BLINDED BY NOMINAL CONFUSION: Recognizing Opportunities During Hyperinflation by Lynette Zang

There are three keys I believe everyone should have the ability to recognize to make fully educated choices.

- What is the fundamental or true value of this asset? This is the only way to know if something is undervalued, fairly valued or overvalued. Therefore, do I want to buy it, hold it or liquidate it. Which we will look at in Part 4 of this series.

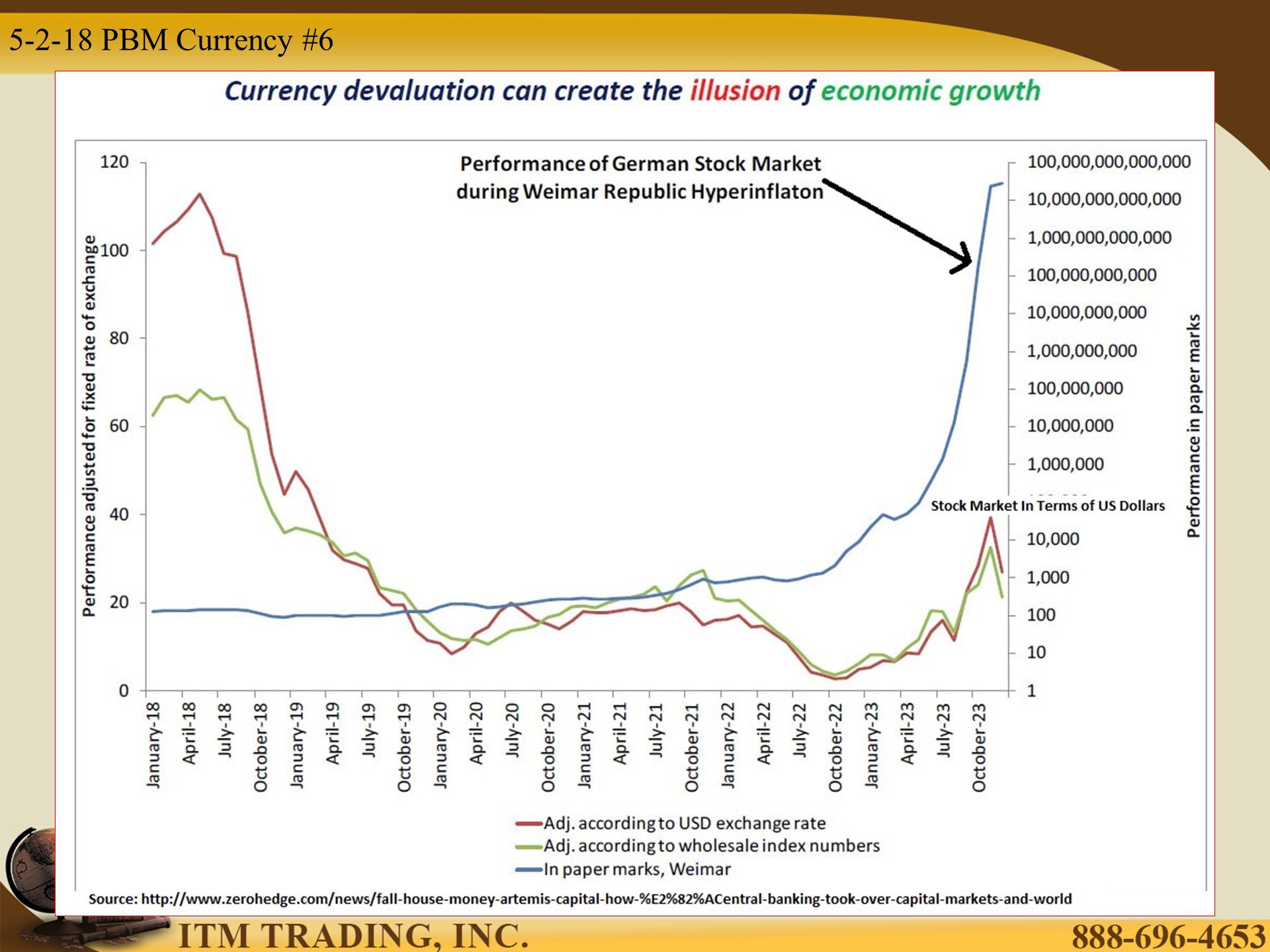

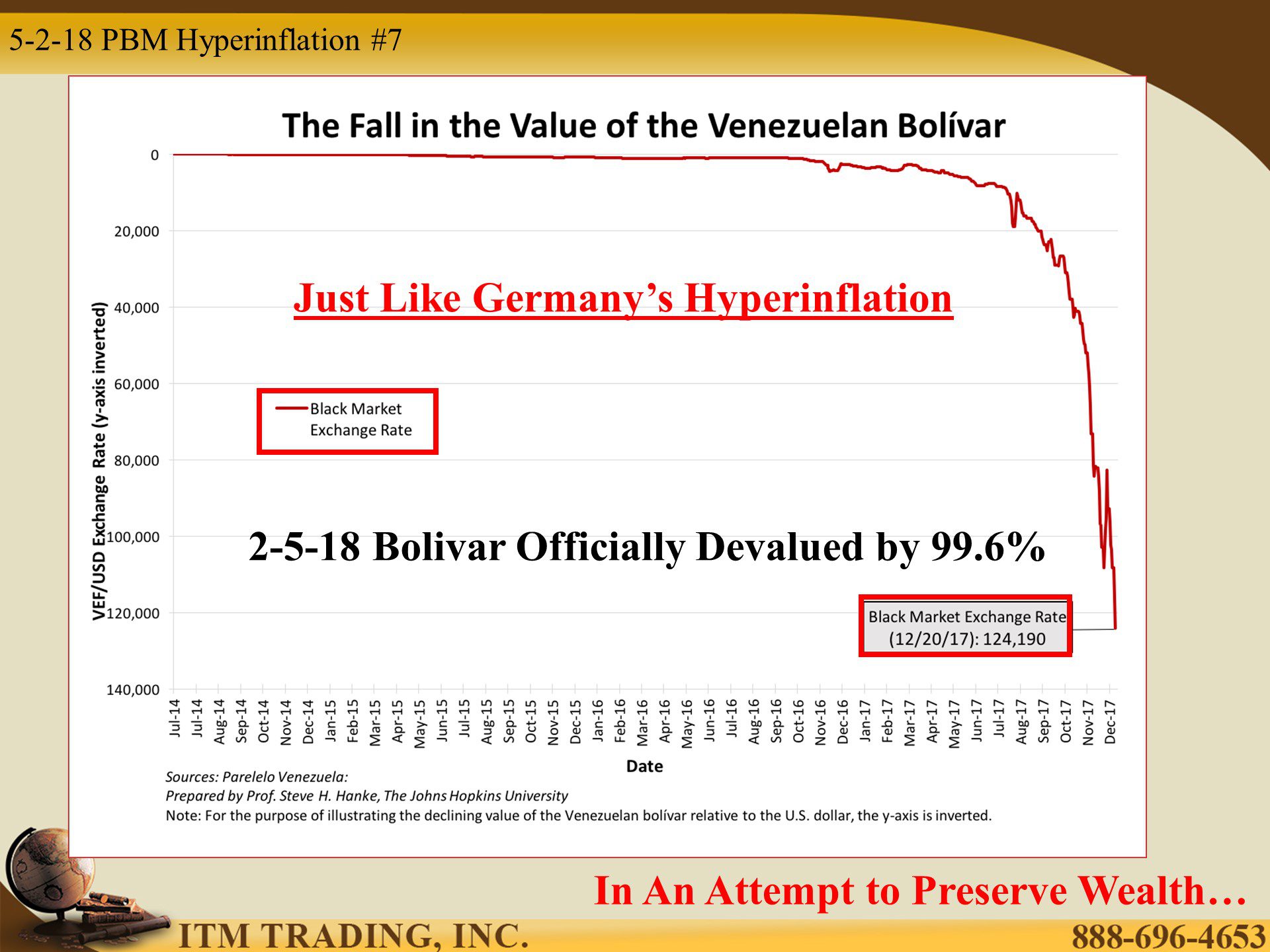

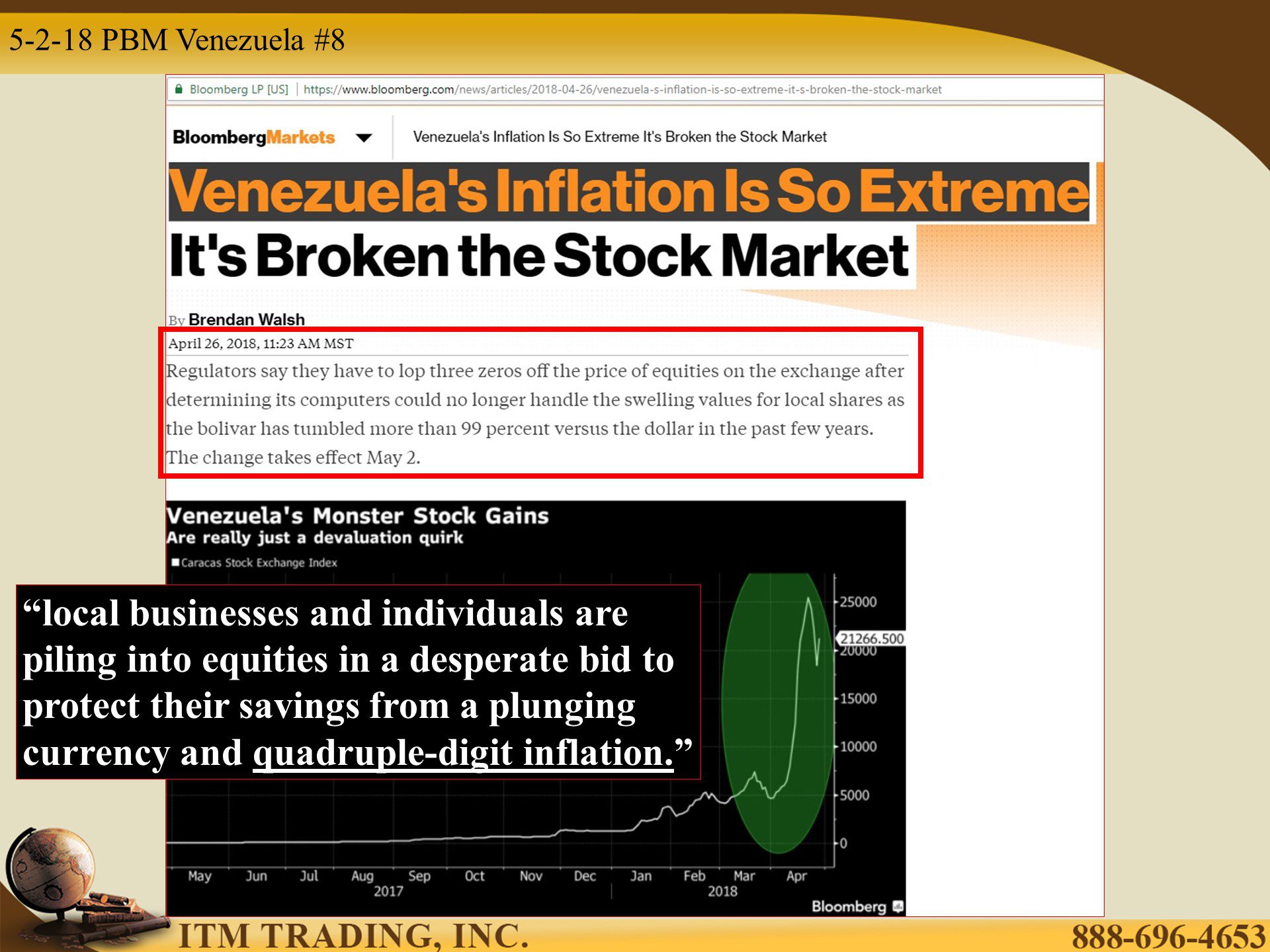

- Is the long-term trend positive or negative? We’ve been trained to think short term and believe there is value in bankers’ creations. This makes it important for them to go up. But in truth, that simply hides the true trend which is in the loss in value of money. 1,000,000,000 x 0 = 0 Which you will see today.

