AVOIDING BAIL-INS WITH A BROKERAGE…HEADLINE NEWS WITH LYNETTE ZANG

Treasury Vix Chart:

Transcript:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And let me tell you, we all need strategies right now because it should be apparent to everybody that the great reset on everything, social, economic, and financial is well underway and chugging along. Just fine, depending upon your perspective. Well, I want to start with a question that I said that I would look at and I’ll, I’ll read this again. This is from yesterday’s Q and a can money be put into a brokerage house like Edward Jones or TD Ameritrade instead of a bank to avoid the bail ins, etc, on a temporary basis until hard assets can be purchased. And, um, you know, so I took a look at that number one, uh, I said this yesterday, so I’ll just repeat it. You have to be absolutely certain that your brokerage did not, and is not currently set up as a bank.

So in this particular case, they use TD Ameritrade and there was TD Ameritrade, which was recently sold to Charles Schwab will Charles Schwab became a bank. So you got to do a little digging and it doesn’t matter what your perception is. However, if it is indeed a pure brokerage, then that would not be subject to the bail in laws. But again, do not assume anything because there are so many intertwined sub categories, sub classified it as sub businesses and who is the actual owner of it. And so if they are indeed a bank, like in this case with TD Ameritrade, there’s also TD bank. That’s different than TD Ameritrade. However, it’s still a bank. So if it’s a bank it’s subject to bail ins, if it is a pure brokerage, then from what I can tell, it is not subject to bail ins, but do not assume just because you think it’s a brokerage, you need to dig deeper and see who really owns it.

Okay. So I want to go into this because the Pennsylvania teacher’s retirement fund put more into hat more than half its assets into risky alternative investments. Now, look, we do know because we’ve been following this for a number of years that as the yield on what is considered safe, you hear my hesitancy because I don’t really think bonds are safe. However, out of the investing world, treasury bonds are classified as safe because they can print the money to, to pay you well, as those interest rates have been anchored at near or below zero for the last, what, 10, 12 years or so 14 years funds that have defined benefits. So this is how much they’re going to pay. You have had to take on more and more risks than I’ve shown this over time. Whenever I do something on retirement, you can see how these alternative, which means not really liquid investments have been growing in those retirement funds.

So if you aren’t counting whether it’s Pennsylvania or any of the other ones, to be perfectly honest with you, if you are counting on them, to enable you to retire and live comfortably and sustain your standard of living, you better be doing other things as well. What you need to sustain your standard of living is ample food, water, energy, security, as well as barter, durability, wealth preservation, shelter community. So you need all of these things and I would not be counting on the pensions in interesting they’re, they’re kind of singling them out, but, uh, let’s see, it says, uh, let’s see. Now the FBI is investigating on the case, uh, looking at their investment practices at the Pennsylvania public school employees, retirement system, and new questions are emerging about the, how the fund staff and consultants calculated returns. Well, how all of these pension plans have been calculating returns and anticipating how much they had to fund these pension plans in order to pay out those benefits.

Frankly, that’s been in questioned for a very, very long time. So what I’m going to encourage everybody to do is make sure that you have investments outside of the system that will enable you to hold your purchasing power. Because I think with the retirement plans, it’s going to be a double whammy. The money’s not going to be there when you, you get to use them. Plus, I mean, look at what’s happening in all of the markets. It’s an obvious we’re near the end of this shell game. There’s almost no purchasing power left in the currencies and they keep telling you, it’s not enough. We want more, you’ve got to feed the inflation beast. And with that, we’re just going to go on to inflation because yesterday the CPI, the consumer price index, which takes out a lot of stuff by the way, went up to 4.2% for the year.

It’s biggest, since 2008 fueling worries of a rate hike. And today the PPI, the producer price index also jumped 6.2%. Okay? So April’s increasing consumer prices was driven partly by sharp rises in prices for used cars, gasoline and airfares. Yeah. Used cars and trucks up 21% household energy up 6.4% gasoline up 49.6% air force fares up 9.6% furniture up 3.5%. And they haven’t been able to hit their 2% target. And remember, they take a lot of real what we have to buy on a day-to-day basis. They take that out of the inflation calculation. So why would the markets then stocks tumble on inflation fears that was yesterday, today? You know, they’re up, but why? Because in Siri now, remember we were warned once they went to an average 2% target, you knew darn well, we talked about it, that they were going to allow inflation to run hot.

