BANKS IN TROUBLE? What Jamie Dimon Is Saying

The banking stocks are not doing well. Neither are the banks. Let’s talk about it.

CHAPTERS:

0:00 Introduction

0:51 “Negative Consequences on the Global Economyâ€

3:265 Banks Pass Fed Stress Test

10:33 Banks Suspend Buybacks & Revenues Drop

19:59 The Visible Price of Gold is Manipulated

22:30 What’s Next?

TRANSCRIPT FROM VIDEO:

Wow. The banking stocks are not doing well. Neither are the banks. Let’s talk about that. Coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, full service, physical gold and silver dealer, specializing in custom strategies. And this is what we talk about all the time. So if you haven’t subscribed yet, just hit that little bell below and we’ll let you know when we’re going live because you need to know what’s going on today.

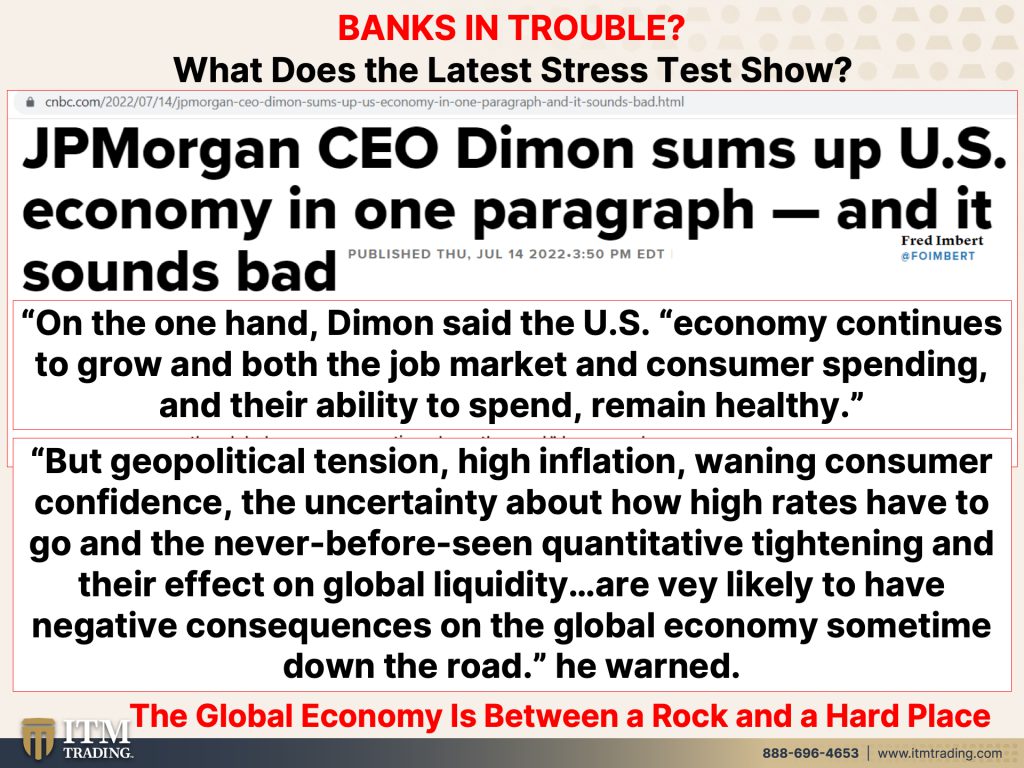

So that you can make choices that put your best interest first. And we can look at the stress test, but I’d like to remind you that the stress tests were created after the crisis in 2008, along with Dodd Frank, and a whole bunch of rules of regulations that have subsequently been dismantled, except for the bail-in, that hasn’t changed. They have the right to access what you perceive as your money in the bank. But let’s just talk about that because Jamie Dimon over at JP Morgan, well, he does not think that the economy in the U.S. Is doing so great. On the one hand, he says the U.S. Economy continues to grow and both the job market and consumer spending and their ability to spend remains healthy. And this is so important because we are a consumer driven economy as is frankly, most of the world. But, geopolitical tension, high inflation, waning, consumer confidence, the uncertainty about how high rates have to go. That’s not gonna help anyway. And the never before seen quantitative tightening, you get that never before seen, this is another new experiment and their effect on global liquidity. The ability to buy and sell are very likely to have negative consequences on the global economy sometime down the road. And, you know, I don’t think we’re looking at too far down the road, the global economy and the central banks are between a rock and a hard place, with all that new money that they printed, particularly since 2008. But remember, this is actually the kind of experiment that they’ve been doing in earnest. Well really, since 1913, but in all seriousness, 1971, when they removed gold from being part of the currency system at all, or the financial system at all, that’s when we eliminated any fiscal responsibility, frankly. And so now we’ve gotta deal with the consequences of those actions. It’s not just this one little thing we’ve been taught to think really short term, but you can’t think really short term and understand where we are inside of this trend.

