Are We Prepared for the Fallout? (Don’t Ask Yellen)

On the economy. There are increasing reports and surveys around the U.S. that lending is getting tighter following the recent banking stress. Are you seeing evidence of that in the data? And do you agree with the IMF assessment that a credit that a credit crunch increases the likelihood of a hard landing, whether in the U.S. or globally? So I’ve not really seen evidence at this stage suggesting a contraction in credit, although that is a possibility. I believe our banking system remains strong and resilient. It has solid capital and liquidity, and the U.S. economy is obviously performing exceptionally well with continued solid job creation, inflation gradually moving down, robust consumer spending. So I’m not anticipating a downturn in the economy, although of course, that remains a risk. Yeah, the Fed disagrees with her. The IMF has some stuff to say on it.

CHAPTERS:

0:00 Introduction

1:35 Perception Management

3:10 Short-Term Inflation Expectations

5:37 Securitized Consumer Credit

9:17 Global Financial System – High Inflation

11:47 Nonbank Vulnerabilities

14:50 Geopolitics & Fragmentation

17:00 Gold Above 2K

20:37 Thrivers Community

21:40 Wrap Up

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

On the economy, there are increasing reports and surveys around the US that lending is getting tighter following the recent banking stress. Are you seeing evidence of that in the data and do you agree with the IMFs assessment that a credit, that a credit crunch increases the likelihood of a hard landing, whether in the US or globally?

So I’ve not really seen evidence at this stage suggesting a contraction in credit, although that is a possibility. I believe our banking system remains strong and resilient. It has solid capital and liquidity and the US economy is obviously performing exceptionally well with continued solid job creation inflation, gradually moving down robust consumer spending. So I’m not anticipating a downturn in the economy, although of course that remains a risk.

Yeah, the Fed disagrees with her. The IMF has some stuff to say on it, and we’re gonna talk about that, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service physical gold and silver dealer, but really specializing in strategies to enable you to be as self-sufficient and independent as possible, creating a community to survive where we are in this currency’s lifecycle trend, which is frankly at the very end.

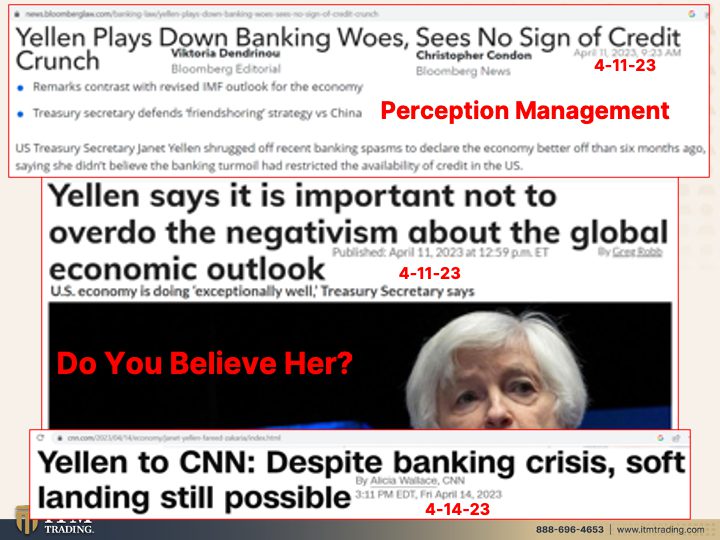

But what you just heard from Treasury Secretary Yellen was all about perception management, nothing to see here, no credit crunch because we don’t have a banking crisis. The economy is strong even though 70% of Americans are concerned about their financial security and more than half don’t have any savings. But what are you worried about? Everything’s gonna be just dandy. She sees no sign of credit crunch and, and what banking woes, what are you talking about here? Yeah, but the remarks contract with revised IMF outlook for the economy. And I gotta say US Treasury Secretary, Janet Yellen shrugs off recent banking spasms to declare the economy better off than six months ago, saying she didn’t believe the banking turmoil had restricted the availability of credit in the US. Mm-Hmm <affirmative>. So it’s just important not to get so negative. Everything is hunky dory and just fine. We have a great global economic outlook and certainly the US economy is doing exceptionally well. And hey, by the way, despite the current recent banking crisis, a soft landing is still possible. Oh, and by the way, I have this bridge in Brooklyn. If anybody’s interested, let me know. Cause you gotta ask yourself, do you believe her? I don’t. That’s for sure.