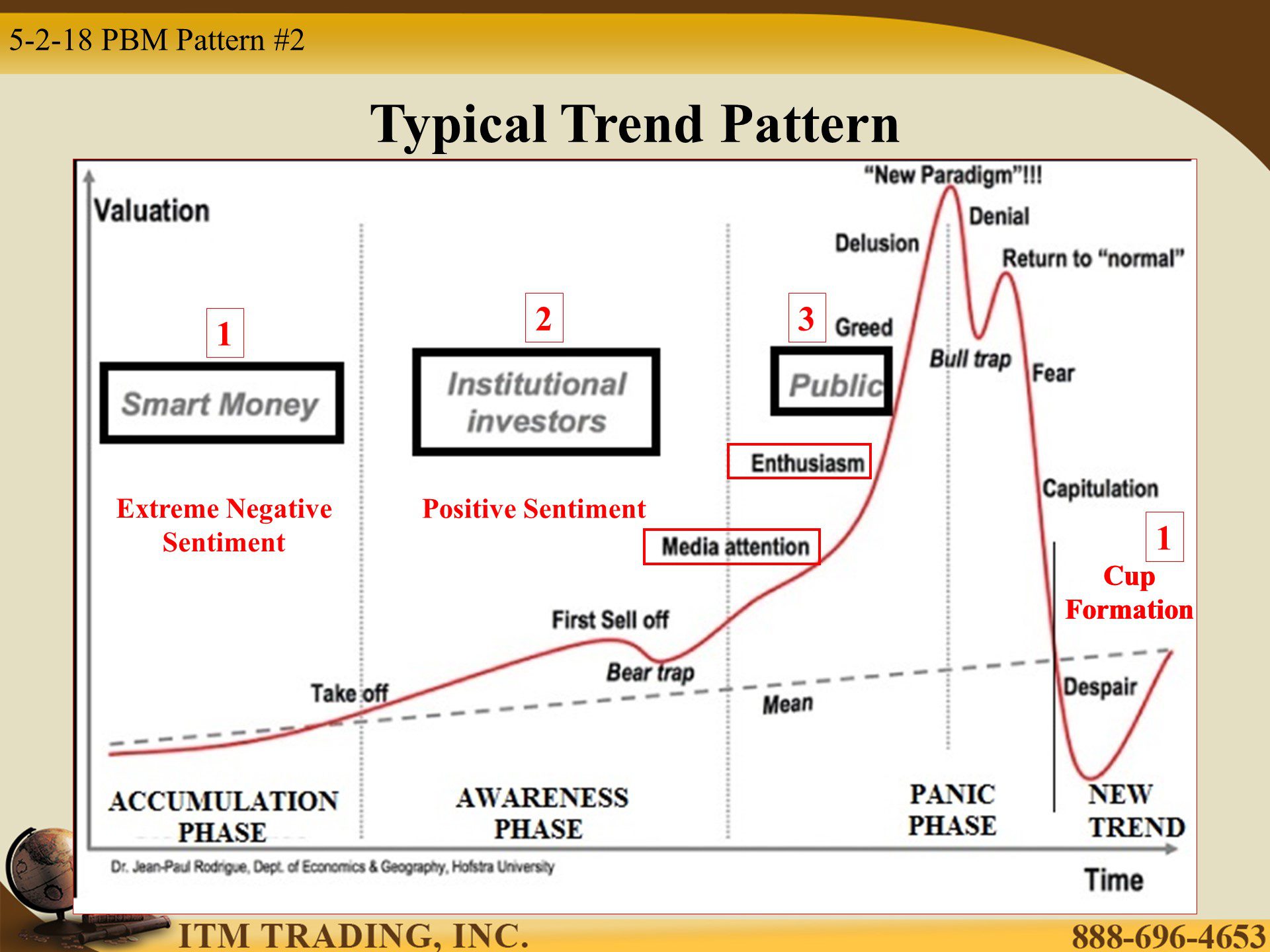

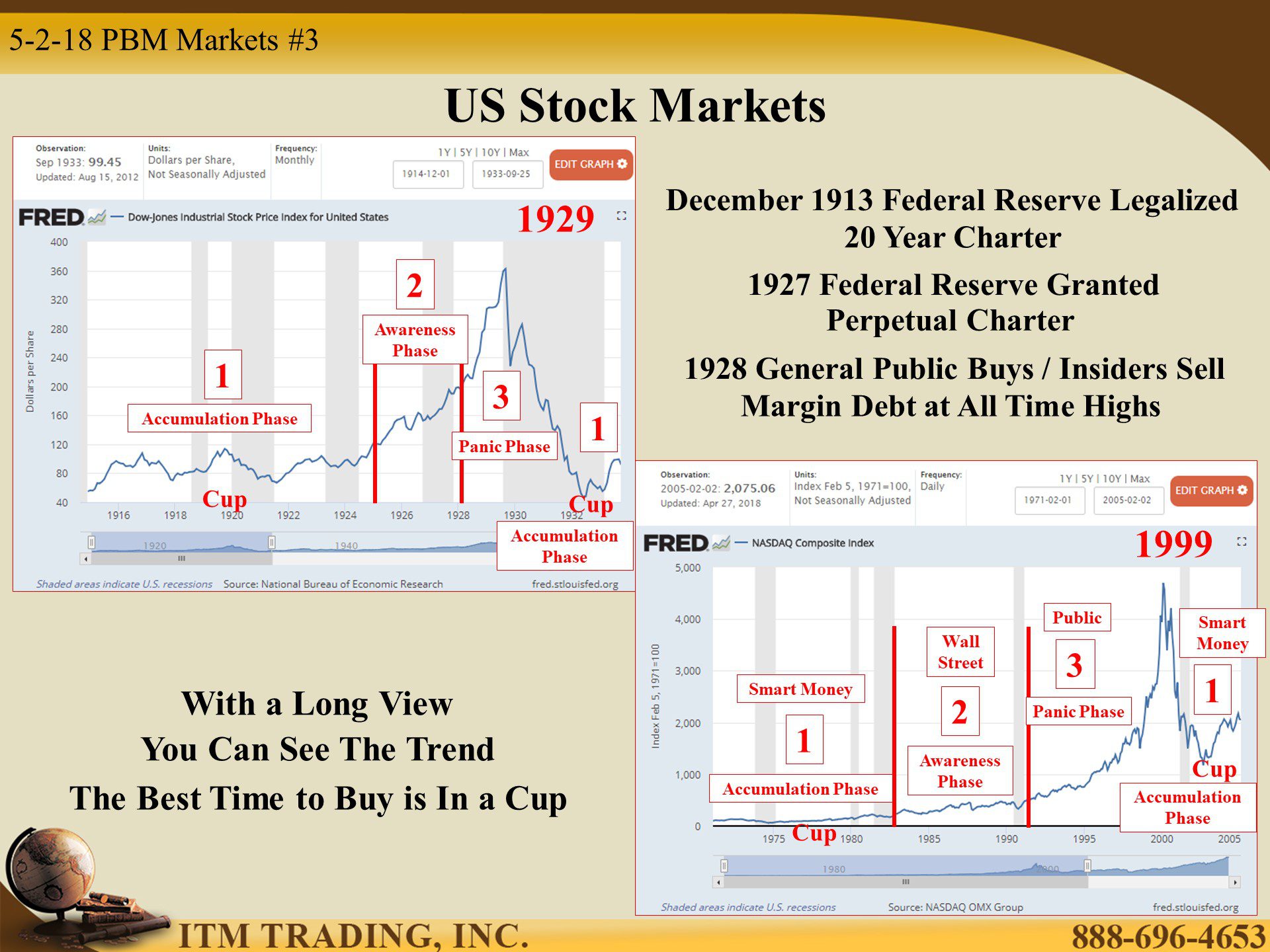

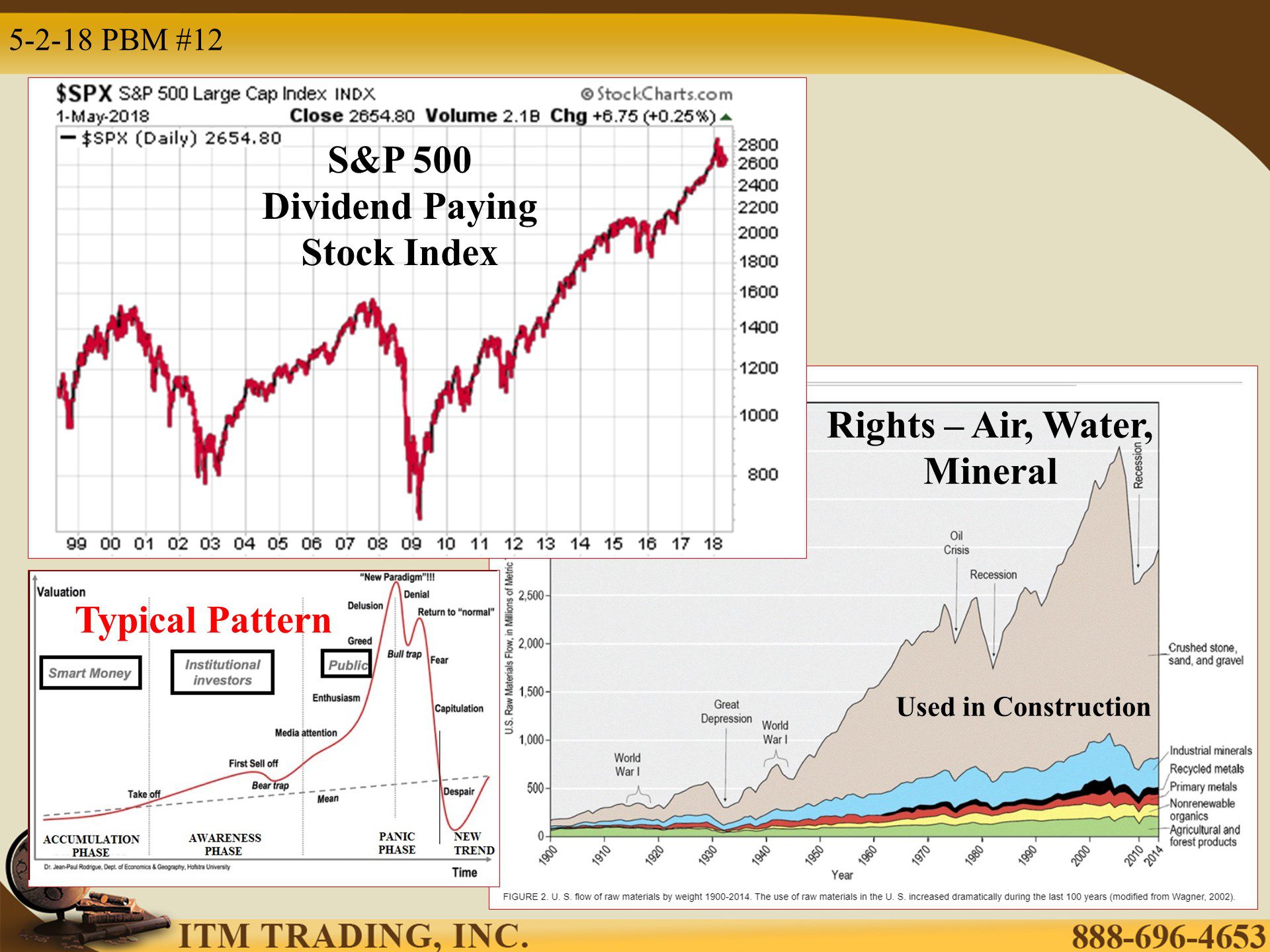

- Where are we in the trend cycle? There are 3 main phases in every trend; the accumulation phase when the smart money buys, the awareness phase when wall street buys and the panic phase when the public buys. This is what we will walk through today.