And this is transitory. Well, you know, maybe this level of gains is not going to maintain and we’ll go and see, but inflation is not transitory. It is ever present because it is part of the FIA money system based upon constantly compounding debt and the tool that governments and central banks, particularly central banks have to regulate the speed and the rate of the inflation, our interest rates and fed chair Powell. And as well as lots of other central banks, they will not be changing their interest rate policy, which means they’re going to do nothing to attempt to tamp down this inflation that they created with all of their money printing and subsequent, both fiscal and monetary. In other words, central bank and government distribution to everybody because they couldn’t get away with what they did in 2008 was just to give it to the 1% overtly. They have given it to the 1%, but now they’re giving it all around. So be prepared because the question is have the central banks lost control of inflation wall street is not so sure that’s why it’s waffling. That’s why you’re seeing it’s down one and a half percent. It’s up one and a half percent, right?

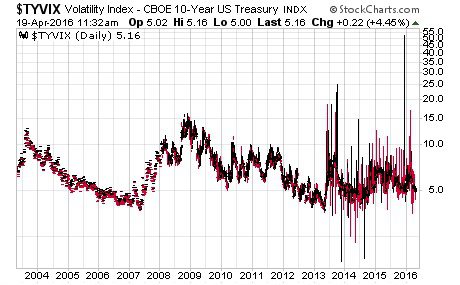

At some point, if this is an ed and this could be it, I don’t know yet, if this is not it, then hyperinflation most definitely. Anyway, hyperinflation obvious that we, you and I say is in the reasonably near future. Maybe it’s next month, maybe it’s next year, but it’s not far away. So you need to be prepared today. Sorry to be redundant, food, water, energy, security, barter ability, wealth preservation, community shelter, get it done. Now this particular article I found really, really interesting Europe seeks to curb hedge funds on bonds. You know, I should have, we’re going to put this in the blog. And would you make a note of it? The, uh, the treasury Vic’s okay. Because you can see on that, I’ve shown this graph many, many times where you can see basically no movement in the treasury bond market until 2008, then you see bigger move until 2013. Then you saw when traders took over traders have what they call hot money moves in fast leads fast. So it can just go in and out really fast. That’s what we have. It is the traders of the world. Thanks to all of this abundant, basically free money that have taken over all of the markets. But now Europe seeks to curb hedge funds on bonds. European governments are acting to limit hedge funds participation in the market for new sovereign bond issuance. So not off the run on the run on the run is new off the run is stuff that’s already out there in the secondary market. Following a surge in demand from the firms. The pushback was prompted by unusually large orders placed by hedge funds for new bonds. Okay. Now listen to this next piece, because this is just blanket true, which can then potentially be sold sometimes within hours to the European central bank for a profit order books, which track demand for new bonds and help determine the prices have ballooned since hedge funds began to pile into this trade. So you can see on that one graph and we’re going to post it on the blog, but I’m that? What, is there any way for you to pull that up out of my charts Iger actually right now, if you could do that, okay.

We’ll show you. stockcharts.com, anybody can do this. You can go into stock charts.com and put in, um, I’m pretty sure it’s the dollar sign $TYVIX. I’m pretty sure that’s the symbol for it. If not, if you go in and look at treasury, Vic’s in the charts, it’ll show the last time that I pulled it up and looked at it and then you have to go out long-term. So if you do that, I mean, there’s a reason why I love the long-term charts, because it gives you a different perspective and you can watch the evolution and you, and, and certainly in government bonds, you can see that evolution. And I think that this indicates that we have now gone to a new and much more dangerous level in the government bond market, because while traders were in there, that in and of itself is not a good thing.