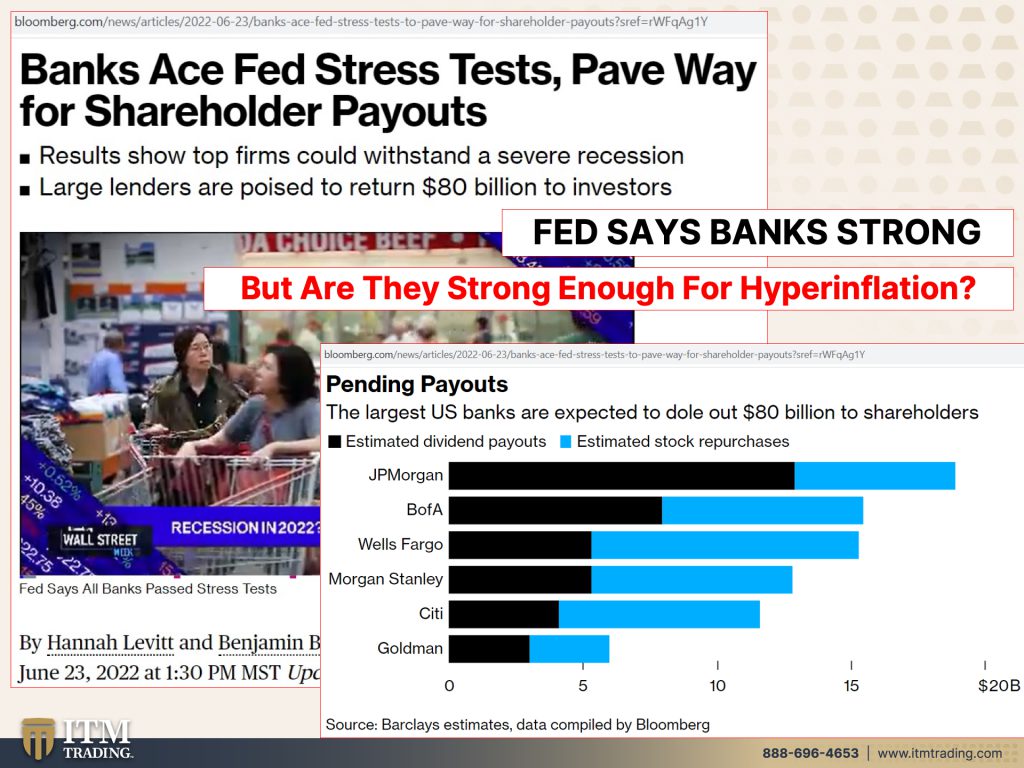

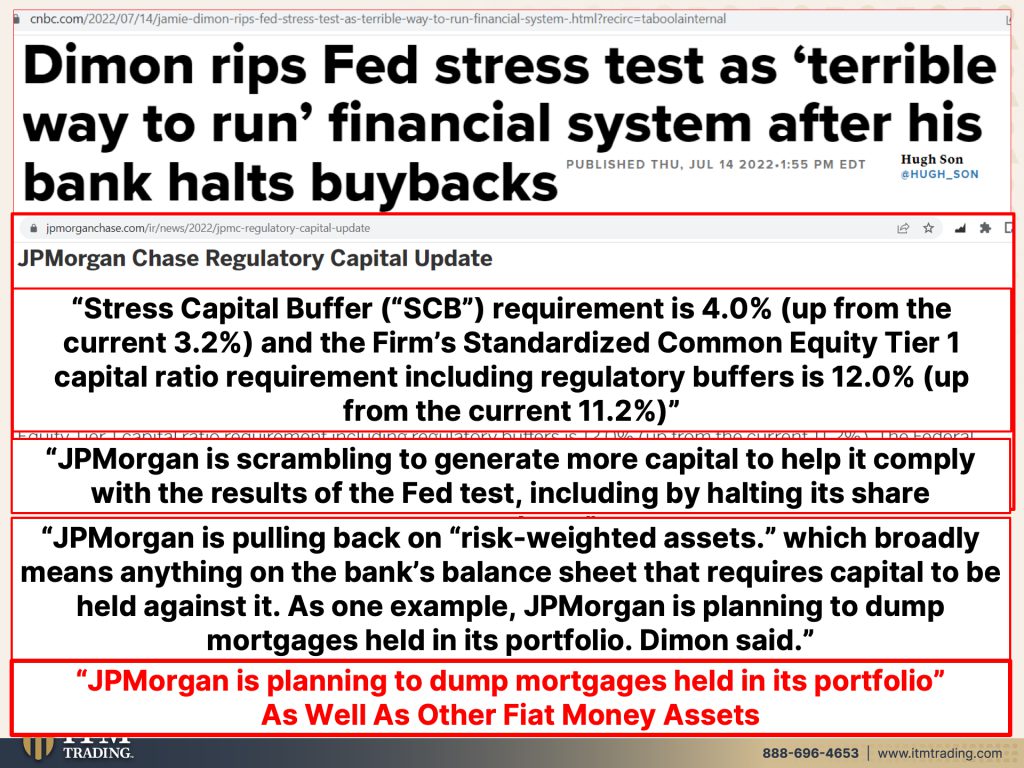

So the Banks Ace those fed stress tests, which were put in place so that you had confidence in the banks again, and they paved the way for shareholder payouts. So the Fed is saying that the banks are strong, they’ve got plenty. And they’re looking at all of these estimated dividend payouts and estimated stock repurchases. And you can see that JP Morgan is right up there, but my question is, are they actually strong enough to handle hyperinflation? I personally don’t think so. We’re gonna find out moving into the future. Cause I don’t think we’re very far from that test, but Hmm. Jamie Dimon did not like this year’s fed stress test. It’s terrible way to run financial system after his bank halts, buybacks. Why did his bank halt those buybacks? We just looked at it and Hey, he passed. He could do it. Well, what it is is they changed the stress capital buffer. In other words, how much the banks have to hold in reserves. And I’m wondering, seriously, I’m wondering if this isn’t about getting ready for something very nasty that is headed this way. So they increase the requirement to 4% up from 3.2%. And the firm’s standardized common equity tier one capital ratio requirement is now 12% up from 11.2%. So the problem is, is they have to hold more money back. And that’s why they made the choice to halt the buybacks, not the dividends, by the way, maybe those will be even higher than we were thinking. But JP Morgan is scrambling to generate more capital to help it comply with the results of the fed test, including by halting its share repurchase, cause they have to keep more money in house. JP Morgan is pulling back on actually all risk weighted assets, which broadly means anything on the bank’s balance sheet that requires capital to be held against it. So for them to hold back money in reserve, in case these bets go bad. As one example, JP Morgan is planning to dump mortgages, mortgages? Held in its portfolio. What do you think that’s gonna do to the real estate market that has already peaked and going on the down side. Mortgages as well as many other Fiat money assets. So the banks have been pulling back from making markets. In other words, you know, if say a bond is falling and a bank, a commercial bank would step in and buy a whole bunch of those bonds, hold it on their books and then sell it to their customers. Well, that’s been changing really since 2000 that’s been going down and down and down. So the liquidity in the market, something that we’ve talked about quite a bit, well this is going to make that liquidity a whole lot worse. You know that question from that other video on, should I hold my stocks or buy gold? Well, I don’t own any stocks, so, but I do own a lot of gold. You tell me what I think you should do.