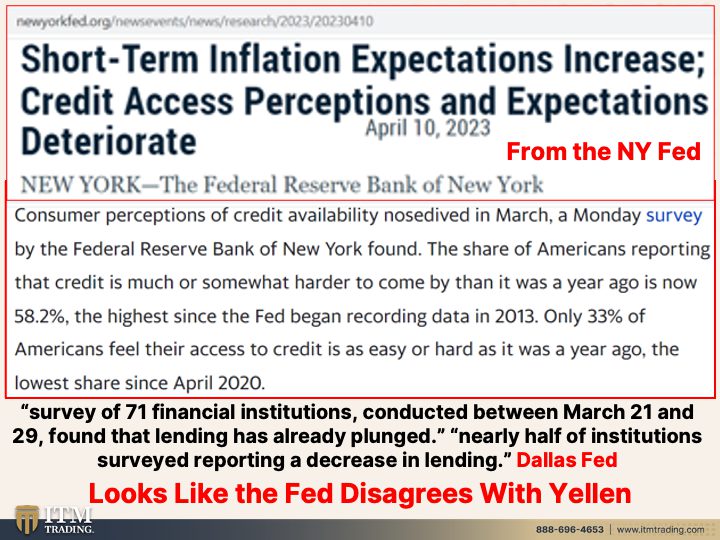

Short term inflation expectations increase. Why? Because prices are continuing to go up. Credit access perceptions and expectations deteriorate. This is from the New York Fed. So in other words, the perception that you can even get credit after this banking crisis, it’s deteriorated. It’s worse than it was. And since we are on a debt-based system, the whole growth is based upon debt, which we’ve talked about, frankly, probably ad nauseum. Consumer perceptions of credit availability, nose dived in March. Monday survey by the Federal Reserve Bank of New York found the share of Americans reporting that credit is much or somewhat harder to come by than it was a year ago, is now 58.2% the highest. Since the Fed began recording data in 2013, only 33% of Americans feel their access to credit is as easy or hard as it was a year ago. So it’s the same, basically the lowest chair since April, 2020. What’s that really telling you? That’s telling you that Yellen is out there doing her job, which is frankly really the same as when you see Jay Powell or any of these guys go in front of an audience. Their job is to keep you calm and keep you in the system, but don’t believe them because we’re watching this whole thing deteriorate. And I guess Yellen never bothers to pay attention to anything that any surveys from the Fed either. A survey of 71 financial institutions conducted between March 21st and 29 found that lending has already plunged. This is from the Dallas Fed. Nearly half of institutions surveyed reporting a decrease in lending. I’m telling you, I just don’t think she bothers to look at anything that the Fed’s doing because they just contradicted her right then and there. But nothing to see here, folks.