The Wealth Transfer Pattern

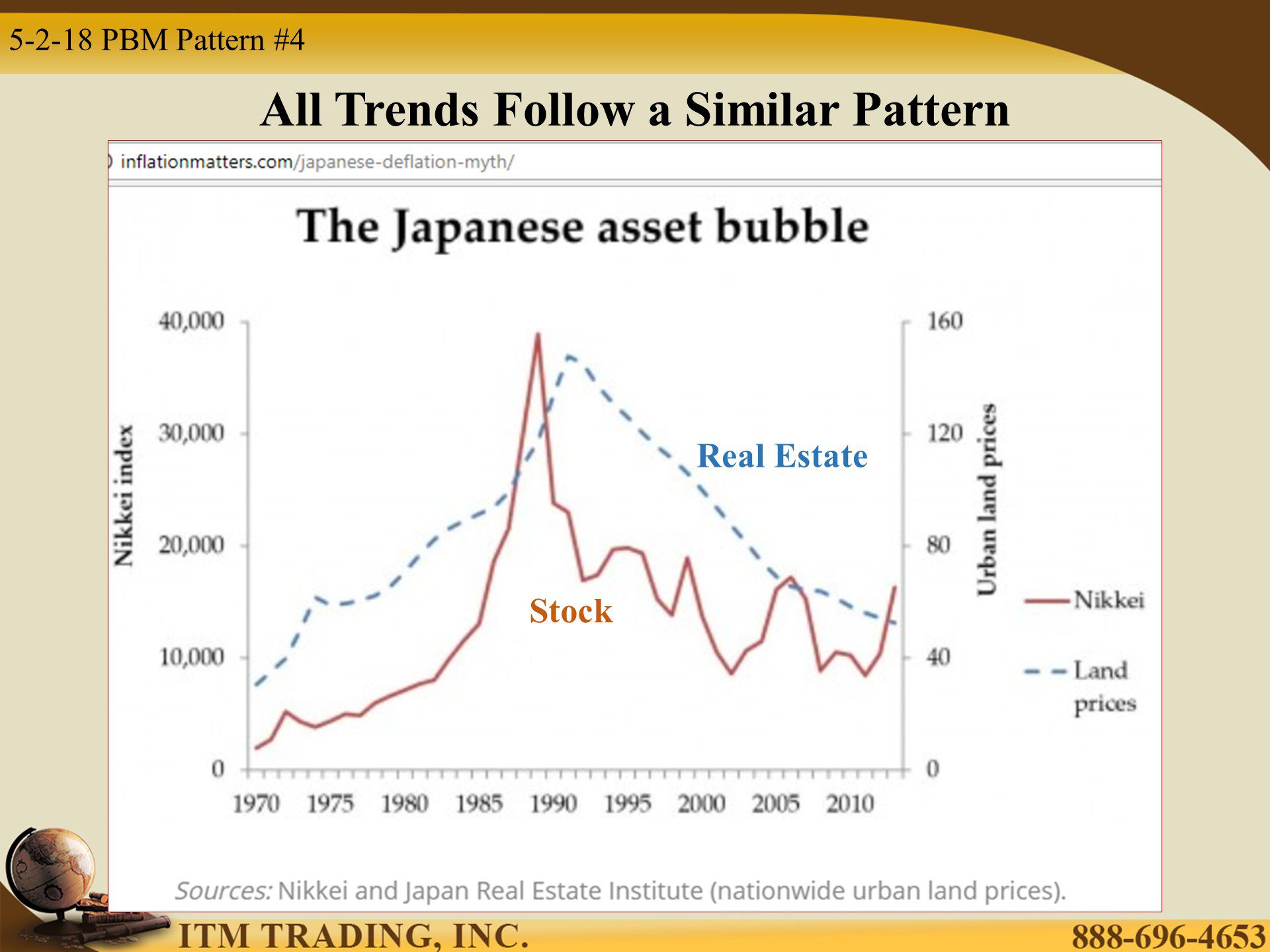

Here’s a secret; Every trend cycle follows a similar pattern.

The accumulation phase, when the smart money buys, recognizes an undervalued circumstance and quietly “accumulates. Market sentiment is typically black bearish (Extremely Negative). The public hears this negativity and shies away at the best time to buy, because it is likely to be near the cheapest point.

If you learn what this opportunity pattern sounds and looks like you’re way ahead of the public, who typically buys near the high as smart money sells to lock in gains. Guess who’s left holding the bag when the bottom falls out?

This is all part of wealth transfer. The goal of the strategy we employ here at ITM, is to have wealth transfer YOUR way.

