BREAKING NEWS: Banking Collapse! -with Lynette Zang

In this special breaking new report, Lynette Zang discusses the collapse of Silicon Valley Bank, the risks of rising interest rates and the interconnectedness of the banking system. With SVB Bank, Silvergate, and Wells Fargo in focus, Lynette delves into the possibility of a contagion. Will this be the straw that breaks the camel’s back for the Federal Reserve and the banking system? Stay tuned to find out.

AUDIO CLIP FROM FDIC:

CHAPTERS:

0:00 New Enron?

1:05 Interest Rates

4:01 Contagion Fears

7:24 What Cause SVB Bank Run?

10:49 Silvergate & SVB Shares

16:41 FDIC Shuts Down SVB

19:15 Securing Your Wealth

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Michael Burry thinks that we have just found the new Enron. Could this crash the system? We’re gonna talk about all of this and so much more in the integration and what’s happening with SVB Bank and Silvergate and Wells Fargo. And take your pick coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading a full service physical out of the system. Hold it, own it. Precious Metals firm specializing in strategies. If you don’t have one, you need to get one click that Calendly link set up a time to meet.

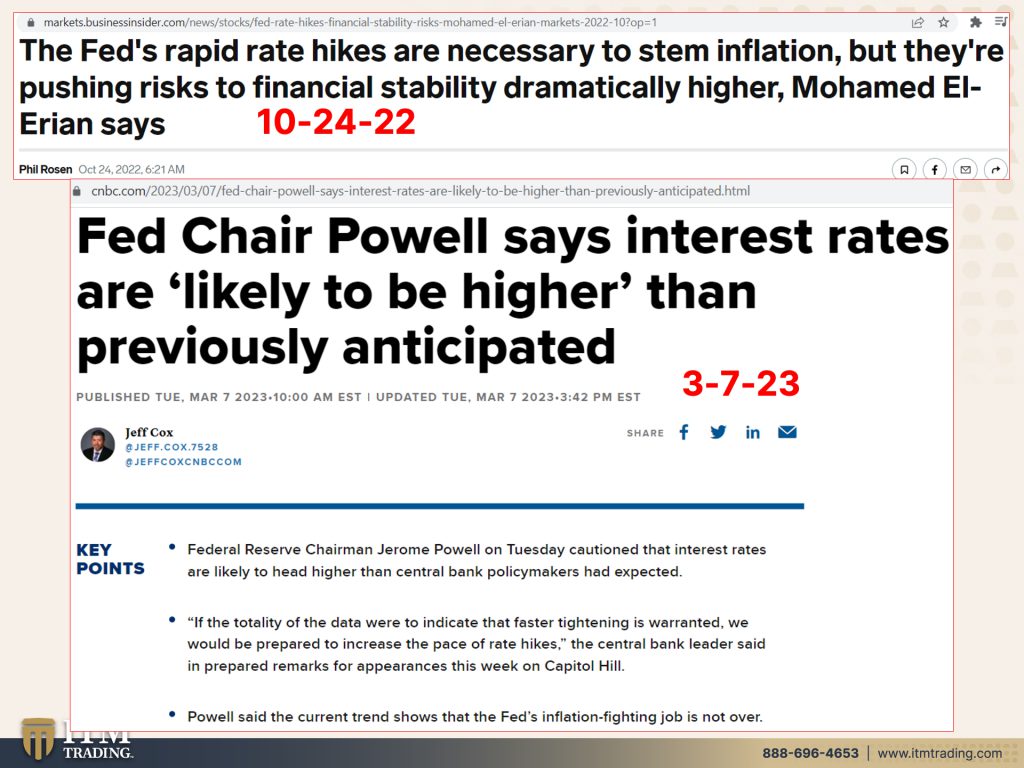

So let’s just dive right into what’s going on. Okay, first of all, oops, I need my little laser pointer. Okay, first of all, is the Fed, is this the straw that breaks the back with the Fed raising interest rates when they’ve gotten the entire system so used to zero interest rates over more than a decade? Now, this is back in October. The fed’s rapid rate hikes are necessary to stem inflation, but they’re pushing risks to financial stability dramatically higher. And is this just the canary in the coal mine? Because remember, everything is incestuously interconnected in the banking system. Well, not a surprise, but just a couple days ago, Fed Chair Powell says interest rates are likely to be higher than previously anticipated. And further, and you’ll have to forgive me, I put this together rather rapidly this morning, but if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes. Now look, the president of the ECB just told us, do the banks understand what their mission is regarding inflation? And I asked you the question, do you understand? Because the mission is not to keep things status quo. If you look around you, how much has changed since 2007? How much has changed since 2020? We are already in a different world, and we’ve been transitioning into this for a very long time. Central banks cannot hold the system together because there’s no purchasing power value left in the currency. None. Rapid inflation reveals that. They wanna tell us, oh, they’ve got it under control. And then guess what? It rears its ugly head again because they don’t have it under control. And frankly, they don’t want to get it under control because if there’s no purchasing power value left in the currency and the whole system is hanging on by a thread of confidence, they need to shift us into a new system because the biggest tool that they have are interest rates. And I’ve talked about this before and I’m gonna show you, well, let, let, let, me take a breath, <laugh>, okay? I’m gonna show you what’s really happening under here. Okay?