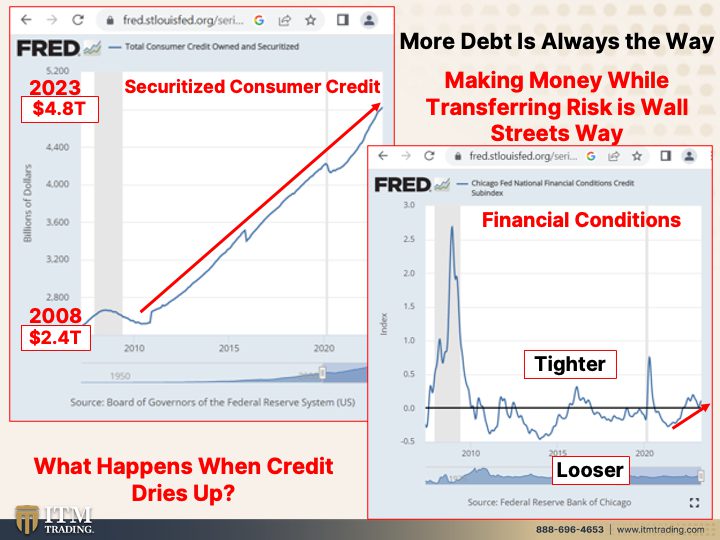

And in the meantime, this is securitized consumer credit, which is over 4.8 trillion. So what does securitize means? It means that a lot of people went out, spent on their credit cards and then Wall Street took that debt and those debt payments and turned them into securities and sold them back to you. Pension plans, mutual funds, ETFs, etcetera. Can you see the problem if the consumer can no longer pay these bills? And oh, by the way, in a debt-based system, it absolutely requires you, not you personally, but a collective you to continue to take on more and more and more debt. This is how money is created in this system. And you can see from 2008 at 2.4 trillion during the crisis, it’s gone much higher. These are credit cards, these are revolving loans that have been turned into products and given to you, sold to you. Do you see the problem in that? Especially as we go into recession, more debt, it’s always the way and making money, Wall Street, while transferring that risk is Wall Street’s way. So yeah, maybe they keep a little bit of the risk on their books, but most of it is transferred to you because when these consumers stop paying these credit card bills, whoever owns this crap, is the one that’s going to pay for it. I mean, it’s really genius. They get paid going in, they get paid going out, they get paid while you’re waiting and you are taking all of that risk. I don’t think it’s what I like personally, but these are the financial conditions, right? Anything above this line is tighter. So you see what happens inside of a crisis is credit conditions get quite tight. So maybe Yellen is looking at this and going, well, they’re a little higher but not so bad. Below the line is looser. So maybe they aren’t looking at any of the other stuff. Just this one graph and going, ah, me. Well, I guess it’s not so bad it’s gotten a little tighter, but maybe it’s not so bad. But here’s the problem. The Fed is intentionally raising rates to make these credit conditions tighter, to slow down the economy so that they can maintain price stability, which are workers not asking for more money to meet the inflation. I mean, what happens when the credit dries up? Do you remember what happened in 2008 was like within 24 hours credit dried up, but maybe we’re paralleling what happened between, you know, between JP Morgan taking over Bear Stearns in March and then it became apparent, apparent to the world in September. Maybe it’s gonna look a little different. I don’t know. But what I absolutely a hundred percent know without even one doubt in my mind, is simply this. That we are at the end of this currency’s life cycle and we have to transition and we need a really big crisis in order to do that.

