BANKS WILL MODIFY YOUR CONTRACTS DURING THE RESET by Lynette Zang

The Most Important Number in the World

What I’m going to show you today is the most likely trigger to blow the financial system up where it is NOT repairable; and how the banks have the legal right to change YOUR contracts on mortgages, auto loans etc., without your permission.

Originally LIBOR was supposed to reflect the actual cost to banks to borrow from another bank (interbank lending) overnight. But as the 2007 – 2008 crisis unfolded, the Interbank Lending Market plunged as banks refused to lend to each other. The market never recovered.

In 2012 it was revealed that more than 15 banks, including the Bank of England, had been manipulating the LIBOR with the express purpose of boosting profits. It was also revealed that most of the “submission†were just an opinion and not actually based on real rates. Can you see how easy it is to manipulate that number?

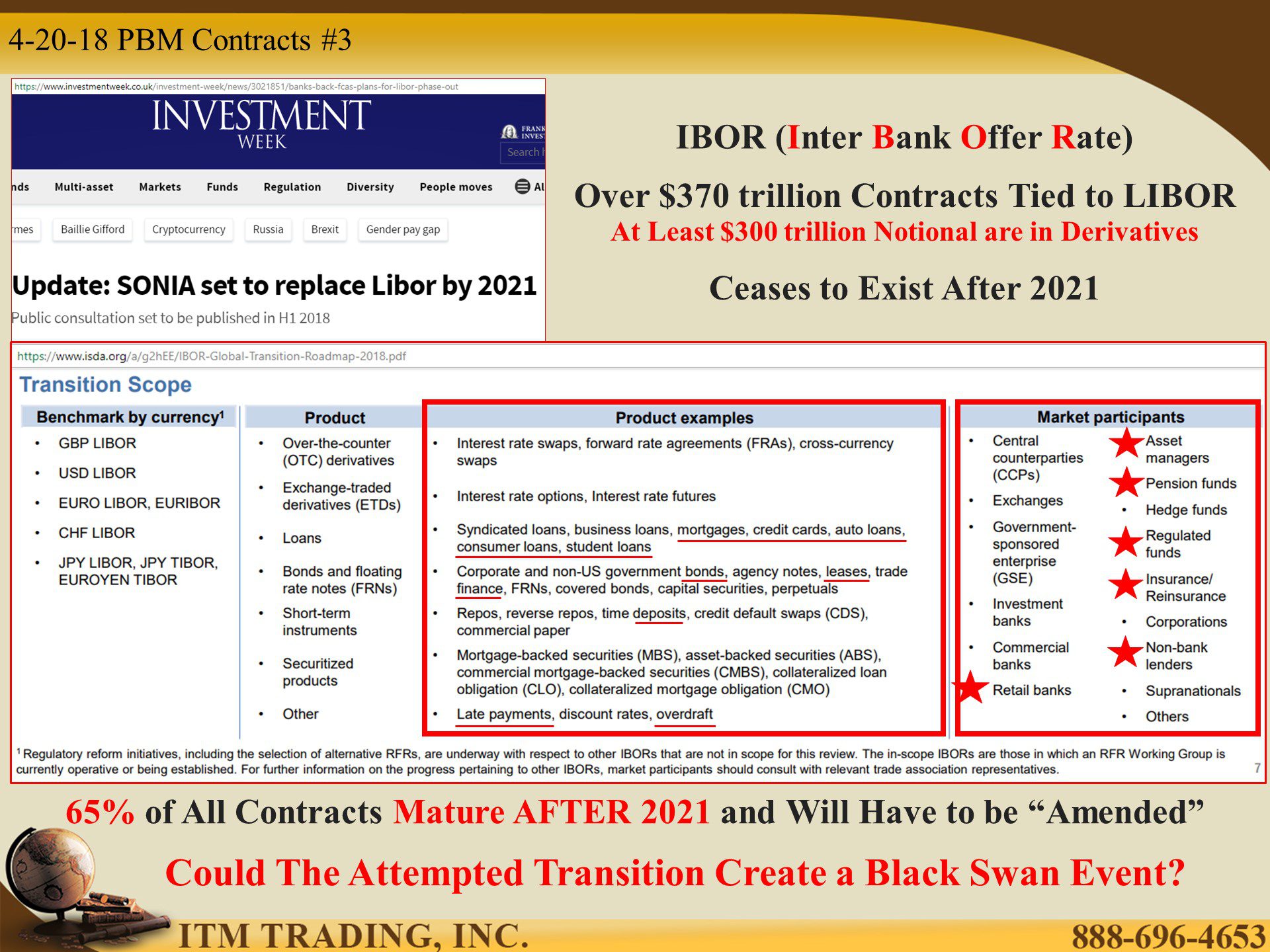

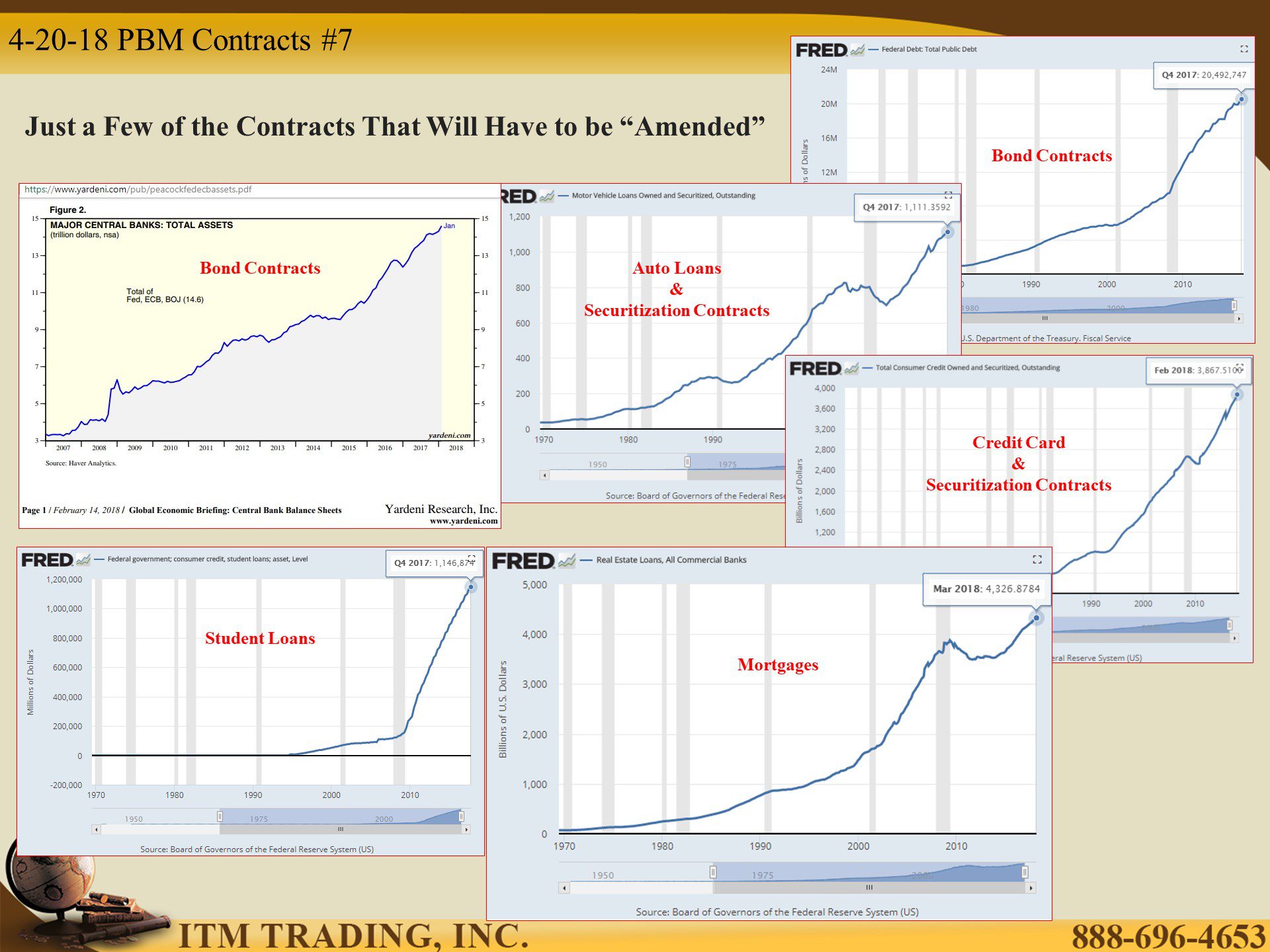

It’s considered the “Most Important Number in the World†because over $370 trillion in contracts are based on the IBORS (Inter Bank Offer Rate) yet even today 70% of the 18 banks that submitted rates used their “expert opinion†in setting those rates.

In July 2017 the FCA (Financial Conduct Authority) announced the end date (2021) they would require banks to submit their “expert†opinion on rates. After that the IBORs will be dead and buried.

What happens to those contracts that mature AFTER 2021? How will all those contracts be converted to the new benchmark? What happens if they make a mistake?