This is supposed to be the ten-year treasury is supposed to be the foundation of the global markets. Right. But any government bond, they’ve trained us to think of them as risk-free. Well, no, because hedge funds are only and traders too. They’re only interested in making a little bit of money and the level of their volume they’ve gone in at 3 billion, right? Some hedge funds have put in orders for as much as 3 billion of bonds and a single offering, which is far more than they can realistically by the bankers say, but it’s also far more than what they typically do, like three times more than they typically do. So can you see that these markets, not just the, the government bond market in Europe, but it’s all of these markets, all of the real estate market, the stock market, the bond markets have all been taken over by short term, thinking now, at some point, you and I have to retire. Don’t worry. I’m not going to do it for many, many years. I don’t even know if I ever will, but that’s a long term perspective. Do you want your long-term perspective guided by short term nominal in terms of dollars or years or where, wherever it is that you live, short-term thinking they’re just trying to pick up a buck here, a buck there, no. Or, or even, you know, central banks that are controlling all of this. No, that is not what we want when we’re trying to plan for the future, whether it’s our children’s education or our retirement or anything in between, but here there is a little bit of good news here. Credit card debt falls, bruising banks, Americans are. And I really do like this one, Americans are paying down their credit card debt at levels, not seen in years. That is good news for everyone, but credit cards, issuers. We need to get rid of that variable rate debt because the variable rate debt is what kills you in a hyper-inflationary environment. You will never get out of debt because obviously that’s variable rates. So those rates will move as the rest of the rates do move. And even as they’ve been held near zero, a lot of the credit card debt is that like what? 16, 18, 28%. So they’re making money hand over fist. This is a little bit of good news back into that’s such good news, whole prices surge across the nation, amid tight market. And part of that goes back into the big corporates coming in and taking over what our markets for you and me and turning them into whole cities of rentals, single family rentals. It’s really no wonder there is a tight market because even the builders are building new communities that are being bought up by single entities. You and I, or mom and pops can’t afford to do that. But with easy access to free money, easy peasy to do this is not good. This is a trend that started in 2008 and it was a setup, but another story for another day, okay. And I’m going to finish this. This is a story that’s really happening on a global level, but you know, every now and again, I do like to bring up China because I think that in many ways, China is showing the rest of the world how to control their population drop in births, risks, stunting China’s growth. Now, before I do this, I want to say, uh, in the U S the social security system, when they first put that into place, they had 153, uh, workers contributing for everyone, social security recipient. The last time I looked and I think the most current data on that, I can double check that again.

But I think that went to like 2013, and I don’t know why they haven’t updated it. It was 2.8 workers for everyone, beneficiary recipient. So births and worker and growing that worker pool is essential globally to having the ability to pay on these social contracts. Okay. I just wanted to throw that in there because I know it’s a lot worse than that. And what I’m about to tell you, the drop in births is happening on a global basis, but this risk stunting China’s growth China’s population is growing at its slowest pace in decades with a plunger and birds and a graying workforce presenting the communist party with one of its greatest social and economic challenges, figures from a census released on Tuesday. Show that China phases a demographic crisis that could stent growth in the country. The world’s second largest economy behind the U S uh, let’s see, China has long relied on an expanding and ambitious workforce to run its factories and achieve Beijing’s dreams of building a global superpower and industrial giant, an age aging slow growing population. One that could even begin to shrink in the coming years threatens that dynamic China’s aging related challenges are similar to those of developed countries like the United States, but its households live on much lower income on average than the United States and elsewhere. Now I want you to just kind of think about that.

If we’ve got an aging population coupled with fewer births, what do you think that means for the global growth? It’s not a good thing. It’s not a good thing at all. But then one would question this, except once you read this, or once I tell you this, you’re going to understand it. China. Let’s see. What’s. What was the date on this one? The date on this one was yesterday, May 12th. The date on this one was Tuesday, May 11th. So let’s not do it side by side. So anybody can make a comparison.

China Is forcing birth control on Muslim women when China’s government ordered women and they’re mostly Muslim community in the region of zing. Dang. Um, I know I’m butchering it. I’m sorry to be fitted with contraceptive devices. Kel manure Sedeke pleaded for an exemption. She was nearly 50 years old. She told officials she had obeyed the government’s birth limits and had only one child. Well, it was no use. The workers threatened to take her to the police. If she continued resisting. She said she gave in and went to a government clinic, okay. Where a doctor did what he was going to do. So that sounds like a selection that’s going on. Kind of reminds me of, I hate to say this Nazi Germany, freedom is everything. It’s not convenience other than it’s being convenient, but physical gold and physical silver gives you. Freedom gives you freedom of being dependent on a government and growing your own food.

Give gives you freedom from being dependent on the grocery stores, the mantra, food, water, energy security, barter ability, wealth preservation community, which can help you be free and independent. Even amongst a group of like-minded people is what is going to enable all of us to continue to have choice. If you allow yourself to be completely dependent on the government system and the central bank system, what does that tell you about your freedom? And it’s not, you know, for me, you know, I’m 66. So I still plan on being around for a long time. But as you guys know, I’m far more concerned about my grandchildren and my great-grandchildren. I want them to have choices. And if enough of us pay attention to this, as they cram or attempt to, I mean, look, they want you to think that it’s your choice and they will nudge you in that direction using perception management.