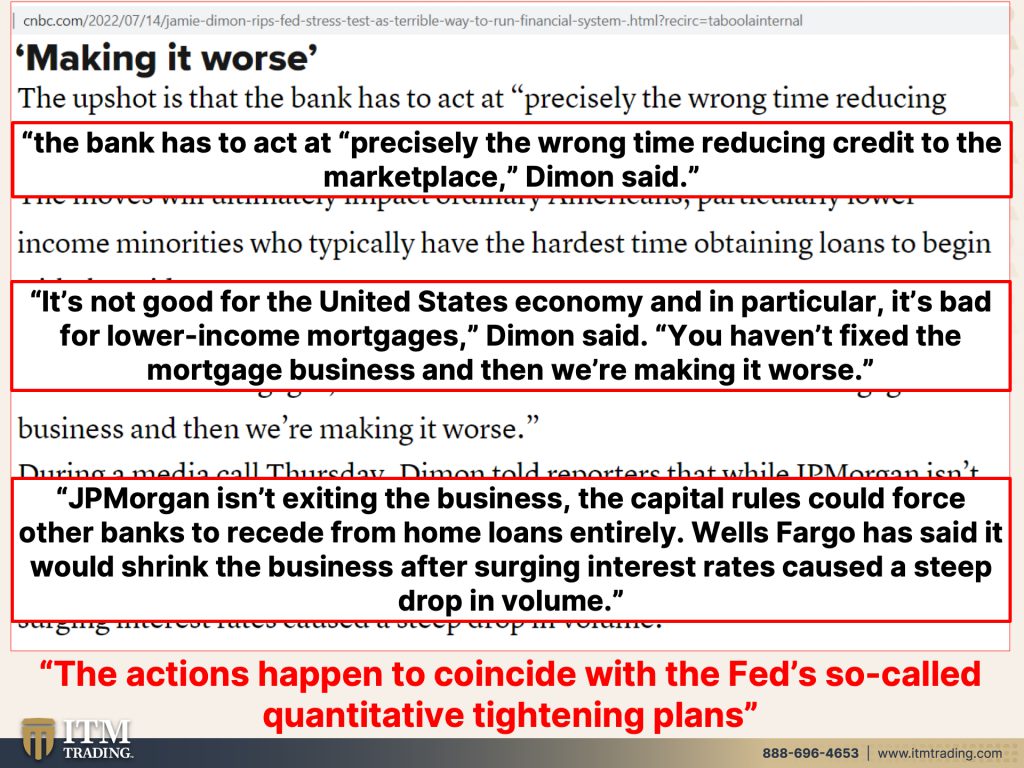

Because really what’s going on, is the central banks, the problem that they created with all of that printing and all of their pivoting. Well, you know, now that they’re trying to change that they’re trying to run off their balance sheet, which didn’t work in 2016 to 2019. They’re trying to raise interest rates, which didn’t work when they tried it the last time in 2016 ending in 2019. I mean, you know, the bank has to act at precisely the wrong time, reducing credit to the marketplace. But I love this. It’s not good for the United States economy, because after all this whole system is based on debt. So people have to keep growing more debt in order to create more money, just like governments and central banks. But it’s not good for the United States economy. And in particular I love this one. It’s bad for lower income mortgages because you know, Jamie Dimon’s right out there to support those people that are less fortunate than he is with his, I don’t know, a hundred million or so salary, you haven’t fixed the mortgage business and then we’re making it worse. Well, you know, when you stop and think about it, if you’re making lots and lots of money, why would you change? It’s only when a crisis happens that you create some semblance of change, but as we’ve witnessed in this k-shaped recovery really it’s just everything that the central bank has done. And, and we can look globally and this statement is accurate as well, has made that wealth and income inequality, worse and worse and worse. So, you know, it’s always, but “think of the children” we’re gonna do all sorts of bad things over here, but it’s gonna affect the children over here. I love that because it’s just, it’s just a smoke screen. It’s just a smoke screen. Really. JP Morgan isn’t exiting the business. The capital rules could, mortgages meaning, the capital rules could force other banks to recede from home loans entirely, Wells Fargo has said it would shrink the business after surging interest rates causes steep drop in volume. And we certainly know how well Wells Fargo takes care of all of its customers don’t we? I think they’re more concerned about themselves than they are about their customers. I hate to say that, but I think it’s true. The actions happen to coincide with the Fed’s so-called quantitative tightening plans. And again, quantitative tightening has never happened in this country. Even the little bit of attempt between 2016 and 2019 was a big fat fail, big fat fail. In fact, every single country that has attempted QT since 2009, or even raising rates, they’ve been forced to turn around and no doubt the same thing is gonna happen again. It’s inevitable.

The only way to fight deflation is with inflation. And the only way to fight inflation is with deflation. And so what’s happening is we have a schizophrenic market because nobody really understands what is most likely to happen and what really is going on. So chaos is becoming the rational base case in a market ruled by fear. And the earnings are now coming out because interestingly enough, even though everybody believes we’re entering recession and actually Jeremy Siegel thinks that we’re already in, he says that U.S. Is already in a mild recession. The earnings projections haven’t really come down. And yet JP Morgan chase earnings fell 28% after building those reserves for bad loans and suspending their buybacks. And still because they put that money aside as was required, their earnings fell. Yeah. The more that they have to play with and gamble with and bet to do these derivative bets, the potential more money that they have to, that they can make. But, Wells Fargo profit also falls as the bank sets asides funds for bad loans. Now, I’m thinking if they’re setting aside all of this money for bad loans, that means somebody must be anticipating a lot of defaults. And remember we have all these zombie companies that are out there and a zombie company has not earned enough money to pay all of its interest, let alone any of its principle. And maybe the rest that it owes or the rest of the interest for at least three years, count them, three! Well, the banks kept them on the books because they didn’t wanna show that loss, but they may now be getting into a position where they’re not gonna have any choice because the Fed’s free money spigot has been. I don’t wanna say it’s been turned completely off, because I believe that it’s gonna be turned on in a very, very, very big way once enough pain has been felt. But these markets have never really quite experienced the level of quantitative easing that we’re experiencing now. And why did their revenues drop? It’s really kind of interesting.