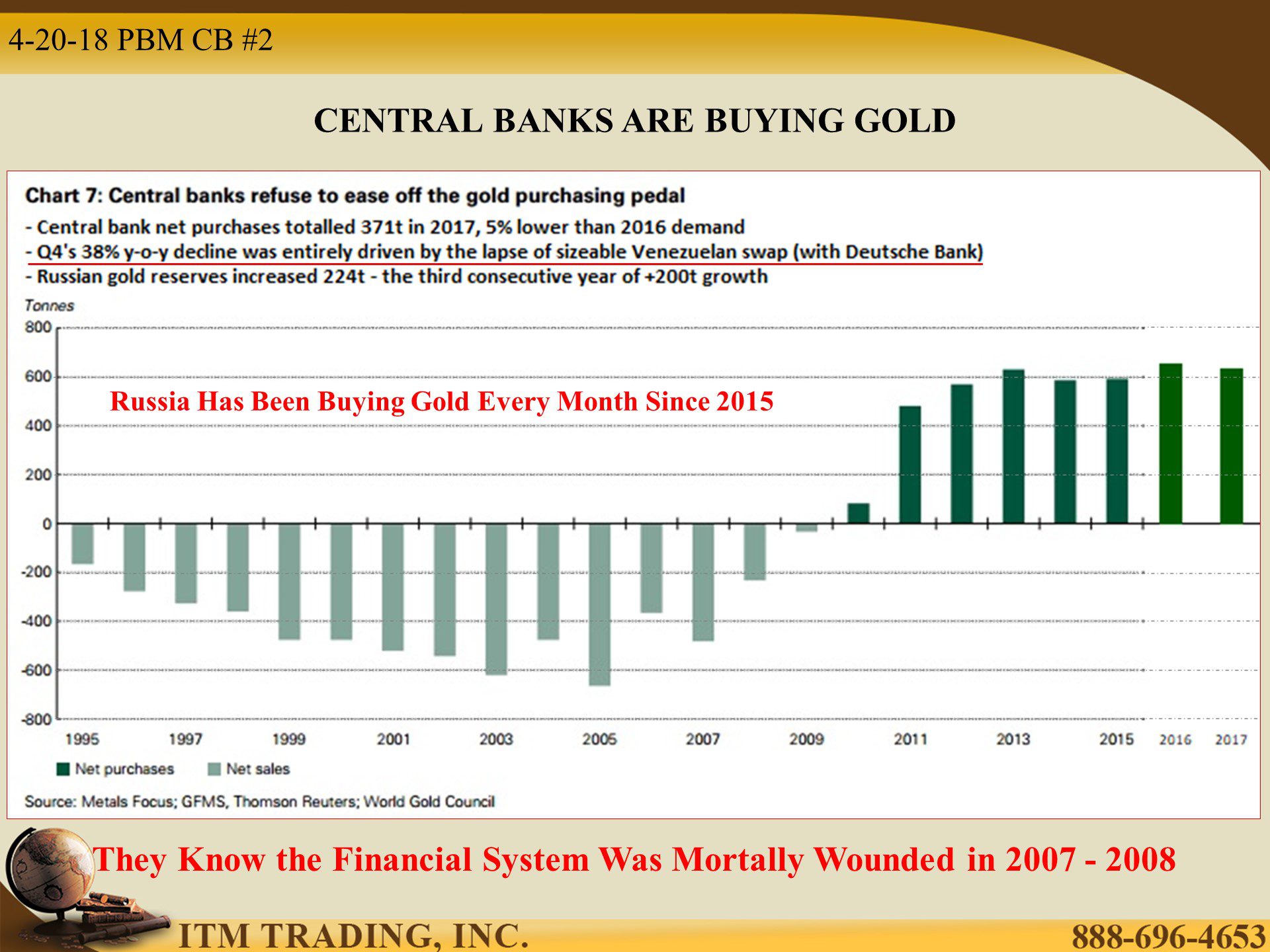

Could this be why central banks and governments have been voraciously accumulating gold?

How Does This Impact Me?