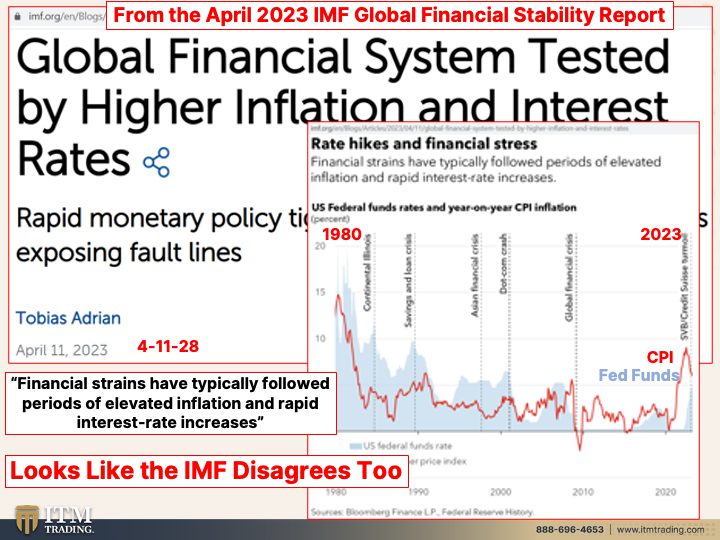

So this is from the April, the most current April, 2023 IMF Global Financial Stability Report. And there are three key parts, and of course you’ve got the links. So you’re welcome to go in and I encourage you to do it, read this whole report. But the global financial system is tested by higher inflation and interest rates, really as global central banks try and and pull back all the inflation that’s been created by all these years of money printing. Yeah. And you can see on this graph, oh, took my little laser pointer away, that the tightening rapid monetary tightening always precludes a crisis. Whether it was the, in continental Illinois, the savings in loan crisis in the eighties Asian financial crisis and the.com crash. But between these two was also when they started with the with, with the derivatives, the speculative derivative trading. And this is when Wall Street adopted that. So it’s gotten worse. Maybe it’s helped manage and hide some things, but it’s the derivatives that hidden risk that we can’t see that a hundred percent will topple this system. This is the great, the global financial crisis, which was never repaired. It was just papered over. Now we’ve gotta pay the piper. You can’t just get away with this garbage forever. You can get away with it longer than you would think possible, especially if you can change the rules as you go along. But the reality is, is that at some point the bill comes due and the bill is due now. Financial strains have typically followed periods of elevated inflation and rapid interest rate increases. And we’re seeing that again. So this is the red is the CPI, the blue is the Fed funds. So you can see as they’ve raised the Fed funds rate to fight the inflation, you’ve ended up with a crisis. And I don’t think this time is any different. So the IMF is also disagreeing with Janet Yellen. Shocker, 1980, 2023, and here we go.

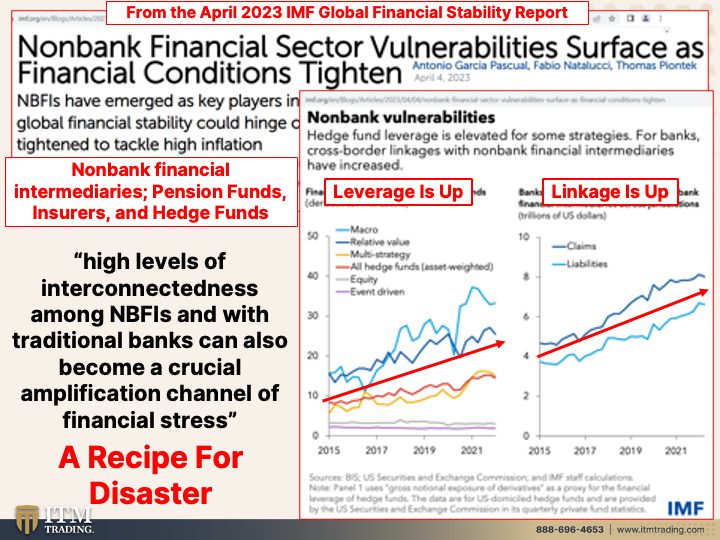

Now, part two, non-bank financial sector vulnerability surface as financial conditions tighten. So NBFI’s are non-bank financial sector vulnerability. So these are corporations, but these are, they say how much safer the banking sector is. But the problem is, is they’re all interconnected. So does it really matter where the crisis begins? It can translate very rapidly, but non-bank financial sectors have emerged as key players in the financial sector and global financial stability could hinge on the resilience as policy is tightened to tackle high inflation. So who are these non-bank financial intermediaries, pension funds? Insurers. So you go, well, oh, they have insurance. Well, you know, it’s only as good as the counterparty, right? And as long as the insurance company can pay out those claims and hedge funds, that’s who we’re talking about here. And what you see is that the leverage has grown substantially and it’s certainly grown substantially since 2008. They only went to 2015 in this report. But in every single area, relative value, macro, multi strategy, all hedge funds, equity and event driven are the bottom. Those have kind of stayed there, but the leverage is up in all of these non-banks and it is, it makes this whole system very, very vulnerable and the linkage is up. So that’s what I’m trying to tell you is that even though these pension funds, insurers, and hedge funds, they are incestuously interconnected with the banking segment.