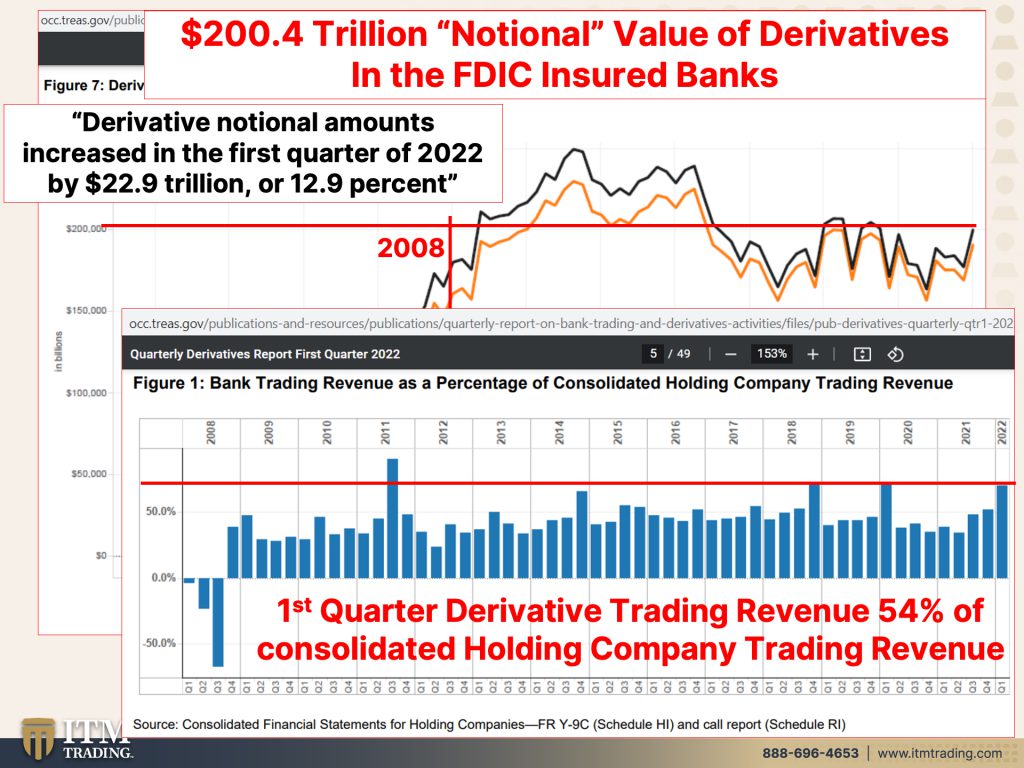

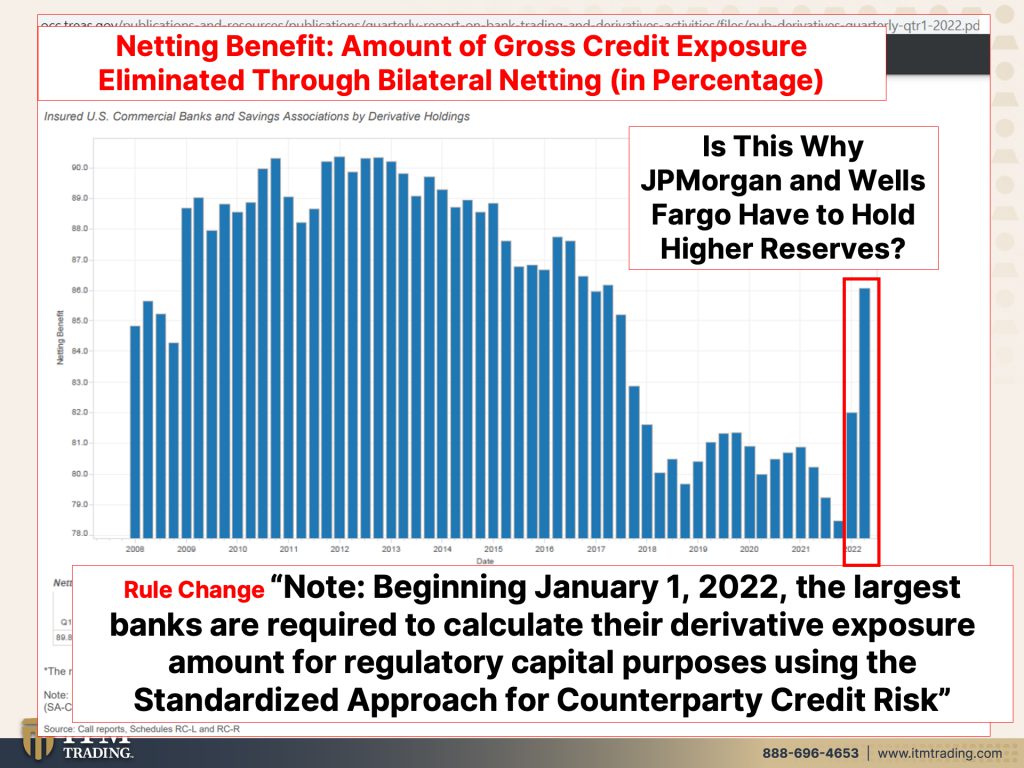

I’m gonna take you to the office of the comptroller, the currencies derivatives in the FDIC insured banks. Because even though most of the rules that were put in place from Dodd Frank from the last crisis have been, you know, changed and rescinded the bail-in laws have not. So as a reminder, the banks have the right to take your funds and use them for your best interest. So that’s called sweeping your money. You make a deposit, they sweep it into sub accounts that are in their names and they can do anything they want with that money. Well, if the bank fails, then they actually have the right to just keep those money and leave you stock shares in that failing bank. Whoop dee doo because of eminent domain laws, which frankly is one of the things that I look at when I’m looking at the difference between just bullion gold, monetary gold, or collectible gold coins. Because I think that the same rules are likely to apply. Eminent domain means that they have to pay you fair value, but guess what? They’ll get to dictate or determine what that fair value is. Do you really want stocks in a failing institution? Really? So, we’ll talk more about that on another day, but these are derivatives. And at this time when they finished doing this report, the OCC, there were over 200 trillion notional value of derivatives. What does that mean? That’s just the value that the banks agreed were the value of the contracts that they were sharing, that they were, you know, one counterparty to the other counterparty that in no way, shape or form really tells you how much real value is at risk. We don’t know that. And I’ve been saying forever, the derivatives market, which is just a leverage bet is going to be the death now because that’s really what happened in 2008. And that was the second derivative implosion. The first one is 98 with long term capital management. And we have that last one that next one coming up. Derivatives notional amounts increased the first quarter of 2022 by 22.9 trillion or 12.9%. Wow. There’s 2008, much higher than what we know of or what they’re reporting is