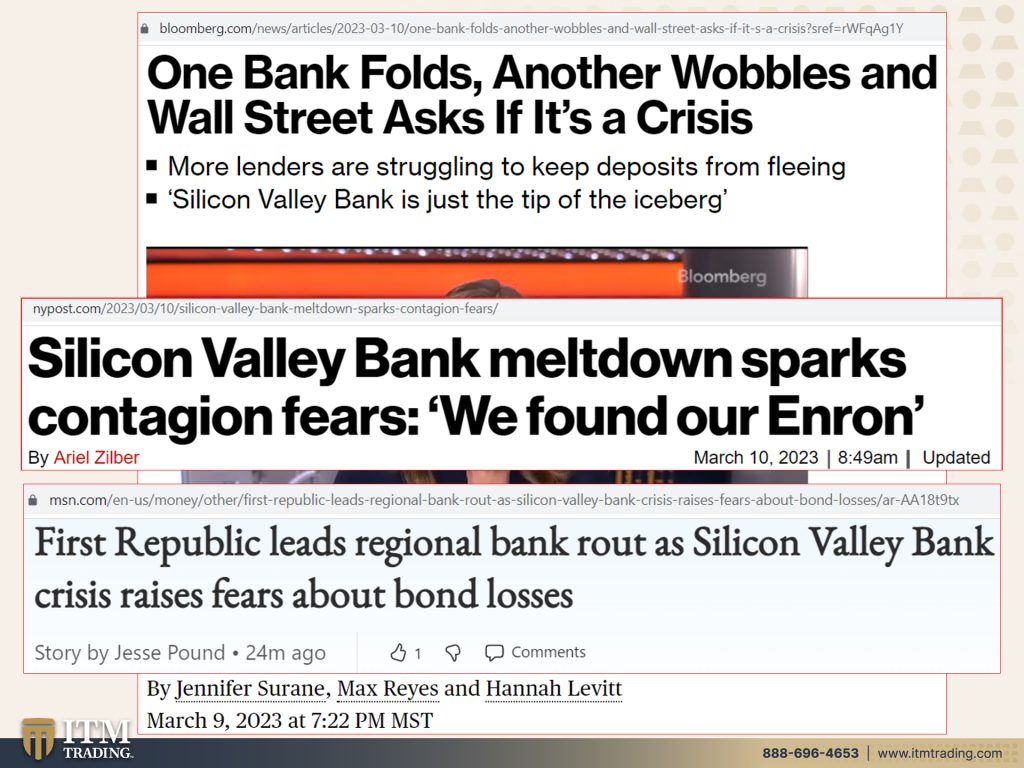

So one bank folds, another wobbles. Well, guess what? It just folded a couple minutes ago. FDIC took it over and Wall Street asks if it’s a crisis, maybe it’s not a crisis, maybe we won’t have a recession. Maybe the Fed can slow down raising interest rates. This is such garbage. If you are in this system and you’re watching this unfold, this is warning you please take heed because the Silicon Valley Bank meltdown sparks contagion fears. And Michael Burry said, we found our Enron. Hmm, I think we did. Because here’s the problem. And here’s the problem that I’ve been telling you about. First Republic, that’s another regional bank leads, regional bank route. As Silicon Valley Bank crisis rage raises fears about bond losses. So remember I told you that the LIBOR is ending the, SOFR is we’re shifting into the SOFR, but those are the new the old interest rate benchmark and the new interest rate benchmark. The SOFR no matter how they have tried to jury rig these benchmarks, they are not the same. And we are in an environment of increasing interest rates. When this is interest rates. This is the principle of the bond. When interest rates go up, the market value of all of those bonds go that are out there already go down when interest rates go down, the value, the, the value of all of the bonds that are out there go up. So in this particular interest rate environment, the value of the mortgage backed securities, the value of all of the bonds, all of those contracts are going down. And when those bonds have been used as a valuation to the value of the different banks and institutions, that’s a problem. So I’ve gotta delve into this a little bit more. It was just a little snippet that I heard, so I don’t really wanna put this out there as fact. But a lot of these banks and corporations are not marking well, actually it is fact, because I’ve talked about this before. I’m sorry, I’m just a little frazzled right now. But remember, a lot of these banks are not marking these bonds and these contracts to the market. They are using internal valuations. So it makes everything as clear as mud. Okay? So keep that in mind. And a lot of the problem and the contagion is that this is now all being revealed. Things happen slowly until they happen fast. And I gotta tell you, I don’t even know what’s happening in the spot market this morning. The Dow was barely down. Nothing to worry about here. You know, this is probably nothing, no big deal.