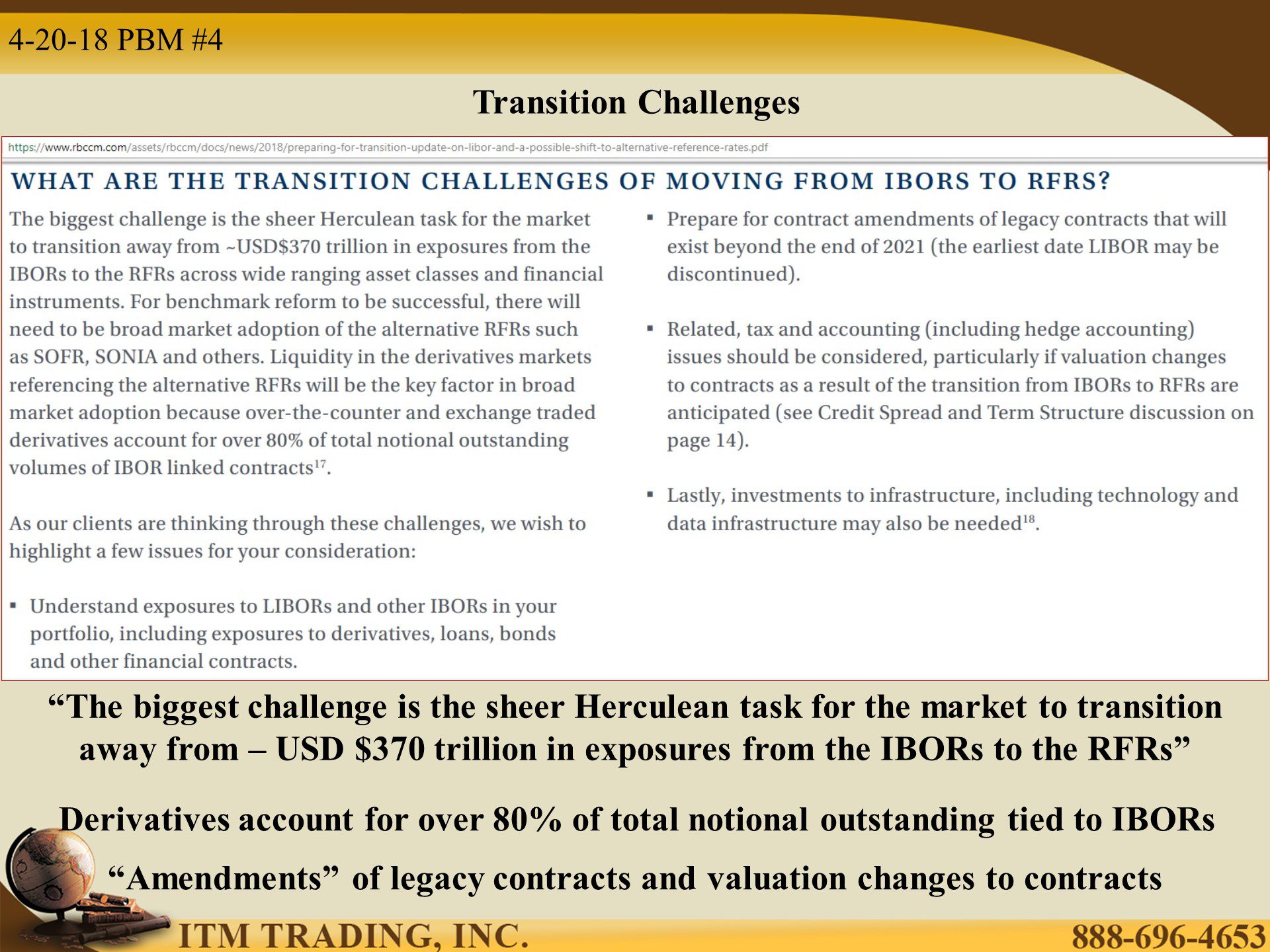

You might think, OK, just create a new benchmark no big deal. But keep in mind that at least $300 trillion of those contracts are tied to derivatives, which represents a complex interconnected, leveraged bet. If you have a loan of ANY type, it is likely part of a derivative.

To make this even more complex is the ability to co-mingle sliced and diced derivatives, so how would this be unraveled? Remember how, as the crisis unfolded in 2008, we were continuously told that the crisis was “contained†and this was probably it? Well it wasn’t. But who got “bailed out� Not you.