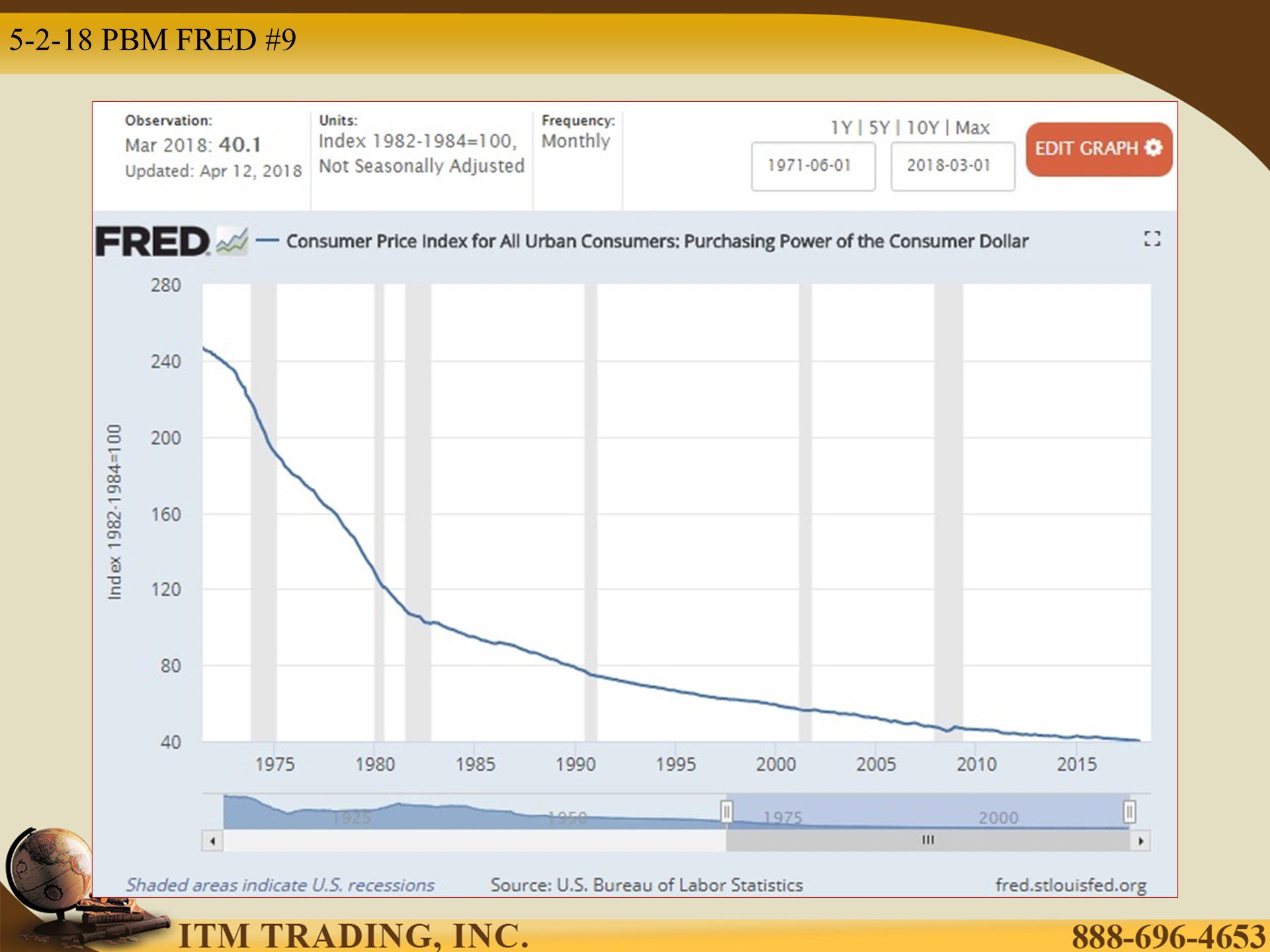

Three Cups For Gold

According to the Federal Reserve, 96% of the value of the US Dollar has been removed since 1913. That loss sped up once Nixon handed full control over inflation to bankers (closed the gold window.) Spot gold, a perception management tool, was created to generate volatility and inspire the public to stay away from physical gold, which is NOT a bankers’ creation.

Physical gold is good money and its rise in terms of fiat money, reveals the nominal confusion lie. This is why gold has been heavily manipulated over time. It is also why, no matter what manipulation is thrown at it…since 1971, spot gold has generated two full accumulation patterns. It is in process of generating a third.

What About Income Producing Assets?

