A GOLDEN PLAN FOR REAL ESTATE: Housing Market Opportunities Become Clearer… By Lynette Zang

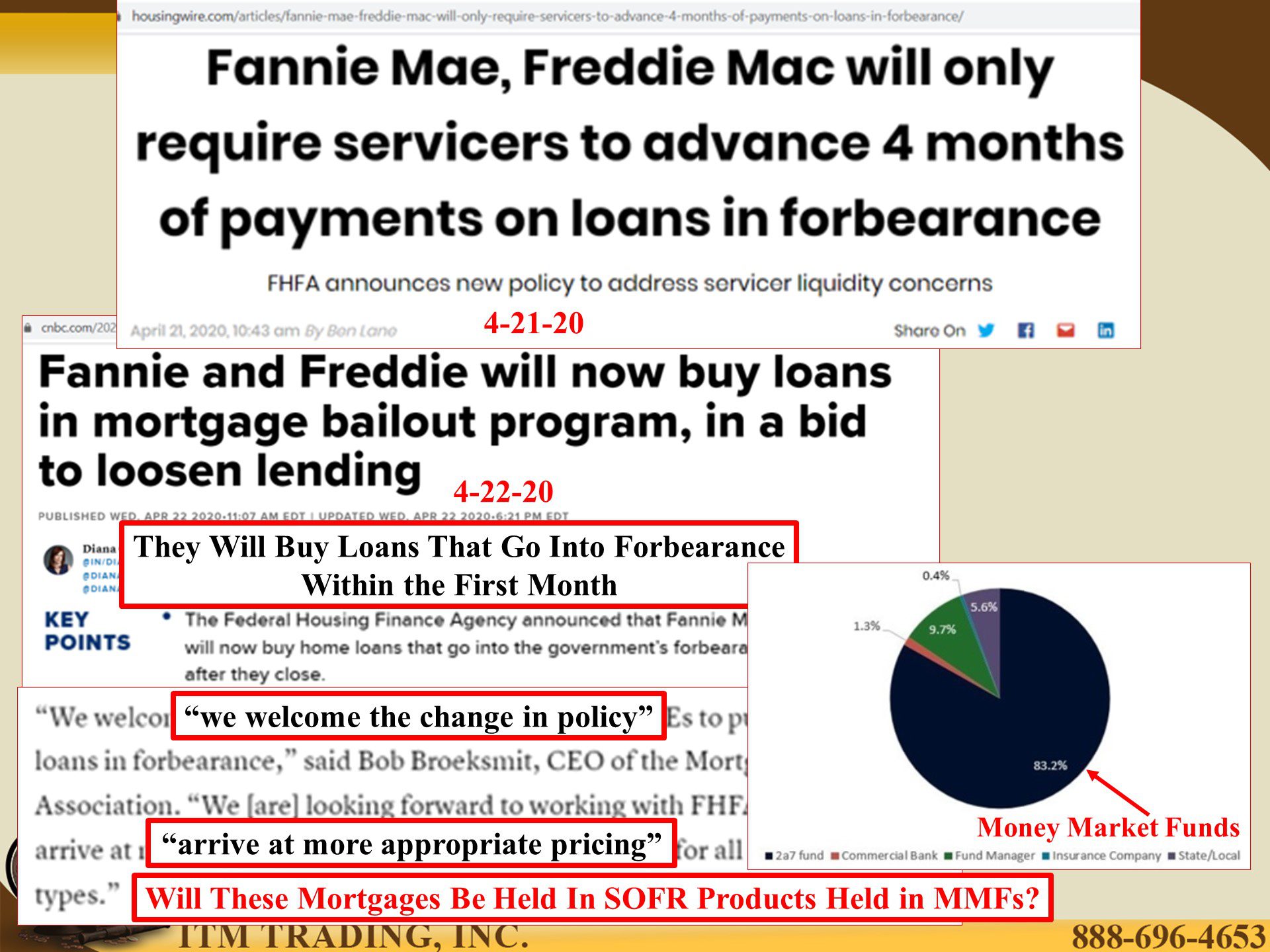

As we know, real estate spending is 30% of GDP. Wall Street turns mortgage debt and payments into fiat money products that are held in pensions, retirement plans and individual accounts through REITs, Mutual Funds and ETFs.

Additionally, GSEs (Government Sponsored Enterprises) like Fannie Mae issue debt that funds mortgage purchasers, tied to SOFR (new LIBOR interest rate alternative benchmark) in effort to create a new market in preparation of LIBORs 2021 death. Most of this issuance is held in Money Market Funds.

Have more questions that need to get answered? Call: 844-495-6042

Data indicates that the real estate bubble began to pop in December 2018 as the world entered a global slowdown.

