A Golden Summertime Opportunity

Some things tend to happen rather consistently. The Sun comes up. Tides go in and out. Even birthdays and April tax deadlines keep a special place in your minds’ calendar. For the most part I have not found anyone who can turn a profit simply by having the Sun come up or the tide wash in, and tax refunds and birthday card receipts tend not to make it into the savings account, but I am about to share a re-occurring secret with you that your banker and financial adviser don’t want you to know about, and my timing is perfect.

Some things tend to happen rather consistently. The Sun comes up. Tides go in and out. Even birthdays and April tax deadlines keep a special place in your minds’ calendar. For the most part I have not found anyone who can turn a profit simply by having the Sun come up or the tide wash in, and tax refunds and birthday card receipts tend not to make it into the savings account, but I am about to share a re-occurring secret with you that your banker and financial adviser don’t want you to know about, and my timing is perfect.

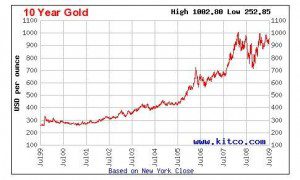

Quite often markets are cyclical, and over the last decade or so gold has proven not to be an exception. June not only typically marks the beginning of summer, but also the beginning of a summer lull in the gold market. A careful analysis of annual gold charts will reveal that from 2002 thru 2010 gold could judiciously be bought at a lower price per ounce in June and July than it would cost to buy that same ounce a month or two earlier on June 1st. One might take this information as a reason not to buy gold in June, and that person would have only half of the information you will a few moments from now.

But before I let you in on the rest of the secret, I want you to flash back to Economics 101. You may not remember your teacher or the classroom, but the next two concepts we seem quite familiar: “Price is derived by the interaction of supply and demandâ€, and “Buy low – Sell high.†What we are discussing in this article is how these two exact factors come to play in tandem nearly every summer, and no one invites you to the “Financial Windfall Ball†to cash in your newfound chips at the end of the year. You have part one – buy as you can in June and July at prices below the June 1st close. Step two is Easy: Forget about doing anything else until at least December. This is where things get interesting.

If you read technical charts, and take the time to do so (these are as easy as “Clifford the Big Red Dogâ€, I promise) you will see that with the exception of 2008, there was a very substantial rise in gold from August 1st to December 31st from 2002 through 2010. In fact here they are:

Increase in Gold price per ounce from Aug 1st through December 31st:

2002:Â Â Â +9.77%

2003:Â Â Â +17.42%

2004:Â Â Â +10.99%

2005:Â Â Â +20.81%

2006:Â Â Â +3.60%

2007:Â Â Â +26.23%

2008:Â Â Â -3.80%

2009:Â Â Â +16.70%

2010:Â Â Â +17.00%

2011: Your Opportunity

Lest we not forget, 2008 was a year of financial crisis. Bear Stearns, Lehman Brothers, Stock Market Crash, Foreclosure, Real Estate Bubble – those are all keywords to remind us of 2008. In June and July of 2008 gold prices actually surged as concerns were ignited over the frailty and condition of the markets and banking system. Had you bought gold at the high price of $975 in July of 2008, you would have had to wait until March of 2009 to exit without a loss. The vast majorities of Americans were not dealt so kind a hand and are still working to restore their nest eggs.

Just as you may make an IRA contribution every year, or set aside money for income taxes, I propose you begin setting aside funds for this market. Buy in during June and July at levels below June 1st’s close and wait. Balance your checkbook, look at your accounts and their returns’ and re-allocate while Supply, Demand, and buying low are all on your side, and enjoy the summer.

(I must remind you that past performance it no guarantee of future profits, and that physical gold should be owned as a long-term hold)