So they can make things look like they want. But the reality is still the reality and leverage is up and that means vulnerabilities, high levels of interconnected and interconnectedness among NBFIs and with traditional banks can also become a crucial amplification channel of financial stress. You think? This is a recipe for disaster. And see, the thing is, is we’ve got so many different avenues that are dangerous to us. We don’t know which one exactly is going to hit first, or if a lot of these are used to cover up other issues that they’re hoping to postpone a little bit longer or not. Because remember, we need people to be very, very scared, scared enough to accept whatever garbage, those that are currently in power wanna cram down your throat and still remain in power. I don’t want these guys in power. They’ve done such a crappy job. Well, I guess it’s your perspective.

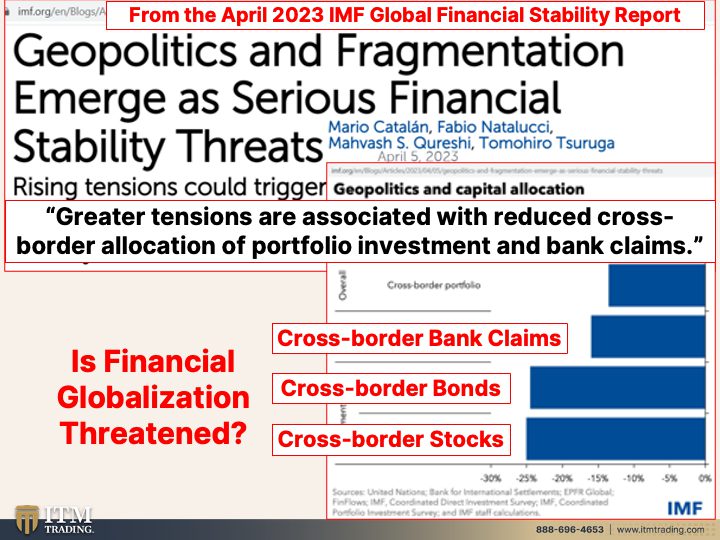

For the public. They’ve done a really crappy job for the 1%. For those that have been chosen to win, they’ve done a great job. So they want them to remain in power. I don’t. But on top of those two issues, big issues, you have geopolitics and fragmentation emerge as serious financial stability threats, rising tensions could trigger cross-border capital outflows and increased uncertainty that would threaten macro financial stability. Let’s look at that because we know a lot of the geopolitical issues between not just Russian Ukraine, which frankly looks like a proxy war for China and the US but even between China and the us aside from that, that’s heating up, it’s heating up in the Middle East. It’s heating up everywhere. And what their, their concern is, is that cross border. So okay, investors in the US invest in stocks and bonds in China or other places. So if there’s geopolitics that come into place, those funds don’t flow as well as they would like them to. Greater tensions are associated with reduced cross-border allocation of portfolio investment and bank claims. These are cross-border claims. This is cross-border bonds that’s down on the claims. It’s down about 15% and on the bonds and on the stock, it’s down cross-border stocks, it’s down 25%. So financial globalization is threatened even as central banks and governments are trying to further integrate the currency into a one world order. So as all of this fragmentation, a smoke screen? Look over here, but don’t look back here. This is really where the power is. Don’t look over here, we’re gonna find out, but that’s what I suspect.