what I should say, not than what we know of, because we really, this is such an opaque market, frankly. Nobody really knows how much is at risk and how high these derivatives are, because there’s all sorts of tools, which we’ll talk about in just a second. But I wanted to point out to you that banks generate a lot of their income from trading using your deposits to trade. Right? In fact, this is about 55% of the first quarter derivative trading revenue of the consolidated holding companies, trading revenues, 54% of all trading revenues that are all revenues. That’s a lot, that’s a lot. So for them, for JP Morgan to be down, you know, whatever that number was, I mean, that’s saying something they’re having a lot of trouble and in this volatile market, that’s when trading really kind of explodes. But one of the tools that they use to hide how much is out there is netting, right? Where, oh, I have this contract and you have this contract and they cancel each other out. So it’s really, the risk is so hidden that by the time we know about it, it’s gonna be way too late to do anything about it. But again, they have changed amazingly some of the rules where they have to report more. So you can see since 2013, how much it removed from that notional value. And now it’s starting to spike and I’m gonna show you why. And I did actually show you why recently, because they reclassified some things gold being one of ’em. So that instead of it just being treated like a paper contract, while they actually had to treat gold like a real commodity though, I’m not really sure that we’re seeing the truth. So is this one of the reasons why JP Morgan and Wells and others have really had to hold higher reserves? Because this is a little more honest? do I really trust it, frankly? No, I don’t. So I think it’s much worse. But beginning January 1st, the largest banks are required to calculate their derivative exposure amount for regulatory capital purposes. In other words, that they have to hold those reserves using the standardized approach for counterparty credit risk. And you can see how much that has skyrocketed. There is something very nasty embedded in these banks.