But at the end of the day, is it really your choice? If you don’t have a choice or you feel like you don’t have a choice, golden silver is more important today than it’s ever, ever, ever been. Because our freedoms not, it’s not just that they have been getting more and more and more narrow over time because they have, they have, it’s easy to once you’ve lived a long enough life, you can see those narrowing of choices and therefore narrowing of freedoms. But what lies in the future, if the powers that got us into this mess remain in power is no freedom at all. And I read this from China because I think that a lot of what’s happening there, they’re showing the world how to control a population. I don’t want to be controlled like that. It’s bad enough. What we’ve all gone through in the last year and a half, Â fear.

Fear can control is to be brave by golden silver, start a garden, make sure that you have alternative energy sources that are not reliant on the grid. We’re going to be getting into this a lot more in the future, but there are things that you can do today to ensure that you have a free future and I’m encouraging you strongly to do it and to do it now, while we still have choices, China, by the way, is back in a huge import and buying mode of gold. There’s a reason because they plan on ruling the world, rule your own world, become your own central banker.

This week is speaking of all of that, this week I was on with my good friend, Sean, over at Sgt report. You’re not going to find him on YouTube anymore. Nana, no, they cut his knees right off and you’re not going to be able to find his podcast on Spotify anymore because they stopped that too. I don’t know why they think he’s so dangerous, but, uh, we have the link in the description. So I encourage you to watch it. We covered a lot of ground. And then also, which is going to be out tomorrow, right tomorrow. I did a coffee with Lynette, with Chris Marcus, from Arcadia economics. And, um, he was in town. So he came and we did one by my pool and the ducks were very entertaining. The fish were, it was almost like they knew they were on camera, the ducks of the fish. So they got a little loud toward the end, but I think you’re really going to enjoy that. And we talked a lot about silver, some about gold, but a lot of the changes that have recently taken place. And I don’t want to spoil the video for you. So just watch that tomorrow. That will be out next week. I’m going to be on with my good friend, Mario Innecco over at Maneco64. And those interviews for me are always a lot of fun. So I am I on his channel or his how much? Nope, I’m going to be on his. Okay. So I don’t know what he’s going to ask, but I’m sure it’s going to be good. And I’m kind of curious to see because Brexit has taken place and it doesn’t seem like anybody’s too happy with it, but so I may ask him some questions too, but, uh, for behind the scenes and updates, you can always follow me on Instagram at Lynette Zang, and also Twitter at ITM trading underscore Zang.

And of course I hope you guys are really enjoying the podcast. We’re going to make a few little changes with that as well. So make it better. And we’re always trying to make things better and better and better. But if you haven’t already subscribed, please do so and make sure you hit that bell. So you get notification when we go live and also please leave us a comment, uh, give us a thumbs up and share, share, share. It is so critically important that we reach the most number of people that we possibly can with all of these videos, because you guys know ignorance does not make you immune. It just leaves you vulnerable. And you also know this a hundred percent. It is time to cover your assets. And here at ITM trading, we use the wealth shield, which is based on the strategy that I started working on back in 1987 when I started studying currencies. So it’s based on repeatable patterns, but it enables you to sustain your current standard of living and even take advantage of the shift into the completely new system and take advantage of the reset because there will be some, I guarantee you, there are always 1% at the top they’re taking advantage of this. Never let a good crisis go to waste. Well, I’d rather that the wealth transferred your way, that their way. So let’s make that happen. And until next we meet, please be safe out there. Bye-bye.

Sources:

https://www.wsj.com/articles/global-stock-markets-dow-update-05-11-2021-11620708764

https://www.wsj.com/public/resources/documents/IcTW6zqd9XHVDl8RYDOb-WSJNewsPaper-5-13-2021.pdf

https://www.wsj.com/articles/credit-card-debt-keeps-falling-banks-are-on-edge-11620725580

https://www.wsj.com/articles/u-s-home-prices-surge-higher-pricing-out-many-buyers-11620748183

https://www.wsj.com/articles/hedge-funds-face-backlash-from-europe-in-bond-market-11620639114

Podcast: https://anchor.fm/itmtrading

SGT Report Interview: https://www.bitchute.com/video/EllIUKr2t20C/

Follow Lynette Zang ⬇️

Instagram: https://www.instagram.com/lynettezang/

Twitter: https://twitter.com/itmtrading_zang