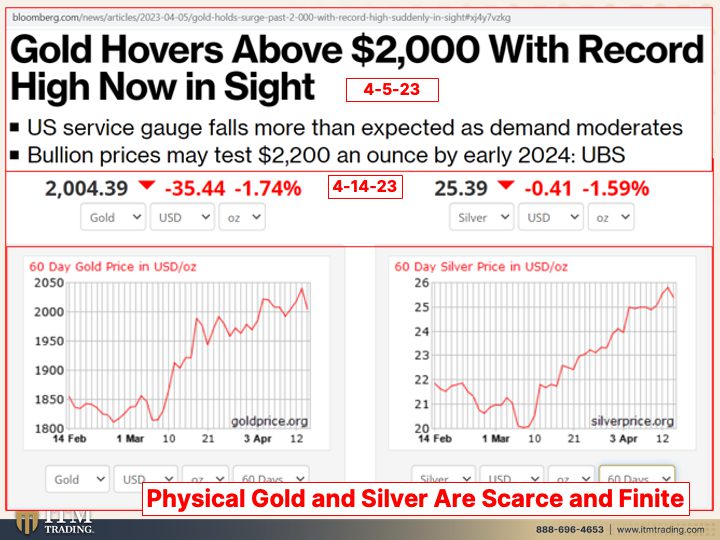

And in the meantime, the true flight to safety is gold, but not ETFs. Not intangible gold, not gold, that you can’t hold in physical gold because gold is the primary currency metal. And you know, with record high in sight so far below its fundamental value, but this is what they do that overnight reset against. And you know, we’re talking about the fed raising rates one more time and then holding it there. But how about when we get into a crisis, what are they gonna do? They’re gonna do that because that’s all that they have left. So let’s take a look at what’s been happening with, with both spot. That means the contracts, because we know there’s been a divergence between the physical metals and the contract metals. But what I think is really interesting is that gold has created a triple top. Now it’s pulled back a little bit because after all, if the Fed raises interest rates, gold doesn’t pay interest. Well, gold doesn’t have to pay interest. It’s the safest thing that you can do and has the broadest base of buyer. The treasuries are trying to, the treasury bonds require interest to attract people buying them just like, Hey, Goldman Sachs and Apple are putting together a high yield savings account because Goldman needs more deposits to go gamble with. But hey, if you perceive it as safe, at any rate, once this breaks above that triple top, then what you have is a major breakout and we will see gold spike on the spot market. It’s already doing that in the physical market. With silver. Oops, let me go back. I went a little too far with silver. You can see it’s not really created a triple top yet. But in both of these cases, the physical metal out there is gone. Neither one of them reflects the true fundamental value. This is just going back 60 days. So two months. And you can see that it’s higher and higher with little pullbacks because they want you to think that this is the value of gold and this is the value of silver. And it’s not. It is for trading purposes and for suppression purposes because after all, what do we know? We know a rising goal price is an indication of a failing currency, but we also know how much demand has grown and demand absolutely outpaces supply. When you come to the physical world. In the digital world, well, you can create an unlimited supply. That’s nothing that’s easy peasy. But in the physical world, there’s a finite amount and we know central banks are buying it like crazy. And frankly, I always think that you should do what the smartest guys on any given topic are doing for themselves and they’re buying gold. How about you?

So if you haven’t done it yet, make sure that you click that Calendly link below, set up a strategy session with your gold and silver specialist, get your strategy in place and get it executed. ASAP. Now, we have recently, just a couple weeks ago set up the Thrivers community. We’ve been working on that for three years. And it’s a place where like-minded individuals can come and share the knowledge and gain knowledge because everybody has a gift to give. So come join us and give that gift. It’s really important that you are as prepared as possible and we’re talking to people in there from all around the world and setting up groups. So maybe there is a community near you that you don’t even know yet, or you can create that community near you that you don’t even know yet. This is really important. We’re trying to do our part to bring communities together, both verbally like this, but also physically if possible. You can load, download that app on the web at www.thriverscommunity.com or download The Thrivers Community on the app store or Google Play. And if you haven’t done it yet, make sure you subscribe. Leave us a comment, give us a thumbs up and share, share, share. Because ignorance does not make you immune. It just leaves you vulnerable. And I don’t want anybody to be vulnerable. These guys, these guys that have control of this printing press, which I wish that would, I wish they would run out of it, but they’re about to because when people lose confidence in this crap, there’s your hyperinflation. I hope you’re ready for it. And remember, financial shields, they’re made of physical metals. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.cnn.com/2023/04/14/economy/janet-yellen-fareed-zakaria/index.html

https://www.newyorkfed.org/newsevents/news/research/2023/20230410

https://fred.stlouisfed.org/series/NFCICREDIT