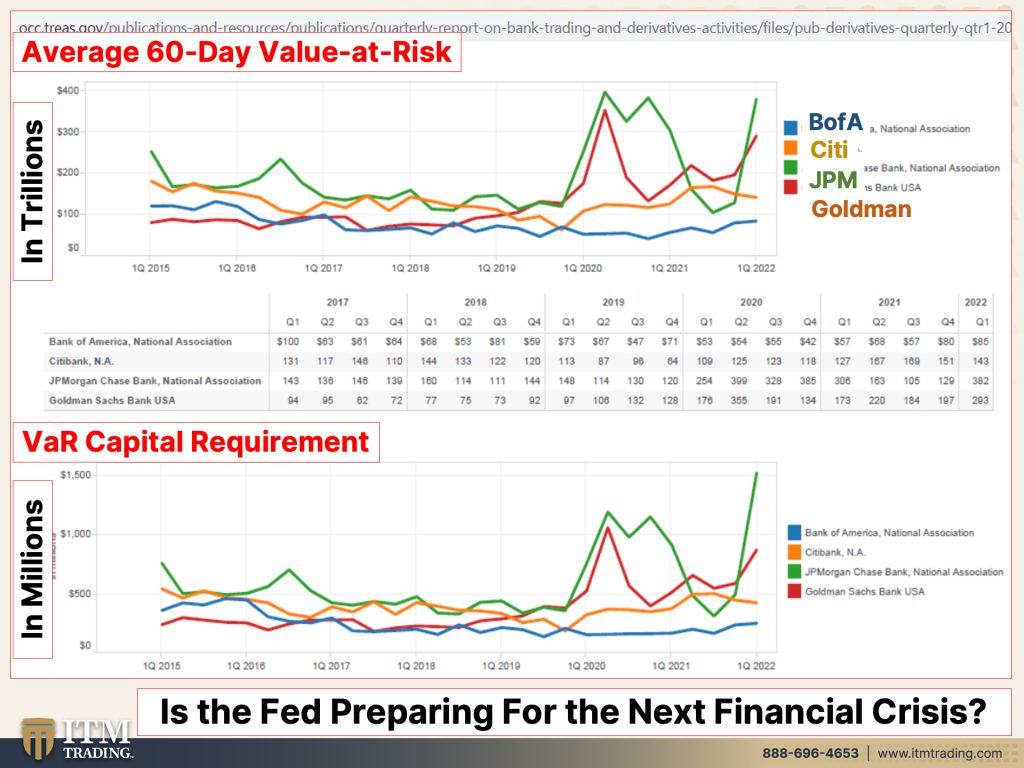

And I don’t think that it’s really a good thing. This is your average 60 day value at risk. All it is is the value of the contracts. And you can see how much that’s gone up between 2021 and 2022. This is in the trillions hundreds of trillions, really that’s bank of America, city, JP Morgan, and Goldman Sachs. These are the four key banks that work in this derivative arena, the most, by far, the most. Oops, oops, sorry about that, didn’t mean to do that. Now this is your capital requirement. So you can see particularly on Goldman Sachs and on JP Morgan, which is the green one and the rust colored one, particularly that their capital requirements, the reserves that they have to hold back for these bets has gone up a lot. So hence the losses that they’re seeing or one of the reasons for this year, and I’m just really wondering if the Fed isn’t trying to get prepared for the next financial crisis, because who’s gonna survive that?