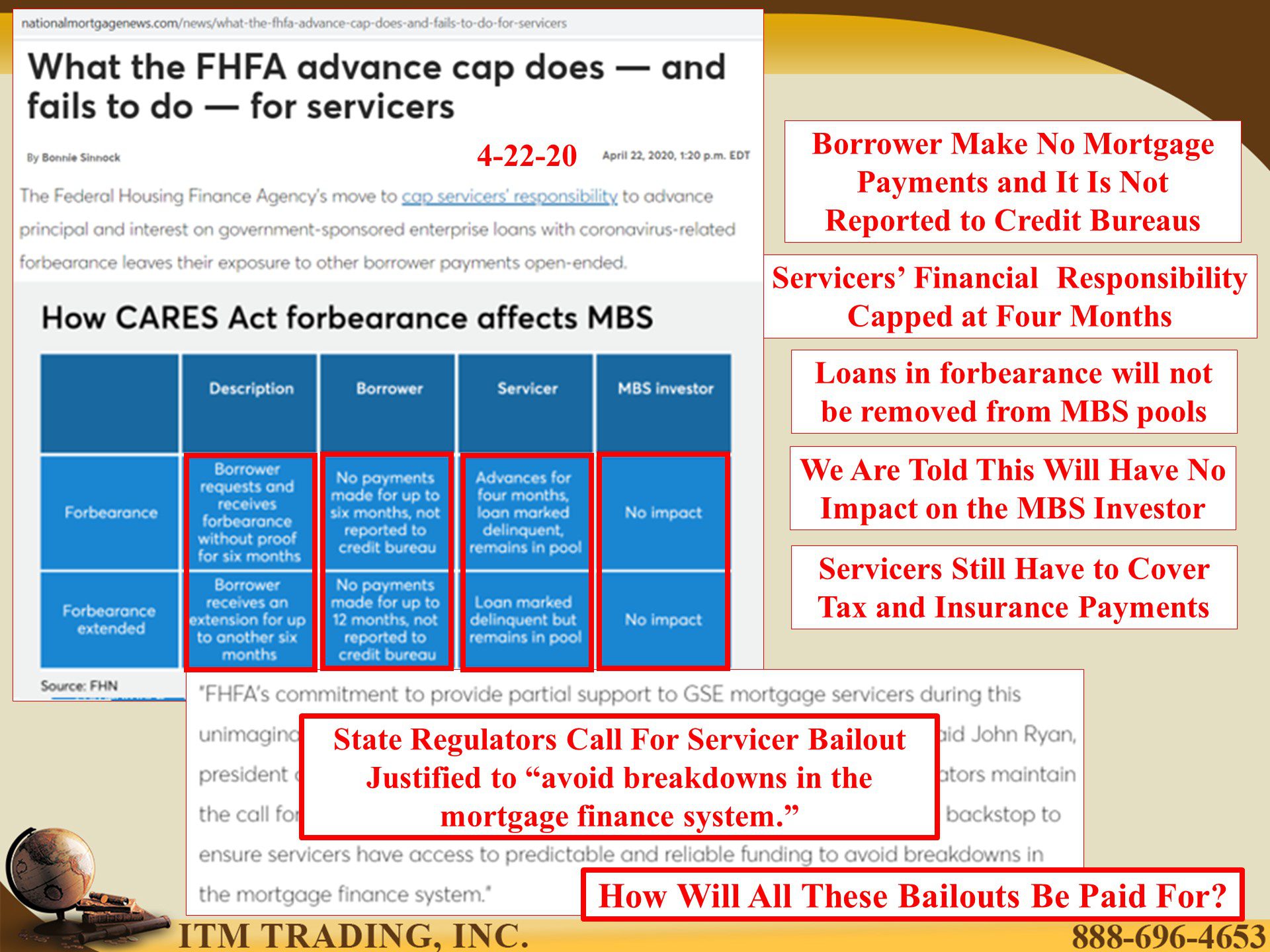

Covid-19 turned a downturn into crisis as witnessed by 3 million Americans forced to skip mortgage payments and requesting mortgage forbearance (ability to stop mortgage payments for up to 12 months) and an official rent moratorium as government lock downs force over 30,000,000 onto unemployment so far.