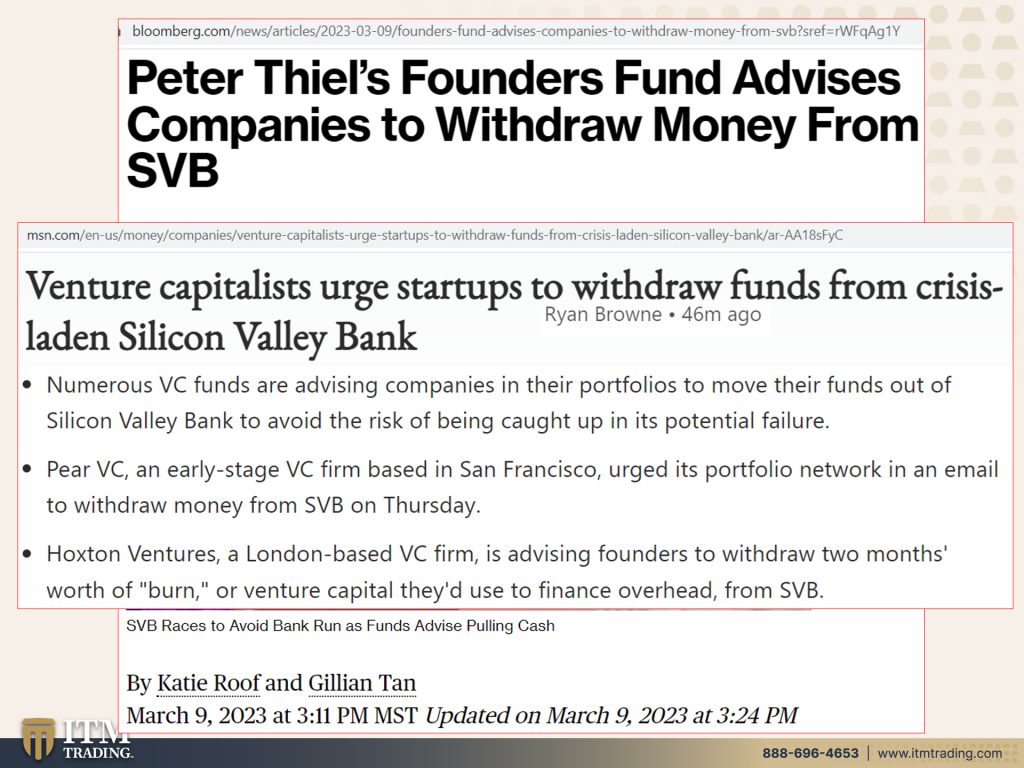

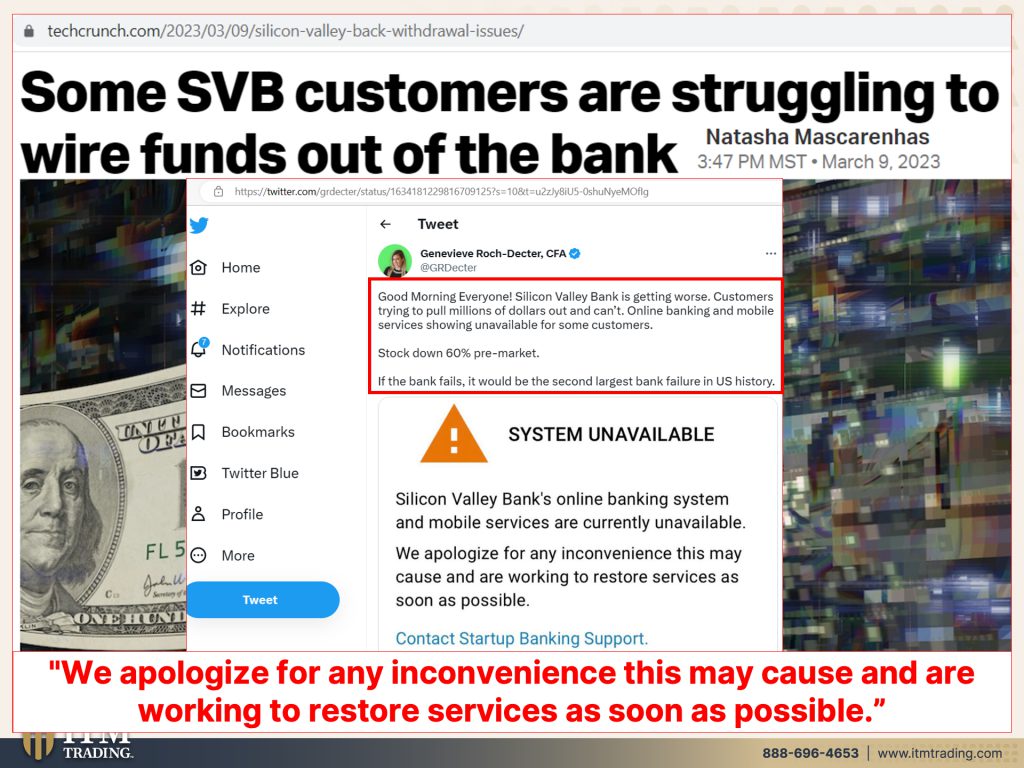

But in the meantime, a lot of the fund advisors are telling their companies to just to withdraw the money. That’s what started the bank run. Venture capitalists, urge startups, which is mostly where SVB worked to withdraw funds from crisis laden Silicon Valley Bank. Numerous VC funds are advising companies in their portfolios to move their funds outta Silicon Valley Bank to avoid the risk of being caught up in its potential failure. That’s what I’ve been telling you guys to do too. The system is failing. Why would you hold your wealth in it? Pure VC and early stage? Okay? that’s nothing. Okay, let’s just keep going because some SVB customers are struggling to wire funds out of the bank. Guess what? Since the FDIC just took over the bank, all all SVB customers are not going to get any of their funds out of the bank. In fact, this is from Genevieve Roche Detter, who is a CFA certified financial something. Anyway, good morning everyone. Silicon Valley Bank is getting worse. Customers trying to pull millions of dollars out and can’t. Online banking and mobile services showing unavailable for some customers, the stock is down. We’ll talk about that in a minute. But if the bank fails, which it just did, it would be the second largest bank failure in US history. And when customers go there. And I tried to go, but I wasn’t a customer, so I couldn’t get this far. What does it say? System unavailable. And this is the part that I love. We apologize for any inconvenience this may cause and are working to restore services as soon as possible. Well, let’s see. This came up so I didn’t even have time to move it over. The FDI creates a deposit insurance. National Bank of Santa Clara, national Bank of Santa Clara. They move to protect insured depositors of Silicon Valley Bank. That means anything over $250,000 is not insured. So we’ll talk a little bit more about that, but they gonna get bailed in? Further. Silicon Valley Bank insured depositors. Don’t worry, everything’s fine. Those insurance depositors will have access on What day is that? Monday? Today is Friday. These things always happen. I think that’s the last one. These things always happen over the weekend when there’s nothing you can do, done and done. Things happen slowly. I mean, yesterday, you know, the, the president of SVB Bank comes out and says, stay calm, don’t worry. Everything’s okay. It’s always okay until it’s not.