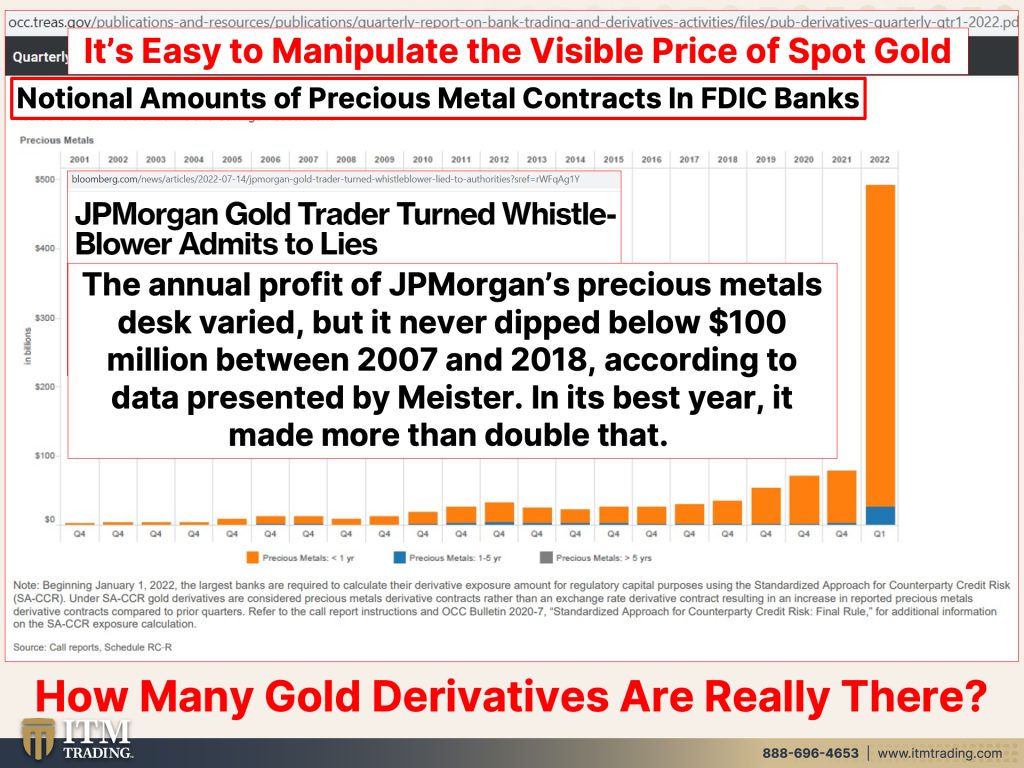

I don’t know, we’re gonna find out it’s so easy to manipulate the visible price of gold.

These are the notional amounts of precious metals read goals, contracts in the FDIC insured banking system most held by those four entities, JP Morgan being huge. And what I think is really interesting is JP Morgan gold trader turn whistleblower admits that he lied and admits that, you know, I mean, it’s, it’s all coming out how these markets were manipulated the annual profit of JP Morgan’s precious metals desk varied, but it never dropped below a hundred million between 2007-2018 in its best year. It made more than double that. And so you can see how we’ve been lied to, lied to, lied to. Easy to suppress the price of gold when it costs you nothing to control many, many ounces of gold. But what I’m really still wondering is how many derivative gold contracts are out there? Because I know personally from the Bank for International Settlements, the Central Banker’s central bank, before, unfortunately I knew how to do print screen so I’m sure it’s much worse than that now.

For every one ounce of physical gold, they created…the banks, I mean, created 62,000 digital ounces of gold! Do you think that could suppress the price? Yeah! But at the end of the day, this is an asset that runs no counterparty risk. You hold it, you own it. It is out of the system. It is invisible to the central banks. It has the broadest base of buyer. What do you want to make sure that you’re holding into this transition? This is what I wanna make sure I’m holding. I have some silver too. That’s Barterability. I have a lot of silver too, but that’s for Barterability. This is for Wealth Preservation and growth.

So if you have not yet seen it, well, you might wanna look at the piece that I just did on Tuesday on Zimbabwe, bringing out a gold coin because when all confidence in the currency is lost, that’s when gold comes into play and it will just like, it has over 4,800 times. It will do it again. But also last week’s interview with Dr. Ott was phenomenal. And his meeting with the former Fed chairman, Paul Volcker, because everybody raves about Paul Volcker. I think you’ll find that interview extremely interesting. So make sure that you share, share, share, share, share, and if you don’t already have a strategy in place, click that calendly link below, set up a time to meet with one of our consultants. Make sure you subscribe to this channel, leave us comments, give us thumbs up, help us share this message. Let us all come together in Community to help each other because there is absolutely zero doubt that it is time to cover your assets and as quickly as you can, and until next time, please be safe out there bye-bye.

https://www.federalreserve.gov/publications/files/2022-dfast-results-20220623.pdf

https://www.jpmorganchase.com/ir/news/2022/jpmc-regulatory-capital-update

https://www.cnbc.com/2022/07/14/jpmorgan-jpm-2q-2022-earnings.html?recirc=taboolainternal

https://www.cnbc.com/2022/07/15/wells-fargo-wfc-2q-2022-earnings.html?recirc=taboolainternal