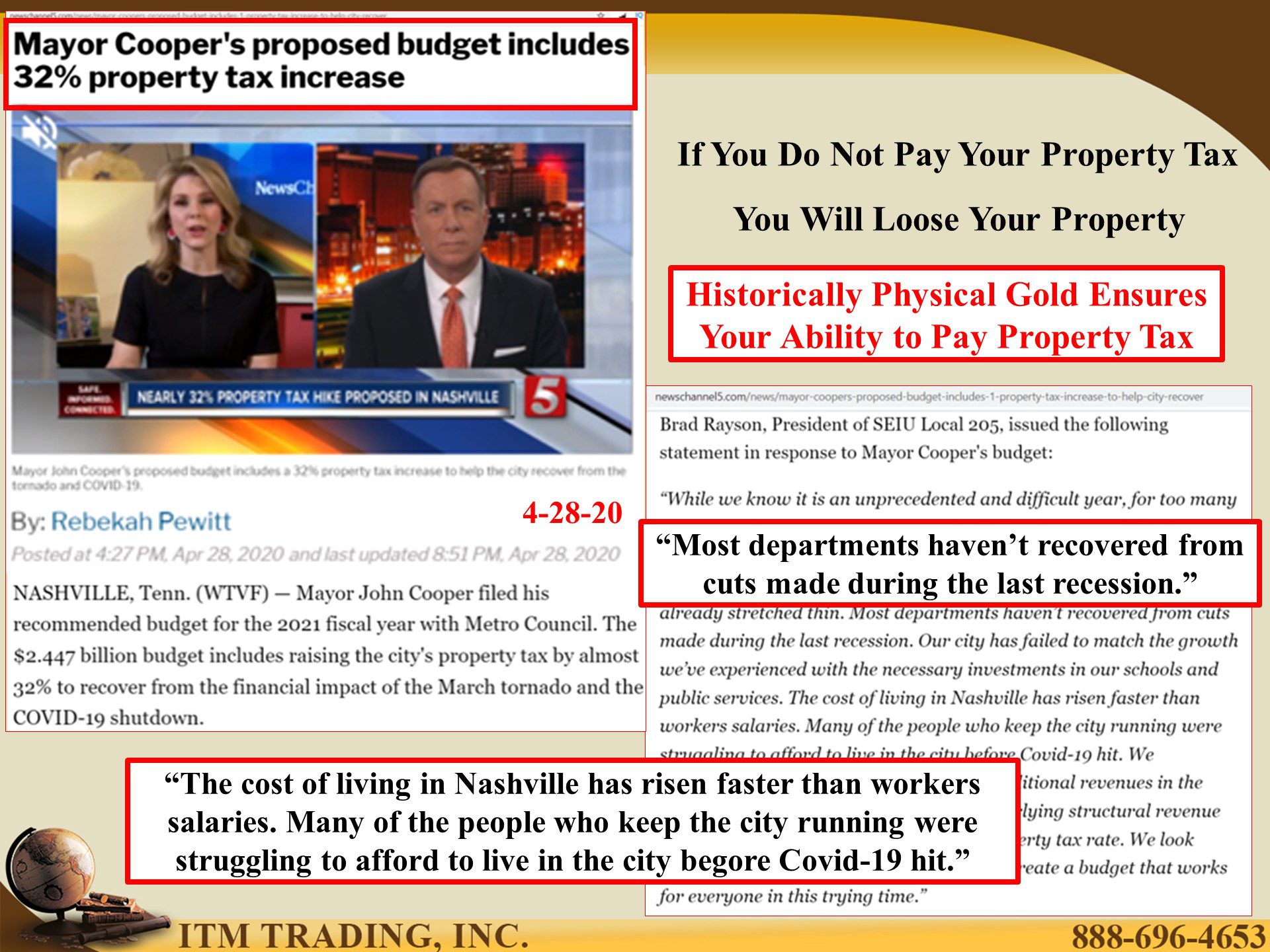

The cost of Covid-19 is overwhelming already stretched budgets of state and local governments. With the Federal government bailing out corporations and wall street, the debate on bailing out states rages on. Understand that states and local governments generate most of their income from taxes; sales, income and property, so when income falls and costs rise in one area (unemployment) which is out of government control, they will have to raise taxes where they can, on immovable property, real estate.

What I’m mentioning here is just the tip of the iceberg when it comes to the real estate crisis, but you must keep in mind that there is always opportunity in crisis and this time is no different.

What are the current risks as a real estate owner and what are the opportunities?

First of all is having a savings safety net so you can maintain making mortgage payments and/or having the ability to pay off the mortgage loan. Second, during the depression in the 1930’s, even if your mortgage was paid off, if you could not pay your property taxes, you lost your house. Therefore, the ability to pay your real estate taxes as they rise is of huge importance. Finally, the most likely outcome is that, as this crisis continues to unfold, massive amounts of real estate will be flooding the market and driving prices down. Having a store of value (also known as dry powder) to buy bargains with, will put you in position to take advantage of those future opportunities.

