-9293-42f9-a4f0-13290109ea02

https://www.cnbc.com/2022/06/03/gold-markets-dollar-federal-reserve-interest-rate.html