Why Can’t They Just Change the Benchmark

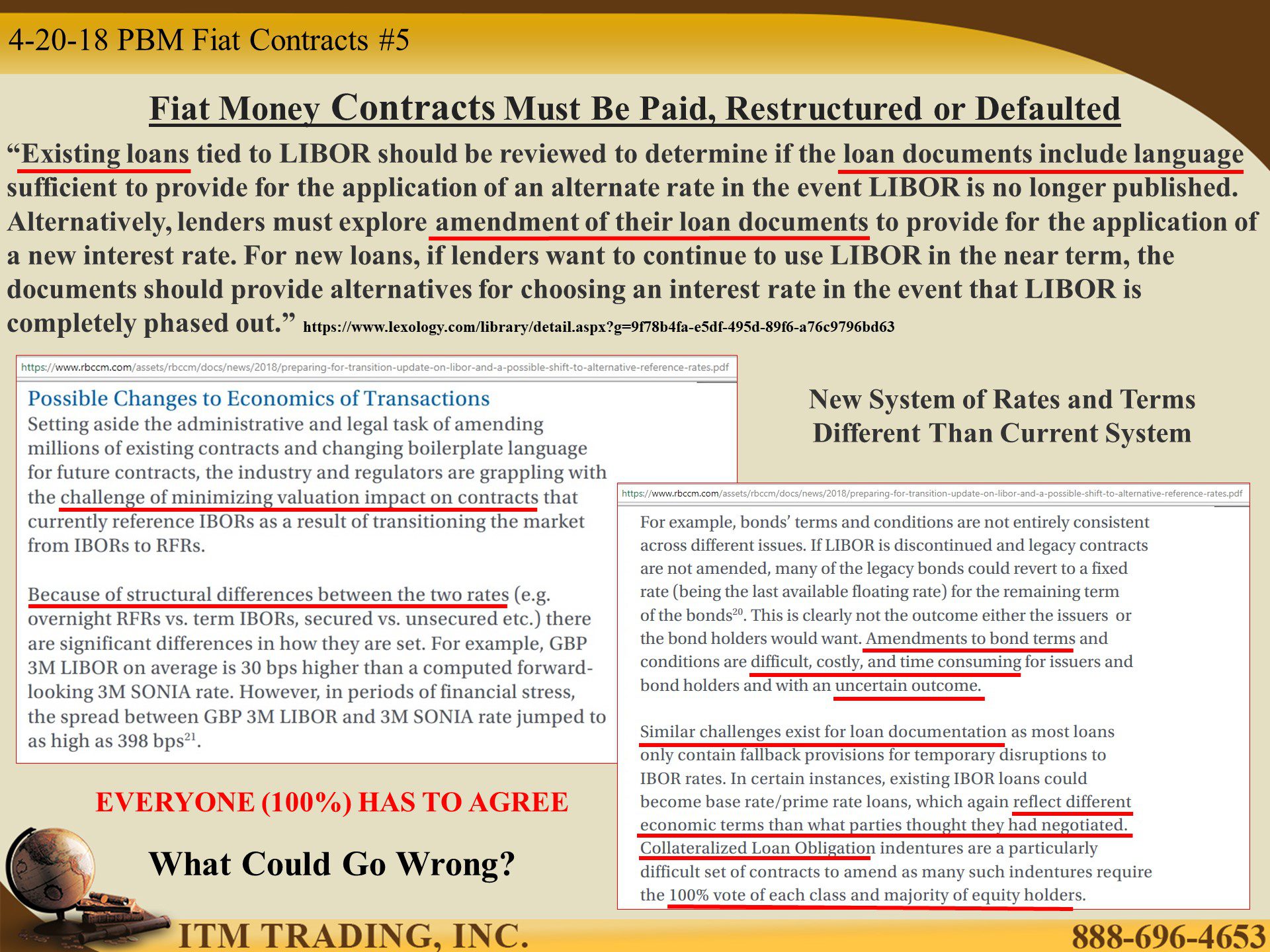

Advanced economies are working on new interest rate benchmarks, but they would be calculated differently than the old ones. That would impact the “value†of the contract, since all contracts are valued based upon the current interest rate. That could have significant consequences and many legal ramifications.