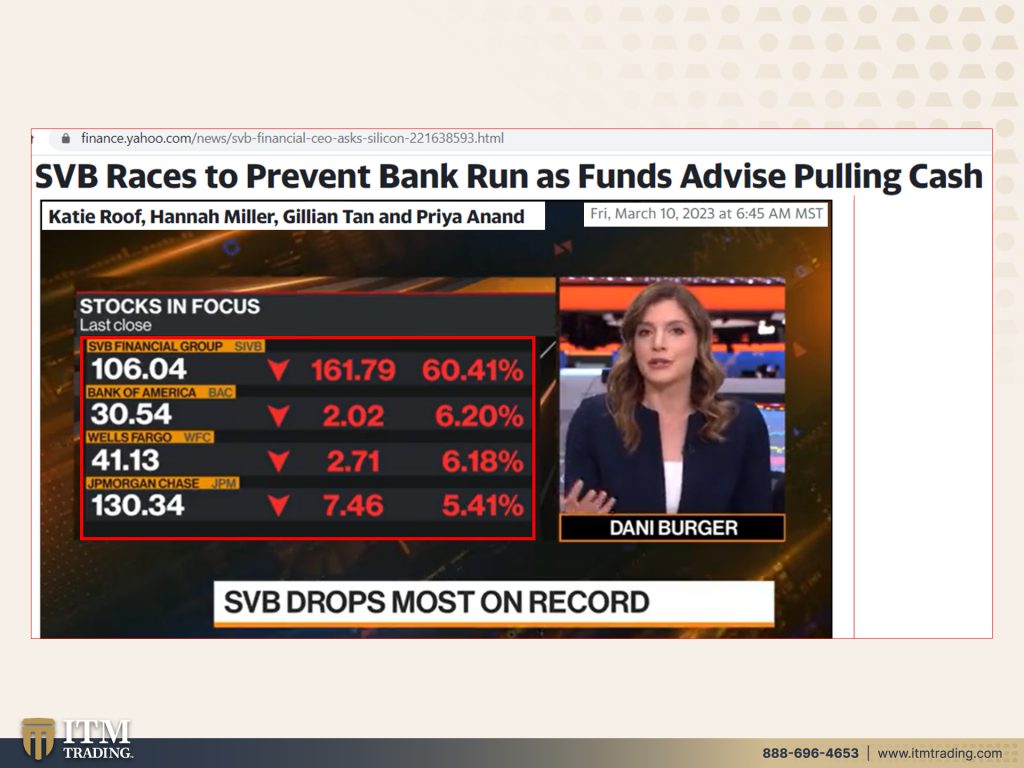

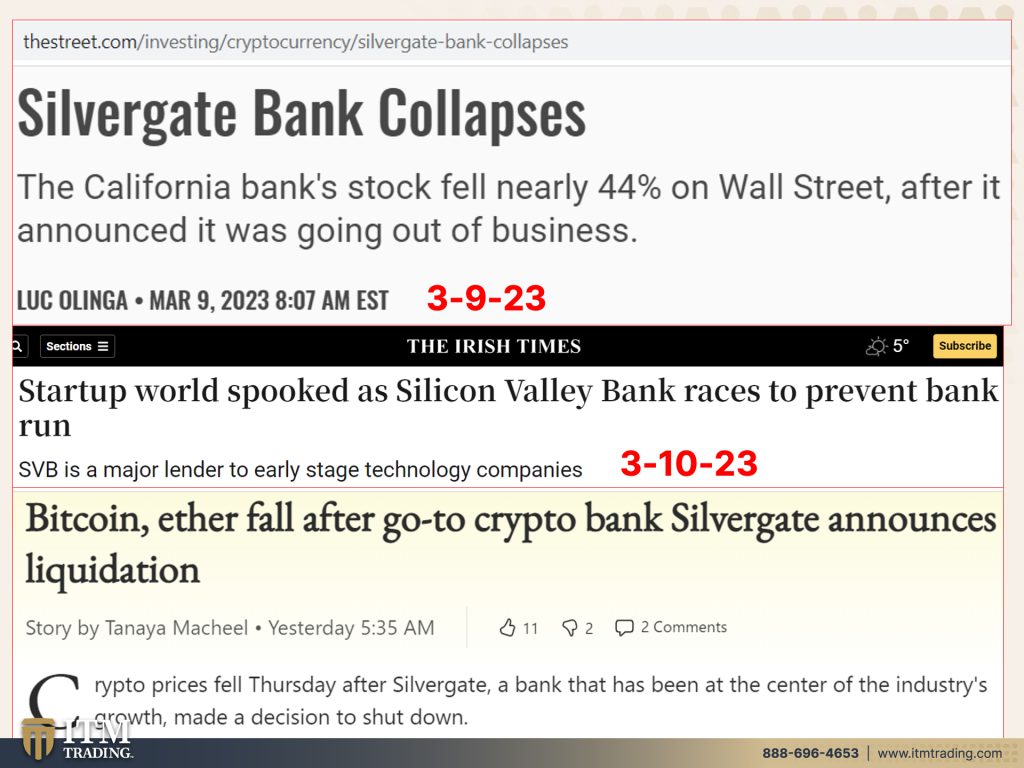

And what I also wanted to show you now, SVB was down 60%, but here’s Bank of America down 6.2% at the moment. Wells Fargo, we’re gonna come back to Wells Fargo down 6.18% and JP Morgan down 5.41%. Why? There’s nothing to see here. There’s what are you worried about? Everything is just fine. And after all the FDIC is going to save us. My money is insured, what in the world is the problem? But you see it’s the contagion and it’s the spreading because where do these smaller banks get their funding from? We’re gonna talk about that in a second, but it’s the commercial banks. The California bank’s stock fell nearly 44% on Wall Street after it announced it was going outta business. This is Silvergate Bank. This is a lot of where the private cryptocurrencies between these two, the startup tech companies, the private crypto companies bank and, and borrow and, you know, hold their wealth startup world spooked as Silicon Valley Bank races to prevent the bank run. Well, they didn’t prevent the bank run and they’re now defunct. Mm this is a problem because they are a major lender to early stage technology companies. Bitcoin, ether fall after go-to crypto, crypto bank, Silvergate announces liquidation. Do you see how these are all interconnected? Crypto prices fell Thursday after Silvergate. A bank that has been at the center of the industry’s growth made a decision to shut down. You know, there’s gonna be a problem with this private crypto space, but don’t worry, we’ve got the CBDC’s coming. Although we are assured we are many years away from that in the US. I don’t think so. We’ll see. Maybe I’m wrong. I don’t think so.