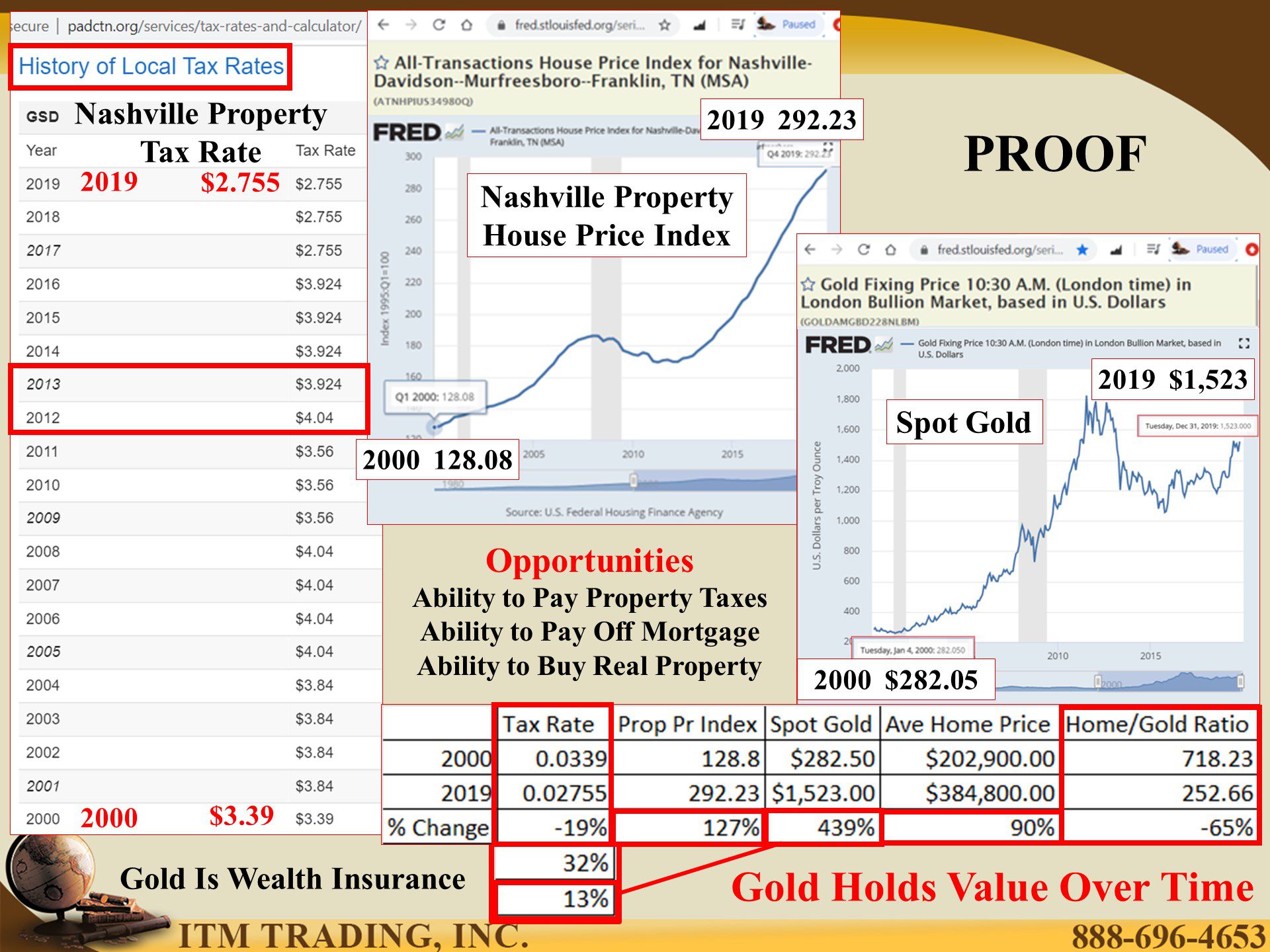

This is where gold, as a long-term store of value, becomes possibly your best asset and I have proof.

Mayor Cooper of Nashville Tennessee has put a 32% property tax increase into the new budget. That seems like a pretty big jump but may be what we all see moving forward. So I decided to see if the historical norms held true this time.

I looked at three golden opportunities: how gold ensures your ability to maintain property tax payments, how gold provides the ability to payoff a mortgage in one lump sum and how gold puts you, as an investor, into a position to take advantage of the crisis now underway.

What I found, and you will see, is that gold has continued on with its 6,000 year job of being a store of value and amply positions all of those above mentioned opportunities and more.

Between 2000 and 2019, property tax rates in Nashville have actually declined by 19%, while property prices have increased by 127%. Spot gold also increased during this time, but by a whopping 439% (through December 31, 2019). So it should be easy to see that had you bought gold to pay property taxes or pay off your mortgage, you can do so easily, even with a 32% property tax increase.

How about the ability to buy a house? In 2000 it would have taken 718.23 ounces of gold to buy an average priced home. At the end of December you only needed 252.66 ounces, so the trend should be clear. Just keep in mind that the historic average is 25 ounces of gold (or the equivalent) would buy an entire city block, buildings and all.

I would say that’s a lot of opportunity.

Slides and Links:

http://www.padctn.org/services/tax-rates-and-calculator/

https://fred.stlouisfed.org/series/ATNHPIUS34980Q