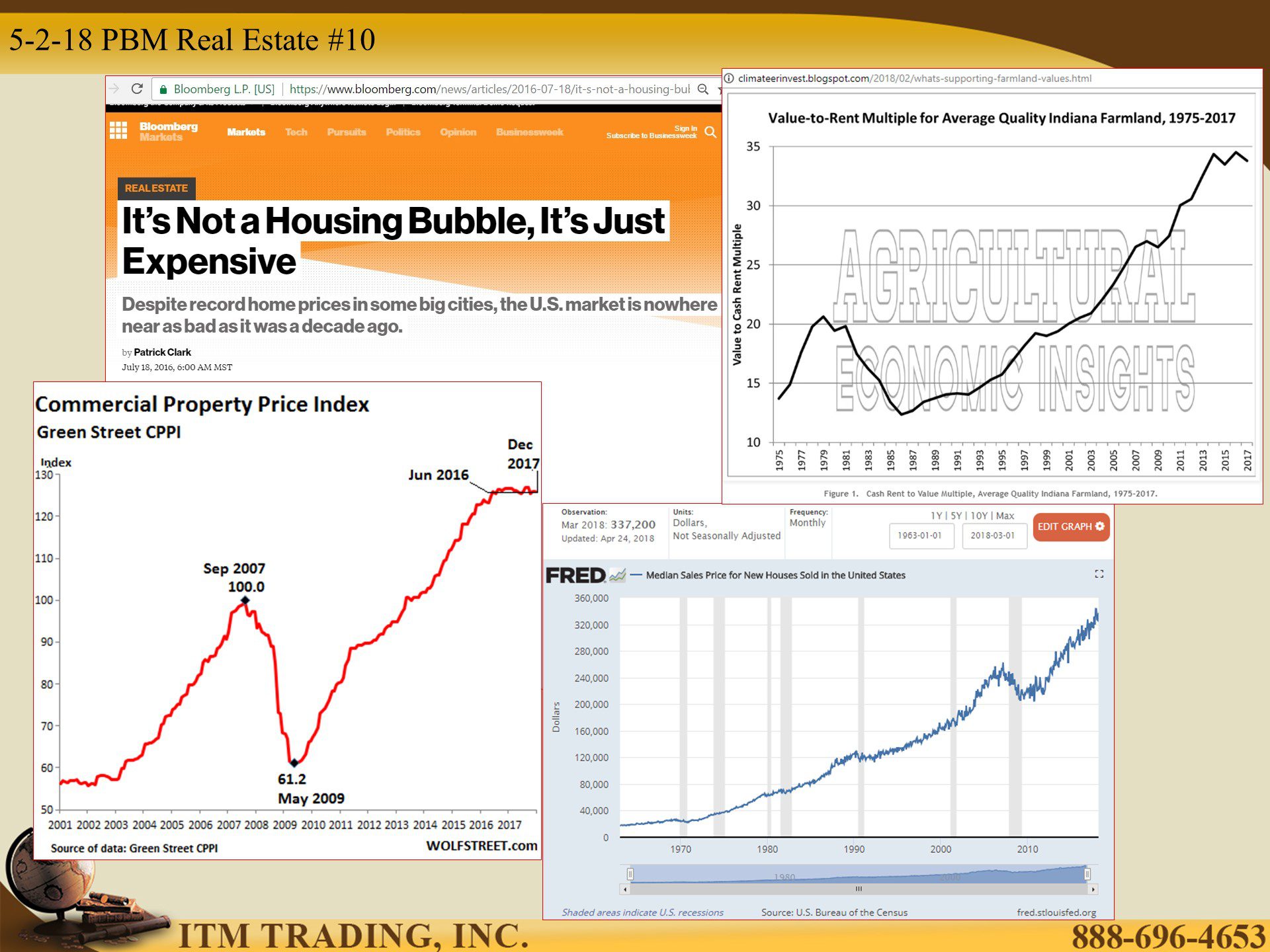

Real estate, dividend paying stocks and rights leasing are all income producing tangible assets that are now severely overvalued to all historic measures, with the support of global central banks. The nominal price rise of these assets hides the loss of value of the fiat currencies.

But the current financial system died in 2008. Since then central bankers have used up the postponement tools. They tell us the interest rate system will completely shift by the end of 2021.

Opportunity Ahead

Once people realize the shift is in process they will want to fly to safety, but will truly safe assets be available then or will they have been accumulated by smart money?

Slides and Links:

https://transportgeography.org/?page_id=9035

https://fred.stlouisfed.org/series/NASDAQCOM

https://fred.stlouisfed.org/series/M1109BUSM293NNBR

https://fred.stlouisfed.org/series/GOLDAMGBD228NLBM

https://tradingeconomics.com/venezuela/stock-market

https://www.zerohedge.com/news/2017-12-20/venezuelas-grim-reaper-current-inflation-measurement-current-annual-rate-4327

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://wolfstreet.com/2018/01/15/commercial-real-estate-prices-suffer-first-down-year-since-2009/

https://www.everycrsreport.com/reports/R45117.html#_Toc507581366

https://fred.stlouisfed.org/series/MSPNHSUS

http://climateerinvest.blogspot.com/2018/02/whats-supporting-farmland-values.html