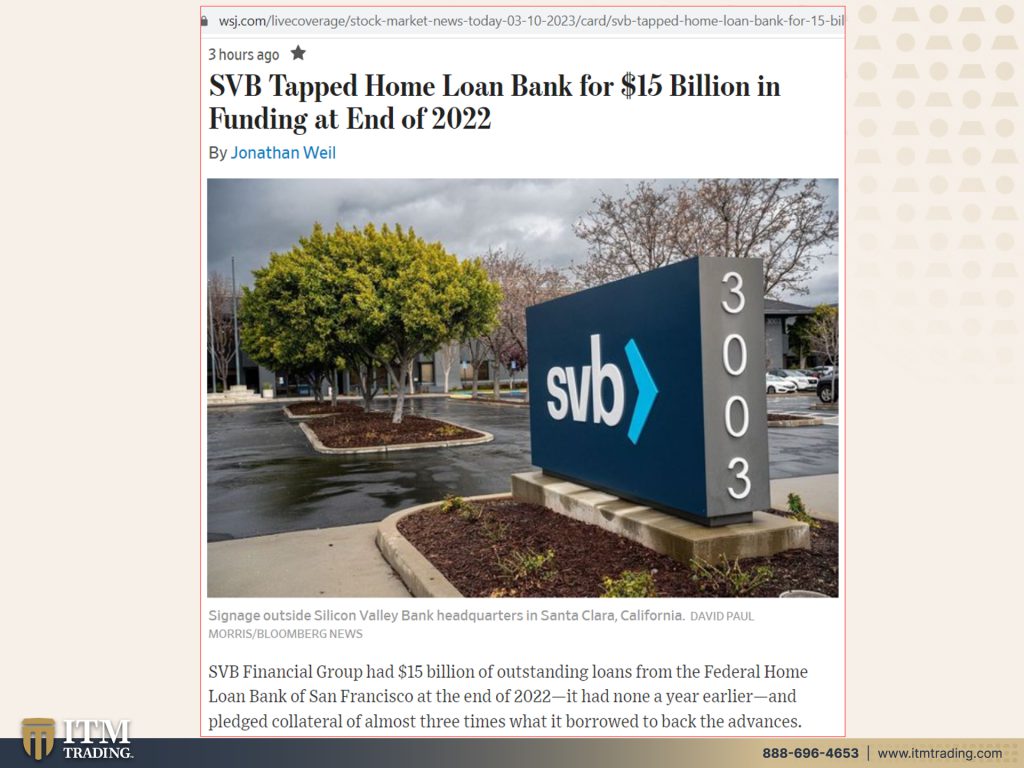

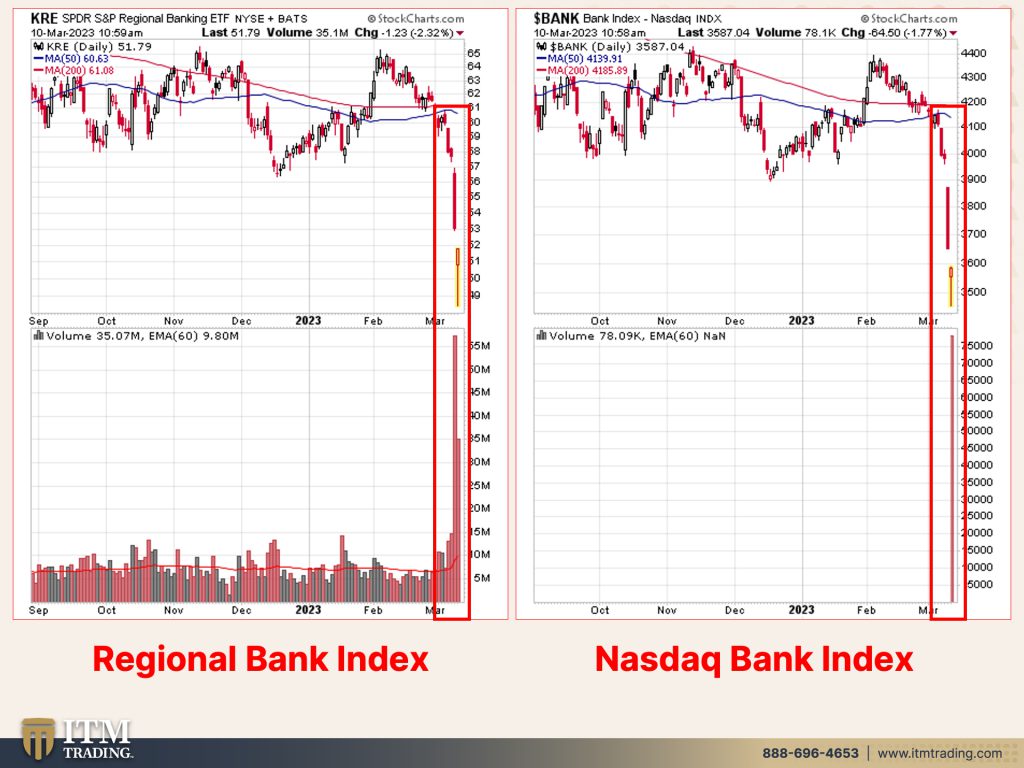

Now where do these other banks get their money from, right? Well, if it’s a deposit taking bank, that’s a part, a big part of their funding. And hey, once you make that deposit, it’s not your money anyway. You have loaned it to that bank, whether you realize it or not. But that’s what legalizes the bailin because you are a creditor to them. And SVB Tapped Home Loan Bank, that’s the, the Federal Home Loan Bank of San Francisco for 15 billion in funding, blah, blah, blah. But that’s the point. They get it from tied in banks, from commercial banks, from taxpayer bailouts. Is that what we’re gonna do with SVB? We’re gonna see because some are calling for it and look at the stock. I mean, I think it’s really interesting when you look at this and this is the stock price. Look at that huge gap. So if you are thinking everything is just dandy when you went to bed last night? Look at what you woke up to this morning, right? And look at the trading, this selling volume. So of course they had to halt the shares. So if you didn’t get out even somewhere in here, because this was from roughly almost 275 down to 106 at the moment that I captured this, if you didn’t get out, what is the value of your shares now? The bank is closed. The bank is done. So can you see that? I mean really we had warning in February, that was a recent peak. And there are some other technical things. See, here’s a gap over here. It had to go and fill that gap, which is what it did. There’s a gap here. It’s gonna go well didn’t fill it because it’s done. But what I really want you to see is we are getting all of these warning signals you need to get into position. And if you haven’t subscribed yet, you need to subscribe so that when things like this happen, you know about them