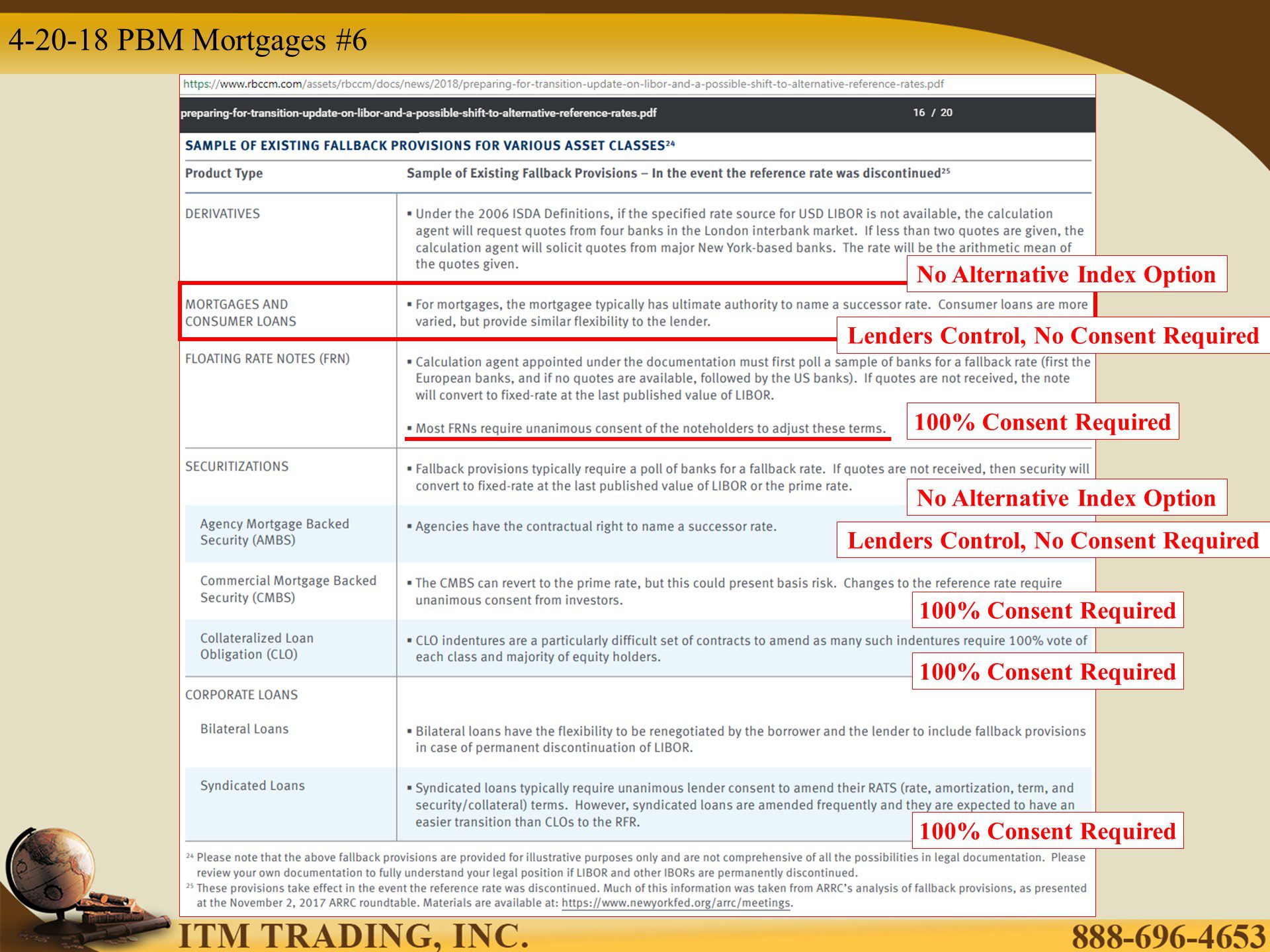

While the lenders on mortgages and other consumer loans typically have the proper language in the contract to change the benchmark on which your loan is based without additional consent (you did that when you signed the contract), in many of derivative contracts that language does not exist. To make those changes, in most cases, 100% consent is required. This could certainly prove to be an insurmountable task considering how complex derivatives are.