and you need to get well, you know, anybody that you can because we are at a huge crossroads and there is no escape from this. There’s no kicking the can down the road. We are at the end. And this could very well be the crisis that, that the Black Swan event that infiltrates the whole system. So that what is supposed to happen with that transition into the new benchmark, it happens in a different way cause we’re in crisis again and have we not been running from crisis to crisis? And how does that impact, oh, the regional banks, Hmm. Kind of looks similar. And how about the big bank NASDAQ Index? Oh, kind of looks similar. Now if you are not paying attention, if you are in, if you have this in your retirement plan, etcetera, and you’re just not paying attention, even if you are paying attention, it doesn’t look so horrible until it looks absolutely horrible. And they both pretty much look the same. And they both pretty much look the same as what happened at SVB.

So this came out just before I came on. I grabbed it really fast. 9:04 AM US regulators descent on Silicon Valley Bank to assess its finances. And guess what? They shut them down. So again, I’ll go back for hopefully nobody that we know. Two, three, okay? So understand FDIC has created, see how fast they can do that? All they, they really have our back, don’t they? They really do. Okay, so FDIC creates a deposit insurance National Bank of Santa Clara. They move to protect insured depositors of Silicon Valley Bank. And Silicon Valley Bank insured depositors will have access to their funds on Monday. And here it is Friday morning. But hey, you know, if your funds are insured, what in the world? I mean, so they will just give you your money back. Anything over 250? Ah, too bad. So sad. You’re gonna get shares in that s BBB bank anyway. Isn’t that what you want?

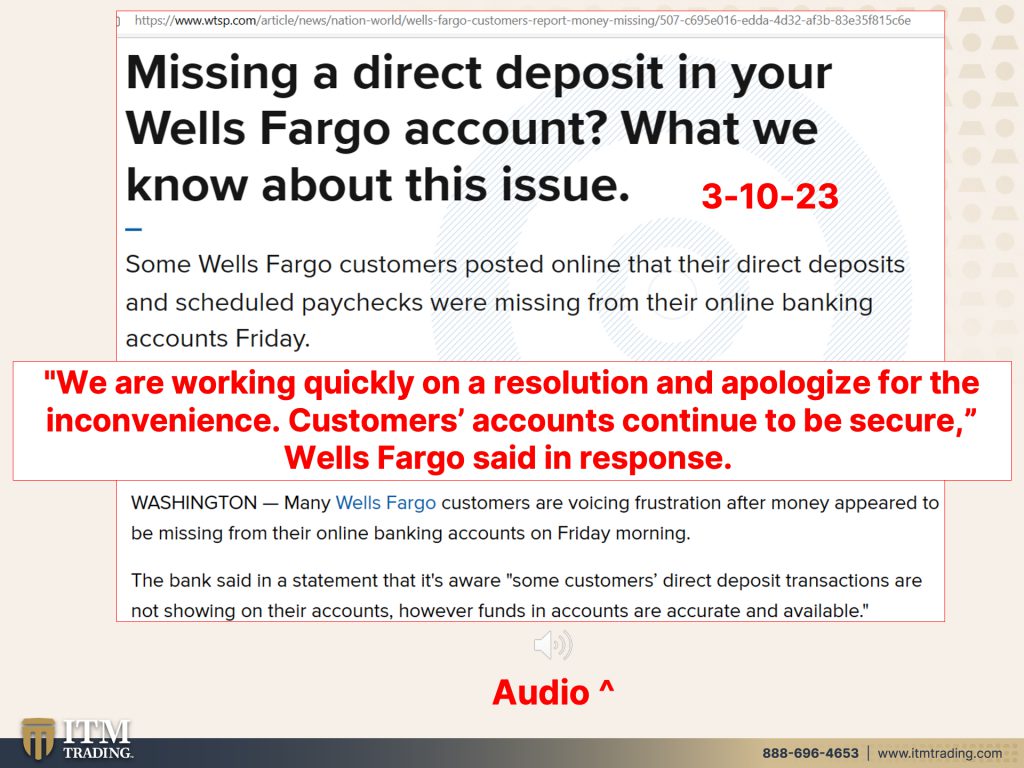

And by the way, you know, I mean, oh, oh, Wells Fargo. Missing a direct deposit in your Wells Fargo account because we certainly know how well Wells Fargo has taken care of their depositors over these years with scandal after scandal after scandal. And here’s what we know, some Wells Fargo customers posted online that their direct deposits and scheduled paychecks were missing from their online banking account. And they say many Wells Fargo customers are voicing frustration after money appeared to be missing from their online banking accounts on Friday morning. I don’t know. I mean, It’s a coincidence I’m sure that’s all. The bank said in a statement that it’s aware some customers direct deposit transactions are not showing on their accounts. However, funds in accounts are accurate and available. And what do they tell us? We are working quickly on a resolution and apologize for the inconvenience. Customers accounts continue to be secure. Gee, isn’t what, that what they just said about SVB yesterday? Hmm okay, well is this the audio? Is the audio playing?

A little bit conflicted? Right? I mean, it’s important that people understand they can be mailed in, but you don’t want a huge run on the institution. But they have I mean they’re going to be, that’s, and and it could be an early warning signal to the FDIC and the primary regulators when these things happen. And there may be some other prices. This is similar to what Jay was saying in the market, that you can tell whether people understand how the, who’s going to be protected, who isn’t going to be protected. It would be, I think, an interesting study to look at the evolution of market prices in a situation like March of 2020, for example, and see whether people understood what might happen.

So my point to all of this is things happen slowly until they happen quickly. And our system is incestuously intertwined. Could this be the start of the whole system, the banking system collapsing Black swan? Absolutely, yes it could. They want you. Oh well those are just, you know, regional banks. But understand that this is now the second largest bank failure in US history. Get into position, please. This is out of the system please. Plus Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. You can’t see what’s happening underneath the surface. Nobody can. Next week we’re gonna take a look at the volume and what’s been happening in the derivatives market. And please don’t hesitate. Don’t think Wall Street has your back. Don’t think that you are immune. Nobody’s immune. Nobody, nobody. This is your best insurance. Wealth insurance is made of physical metals. And remember, interest rates go up principle value of the bonds go down. They can hide the real value on the stock market until they can’t, don’t get caught up in that mess. And don’t forget to watch our recent interview I did with Clive Thompson a private Swiss banker. He is now retired on CBDC’s and the end of fiat currency. Also take a look at the Spanish channel, which we’re gonna be doing something on this about next week. And BGS beyond gold and silver Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. I have Christopher out there today taking care of my trees, moving things. These are not just trees, these are food trees. So really, please, please get it done and until next we meet. Be safe out there. Bye-Bye.

SOURCES:

https://techcrunch.com/2023/03/09/silicon-valley-back-withdrawal-issues/

https://finance.yahoo.com/news/svb-financial-ceo-asks-silicon-221638593.html

https://www.thestreet.com/investing/cryptocurrency/silvergate-bank-collapses

https://stockcharts.com/h-sc/ui

https://nypost.com/2023/03/10/silicon-valley-bank-meltdown-sparks-contagion-fears/

Wells Fargo paychecks missing: Bank reports technical issue | wtsp.com

We believe that everyone deserves a properly developed strategy for financial safety.

Lynette Zang

Chief Market Analyst, ITM Trading