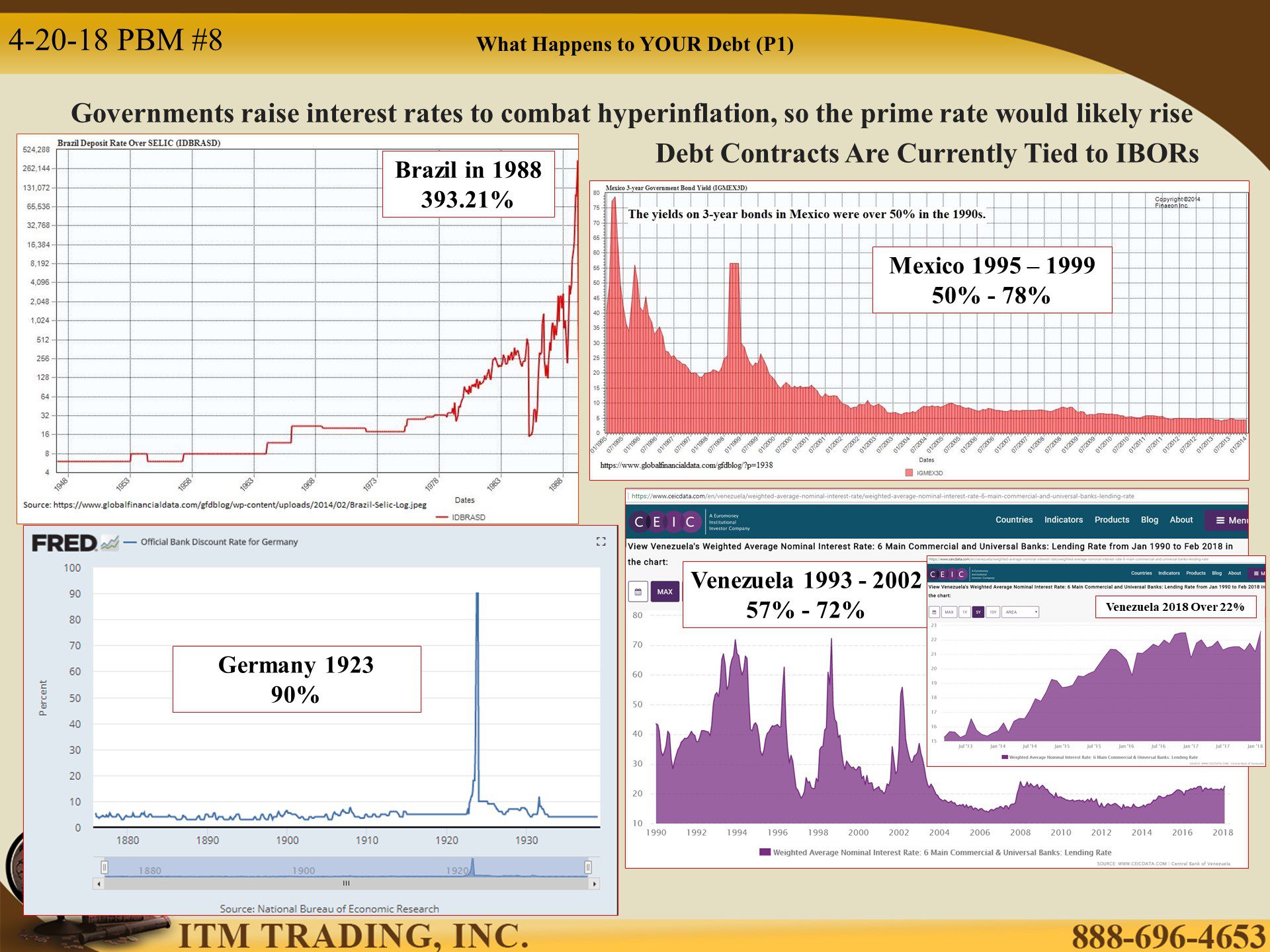

What Is Likely to Happen to Interest Rates

History tells us that when trust is lost interest rates go through the roof. Do you really think that banks are in business for your benefit? Will they allow your contract to remain in the old system? Of course not, they need 100% participation.

The old financial system has been on life support since 2008. It is dying, frail and rigid and the central banks have used up their fiat money bazooka. I cannot tell you that there will be no hiccups between now and 2021. But I can tell you that the central bank lead synchronized global recovery is a lie to keep you in a dying system.

Central banks are accumulating gold to protect their power…me too.

Slides and Links:

https://uk.finance.yahoo.com/news/bank-england-implicated-libor-rigging-080345014.html

https://www.gold.org/download/file/4815/GDT_Q4_2015.pdf

https://www.isda.org/a/g2hEE/IBOR-Global-Transition-Roadmap-2018.pd

https://www.lexology.com/library/detail.aspx?g=9f78b4fa-e5df-495d-89f6-a76c9796bd63

https://www.isda.org/2018/02/05/the-370-trillion-benchmark-challenge/

https://www.isda.org/a/g2hEE/IBOR-Global-Transition-Roadmap-2018.pdf

https://www.rbccm.com/assets/rbccm/docs/news/2018/preparing-for-transition-update-on-libor-and-a-possible-shift-to-alternative-reference-rates.pdf

https://fred.stlouisfed.org/series/REALLN

https://fred.stlouisfed.org/series/TOTALSL

https://fred.stlouisfed.org/series/FGCCSAQ027S

https://fred.stlouisfed.org/series/MVLOAS

https://www.globalfinancialdata.com/gfdblog/?p=1938

https://fred.stlouisfed.org/series/M13015DEM156NNBR

https://www.grantspub.com/resources/commentary.cfm

http://www.businessinsider.com/global-economic-recovery-slowed-down-sharply-2018-4